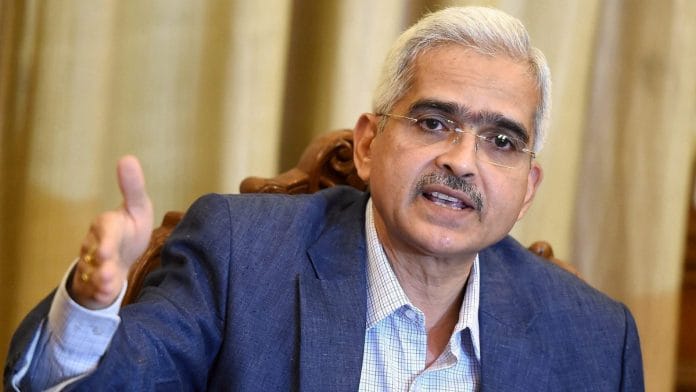

Shaktikanta Das has always been considered an extension of the government, without a voice of his own.

The timing of Shaktikanta Das assuming charge as the RBI governor could not have been more precarious. The success of his tenure will depend on how much he gives, and how much he takes. And, the first test comes as early as this Friday when he will chair the crucial RBI board meet to discuss a host of not-so-comfortable issues with the Narendra Modi government.

Before taking over as the Reserve Bank of India governor Wednesday, Shaktikanta Das was a member of the finance commission and India’s Sherpa to the G20 – he is stepping down from both positions.

As secretary in department of economic affairs till his retirement in May last year, Das had held several meetings with the RBI, but was always considered an extension of the government without a voice of his own.

Also read: Reading the mind of the new RBI Governor, one tweet at a time

At Friday’s RBI board meet, Das will be discussing the thorny issues of passing on a larger share of the central bank’s surpluses to the government and easing of lending norms, especially for the micro, small and medium enterprises (MSMEs).

The government is in a hurry to ease the lending norms, especially after the state election results and the slowdown of economic growth. For Shaktikanta Das, however, the biggest challenge will be to maintain a balance and decide on how much to give in to the Centre’s demand. He is set to choose a middle path – he is known for his give a little, take a little approach.

Instead of directing a larger sum of money to the government, he might decide to use a substantial part of the surplus in recapitalising the cash-starved public sector banks.

The decision to part with the surplus and use it to strengthen government banks will be a face-saver for Das. Such a move will help in boosting credit growth in the crucial election year and also bolster the bank’s sagging financial health.

The Friday board meeting will also see a decision on who will head the committee to review the RBI’s economic capital framework. While the government wants former RBI governor Bimal Jalan to head the committee, the RBI is said to be keen on having former deputy governor Rakesh Mohan.

Also read: Former RBI Governor Urjit Patel paid a heavy price for his unseemly power grab

Among other challenges, Shaktikanta Das will also have to strike a cordial working relationship with deputy governor Viral Acharya and other senior officials. Acharya had lashed out at the government for trying to undermine the RBI’s autonomy.

Das’ strong points are his communication style, affable demeanour, cool-headedness and his ability to work in a team. His sudden appointment as the RBI governor, however, has not gone down well with many in the financial circles, who have already declared him a government mouthpiece.

They feel that Das, who holds a Masters in History, is not qualified for the RBI governor’s role. His critics even say his appointment is a result of his work during the demonetisation period.

For many in the RBI, former governor Urjit Patel went down fighting the government on issues related to the central bank’s autonomy. His resignation Monday, widely seen as a ‘note of protest’, stood in sharp contrast to his earlier non-committal stance and silence on demonetisation.

Also read: Urjit Patel quits: Cry for RBI autonomy or inability to work with Modi govt on economy?

After Patel, who was under constant scrutiny since he took over from Raghuram Rajan, the spotlight will now be on Shaktikanta Das and his decisions will be measured and analysed like never before.

It is most unfortunate that the government could not find some from within RBI to head the central Bank. I am sure some brilliant mind within RBI may simply counting currency.