It is now clear that the Narendra Modi government was spooked into imposing a higher TCS—tax collected at source—on foreign transactions by the rapid growth of such transactions following the Covid-19 pandemic. Not only does this highlight the trigger-happy nature of government officials, but it also betrays an overall sense of economic insecurity the government is starting to show.

Significantly, it provides some insight into the personal insecurities of Indian bureaucrats, a troublesome phenomenon when it comes to devising policy.

Conversations with several officials in the Ministry of Finance have revealed that the key driver of the Budget 2023 move to increase the rate of TCS on spending under the Liberalised Remittance Scheme (LRS) from the existing 5 per cent to 20 per cent was the growth in such expenditure in 2021 and 2022, the years after the pandemic.

Data with the Ministry of Statistics and Programme Implementation shows that foreign spending by Indian households increased by 33 per cent in 2021-22, soon after lockdowns were lifted around the world, and in India. Despite this high growth, the absolute level of Rs 1.2 lakh crore was still lower than pre-pandemic levels. The next year more than bridged this gap.

Foreign spending in 2022-23 surged to Rs 2.3 lakh crore, a more than 90 per cent jump over the previous year. While the statistics ministry hasn’t yet released this data for 2023-24, the numbers will likely show a continuation and perhaps even an acceleration. Tourism sector analysts say Indians are travelling abroad like never before, and are spending increasing amounts, making use of loopholes in the system.

The thing is, this used to be a matter of pride for the Indian government, and facilitating it was a display of confidence. When did it become a source of insecurity?

Also read: Loopholes, high limits & timely buys — why govt’s 20% TCS on foreign spending isn’t deterring anyone

Channeling forex reserves

The Liberalised Remittance Scheme or LRS was introduced in 2004, and was seen as a way to encourage Indians to spend abroad. In keeping with this sentiment, the limit an individual could spend abroad was periodically hiked to its current level of $250,000, 10 times higher than the $25,000 limit when the scheme was introduced.

There were two factors driving this open approach to foreign spending, both linked to the level of India’s foreign exchange reserves.

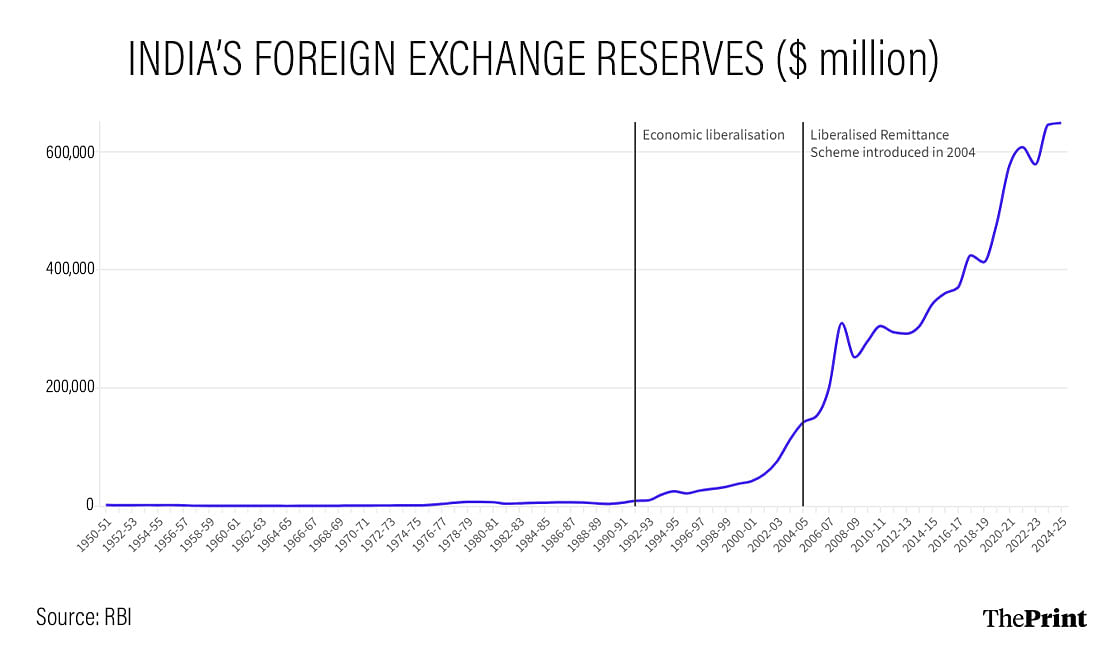

Since Independence to about 1990, India’s forex reserves remained low and flat, staying below the $10 billion mark. Following liberalisation, this began to change. As the Indian economy opened up, dollars started flowing in. By 2003-04, India’s forex reserves stood at about $112 billion.

This rapid influx of dollars forced the government to also think about what to do with so much foreign currency. One solution was to encourage Indians, steadily rising in affluence, to go abroad and spend dollars. And so, the LRS was introduced in 2004.

The second factor driving this decision was a sense of confidence about the Indian economy, that we are not afraid of forex outflows since our economy is attractive enough to ensure steady inflows. Sure enough, India’s forex reserves continued to grow strongly even after the LRS was introduced.

It was simple. Companies were ploughing in more dollars into the country than Indian tourists and high net-worth individuals could spend abroad.

But now something seems to have changed. Whether it is a waning confidence that investors will bring in increasing amounts of dollars, or a fear that even our current high reserves will fall short on a rainy day, or a mean-spirited attitude among bureaucrats to rein in a public that’s flying high, the fact is the government is no longer happy if you spend money abroad.

Also Read: No TCS on foreign debit & credit card transactions up to Rs 7 lakh, clarifies Union govt

Discouraging the spenders

Since October last year, foreign transactions above Rs 7 lakh under LRS have attracted a 20 per cent TCS. Given that a TCS isn’t a real tax and will be refunded to the payer, it’s not about revenue. It’s about sending a signal to big spenders abroad: we are watching you, and we want you to stop. After all, if it was simply about tracking, the 5 per cent TCS was more than enough.

It’s also not about curbing black money going abroad. Spending under the LRS is anyway trackable and accountable. The black money going abroad would not be caught by the TCS, whatever rate it might be.

The government had even tried to include credit card spending under this regime, but was quickly shouted down by its critics and supporters alike. Moves by it to remove the Rs 7 lakh limit, too, had to quickly be withdrawn.

Now, all of these decisions reveal several things. The first is that not a lot of thought went into the decision, given how taken aback government officials seemed at the outrage.

The second insight is that, the little thought that did go into the decision, was decidedly small-minded. Why should anybody have the luxury to spend abroad and buy foreign property, seemed to be the thinking, especially when it came to removing the Rs 7 lakh limit. That limit had been in place to target the high spenders and exempted about 90 per cent of tourists.

But government officials are famously underpaid — notwithstanding the other perks they receive — and seem to want everybody who spends money abroad to feel the pinch.

From a policy point of view, it is a fact that foreign direct investment (FDI) has been falling in the country for some time now. Perhaps this is bothering the government more than it lets on, and so it wants to hold on to its forex reserves.

Or, to give the government the benefit of the doubt, maybe it feels that the geopolitical landscape is so volatile at the moment that it needs to keep a large amount of dollars at hand in case of an emergency. Perhaps the RBI feels it needs an ever-larger amount of dollars to intervene in the markets to prevent the rupee falling sharply.

There are a number of reasons the government could have changed its stance on foreign spending by Indians. All of them, unfortunately, point to a distinct economic insecurity that seems to have taken hold over the last few years.

The author tweets @SharadRaghavan. Views are personal.

(Edited by Prashant)