For generations, the image of retirement has typically been of a man enjoying his golden years, thanks to a steady income from pension. For many women, this benefit remains somewhat distant. As the world grapples with the challenges women face in achieving financial independence and security, particularly in their retirement years, it becomes evident that addressing these issues is crucial for spurring gender equality and ensuring a more equitable future for all. Despite significant advancements in gender equality as well as government supports, women continue to encounter disparities in various aspects of life, including their financial well-being. One of the most pressing issues on this front globally is the gender gap in pensions, where women receive significantly lower retirement incomes compared to men.

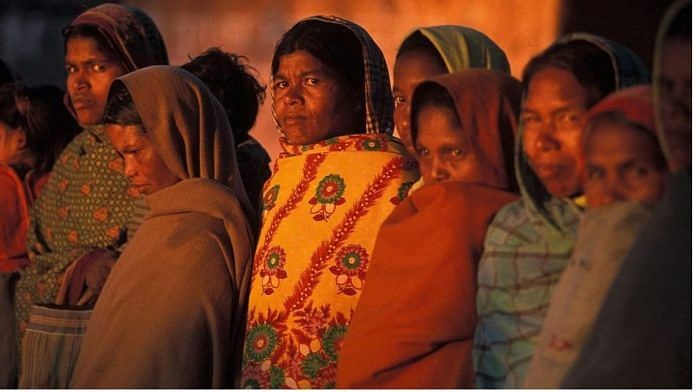

Women’s pensions are 25-30 per cent lower than those of men, according to the World Bank, highlighting a significant disparity in retirement outcomes. In India, this gap is even more pronounced, exacerbating the financial challenges faced by women in their later years.

Another issue in the country is a widespread lack of financial literacy. Only about 27 per cent of India’s population is financially literate according to the 2020-21 report of the National Centre for Financial Education. This number is even lower for women, at 21 per cent.

Several factors entangle to create the gender gap in pension outcomes: reduced participation in the formal workforce due to societal roles, lower pay even when employed, career breaks for caregiving responsibilities, and limited financial literacy hindering awareness of retirement planning options.

While addressing systemic issues like the gender pay gap is crucial, empowering women with financial knowledge and advocating for inclusive policies like flexible work arrangements and micro-payment contribution options are equally important to bridge this gap and achieve a secure retirement future for all.

Also Read: More Indian women are joining workforce but gender employment gap is still high, shows new report

Promoting financial literacy is essential

Financial literacy and retirement planning are essential components of women’s empowerment and economic independence. Women with better knowledge of personal finance make informed decisions, including saving for retirement, investing appropriately, and planning for unforeseen expenses. Retirement planning allows women to build a financial safety net for their later years, ensuring that they maintain their standard of living and enjoy a dignified retirement.

Despite the importance of financial literacy and retirement planning, many women face barriers to accessing financial education and resources. Cultural norms, lack of access to financial services, and limited awareness of retirement planning options contribute to women’s financial vulnerability.

By promoting financial literacy and providing women with the tools and resources they need to plan for retirement, society can empower women to achieve greater financial security and independence.

Bridging the pension gap

In the National Pension System (NPS) women account for less than one-third of accounts, partly reflecting the nature of the organised labour market. Their share improves significantly to 46 per cent in the case of Atal Pension Yojana (APY) due to greater participation of women of self-help groups (SHGs) in rural areas. Women are also seen to be more responsible financially; having come to the pension space they are more likely to continue.

Considering that the longevity of woman is higher, and many are involved in unpaid house work or farm work, they are in greater need of retirement security. Closing the gender gap in pension outcomes demands a multi-pronged approach. Governments, corporates, financial institutions, and individuals all have a role to play.

Also Read: Wikipedia needs more women. And India can help bridge this gender gap

Support for women

Flexible contribution options, such as voluntary contributions and micro-payments, can accommodate women’s varying financial circumstances and preferences. Notably, the central government has issued an advisory urging employers to promote women’s participation in the workforce, stressing the importance of maintaining a balance between employment and caregiving responsibilities. Additionally, the advisory emphasises the need for adequate representation of women in management positions, support for women entrepreneurs, and the eradication of gender bias in recruitment, promotion, and performance evaluations.

Gender-sensitive products, such as pension plans tailored to women’s needs and preferences, can provide women with customised retirement solutions that align with their goals and priorities. Also, women must actively engage in their financial well-being, taking control of their bank accounts and seeking professional advice for personalised retirement plans. By implementing these strategies, society can empower women to take control of their financial futures and bridge the gender gap in retirement planning.

As we celebrate International Women’s Day, let us recommit ourselves to empowering women through financial literacy and retirement planning.

Deepak Mohanty is an economist and chairperson of the Pension Fund Regulatory and Development Authority (PFRDA). Views are personal