What is the sharing economy? What do platforms actually do? Do they simply intermediate among market participants, or do they shape the market by actively intervening in it? To answer these questions, this report analyses the sharing economy in India through a study of e-commerce platforms.

Typically, the sharing economy was meant for voluntary sharing of resources (for eg. Couchsurfing) but has now transformed into powerful platforms shaping entire markets and even economies (Amazon, Uber, Airbnb etc.)

E-commerce in India makes up only 1.6% of retail sales as of today. But this market is going through significant changes, particularly through the impending merging of online and offline retail with Big Tech investments in retail networks. We are looking at a future where digital technology through e-commerce platforms can determine the future of all commerce in India.

This report looks at two phenomena. One is the tendency of e-commerce platforms to infrastructuralise: that is, to become ubiquitous, accessible and reliable in a way that resembles infrastructure. The other is the tendency of e-commerce to platformise existing infrastructure: that is, to capture, fragment, and privatise infrastructure.

Also read: Amazon and Mukesh Ambani’s Jio are getting ready for an epic fight

Methodology

This report uses quantitative research in the form of two online surveys among e-commerce consumers (402) and third party sellers (68), conducted by the market research agency IRB. Both surveys focused on Amazon and Flipkart, the largest platforms in Indian e-commerce. An extended interview with an industry association of logistics service providers in India supplemented the primary research.

Implications of infrastructuralisation of e-commerce in India

In their study of cyber-infrastructure, Edwards et. al. (2007) describe the key characteristics of infrastructure as ubiquity, accessibility and reliability, among other parameters. E-commerce in India does not as yet fit these descriptors. In 2019, e-commerce made up only 1.6% of retail sales in India. The corresponding global figure was 14%. On accessibility too, e-commerce falls short. India has 504 million active internet users, which is about 36.5% of the population. These users tend to be young, urban and male. Since Covid- 19 lockdowns, the reliability of e-commerce has also taken a hit.

It is much more helpful then to look at the tendency of Indian e-commerce towards infrastructuralisation. The literature on infrastructure recognises monopoly provision as a characteristic of infrastructure. Is Indian e-commerce a monopoly market today? It is clear that if the relevant market is retail in general, e-commerce is not a significant proportion of this market. Within the e-commerce market itself, there exists a duopoly. As of 2018, Walmart-owned Flipkart (with Myntra and Jabong) controlled 38.3% of the e-commerce market, and Amazon controls about 31.2%.

The more relevant question is if e-commerce will continue to be a monopolistic market as it grows outwards into all retail. In 2019, Amazon announced a billion-dollar investment in India to help small and medium-sized businesses come online. This naturally means that these businesses will be supported to sell on Amazon’s own platform. Amazon is also working on turning neighbourhood shops into e-commerce delivery centres. Facebook’s investment in Reliance Jio is meant to primarily bring small businesses online via WhatsApp. Google’s $10 billion Google for India Digitization Fund to help accelerate India’s digital economy involved a significant investment in Jio as well.

From these recent developments in investment, it is safe to assume that the share of e-commerce in retail will continue to grow through ‘new retail’, a term coined by Alibaba founder Jack Ma to denote the blurring boundaries between online and offline retail. It involves the digitalisation of physical stores among other ways of integrating online and offline shopping. Investments from Amazon, Facebook and Google described above are examples of new retail.

With this growth trajectory of e-commerce in mind, we now look at some of the existing economic relationships prevailing between e- commerce platforms and participants on these platforms, that is, sellers and customers. We analyse these economic relationships in terms of value adds and dependence.

Key findings:

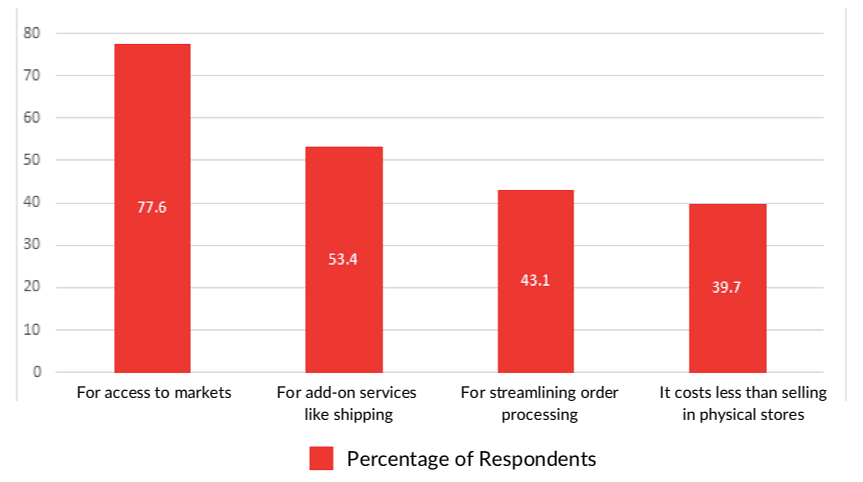

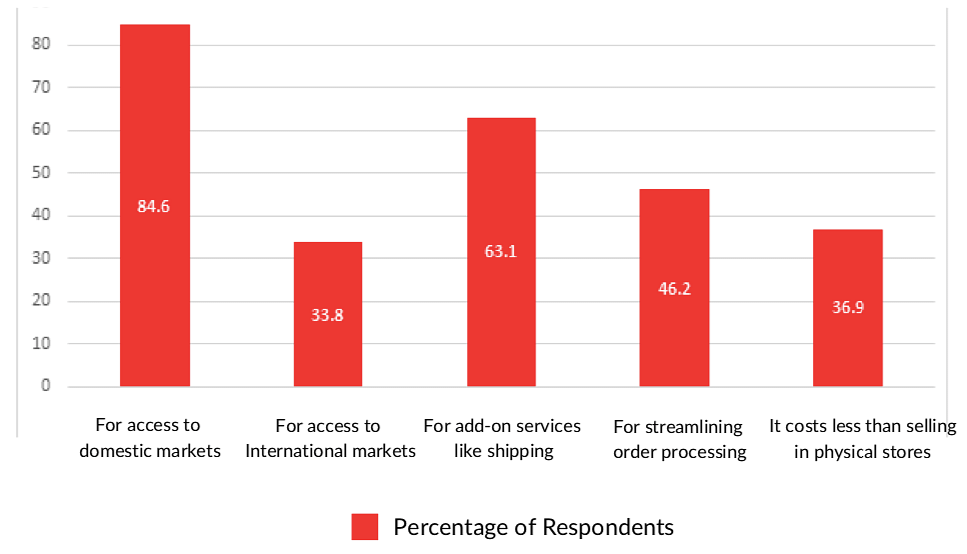

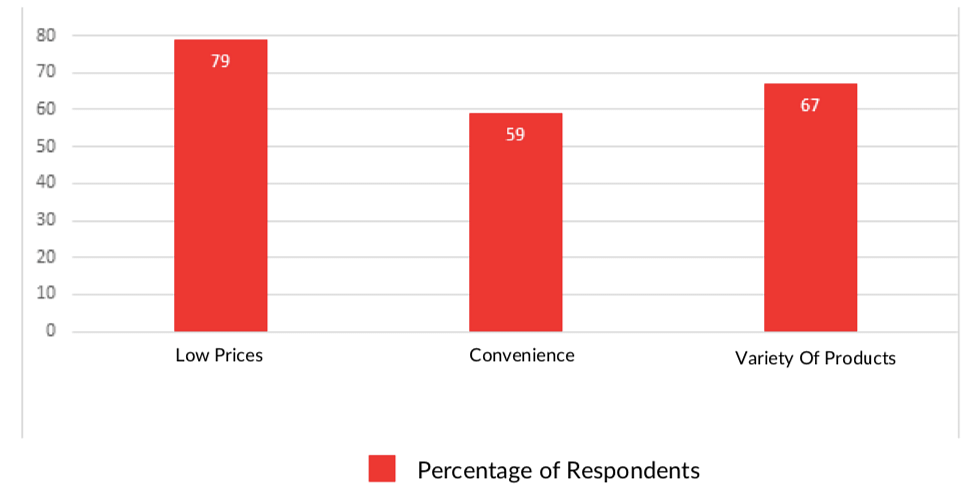

E-commerce adds value to third-party sellers’ business by providing access to new domestic markets (84.6% of Amazon sellers, 77.6% of Flipkart sellers) and improving price discovery (67.7% of Amazon sellers, 58.6% of Flipkart sellers changed their price after going online). It adds value to consumers with helpful product reviews (70% of consumers), lower prices (79% of consumers), and brand discovery (70% of consumers).

Chart 1: Why do you sell on Flipkart?

Chart 2: Why do you sell on Amazon?

Chart 3: Motives for shopping online

E-commerce creates dependence, with a majority of sellers (92.3% of Amazon sellers, 84.5% of Flipkart sellers) making fundamental changes to their business practices to accommodate the rules of the platform or optimise operations on the platform. On average, sellers depended on Amazon for 50.4% of their total revenue and on Flipkart for 39% of their total revenue. Most sellers did not feel “locked in” to a particular platform, but the indication was that they were locked in to e-commerce in general. Most sellers also felt that the commission they paid platforms was low or adequate (93.9% for Flipkart, and 87.5% for Amazon), showing that e-commerce in India is still in early stages of market-building.

Policy recommendations:

Policymakers can choose among the three recommendations below. The choice must be such that it preserves the value-adds of e-commerce:

1. Allow concentrated e-commerce markets to continue, but then undertake one or more of the below:

Disallowing the fusion of online and offline retail, or limiting the growth of this fusion under monopoly conditions;

Regulating platforms to minimise chances of breakdown, because third-party sellers also have an interest in the platform not arbitrarily shutting down;

Restricting the change of policies on platforms that may adversely affect platform participants without duly informing or consulting with the latter.

2. Maintain a minimum level of competition to allow switching between platforms for third-party sellers;

3. Promote public ownership or democratic control of e-commerce platforms to correspond with its infrastructural nature.

Also read: Why Amazon, Apple, FB and Google are in the dock. It’s not just about economy

Infrastructure that e-commerce is platformising

Key findings:

Platformisation of the marketplace is taking place through control over market conditions – e-commerce firms both regulate and act as participants in the marketplace, thereby exerting inordinate amounts of control over the marketplace.

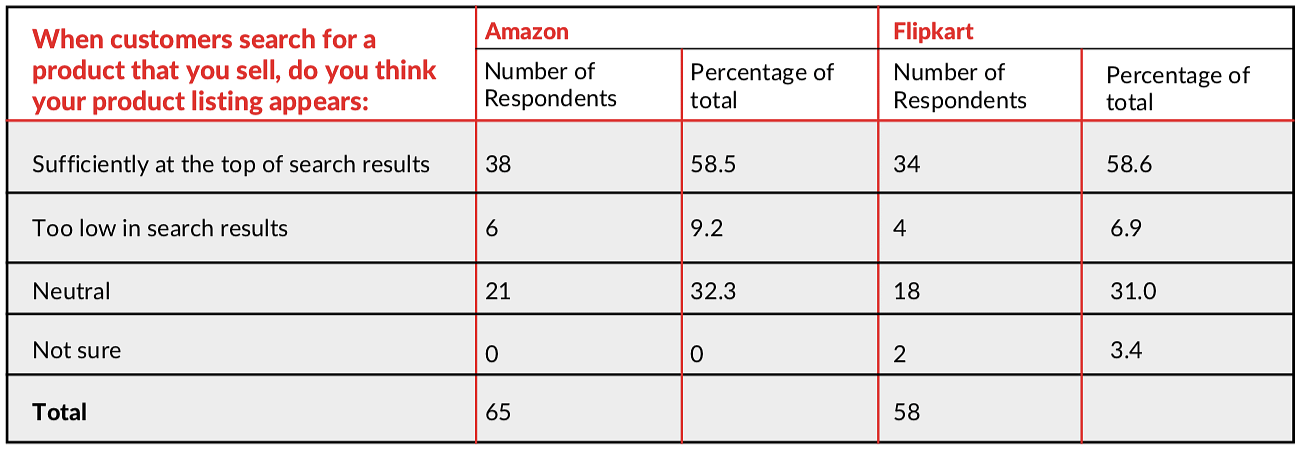

In the survey, most sellers did not have an issue with their appearance in search rankings. This indicates that despite the platformisation of the marketplace, it is perhaps premature to ask for algorithmic fairness in e-commerce; but algorithmic transparency is still needed.

The survey also found that over 70% of consumers now search for goods they are buying directly on the platforms instead of using search engines. This makes it clear that if there were to be an issue with algorithmic fairness in search results in the future, it would affect nearly all of online product search, not just product search on a particular platform.

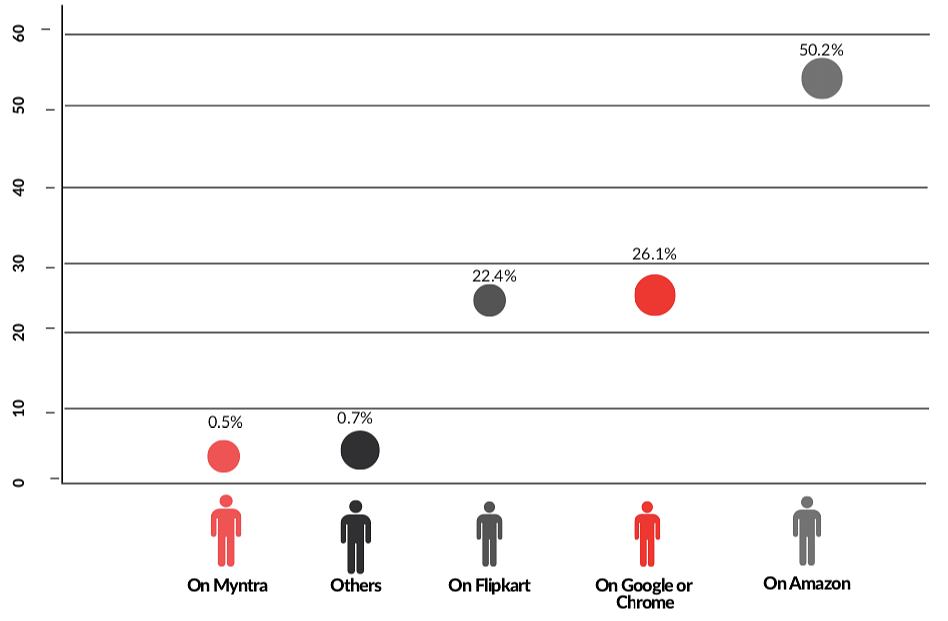

When you decide to buy a product online, where do you usually first search for it?

Platformisation of the marketplace also takes place through private labels. Both Amazon and Flipkart use sales and other data generated on their platform to introduce their own products (private labels) for sale on the platform. This is egregiously anti-competitive as third-party sellers do not have access to the data generated by themselves and which is used to develop and market private labels. A majority of sellers (63.1% for Amazon and 58.6% for Flipkart) said that they saw platform-branded products as competitors to their own products.

Platformisation of logistics: Logistics in India is an infrastructural service that is being platformised by e-commerce through platform envelopment.

Eisenmann et. al. (2011) introduced the concept of platform envelopment – a phenomenon where a player in one platform market captures users in another platform market by bundling its services or functionalities. It is able to do this by gaining network effects in a new type of market with its existing user base. E-commerce providers in India use such bundling often. In fact, telecom provider Reliance Jio’s bid to enter e-commerce is itself an example of an attempt at platform envelopment.

Logistics is perhaps the sector that is most vulnerable to platform envelopment from e-commerce. About 20-25% of the e-commerce logistics market is controlled by e-commerce firms’ own entities. Amazon Transportation Services, in particular, has a strong presence in the sector. In 2018, KPMG estimated that 70% of the deliveries of large e-commerce platforms were made by their in-house delivery arms.

Platformisation of logistics is evident in over half of surveyed sellers (63.1% for Amazon and 53.4% for Flipkart) claiming one of the reasons for selling online is shipping provided by the platform. Sellers and consumers both preferred bundled services (sales and shipping provided together by the platform), showing that such platformisation of logistics is likely to continue. About 20-25% of the e-commerce logistics market is controlled by e-commerce firms’ own entities.

Policy recommendations:

Third-party sellers must have access to the same sales data that is used by the platform to compete against them. Mechanisms for mandated sharing of non-personal data sharing should be built for e-commerce.

Currently, platforms with FDI are effectively disallowed from selling their own products as well as third-party products. This separation of intermediation and sale has to be imposed on domestic e-commerce entities in multi-brand retail above a certain firm size as well. It should not remain limited to e-commerce entities receiving foreign investment.

Third-party sellers should be able to know why their products have a certain rank in search results on the platform. Algorithmic regulation should include a minimum level of transparency about how algorithms rank results on e-commerce sites, with evolving standards for fairness.

To regulate broader economic effects, lending rules in the logistics sector should account for the growing market share of e-commerce firms in logistics.

Also read: Why India’s ban on Chinese apps opens a gold mine for Mukesh Ambani’s Jio & Silicon Valley

Conclusion

Both tendencies underline the fact that e-commerce platforms affect markets and economic relationships outside their immediate scope. Regulations for e-commerce will have to preserve its value-adds to sellers and consumers while limiting its drawbacks.

Jai Vipra is a Senior Resident Fellow at the Centre for Applied Law and Technology Research at Vidhi.

Akshiti Vats is an intern at Vidhi working in the area of law and technology. Views are personal.

This is an edited excerpt from the authors’ report, Changing Contours of the Sharing Economy, first published by the Vidhi Centre for Legal Policy, Read the full report here.