The U.K. luxury unit of India’s Tata Motors Ltd. will eliminate 4,500 positions globally as part of a 2.5 billion pound ($3.2 billion) cost-cutting program outlined in November, according to a company announcement Thursday.

The savings will be relatively minor. Workforce reductions are now standard in an industry struggling to deal with rising costs from technology, pricier materials, and U.S. President Donald Trump’s tariffs.

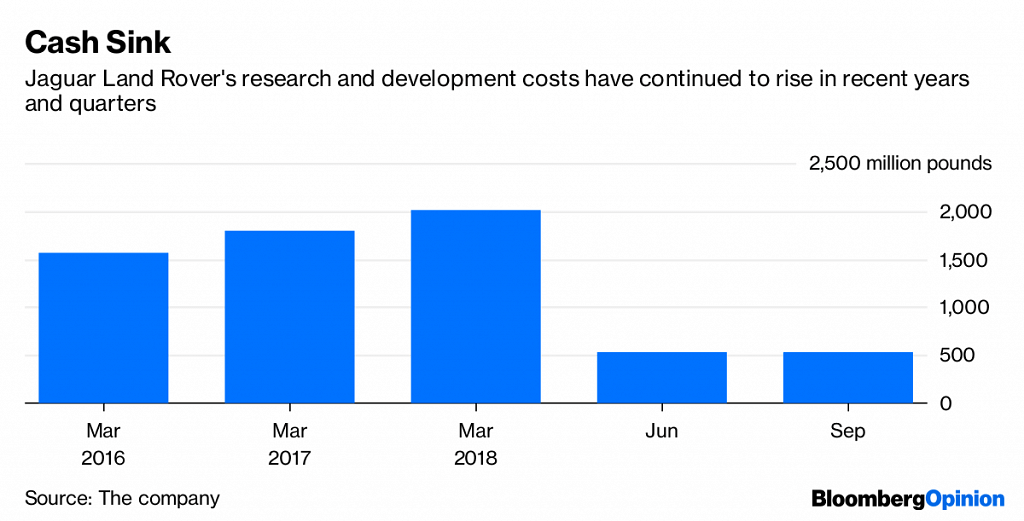

In its release, the company said this was the next phase of a transformation program that started in its fiscal second quarter through September. JLR said its “Charge and Accelerate” initiatives had identified more than 1 billion pounds of improvements and realized 500 million pounds of that in 2018.

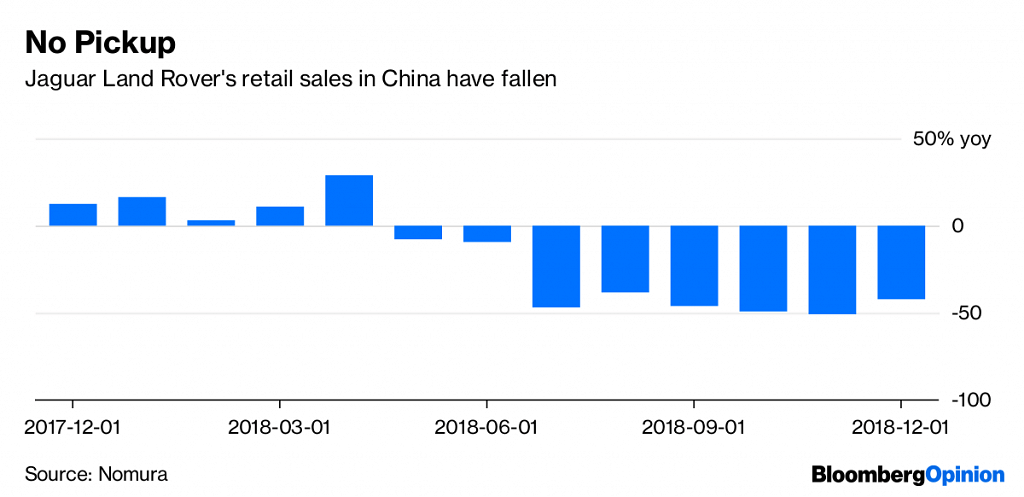

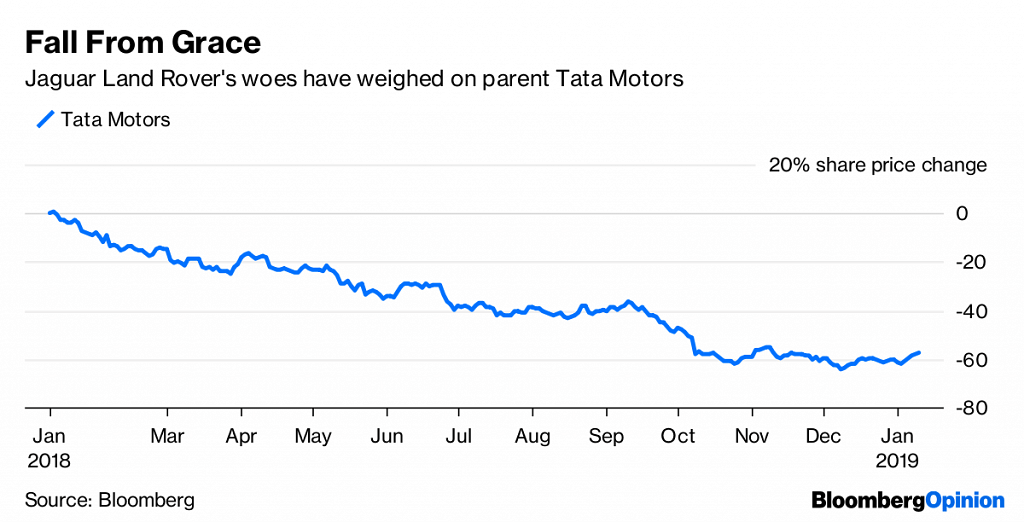

In the meantime, though, there’s no sign of an end to the company’s financial and operational woes. December retail sales were dismal again – Jaguar Land Rover sold around 52,000 cars globally, down 6 percent from a year earlier. China sales dropped 42 percent even as luxury peers posted gains. Free cash flow was negative in the second quarter and executives have said it will stay that way for the year. S&P Global Ratings said in December it expected free operating cash flow to be significantly negative for the next two years, totaling almost 4 billion pounds by March 2020.

In October, the company blamed China for a second-quarter pretax loss of 90 million pounds. It disclosed investment outlays of 1 billion pounds for the three months and took out another $1 billion loan.

This is the automaker’s first announcement since then and, as we’ve argued, it’s doing far too little to achieve a turnaround or even tell investors about its progress.

In December, Jaguar Land Rover said its venture capital arm invested an undisclosed amount in six startups including an online portal for music fans to book tickets and festival travel packages. It also launched its own incubator and has committed $40 million to its team in the Formula E electric-car racing series.

Investing in future technology for electric cars and batteries is one thing; whether this is the type of transformation that an automaker in financial turmoil should be seeking is quite another.

Meanwhile, the job cuts will have only a minor impact on its savings goal. With more than 40,000 employees and associated costs of 2.7 billion pounds in the 2018 fiscal year, a back-of-the-envelope calculation suggests a 10 percent workforce reduction will save only about 280 million pounds.

There was no mention of executives on multimillion-pound pay packages departing, and union workers won’t take cuts at the country’s largest automaker lightly. Ironically, Jaguar Land Rover said on an earnings call in July that its “mission in life” was to leverage its people to deliver the best products.

Operational expenses have risen faster than staff costs. Wouldn’t that be a place to start? JLR could also focus on getting a grasp of the Chinese market, where its iconic brand has been unable to push past the likes of BMW and Mercedes. JLR in recent years has “entered too many product segments at once, added too much capacity, relied too much on super-normal Chinese profits, and ended up with a cost structure that the current top line simply can’t support,” as Bernstein’s Robin Zhu notes.

Creditors haven’t been happy either, as we noted in June last year before Tata Motors was downgraded. Leverage will continue to deteriorate over the next 12 to 18 months, S&P said when cutting its rating on JLR recently. As of late last year, shorts on JLR’s bonds had tripled to more than $280 million compared with the start of 2018. Tata Motors shares rose in Mumbai after the JLR announcement, before falling more than 2 percent on Friday. With progress like this, investors should be asking for more management accountability rather than cheering scraps that come their way. – Bloomberg