The economy is getting painted into a corner. Fiscal policy is boxed in by alarming numbers: Expenditure in the June quarter was 5.4 times revenue! Monetary policy has no room for manoeuvre, as seen Thursday, because the policy rates are already negative in real (i.e. inflation-adjusted) terms.

While the government and the Reserve Bank of India (RBI) find their hands tied, the resources available to the rest of the economy are constrained as GDP is expected to shrink by 5 per cent or more. Corporate profits, as reported, have fallen by about 30 per cent this past quarter, and households are coping with job losses. So the macro-economic ratios of savings and investment that underpin growth will dip. And the government will soak up a higher proportion of the available savings.

These problems are not about to disappear into green shoots, but the June quarter’s grim numbers mark the trough. A recovery will come, but from what levels? Government tax revenues, for instance, are down by a half in the June quarter. Even if they double in the September quarter, the year’s fiscal deficit target of just under Rs 8 lakh crore will have been massively exceeded midway through the year. Even with generous assumptions about further revenue recovery in the second half of the year, the deficit could end up exceeding 6.4 per cent of the GDP, which was the high (or perhaps low) watermark set in 2009-10. In anticipation, the government has already upped the year’s borrowing requirement by 50 per cent, to Rs 12 lakh crore. It may need more than that, and bind monetary policy even more as the RBI plays its role of government banker.

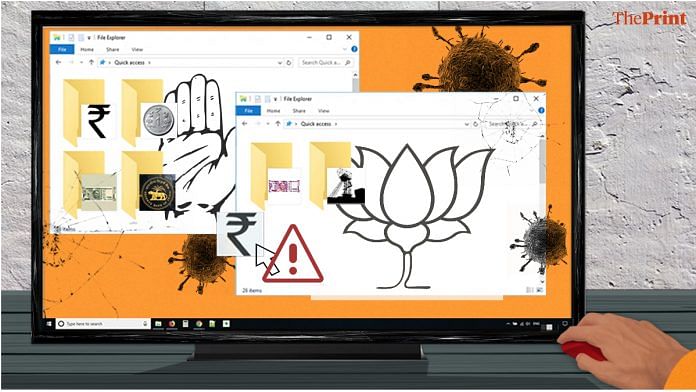

And so we come to policy rollbacks. Start with the assumption that a massive fiscal stimulus is the only answer, as it was in the wake of the global financial crisis when the fiscal deficit jumped from 2.5 per cent of GDP to 6.4 per cent. That fired up a smart recovery; some would say too smart. The difference between then and now is that the deficit and public debt were smaller then, so there was room for an outsize fiscal stimulus and expanded public borrowing. This time the numbers are more stretched, so the government may have to resort, eventually and however unwillingly, to a policy rollback, and revive the automatic monetisation of the deficit. In layman’s language, that means printing money, abandoned as policy and practice in the 1990s.

Also read: How fiscal regression can force Modi govt to take sub-optimal economic decisions

Meanwhile, banks are headed for another dunking in a sea of bad debt and will need additional capital of Rs 4 lakh crore, judging by RBI estimates of potential bad loans. Since that money can’t be found, and more companies risk going under, the only way to keep the financial and corporate sectors functional through a fresh phase of the twin balance sheet problem is to roll back policy on another front. This the RBI has just done by reviving the discarded tactic of kicking the can down the road, via loan restructuring.

If macro-economic management is constrained enough to force rollbacks, what of longer-term policy? The government’s moves so far have been to ease labour policy (via the states), invite foreign investment in new sectors (like coal mining), encourage import substitution, and improve the transport infrastructure. These will make a difference, though all of it not necessarily for the better. The pushback against imports from China (which account for a significant chunk of the non-oil deficit in merchandise trade) is understandable, but the broader lack of conviction that open trade can benefit India has led to the embrace of long-discarded Congress policy by the government, otherwise keen to shed all remnants of Congressism. So we have two more policy rollbacks ― to higher tariffs and, after three decades, the re-birth of import licencing.

The discarded policies now revived did not yield great results the first time round. This government thinks it can do better. Good luck to it, but in the meantime it seems only divine intervention can stop the Covid juggernaut, which started and sustains the havoc. If only religion could serve as something more than a government’s opium for the people.

By Special Arrangement with Business Standard.

Also read: These are the 18 sectors that have been identified as ‘strategic’ for India by Modi govt

So what *should* the government be doing . . . ?

Create infrastructure, rationalise taxation, fix capital economy, dump unnecessary redundant legislation and most importantly get out our way. The biggest enemy of Indian enterprise and entrepreneurship has been our govt. And now that we seem dead certain to return to disastrous 80s, I think China has fulfilled its objectives. Prod Indian govt and then sit back as it leads the country towards an irrevocable disaster. After all how many times can you make the same mistake before the repercussions set in permanently. God save our country for it seems unlikely any of our govts would. Congress never did, I had high hopes from this govt. So much for that.

1. Acknowledge that it needs help managing the economy. Declare a financial emergency and constitute a unified govt which has experts from the opposition in managing the economy.

2. Stop all divisive and hate filled politics and unite all Indians behind the govt for some tough decisions.

3. Strict price controls on all essentials for a year to enable cooling of inflation but allow other manufacturing industries to start production and sell at market prices to kick-start internal consumption and exports.

4. Abolish personal IT for 5 yrs.

5. Amend GST to flat tax rate of 15% tax for every item sold in India

6. Partly monetize deficit to cover subsidy budget with a proviso that subsidy will be only for food and gas.

7. Manage Covid with testing and isolation of cases rather than lockdown.

8. Sell stake in PSUs to raise money for infrastructure projects only.

9. Strictly ensure that low interest rates are passed on by banks to borrowers right away.

10. Ensure all financial disputes are settled within 3 months at govt level and another 3 months in court appeals.

11. Float a well thought out financial policy after the Unity govt (BJP+opposition) agrees and stick to it for next 5 yrs without changing it every few months.

12. Pray to Shri Ram

The best thing government can do at this point of time is reform corporate governance. Corporations have been sitting on some very large sums of shareholders money. I recently studied balance sheets of five auto manufacturers and found that they are holding back more than ₹70,000 crore worth of it. That money needs to be released into the economy. Amendment to companies act to mandate corporations to disburse retained profits if they remain uninvested for (say) more than five years will do the trick.