The beginnings of Samsonite go back to the turn of the twentieth century when Jesse Schwayder, born in 1882 to Polish immigrant parents in Denver, struck out on his own. His father, a former Jewish rabbi like Leon Black’s father, opened a furniture store in Denver, but as a young man Jesse headed to New York City, where he prospered selling luggage on commission.

Returning home to Denver in 1910, Schwayder used his savings to start the Schwayder Trunk Manufacturing Company. Hoping to differentiate his company from other luggage makers, Schwayder characterized his goods as extra-durable. The company scored a marketing coup in 1916, when Jesse, his father, and four brothers were photographed standing on a plank balanced atop one of their suitcases. “Strong enough to stand on,” the photo caption read in company advertisements. Sales took off.

To convey how tough his products were, Schwayder called his bags “Samsons,” after the biblical strongman. Among his workers, Jesse also promoted the Golden Rule to do unto others as you would have them do unto you. Each employee received a marble with the rule engraved on it.

“We have found for practical as well as moral reasons, the Golden Rule is the finest program we could adopt,” Jesse wrote to employees. “The Golden Rule has more power than the atomic bomb. With its help, men can still work wonders.”

Jesse remained president until 1961, when his son King David Schwayder took over. The company was renamed Samsonite and employed four thousand people at its headquarters in Denver, where it also made furniture. It was by far the biggest manufacturer of travel bags in the world.

Samsonite was a classic American success story. But by the 1980s, the company was under siege to a throng of Drexel-fueled financiers that had come along to strip-mine it; in the 1990s, Apollo joined in. Against this group, even the mighty Samson would have been powerless.

Also read: How Julia Roberts and Pretty Woman inspired Manipuri trans activist to be herself

The Schwayder family was still running Samsonite in the 1970s; Jesse’s son King had expanded its operations to Japan and Europe. He believed in integrating his workforce well before other companies did; in charge of the company’s Detroit operations, for example, King backed the appointment of a Black foreman over the objections of white workers, a company history said.

But in 1973, Beatrice Foods, a giant maker of foods, chemicals, and other products, came knocking with a takeover deal. Beatrice, a believer in the conglomeration craze that Leon Black’s father had pursued, owned a constellation of brands and wanted Samsonite in the mix. The Schwayder family sold out, and thus began a series of Byzantine transactions in which Samsonite would be shuffled from owner to owner, each extracting from the company whatever it could, whenever it could.

After the conglomeration craze gave way to the leveraged buyout mania of the eighties, even giant acquirers like Beatrice became targets of corporate raiders. In 1985, leveraged buyout kingpin KKR swallowed Beatrice for $6.2 billion; Drexel peddled junk bonds and warrants to finance the deal, with the warrants winding up in Milken partnerships.

Two years later, KKR spun off Samsonite and some other Beatrice units in an initial public offering. The company took the lackluster name E-II Holdings and was soon acquired by two more suitors in even more head-spinning transactions.

By 1990, loaded with Drexel debt, E-II was in distress. Vultures began circling for a restructuring score; among them were Black and Apollo, who began buying E-II bonds. They had some competition—corporate raider Carl Icahn was also a creditor and interested in gaining control of E-II.

By 1991, though, Black had an advantage, the Executive Life portfolio. The insurer held two issues of E-II junk bonds with a face value of $233 million; best of all, the larger of the two stakes was a senior debt obligation that would give Apollo an upper hand for control of the company.

Apollo and its partners paid just $106 million for the positions when they secured the Executive Life portfolio. Alongside Apollo as an investor in E-II was Francois Pinault, the French billionaire investor whose company, Artemis, would be found guilty by a jury years later of conspiracy to acquire assets fraudulently in the Executive Life buyout.

In the Executive Life deal, Apollo had classified E-II’s bonds in the “A” group: “restructuring opportunities which have the potential for producing satisfactory investments over time.” In July 1992, a few months after Apollo received the bonds, E-II collapsed into bankruptcy, flattened by $1.5 billion in junk debt. Most of the companies in the E-II hodgepodge were hobbled and in need of restructuring. Not Samsonite; it was healthy, posting earnings gains throughout the tumultuous period. Less than a year later, E-II emerged from bankruptcy with a new name—Astrum International, from a Latin word meaning “star.”

Apollo had won control and Black became a director of Samsonite.

In 1993, Astrum bought Samsonite’s primary competitor, American Tourister. Two years later, Astrum spun off the other E-II companies and brought back the Samsonite name, focusing the company once again on the manufacture of luggage and furniture. It issued shares to the public in 1996.

To keep track of all the spin-offs, share offerings, and restructurings that Samsonite endured was dizzying. What’s important to remember is that with each spin of the revolving door, the dealmakers generated fees and paydays for themselves. And those fees diminished Samsonite.

In 1994, before it issued public shares, Samsonite had earned almost $900 million. But the effects of the pillagers were starting to emerge. In the following year, Samsonite began reporting losses that would continue throughout Apollo’s ownership. Then came the inevitable job cuts, with the company eliminating 450 of 1,400 U.S. positions in 1996 for a $3.3 million savings. Most of those laid off had worked at American Tourister, the newly acquired competitor, in Rhode Island and Florida.

Samsonite’s stock was still trading near its high when Apollo’s rival Icahn exited the company in early 1997, selling his shares to the public. That year, Samsonite began offering its shares to employees in a stock purchase plan and added the company stock as an investment option in its 401(k) plan. The timing could not have been worse: in 1998, the company’s shares traded around $40, but by the following year they had plummeted to $5.

As Samsonite flagged, Apollo looked for the exits. In 1998, the firm announced talks to sell half its Samsonite stock to unnamed investors and use the proceeds to pay a $30-a-share dividend to stockholders. Never mind that paying this dividend would impair the company—it would massively enrich Apollo, Samsonite’s largest shareholder. Rewarding themselves with dividends from stock or bond offerings would become a key play for the marauders in

coming years.

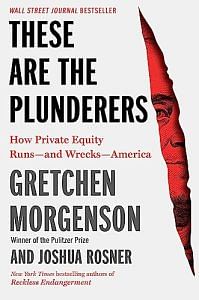

This excerpt from ‘These Are the Plunderers’ by Gretchen Morgenson has been published with permission from Simon & Schuster India.

This excerpt from ‘These Are the Plunderers’ by Gretchen Morgenson has been published with permission from Simon & Schuster India.