The Covid-19 pandemic has been devastating for lower income families. Repeated lockdowns, loss of income and a genuine threat to their lives have left them more vulnerable than ever before. Those without a proper home, and living on rent have been doubly affected. Those who rented their housing have depleted their savings and have been under a constant fear that if anything were to happen to them, their families would be left without a roof over their heads. The low-income rental housing tends to be small and crowded. According to the 2011 census, India’s population density is extremely high with 382 people living per sq km. Overcrowded houses have led to faster spread of infections and in turn, higher levels of stress.

The Pradhan Mantri Awas Yojana (PMAY) Housing for All programme was conceived to help families create capital/equity since ownership provides them with an asset that can be used for collateral, making them credit worthy, while also improving their standard of living. However, it has had mixed results largely due to bottlenecks in execution. According to the PMAY-U portal, as of 8 October 2021, 50.83 lakh homes have been delivered out of a total of 87.95 lakh that are under construction.

Though this seems underwhelming compared to the original target of 1.8 crore homes by March 2022, we need to appreciate the enormity of the task, value unlocked and the burden on the exchequer. Despite the laudable aims of PMAY, it is financially unsustainable to continue this programme to achieve its current targets. The inability of PMAY to provide affordable housing at scale to citizens may also have implications in various state elections due to take place in 2022. As an example, we analyse the subsidy provided to house recipients that fall in the Economically Weaker Section (EWS) category.

Also read: Economic Survey notes ‘improvement in equity’ — better access to bare necessities across India

The subsidy burden

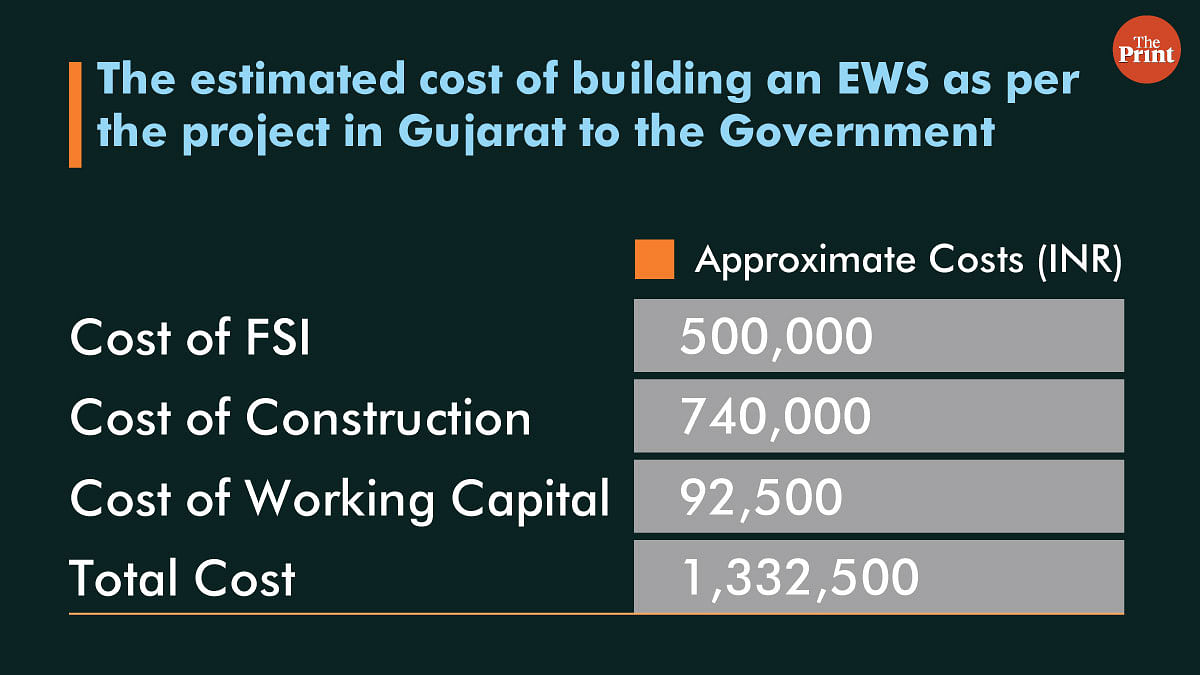

Under the EWS category of PMAY, the government initiated various subsidy models to address the different needs – from self-build in rural areas to dense inner city homes. The main thrust, though, has been homes built by the government and sold at a special subsidised rate. Though the policy stipulates that a beneficiary can avail any form of subsidy, in the case of the government built model, we find that the subsidy actually availed is much higher. We have taken into account a typical EWS project in Gujarat that the government sells at Rs 7 lakh. While building these projects, the government does not take into account the charge for the floor space index (FSI), supervision costs, working capital and actual construction cost. These costs are an add-on to the subsidy provided which is borne by the government. The price of the units is predetermined and an Engineering, Procurement and Construction (EPC) contract is awarded by the municipality.

If we were to take these estimated costs into account, the total cost to the exchequer turns out to be much higher. The total estimated cost is Rs 13.3 lakh to the government which sells the same unit at Rs 7 lakh with an additional subsidy of Rs 2.7 lakh. Hence, the total cost to the government is approximately Rs 9 lakh per house. Here, we are not even considering the considerable human resources the government deploys to award, oversee and deliver these projects.

The Government of India does not account for the number of houses built under this scheme directly but classifies them under Affordable Housing in Partnership. Based on the data available on the PMAY website, 50.83 lakh houses have been delivered so far. So, if we take the cost per house to the government and multiply it to the number of houses that have been delivered so far, we get an approximate cost to the government of Rs 4.57 lakh crore.

This analysis demonstrates that the current model is not sustainable. The government cannot expect to charge more and the only way to reduce cost is to build these homes on land that is cheaper. Over the years, it has become apparent that unless there is a clear value proposition in place, units that are at a distance from the city have a reduced demand and also deteriorate faster.

Bring in private players

The way forward for the government is to restructure affordable housing as Public Private Partnerships (PPP). The past PPP structures have failed because they looked at revenue optimisation for the government, which priced out large public players leading to compromises on quality and leakages. Hence, rental models need to be encouraged. India already has a system for subsidised debt for underserved categories under priority sector lending which can be adopted for affordable rental. This could potentially change the market dynamics of the sector.

IDFC Institute has worked on these models and others that optimise PMAY subsidies for long-term impact and asset creation. There is no one-fit solution to all. Each geography, each location and price point has a different solution. It has to be accepted that the government will have to be the provider for entry-level homes. The scope and challenges will only increase as urbanisation increases and more people migrate to cities. If the current models are adhered to, the subsidy burden that is already unsustainable will become unmanageable. PMAY is an excellent first step to put mechanisms in place for directly reaching the beneficiaries but it has to evolve so it stays relevant and can be scaled up going ahead.

Monani @dhavalm, Bhansali @BhansaliAnushka are respectively Resident Fellow, and Analyst at IDFC Institute. Mariwala @VibhavMariwala was formerly Senior Analyst at the Institute. Views are personal.

(Edited by Anurag Chaubey)