Feroze Gandhi (Rai Bareli): Mr. Speaker, sir, a mutiny in my mind has compelled me to raise this debate. When things of such magnitude, as I shall describe to you later, occur, silence becomes a crime. Public expenditure shall be subject to severest public debate, is a healthy tradition, especially so in an era of growing public enterprise. There is nothing to be ashamed of if a public undertaking has made a mistake, if some people have made a mistake, we should confess it. Parliament must exercise vigilance and control over the biggest and most powerful financial institution it has created, the Life Insurance Corporation of India, whose misapplication of public funds we shall scrutinise today.

Much as I have tried to, I have failed to understand how the Life Insurance Corporation became a willing party to this questionable transaction with the mystery man of India’s business underworld.

A Member: Who is that?

Feroze Gandhi: Mr. Speaker, there is going to be some sharp shooting and hard hitting in the House today, because when I hit, I hit hard and expect to be hit harder. I am fully conscious that the other side is also equipped with plentiful supplies of TNT.

A Member: “T. T ”

Feroze Gandhi: A friend of mine in this House, Sir, mentioned to me that the Finance Minister’s statement was well fortified. Let me see if I can breach the ramparts at the very first shot. It appears the Life Insurance Corporation has committed a breach of privilege of this House by causing to be placed on the Table of the House a statement withholding important information. May I know why one important transaction with Shri Mundhra has been kept a secret from the House? In the absence of this vital information the statement of investments becomes worthless, not even worth the paper on which it is cyclostyled.

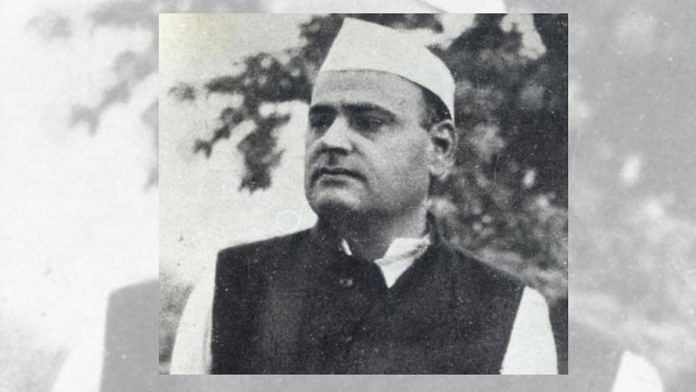

Also read: Nehru’s son-in-law Feroze, a crusader, who exposed corruption in his party’s government

You, Mr. Speaker, are the guardian of the rights of this House, and it is for you to decide this issue. On the 29th November the Finance Minister stated in the House:

“The question is not one of favouring one particular individual or group, but seeing that the Corporation benefits and the policy holders, ultimately, benefit by the investment made.’’

I ask, was it in fulfilment of this policy that the Corporation purchased by direct negotiation from an individual, Shri Mundhra, shares worth Rs. 1,25,00,000 in his concern on the 25th June 1957? In March, in April, in June, in July—July is the one which the statement has left out—in August, in September, for six months in this year and on 19 different occasions the Corporation purchased shares of the Mundhra Group for a sum of Rs. 1,56,00,000. If this is not favouring and financing one particular individual or group, then what else is it?

The Finance Minister, in reply to another question on the 29th stated:

“They”, meaning the Corporation, “wanted to augment their shares…”

And, whenever the Corporation wanted to augment its shares, Shri Mundhra was always there waiting to oblige, so much so that on one occasion the Life Insurance Corporation transacted business on a day when both the Calcutta and Bombay Stock Exchanges were closed.

A Member: On what day?

Feroze Gandhi: Look at the dates and then find out the day. To my own question:

“May I know whether it is a fact that a few months ago some shares were purchased at a higher price than the market price of those very shares on the particular day?”

The Finance Minister gave an emphatic reply: “I have been told that no such thing happened.”

What does the statement reveal? According to the quotations on the Calcutta Stock Exchange given by the minister himself, on the 24th there is an over-payment of Rs 77,000. According to the quotations on the 25th, given by the honourable minister in the statement, there is an excess payment of about Rs 3 lakh. What are the results of these augmentations?

Such was the stability of these concerns, such was the soundness of the investment, so stable was the man with whom the Corporation had struck 19 deals, that within two months of their last augmentation, in September the Government had to appoint administrators and directors in these concerns. This is not investment. This is a conspiracy to beguile the Corporation of its funds.

From the Finance Minister’s statement, it would appear as if these investments were made through the open market. The truth is that this was a negotiated deal with Shri Mundhra himself.

In the case of such bulk purchases, the market value dwindles into insignificance. Taking into consideration the fact that no sane investor would have touched most of these shares with a tadpole’s tail, I am left much against my will to the sad conclusion that this was a device to help Shri Mundhra who happened to be in financial difficulties at that time, as I shall prove later. The sacred savings of the insured were misused for this purpose and, if I may say so, almost gambled away.

I shall now scrutinise the shares purchases made on the 25th June and, Mr. Speaker, I shall confine myself to an analysis of the purchase of the 25th June alone. The purchases totaled Rs. 1,24,44,000. Obviously, all the inspiration to augment their shares could not have burst forth suddenly on the 25th. Deep thought must have been given to this investment.

Prevailing prices of these shares on the Stock Exchange must have been thoroughly scrutinised. Balance sheets must have been looked into. I am sorry, Sir, I made a mistake. Some of these concerns have not published their balance sheets since 1958. I do not know what procedure the Corporation adopted in the absence of balance sheets to arrive at a conclusion as to the value of the shares they were purchasing.

Let us have a look round the Calcutta Stock Exchange, armed with the same authority as that of the Finance Minister, the official report of the Stock Exchange. The 25th was a Tuesday, 24th was a Monday, 22nd and 29th were Saturdays and Sundays when the Stock Exchange was closed. Let us see how much less the Corporation would have paid had they concluded the transactions, say, on the 21st. The answer is, it’s 10,73,000. These very shares could have been purchased according to the market value on the 21st, and the quotations are, from the official report of the Calcutta Stock Exchange, for Rs. 10,73,000 less. But let us move a little backward and see how much less would they have paid on the 20th. Again, according to the same source, the official report of the Stock Exchange, it is Rs. 9,42,000 less. On the 19th, Rs. 11,52,000 less; on the 18th, Rs. 13,47,000 less; on the 17th, that is Monday—Monday week—Rs. 13,62,000. My figures do not seem to be creating much impression.

I am going to jump one week from the 17th to give you an idea of how much less the Corporation would have paid had the purchase been made on the 10th June at prices prevailing and quoted at the Calcutta Stock Exchange. The Corporation could have purchased these very shares on the 10th for Rs. 20,83,000 less than what was paid on the 25th June. I have made no calculations of prices before the 10th. My nerves gave way.

Occasionally you, Mr. Speaker, are very helpful to Members, and on the 29th…

Speaker: The Hon. Member also is a Member.

Feroze Gandhi: You are very helpful to Members, and I think you understood what was in the minds of Members when they were groping in the dark and asking questions. You clarified the position. You, Mr. Speaker, said:

“The hon. Member wants to know whether to push up the falling prices of the shares of this company, either the Government or this Corporation went to the aid by investment in shares.”

Mr. Speaker, you let the cat out of the bag. It had never occurred to me. But I gave very serious thought to all that you said. This is exactly what happened. For purchases affected on the 25th, the prices were artificially created by crude market manipulations on the 24th, when, all of a sudden, all these shares reached their peak. On Monday, the peak was reached. On Tuesday the purchases were made.

Let us see, as I shall prove to you and to the House, how it was worked up. What happened on the very next day, Tuesday? The peak had passed. The downward trend began and as on Friday, the 13th December, the Corporation’s investment has depreciated by about Rs. 37 lakhs against the total investment of Rs. 1,24,44,000.

This, it may be argued, is not a loss, because I have purchased shares and as long as I do not sell them there is no loss. Actually, it would be difficult to argue that way, because the investment has depreciated and what would happen when the actuarial valuation takes place?

An insurance actuary will take the market value of those shares; not what you have paid for it. Therefore, the insured will lose heavily. The actual amount by which the capital investment has depreciated will be much more, because the total investment is about Rs. 1,56,00,000. I have only taken into account Rs. 1,24,00,000 odd in the calculation of Rs. 37 lakhs.

Now, how was the market manipulated? Let us take the case of one concern—Angelo Brothers. Mr. Speaker, on the 17th of June, the price at the share which Angelo Brothers quoted at the Calcutta Stock Exchange was Rs. 16.87 lakhs. On the 18th, Rs. 16.87. On the 18th, Rs. 16.87. On the 20th, Rs. 16.87; on the 21st, 16.87. On the 22nd and 23rd Saturday and Sunday—the Stock Exchange was closed. What happens on the 24th? With the ringing in of the Angelees on the 24th Angelo Brothers was booked by the Insurance Corporation for Rs. 20.25 per share—Rs. 3.38 far more than the quotation of the previous five days. This is how the market was manipulated.

Also read: Feroze wanted to divorce Indira Gandhi & marry another woman. Nehru put his foot down

I shall give you another example— the Osler Lamp Manufacturing Company. It is a very interesting company. It was floated in 1947—ten years ago. Let us see how the shares moved from the 10th June up to 24th June. On the 10th June, the price is 2.78, in the Calcutta Stock Exchange. On the 17th June, the price is Rs, 2.81. On the 18th June, Rs. 2.81; on the 19th June, Rs. 2.87; on the 20th June, Rs. 2.84; on the 21st, 2.84; Saturday and Sunday, 22nd and 23rd. Quotation on Monday, the 24th Rs. 4. What happens on the 25th? The prices collapsed. It goes down to 2.87. It has come to its original, and the Life Insurance Corporation paid Rs. 4 for share. The total investment runs into several lakhs.

But what is the condition of this company in which we have invested the money—the Osler Lamp Manufacturing Company. The dividend on preference shares has not been paid since August, 1949. Preference shares dividend has not been paid since August, 1949. No dividend has been paid on ordinary shares for the last ten years, that is, ever since the company was floated. And the Life Insurance Corporation was looking all round for a healthy investment. This is the kind of concern that they put their money in.

Now, I come to the British India Corporation. The British India Corporation in which on one day, the 25th June, they invested Rs. 42 lakhs, paid a dividend of 14 per cent in 1954, nil in 1955 and 2 per cent, for the year ending 1956.

This will work out at about 1.87 per cent on the Corporation’s investment. Rs. 42 lakhs were invested, and they were handed over to this Corporation on a return of 1.87 per cent. This is what we have done with the monies of the insured.

Speaker: What about the price of this share?

Feroze Gandhi: The prices have fallen. If you like, I can give the quotation. But it will take time.

The British India Corporation, once a tower of strength to the City of Kanpur, is in a state of collapse. One of its mills is either closed or there is notice of closure. It is in a state of collapse. The ruins are a testimony to its pristine glory.

This is part of ThePrint’s Great Speeches series. It features speeches and debates that shaped modern India.