Horlicks is facing a challenge, even in India. The drink is losing its star status as the ‘healthy’ morning and after-school drink.

Unilever NV is buying India’s top drink from GlaxoSmithKline Plc. Let’s hope the global consumer giant didn’t pay too much.

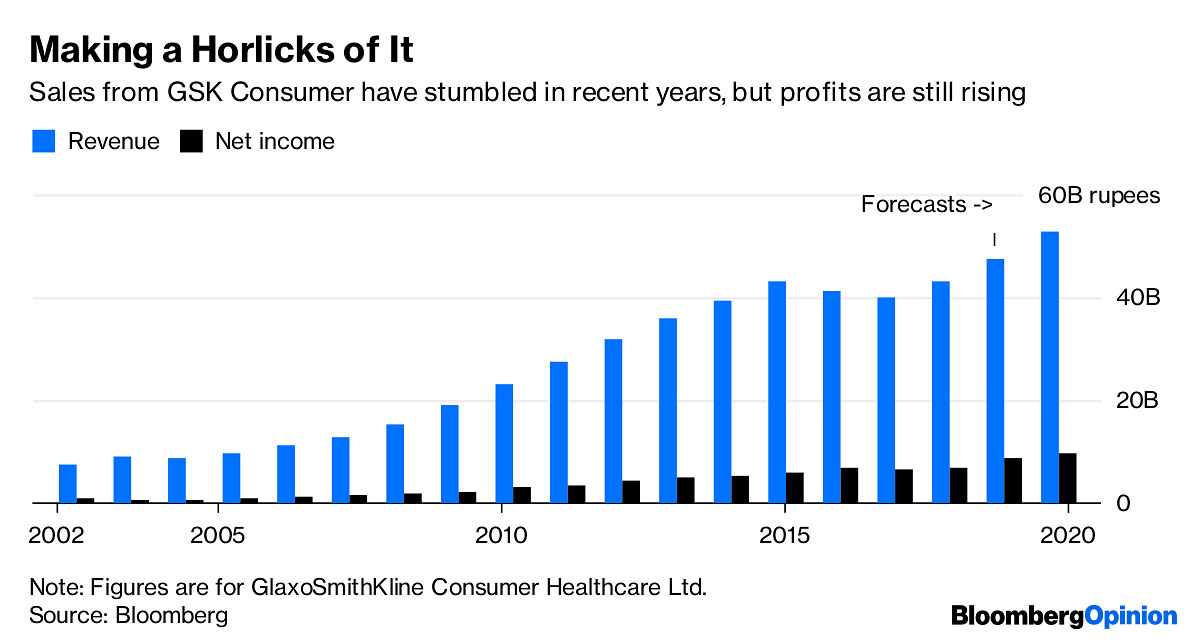

GSK has entered into exclusive negotiations to sell its nutrition business to Unilever, according to the Financial Times. That includes Horlicks, a malted milk drink seen as a staple for the children of upwardly mobile families in India. What the Anglo-Dutch giant has offered is unclear, but GSK’s Bombay Stock Exchange-listed business GlaxoSmithKline Consumer Healthcare Ltd., in which it has a 72.5 per cent stake, has a market value of $4.2 billion. GlaxoSmithKline Bangladesh Ltd., which the Financial Times said would also be included, is worth 15.7 billion takas ($187 million).

Horlicks ranks a distant 56th globally in the health-and-wellness beverage category (with Red Bull and Gatorade in the lead), according to Euromonitor – but in India it’s No. 1, ahead of Mondelez International Inc.’s Cadbury Bournvita and GSK’s other malt drink Boost (popularized by star cricketer Kapil Dev). Unilever, whose extensive distribution channels include training local women as rural sales agents for its soaps and shampoos, will have the kind of sales network GSK Consumer could only dream of.

But Horlicks is facing a challenge, even in India. The drink is losing its star status as the “healthy” morning and after-school drink of choice pushed by Indian parents on their children. In a worst-case scenario, it could wind up with the image it has in the UK, its home market: a sleep-inducing bedtime drink for the elderly.

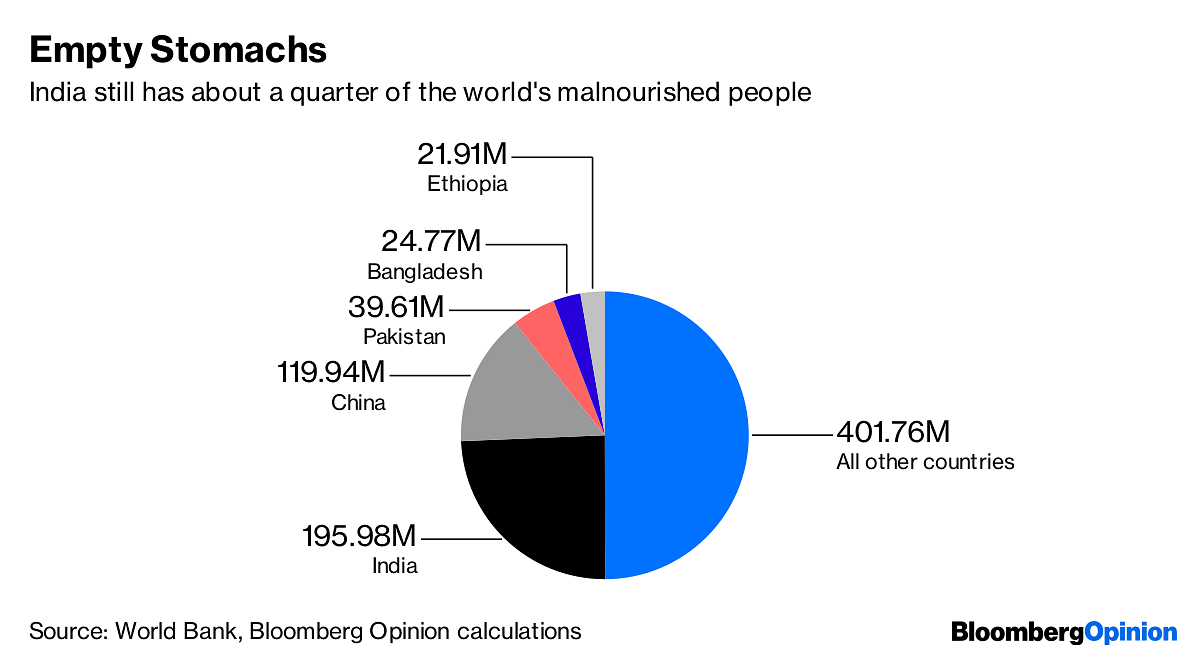

It has other issues to contend with. Indians historically have been big buyers of so-called health-food drinks – a market GSK Consumer controls half of – because companies have been able to pitch their products as essential nutritional supplements. That resonates in a country home to about a quarter of the world’s undernourished people.

Horlicks’s current ad campaign highlights that the drink “contains bioavailable nutrients, which gets absorbed in the blood and hence makes kids more tall, more strong, and more sharp,” Vivek Anand, GSK Consumer’s finance director, told an investor call earlier this month.

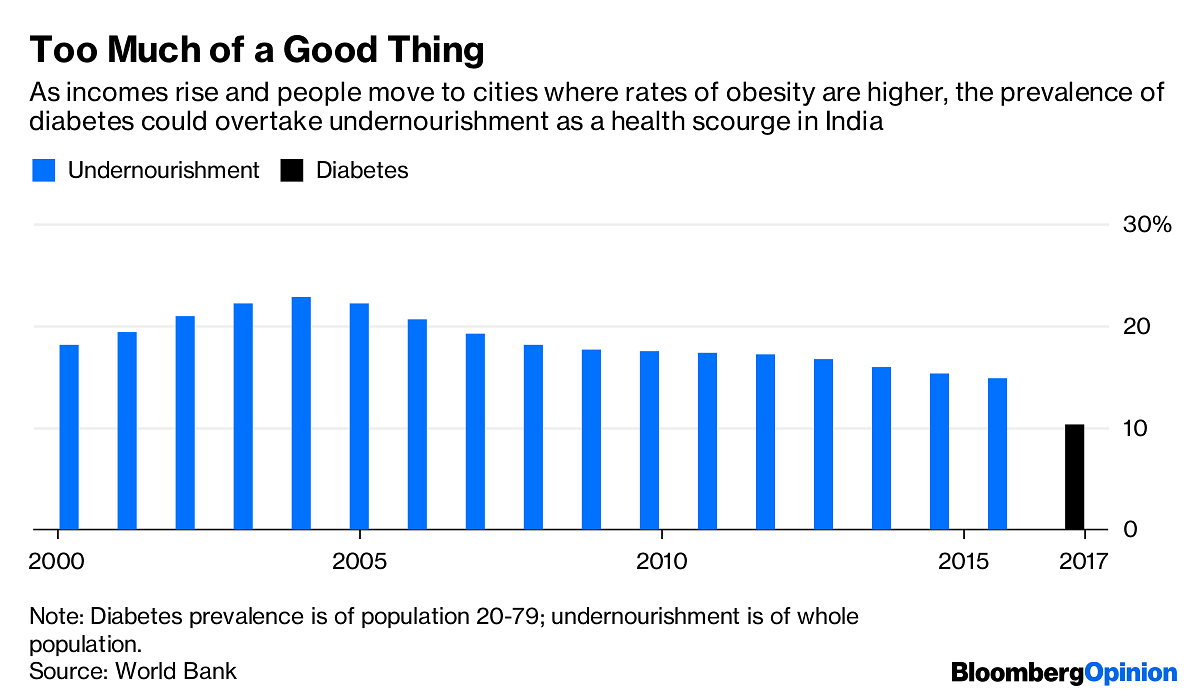

India’s breakneck income growth is introducing a whole new set of health problems. A milk drink made from powdered Horlicks is about one-fifth sugar – and diabetes is India’s fastest-growing health condition, affecting 10.4 per cent of the adult population. On current trends, the disease could soon claim more victims than undernourishment, which impacts 14.8 per cent of Indians.

To see how that’s a game changer, consider what happened the last time GSK sold off one of its storied British drink products. Suntory Beverage & Food Ltd. paid 1.35 billion pounds ($1.7 billion) for Lucozade and Ribena in 2013 as it tried to reduce its reliance on the Japanese market, but the brands have struggled ever since.

In 2016 the UK government announced plans to introduce a tax on sugary soft drinks, prompting Suntory to reformulate its recipe to lower its sugar content by about 50 per cent.

That may have been unavoidable, but the move hasn’t helped sales of products whose image is, in part, built on their sweet flavor (Lucozade was originally known as Glucozade in reference to its glucose content). Even before the sugar tax came into force this year, revenue from Suntory’s UK unit fell by about 6 per cent in 2017. Sales of the main Lucozade Energy brand fell another 12 per cent from a year earlier in the March quarter of this year, the company told an earnings call in May.

For a taste of the damage that government action can do in India, look at the case of Bihar. One of India’s poorest states banned sales of Horlicks earlier this month over a dispute about whether the drink was being falsely marketed as vegetarian (the ban has been suspended temporarily while the case is decided).

As yet there’s no sugar tax, but even there, the central government’s sales-tax reforms have imposed punitive 40 per cent levies on soda, encouraging some manufacturers to increase the fruit content of their drinks to take advantage of lower rates.

Even if manufacturers can fend off government action, consumer tastes may change. Among India’s middle classes, there’s also been a shift from malt-based drink brands. Kraft Heinz Co. last month sold Indian brands including the malted Complan drink for about a third less than expected.

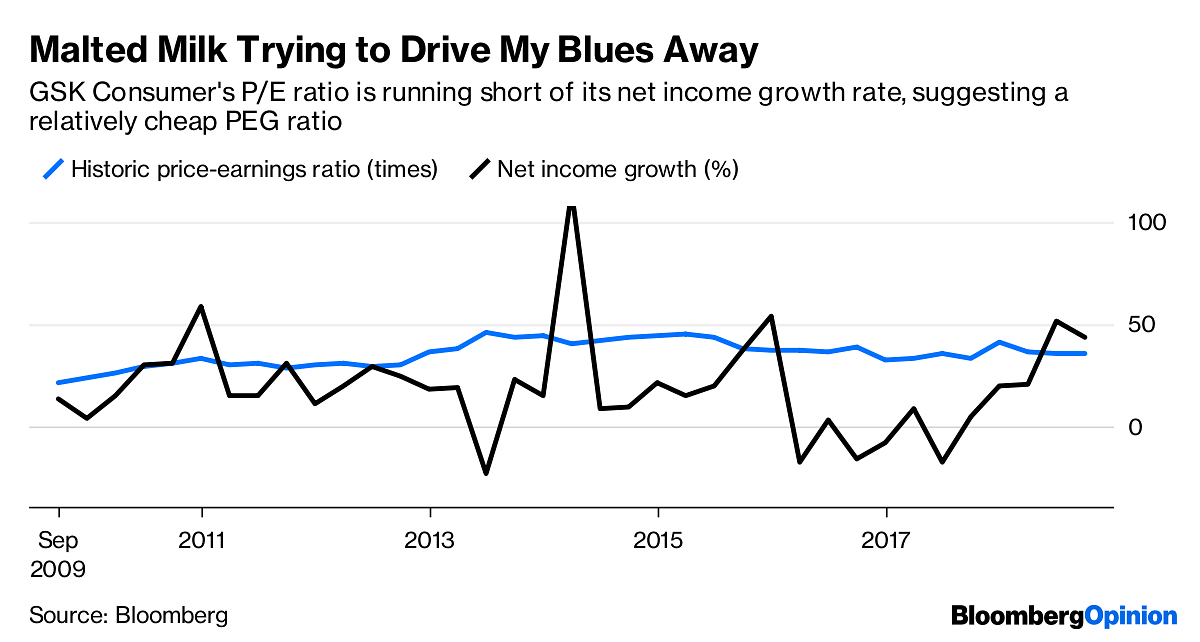

Despite those headwinds, tying GSK’s still-potent brand to Unilever’s peerless local distribution network seems like the best way to secure the future of this business. With a price-earnings ratio that’s below its net income growth rate, GSK Consumer doesn’t look particularly expensive for an Indian food and drinks company. With luck, this cup of Horlicks will provide some youthful energy to its new owner, rather than a geriatric slumber. –Bloomberg