Ultratech’s acquisition spree might cause trouble if the government doesn’t start spending as fast as India’s largest cement firm.

One of India’s most acquisitive companies is buying up cement kilns across the country, going from big to bigger. It’s got the right plan, but who’s buying the cement and actually building?

Ultratech Cement Ltd. is one of the world’s biggest cement manufacturers, with the capacity to put out 90 million tons a year from plants sprinkled across India. It purchased distressed assets from Jaiprakash Associates Ltd. and is battling to buy even more out of bankruptcy.

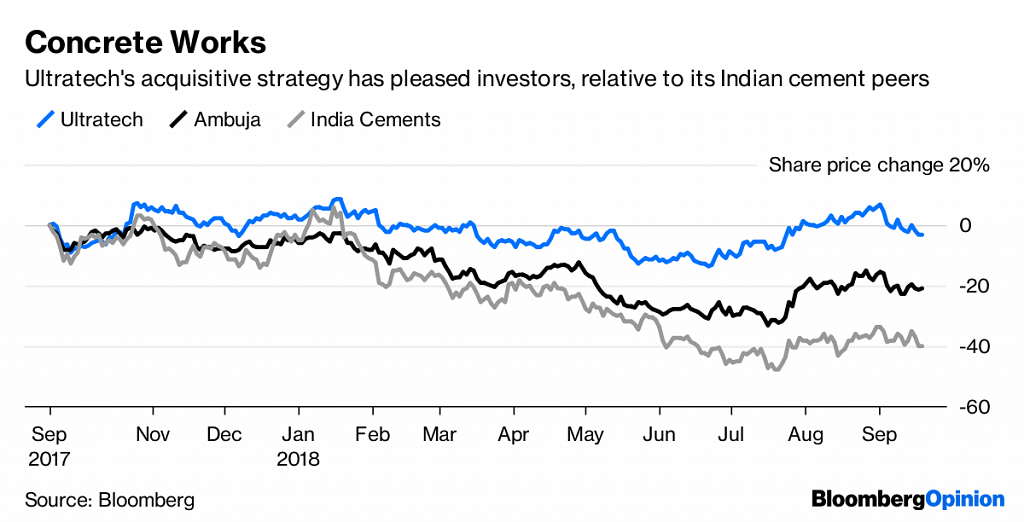

Ultratech is taking a smart tack in India’s fragmented cement industry: consolidation. After its acquisitions, the company, majority-held by the conglomerate Aditya Birla Group, will hold around 40 per cent of the western and central Indian markets.

Cement is big business for the Birla Group, whose industry spans textiles to telecom. It makes up more than 60 per cent of the Group’s consolidated Ebitda, having pulled in $1 billion in the last fiscal year. The dividends from Ultratech are the company’s biggest and help fund its broader ambitions.

Meanwhile, Ultratech’s Ebitda margins are above global cement and aggregate peers at around 18 per cent; its shipments rose 21 per cent in the last fiscal year ended March.

With volume, comes pricing power. While that hasn’t fully materialized yet — India’s cement prices rose just 1 per cent last quarter — consolidation will eventually give Ultratech more leeway. The company needs to raise prices with the costs of inputs like petroleum coke ticking up and a depreciating rupee.

Yet the company’s cement-capacity utilization is already running at 70 per cent. If it expands into a glut, Ultratech may eventually find balancing supply with actual demand a more effective way to influence prices, as its Chinese peers have demonstrated with widespread plant closures. With limited new supply, prices there have risen more than 20 per cent so far this year; and the share price of Chinese cement makers like Anhui Conch Cement Co. and West China Cement Ltd. are up over 15 per cent this year, despite a dismal stock market.

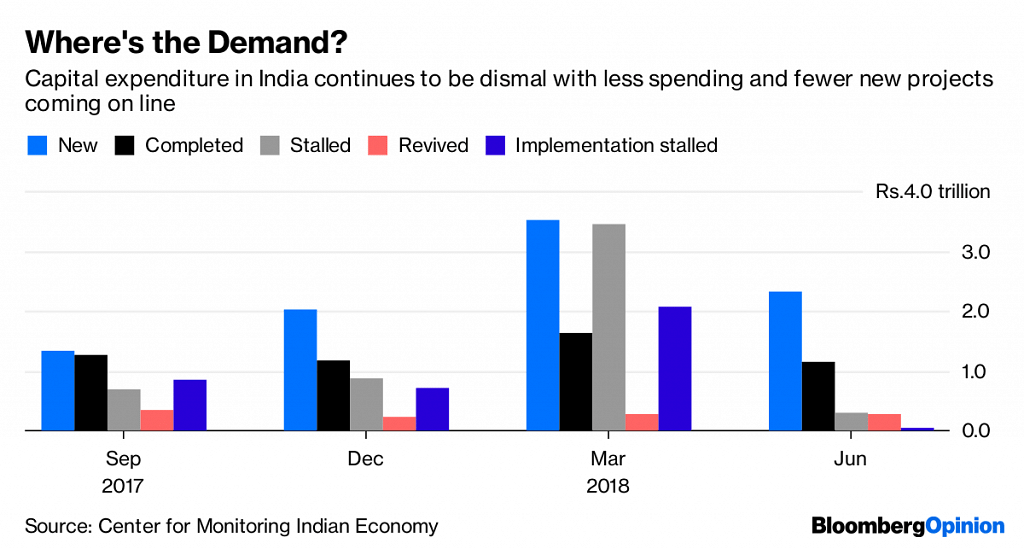

But here’s the wrinkle: Where will all the cement go? Production is growing just south of 10 per cent on year. Big bets on the government’s infrastructure-spending promises (so far, just that) and welfare pledges, like rural housing, are throwing companies into overdrive. Total capital expenditure by the government and companies remains muted, on par with levels in 2004. Public capital-expenditure growth on highways, railways, defense and metro rail projects isn’t ramping up. Companies only expect a 5 per cent increase through mid-2019 from a year earlier, according to a survey by UBS. That’s below expectations for overall demand.

Another blow: The Indian Supreme Court, in an interim order earlier this month, banned construction activity in some states in the north, central and western parts of the country until 9 Oct because governments there haven’t come up with policies to deal with solid waste management.

One bright spot for demand is rural housing, particularly ahead of a big election year. Government spending on such projects rose 60 per cent in the past year and could increase another 40 per cent. That won’t absorb the tons of cement being produced across the country — and raising prices will only get tougher.

For Ultratech, market dominance is great as long as its books are in order. For now, Ebitda continues to tick up; but with its bottomless appetite for assets, so does its debt and the associated interest costs. Cash flows have come down along with cash in hand.

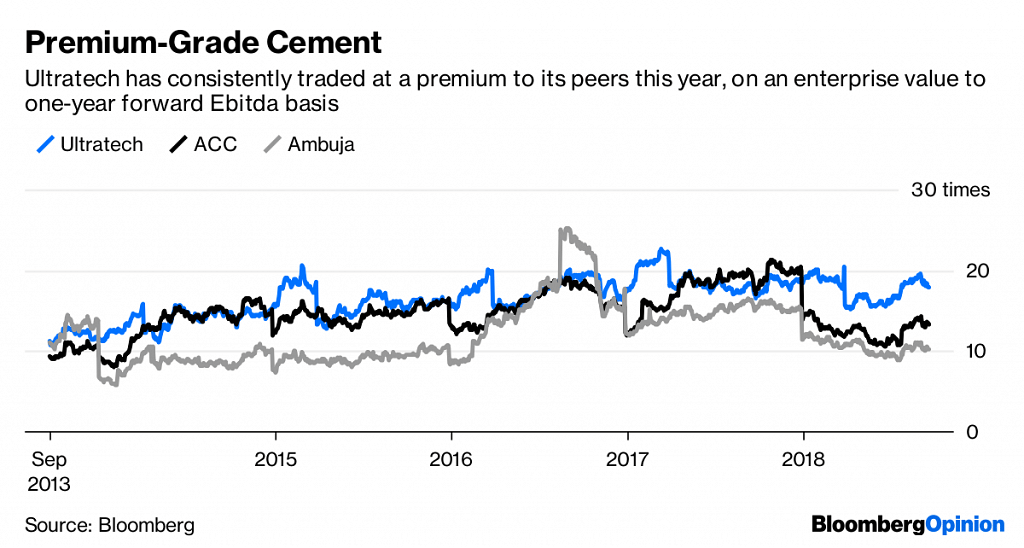

Ultratech is trading at an enterprise value of 16.2 times its one-year forward Ebitda, more than a 60 per cent premium to its peers. If the government doesn’t start spending as fast as India’s largest cement maker, that number might start looking too rich. –Bloomberg