Now that Asia has stitched together the world’s biggest trading bloc, U.S. financial and tech firms ought to be more than a little worried.

The Regional Comprehensive Economic Partnership, or RCEP, will bind the 10 economies of Southeast Asia with China, Japan, South Korea, Australia and New Zealand, creating a prototype of what my colleague David Fickling describes as “a sort of Pax Sinica,” a Beijing-led global order.

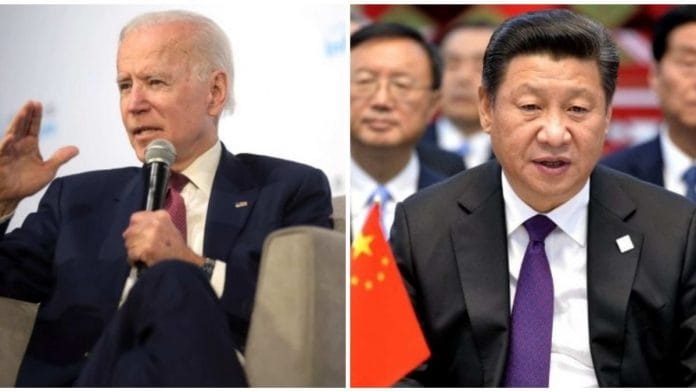

To provide a counterweight, the U.S. needs the Trans-Pacific Partnership. President Donald Trump backed out four years ago. Japan is keen for Joe Biden, as the next president, to reverse the exit. But the goal of a U.S. pivot to Asia can’t solely be to encircle China. The objective must be to establish rules for ownership and use of Asian consumers’ financial and e-commerce data, a commodity that is set to become more valuable in this century than perhaps even oil was in the last.

The main risk to U.S. firms from Washington’s isolationism isn’t trade. Both as the world’s consumer of last resort and provider of the currency in which most things are bought and sold, the U.S. might retain enough leverage on global commerce. It can offer bilateral deals to important trading partners who’ll jump at the chance of getting easier access to the American market. But multilateral agreements like TPP are useful for establishing standards. That’s important when those are sorely lacking, which is the case for data, the raw material that consumers in Asia provide for free to the likes of Visa Inc. and PayPal Holdings Inc., as well as to Facebook Inc., Alphabet Inc. and Amazon.com Inc.

Take the agreement on financial services in the new trade deal. It says that signatory nations will not prevent “transfers of data by electronic or other means, necessary for the conduct of the ordinary business of a financial service supplier in its territory.” However, in the two subsequent paragraphs, we learn that countries can still insist on local copies of records. They can also restrict cross-border transfers that flout their regulations on “personal data, personal privacy, and the confidentiality of individual records.”

Ditto for electronic commerce: There are rules, but with broad escape hatches. A shopping website can freely send data overseas, and it won’t be required to maintain servers in the countries where it’s doing business. All of that can change if there’s a “legitimate public policy objective” or an “essential security interest.” If that wasn’t vague enough, e-commerce will only be brought under the RCEP’s proposed dispute settlement mechanism after a review. It’s a formula for endless delay, and even then, will only apply to countries that accept external adjudication.

Anti-free-trade groups like bilaterals.org have noted that TPP’s stricter digital trade rules would have won more ironclad guarantees for dominant tech companies. The RCEP has put a brake on that by tilting power back toward governments.

But from a globalization perspective, this is America’s retreat from its historic standards-setting role in everything from accounting to food safety, a development that worries scholars like Evan Feigenbuam at the Carnegie Endowment for International Peace. Silicon Valley firms should also be nervous. Their business model is to sell access to processed information — and its predictive power — again and again.

As Columbia Law School professor Katharina Pistor argues in her paper, “Rule by Data: The End of Markets?”, Big Tech treats raw information as “wild animals: things that belong to no one but can be claimed by whoever catches them first.” This lawlessness can’t last. Governments are threatening to wield the stick, at least against the more egregious use of market power that comes from owning data. The European Union is investigating whether Amazon uses sales records of independent sellers to give an unfair advantage to its own retail arm. Potential fines can be as high as 10% of annual sales.

Being in the driving seat of an accord like the TPP means that the U.S. can help write the rules. The diplomatic goal would be to strike a bargain: force U.S. tech and financial services firms to share a part of their supersize profit from algorithms with consumers both at home and overseas, while ensuring that trading partners don’t put arbitrary curbs on access, storage, transfer and processing of raw data. Should Washington not want to shoulder this responsibility, Beijing gladly will. Maybe not today, but in 10 years. And those rules, which will come into effect by closing (or not closing) the escape hatches of the RCEP, would be shared by 2.2 billion people. They would hardly favor U.S. interests.

The cheerleaders of globalization obsessed over tariffs and non-tariff barriers and didn’t pay enough attention to the supply-chain revolution, most notably in China. To continue to view the world of trade from this outdated prism would once again cause the woods to be missed for the trees. Biden needs to bring the U.S. back to Asia, and for the right reason. – Bloomberg

Also read: How will RCEP benefit member nations and what does India’s exit from the trade pact mean

To think that the same Left, and orgs like the EFF, that were actively advocating against TPP 4 years ago are now campaigning for US to join it. Such has been the effect of two bulls in the China shop (no pun intended) aka Trump and Xi.