As the new calendar year gets under way, commentators have switched their attention from the economic growth likely in the current fiscal year (the broad consensus being sub-7 per cent) to the next one.

Realistic projections are important for anchoring the Budget, due to be presented in less than four weeks. This is particularly so because past forecasts, especially by government spokespersons, have been over the top — starting with the promise of double-digit growth made early and repeatedly in the Narendra Modi government’s first term.

Even in the first year of the second term, 2019-20, the then chief economic advisor forecast 7 per cent growth; the year ended with 4 per cent.

Then there is this business of forecasting when the Indian economy will hit the $5-trillion mark — for which the target year has shifted from 2022-23 to 2024-25, and now to 2026-27. Even accounting for the two years of Covid-caused setback, such shifting of goalposts should raise questions about the seriousness of the forecasting.

Still, the latest target date has been endorsed by the International Monetary Fund (IMF), which in October put out a figure of $4.95 trillion for 2026-27, from $3.47 trillion for this fiscal year.

This should not be taken to mean 42 per cent growth in the intervening four years because the numbers are in current dollars, including inflation. US inflation in 2022 was 7 per cent, despite which the rupee depreciated 11 per cent against the US currency. Thus, while real economic growth this year may be sub-7 per cent, nominal growth in rupees may be 14-15 per cent, while nominal dollar growth estimated by the IMF in October was 9 per cent.

If one is to go for dollar benchmarks, better to target the per capita income level that would move India from the lower-middle to the upper-middle income category (about $4,000).

Also read: Food subsidies are no cure for rural distress. Why the money’s better spent on other options

That brings one to the current chief economic advisor’s expectation of a sustained 6.5 per cent growth rate for the rest of the decade. This is entirely realistic, as the economy had already been on a 6.5 per cent growth track for the 28 years starting with 1992-93 and until 2019-20, at the tail-end of which the pandemic hit.

In fact, the overall growth rate should have been accelerating by now, for the fastest-growing segment of the economy (services) is increasingly dominant while the slowest segment (agriculture) accounts for a much smaller share of economic activity now than three decades ago — dropping from 40 per cent of gross value added to 17 per cent.

If the economy is unable to accelerate despite this structural shift and the advantages flowing from better physical and financial infrastructure and digitisation, it is because of the drop in the savings and investment rates from their peaks, and two other constraints — a much higher public debt-GDP ratio and a much lower worker-population ratio. Without these developments, annual economic growth could have crossed 7 per cent on a sustained basis.

Policy can make a difference. Employment remains the biggest challenge. Education is the other constraint, given the low knowledge and skill levels compared to competing countries like Vietnam. Those countries are also more open to becoming part of international value chains, with lower tariffs and a better business environment, whereas India has been raising tariff walls and abstaining from regional trade arrangements. Greater dependence on domestic sources of growth will deny the country the momentum that comes from accessing international markets.

Lastly, what are the prospects for the coming fiscal year? Any assumption of growth beyond 6 per cent would mean a significant uptick from the current tempo.

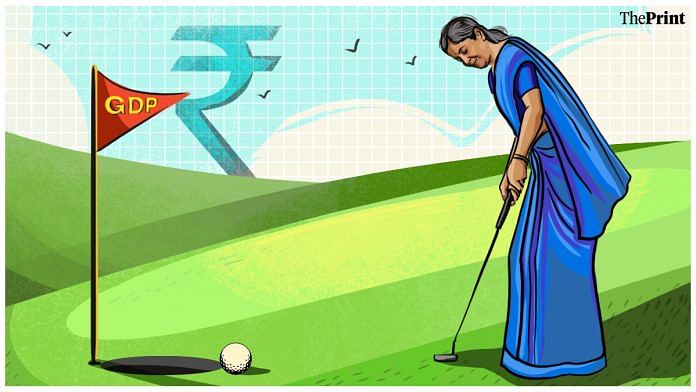

This can happen but there are constraints on both fiscal and monetary policy, which must focus on reducing macro-economic imbalances: The current account deficit, the fiscal deficit, and inflation. All three are too high for comfort. The lead must therefore be taken by private investment and consumption; the pace of recovery on these is as yet hard to predict. On balance, the finance minister would do well to continue with her recent record of under-budgeting, in order to hopefully over-achieve again at year-end.

By special arrangement with Business Standard

Also read: There’s a fast-growing dragon in the sea. For Navy to keep up, India must tackle key hurdles