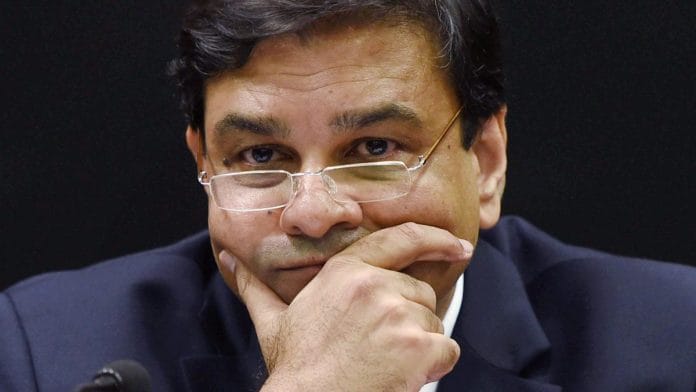

RBI governor Urjit Patel’s resignation is a wake-up call for Narendra Modi government to focus on financial stability.

On 10 December 2018, Urjit Patel, Governor of the Reserve Bank of India (RBI), resigned from his position, citing “personal reasons”. The resignation came on the heels of a public and increasingly-politicised dispute between the RBI and the Narendra Modi government on a range of critical issues regarding the functions of the RBI.

Urjit Patel’s resignation marks only the second time in the history of the RBI when a governor has resigned before the completion of his/her term. His resignation underscores just how crucial an independent central bank is for Indian economy’s financial stability as it addresses long-term concerns and keeps inflation in check, both of which are in the government’s best interests. The government should, therefore, adopt a “whole-of-government approach” that prioritises stability to address the challenges facing India’s financial sector.

The RBI’s independence

The Reserve Bank of India Act, 1934, which established the RBI, does not technically establish the RBI as an independent institution. The act empowers the government to appoint the governor and four deputy governors. However, in practice, the RBI has maintained autonomy in its decision-making, particularly on monetary policy.

Also read: The Modi government is the most faceless, nameless & talent-averse India has seen

The RBI’s independence allows the bank to consider its decisions over a longer time horizon than the government – which must react to opinion polls or upcoming state and national elections –as well as take decisions that may be painful in the short-term, but beneficial to the economy over time. Moreover, the RBI’s independence is also related to better performance. A paper by Alberto Alesina and former US treasury secretary Lawrence Summers found that there is “near-perfect negative correlation between inflation and central bank independence”. This means the more independent the central bank, the lower the inflation rate.

However, the dispute between the government and the RBI over the past few months has threatened this autonomy. The government, in August 2018, appointed S. Gurumurthy and Satish Marathe – two politically-connected individuals – to the RBI’s central board. A few months later, the government invoked a never-before-used section of the RBI Act to provide “directions” to the bank, demanding governance changes to give the central board more power and to use the RBI’s reserves for government spending likely aimed at welfare programmes ahead of the 2019 general election. These directions, however, undermine the overall financial stability of the Indian economy.

“Whole-of-government” approach

Financial stability depends on the RBI’s ability to prioritise long-term gains over short-term outcomes. However, the government, so far, has taken to limiting the autonomy of the RBI for short-term gains that will inevitably have adverse long-term consequences.

RBI governor Urjit Patel’s resignation, however, should be a wake-up call for the government to realise that financial stability will require a new, whole-of-government approach that ensures coordination between the RBI and the government’s ministries.

The government’s demands for more powers for the central board compromise the RBI’s ability for long-term planning. Given the appointment of non-expert, politically-connected directors on the board, there is a credible fear that short-term benefits will be prioritised, even if they have long-term negative implications. This fear is reflected in the findings by Alesina and Summers, which underscore how eroding the independence of a central bank inhibits its ability to combat inflation, adversely affecting overall financial stability and posing deep political downsides for the government. The Bharatiya Janata Party should already be familiar with such a scenario, having faced sky-rocketing onion prices in 1998, which contributed to its loss in the Delhi assembly elections that year.

Also read: Urjit Patel, RBI, institutional autonomy and the Power of One

Moreover, RBI deputy governor Viral Acharya, in a speech at the A. D. Shroff Memorial Lecture, argued that “if a government were to pay attention to markets, it would realise that central bank independence is in fact its strength”. Undermining the independence of the RBI, he noted, would be “potentially catastrophic, a “self-goal” of sorts, as it can trigger a crisis of confidence in capital markets.” This self-goal is already beginning to manifest. Since the announcement of Urjit Patel’s resignation, market analysts noted that the dollar-rupee one-month forward contract saw a 1.1 per cent increase against the dollar, and “the Singapore-traded Nifty futures lost 1.3 per cent”.

It is clear that rather than pushing forward on its current path of tinkering with regulatory bodies without considering the downstream economic effects, the government should change course and adopt a “whole-of-government” approach, beginning with the upcoming board meeting scheduled for 14 December. By prioritising financial stability rather than trying to limit the RBI’s autonomy, the government can use the negotiations to align its short-term priorities with the long-term goals of the RBI and improve coordination between the RBI and all its ministries, and not just the finance ministry.

Also read: Urjit Patel quits: Cry for RBI autonomy or inability to work with Modi govt on economy?

By resigning as RBI governor, Urjit Patel has made a case for the government to adopt a “whole-of-government approach” that improves government-wide coordination and dialogue with the RBI as it tackles the challenges facing India’s financial sector. The government should take these lessons to heart rather than continue down its current path.

The author is research associate, Wadhwani Chair in US-India Policy Studies at Center for Strategic and International Studies. He tweets @amanthakker

Being in election mode 24 / 7 / 365 is not good for either the party or the country. Certainly not for the economy, which is becalmed.