Farm loan waivers may actually dis-incentivise banks from lending to agriculture in the long-term.

The GDP growth of 8.2 per cent for the first quarter of this fiscal (FY19), released Friday, has come on the back of the manufacturing and services segment, and not so much on agriculture.

The gross domestic product (GDP) growth for the first quarter in the last fiscal (FY18) was 5.6 per cent.

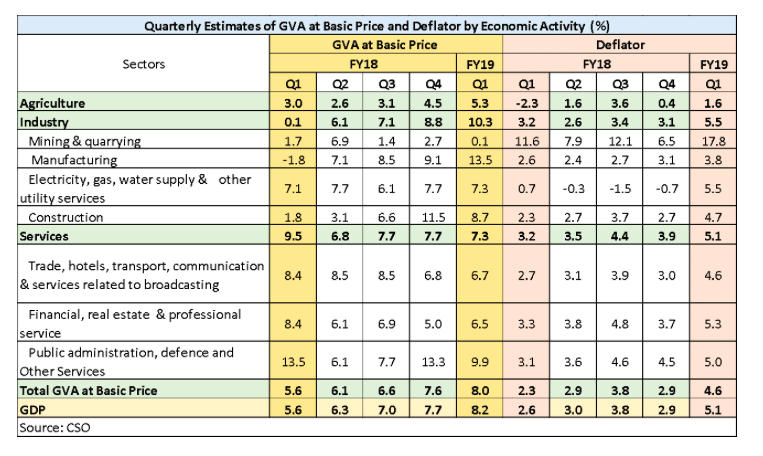

The Gross Value Added (GVA) at basic prices grew at 8 per cent for the first quarter. Around 40bps (basis point) of the upside from our growth projection (7.7 per cent) is attributed to elevated agriculture sector growth. Additionally, base adjusted GVA growth is at 7.65 per cent, implying 35 basis points’ base impact. But to be fair, on all counts, the GVA growth is above the trend growth after several quarters.

Although the agriculture GVA increased to 5-quarter high of 5.3 per cent, but this is a statistical artefact as the growth was primarily due to “non-agriculture” components.

The nominal non-agri GVA has expanded from 11.5 per cent in the fourth quarter of FY17 to 14 per cent in the first quarter of FY19. During the same period, nominal Agri GVA, however, declined from 10.9 per cent to 7 per cent. This indicates that the growth in overall GVA is primarily due to growth in industry and services segment and not the agriculture segment.

The worrying sign continues to be agriculture prices, which are still languishing at 1.6 per cent for the first quarter. Additionally, through the current GDP deflator method, we may be even imparting an upward bias to it.

Also read: India’s Q1 GDP grows 8.2%, brings relief to Modi government

The agriculture sector in a country is marred with problems like (i) rising agriculture NPA, (ii) low credit growth, (iii) price decline and, (iv) deficit monsoon. This increase in agriculture non-performing asset (NPA) along with low credit growth is a cause of worry. The growth in credit to agriculture decelerated during 2017-18 (3.8 per cent) when compared with the previous year (12.4 per cent).

This might be indicative of pressures in the farm sector as corroborated by agriculture debt waivers announced in some states. In order to address growing farmers’ distress, several state governments, like in Uttar Pradesh, Punjab, Maharashtra, Rajasthan and Karnataka, have announced farm loan waivers. While waivers may cleanse banks’ balance sheets in the short-term, but research suggests they may actually dis-incentivise banks from lending to agriculture in the long-term.

Apart from this, we maintain that the agriculture sector needs an immediate intervention like Bhavantar scheme besides the recently launched MSP scheme. Agriculture prices continue to remain depressed and it is not clear how the minimum support price (MSP) may lift it in the absence of an effective procurement scheme, although the MSP scheme needs to be wholeheartedly welcomed.

Herein lies the benefit of the Bhavantar scheme that has no procurement liabilities. The experience of Madhya Pradesh in this regard is quite significant. Our estimates show that an income support scheme, like the one in Telangana, may be rolled out in states like Bihar, Assam, Chhattisgarh, Haryana, Punjab, Jharkhand and Uttarakhand where the cost is not prohibitive.

Service segment’s performance

The Services GDP grew by 7.3 per cent in the first quarter of FY19 compared to 7.7 per cent in the last quarter and 9.5 per cent in the first quarter of FY18.

Last year, the services GDP had grown at a robust pace due to the higher growth of trade sub-segment and professional services because of destocking ahead of GST implementation in July and this has now moderated.

The more than expected growth in construction by 8.7 per cent in the first quarter of FY19 compared to 1.8 per cent in the first quarter of last fiscal year is indicating that construction activities are gaining momentum. Real estate sector, which was quite disturbed after the GST implementation, revived significantly.

Government is also consolidating its expenditure as shown by tapering growth in public administration, defence and other services. However, the service sector data is now proxied by MCA21 results and hence is much closer to reality and a lower than 7.5 per cent growth is a matter of concern. It may be noted that GDP data currently uses MCA21 database. (The Ministry of Corporate affairs (MCA) collects financial and corporate data from all registered companies in India. As on date, the MCA21 system stores information of about more than 17 lakh companies registered under the Companies Act.)

Also read: GDP numbers have become phallic symbols for Congress & BJP

The manufacturing growth rate in the first quarter has seen a huge jump of 13.5 per cent. The percent change has been influenced by low base in the first quarter of the last year. If we make a correction for this, the growth rate will come down substantially to 5 per cent (base effect of 8.8 per cent). However, to be fair, corporate sector GVA results in the first quarter were very strong.

Both total final consumption expenditure and gross fixed capital formation increased in the first quarter. Total final consumption expenditure increased by 8.4 per cent mainly due to 8.6 per cent growth in private final consumption expenditure.

The good thing is that gross fixed capital formation increased by a whopping 10 per cent in the first quarter this fiscal compared to 0.8 per cent in the first quarter of last fiscal.

However, some base effect cannot be ruled out. The valuables which increased in double-digits in FY18 (average: 60.7 per cent) declined by 8 per cent in this quarter.

The RBI’s successive rate hikes will have a heavy toll on private consumption expenditure. During FY14, three successive rate hikes led to collapse of private consumption expenditure to 2 per cent in third quarter of FY15.

Our fear is that if the rupee continues to depreciate and given the fact that there is a cost to RBI intervening in the foreign exchange market, the RBI may be constrained to explore orthodox textbook prescriptions of containing rupee depreciation. This might mean at least one more rate hike, possibly frontloaded. This might lead to a sub-7.5 per cent growth for FY19 despite more than 8 per cent growth in the first quarter, with consumption taking its toll in second half of FY19. This is going to be most important predicament going forward!

The author is the Group Chief Economic Advisor, State Bank of India. Views are personal

Cash to trash was the biggest mistake in India’s economic history. With a strong core banking system, it will take no more than a few days to calculate the total amount received by all the bank’s. The first announcement of 3.4 lakh crores shortage announced by the RBI was a correct figure. However after that initial announcement thing suddenly changed, mysteriously.