According to the Stockholm International Peace Research Institute, global arms trade flows have been changing in the last five years, particularly after two years of war in Ukraine.

The data reflects how the international community of states is responding to three simultaneous events — Russia’s war in Ukraine, crisis in West Asia, and Chinese aggression in the South China Sea.

The global arms trade and its evolving pathways are particularly relevant for India because New Delhi remains a top arms importer globally, importing 9.8 per cent of the total global arms trade. Tracked over five years from 2019 to 2023, these patterns affect India in at least three aspects — diversification of import partners, aspiration to achieve self-reliance in weapons, and equation with Russia, its traditional arms partner.

SIPRI relies on the concept of Trend Indicator Value (TIV), which is intended to represent the transfer of military respites rather than the financial value of the transfer, besides controls for inflation and other factors. It relies on transfers that can be traced.

Also read: Modi govt did for India-Greece ties what others didn’t in 40 years

Five years of arms transfer

France has achieved a significant milestone by becoming the world’s second-largest defence exporter for the first time. Meanwhile, the United States has reinforced its position as the leading arms exporter, with arms trade being a pivotal element of its foreign policy and a cornerstone of its global influence. Exports surged by 17 per cent compared to the previous five-year record. In contrast, Russian arms imports experienced a substantial decline of 53 per cent during the same period, resulting in its descent to the third position in global arms transfers.

While Russia’s arms exports have decreased by half, the US has emerged as the primary arms supplier to Asia and Oceania. Furthermore, Washington has significantly increased its exports to Europe, which has seen a notable surge in major arms imports, doubling by 94 per cent between the periods of 2014-2018 and 2019-2024.

Europe itself remains home to various cutting-edge defence industries whose combined exports account for one-third of total global exports.

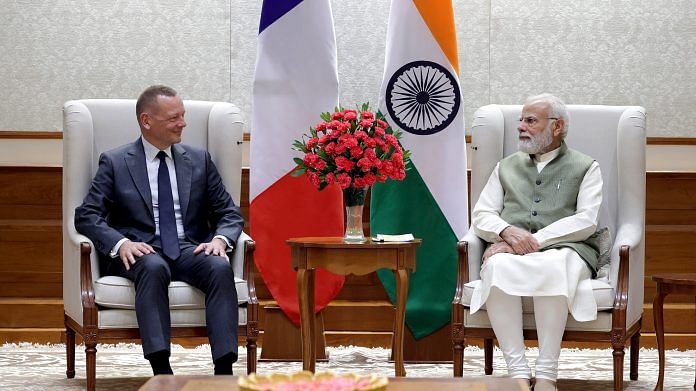

The standout increase in arms exports within Europe belongs to France, which has experienced a notable surge of 47 per cent according to the latest available report, placing it ahead of Russia. India has emerged as the primary recipient of rising French arms exports, followed by Qatar and Egypt. According to SIPRI, France has demonstrated particular prowess in selling its combat aircraft such as the Rafales beyond European borders.

Examining the aggregate data highlights the considerable influence exerted by Western nations. Over the past five years, the US and Western European states have jointly accounted for 72 per cent of all arms exports, emphasising their substantial role in the global arms trade.

Also read: Beyond Macron-Modi bromance—what’s next for India-France partnership?

Changing profile of India-Russia arms trade

Russia remains the topmost arms exporter to India, with 36 per cent of total exports to Delhi. France comes second, with 33 per cent, and the US is third, with 13 per cent. But there is more to this.

Indian arms imports from Russia have progressively fallen from 76 per cent (2009-2013) to 58 per cent (2014-2018) to 36 per cent now (2019-2023). Moreover, in recent years, China has taken more deliveries from Russia in TIV terms.

One of the key factors behind the reduction in India’s share of Russian arms exports has been the strategy of diversifying imports from other sources and indigenisation that started before the Ukraine war.

There are more explanations for Russia’s falling share of global arms exports, though. There is an increased reliance on fewer export clients, which indicates a shrinkage in Russia’s customer base that went down from 31 countries in 2019 to 12 in 2023. Among this pool are countries like China, Belarus, Myanmar, and Kazakhstan. The overall share of these four countries alone has risen from 11 per cent in 2012 to 54 per cent in 2023, where China’s share has expanded the most.

Also read: India must exploit its goodwill with Russia. Don’t let multipolarity become ‘messy-polarity’

Orders and deliveries conundrum

What is significant is that SIPRI data underscores that there are no deliveries to India for orders after 2021. The most significant push to the TIVs between 2019-2023 comes from the delivery of the S 400 deal signed in 2018.

In other words, India has not placed a fresh order with Russia since the war in Ukraine began. So, for about 400 TIVs worth of items received by India in 2023, about 130 TIVs were for the S-400 order and 77 for 48N6 missiles for that order.

Further, part of that 400 TIV figure comes from licensed production of Konkurs in India — M (ATGM) from a deal signed in 2021, the BMP-2 deal signed in 2020, and the 9 M 119 deal signed in 2018. Note that India’s decision to build new Su-30 aircaft is also a licensed production with India’s HAL. Its recent upgrade is meant to give a push to indigenisation efforts.

The robustness of India-Russia technical military cooperation on licensed production has been the star performer. Bilateral technical cooperation will continue, but getting fresh orders is getting challenging.

According to the latest reports, Russia has conveyed that the two remaining consignments of S-400 systems will be delivered in the third quarter of 2026. These were supposed to be delivered by early 2024. However, the issue of payments remains a technical obstacle despite immense political will on both sides. As pointed out earlier, the issue stems from the lack of convertibility of ruble and the mounting trade deficit between India and Russia, which has accumulated trillions worth of Indian rupees due to the dramatic purchase of Russian oil after the war began.

A similar situation emerges when it comes to Russian arms going to China. While Russia exported far more to China in 2023, again, those were mainly deliveries placed during different times.

Russian arms exports in the future would be directly linked with the orders placed today. But according to SIPRI, there were hardly any orders placed by anyone in 2023. Therefore, not only is it exporting to fewer countries but its arms orders, too, reduced drastically in 2022 and 2023. This will have a direct bearing on its exports in 2024 and beyond unless newer orders are placed. In fact, as per the report, the one country that is placing new orders with Russia is Iran. Arms production today in Moscow remains Ukraine-war-centric. While the war has revitalised the arms industry, Russia has struggled to maintain its arms exports.

The caveat here is that there is always a possibility of arms being ordered without SIPRI being able to track them, but that is beyond the scope of computation anyway.

India faces an additional concern regarding the persistence of sanctions against Russia, which show no signs of being lifted. In fact, discernible patterns indicate that as the war prolongs, the sanction regime against Moscow will be reinforced, with loopholes being tightened. These developments directly impact India’s long-term equation with Russia.

In the coming years, while uncertainty surrounding the conflict in Ukraine may hinder new arms orders to Russia, the significance of joint production of formidable weapons like the BrahMos cannot be overstated. Recently, the Indian Ministry of Defence (MoD) placed fresh orders for BrahMos missiles for the Indian Navy; these missiles are also being exported to other countries.

The Brahmos success story remains unbeaten when it comes to Russia supporting India not only with technology, but also with joint production and indigenisation, all the way to joint export.

Finally, the SIPRI database shows the ascendance of China as the primary arms supplier to both Pakistan and Bangladesh. Islamabad, the fifth-largest importer, sources 82 per cent of its weapons from Beijing and Bangladesh imports 72 per cent of its weapons from China. This development underscores the evolving dynamics in the region’s arms trade landscape, which could have implications for India’s strategic considerations.

The balance between diversification of imports and indigenisation has yielded favourable results for India in recent years. The next step is to enter joint production with diversified partners where the scope for export has to be built in at inception. Among others, France, undoubtedly, is the most bankable partner for New Delhi as the arms trade flows adjust to newer realities.

The writer is an Associate Fellow, Europe and Eurasia Center, at the Manohar Parrikar Institute for Defence Studies and Analyses. She tweets @swasrao. Views are personal.

(Edited by Humra Laeeq)