While India’s jump is welcome, the World Bank only takes into account Delhi and Mumbai, whereas other states do better in terms of ease of doing business.

India has made an overall quantum leap of 30 ranks on the 2018 World Bank Ease of Doing Business (EoDB) rankings to enter the list of top 100 countries. The significant jump on these rankings is a welcome development, especially in the backdrop of the ongoing structural reforms.

The report states: “India’s ranking reflects nearly half of the 37 reforms, adopted since 2003, implemented in the last four years.”

The improvement on conditions of doing business in India has also set a new tone for understanding the slew of reforms undertaken in the past few years. But before one can take comfort from these achievements, it is necessary to take stock of what India has achieved, and what is the future road map.

What have we achieved?

The EoDB ranks the performance of countries on various parameters that indicate the environment in which firms conduct their business. It takes into account 10 parameters, and a higher score on each parameter adds to the improvement in overall rankings.

Out of the 10 parameters, India has shown an improvement on six. The highest improvement has come in the ease of paying taxes, while there has been considerable progress on indicators like resolving insolvency, getting credit, and enforcing contracts.

While this assessment is based on business conditions in Delhi and Mumbai, we need to look at the rest of India to make a better judgement of the rankings.

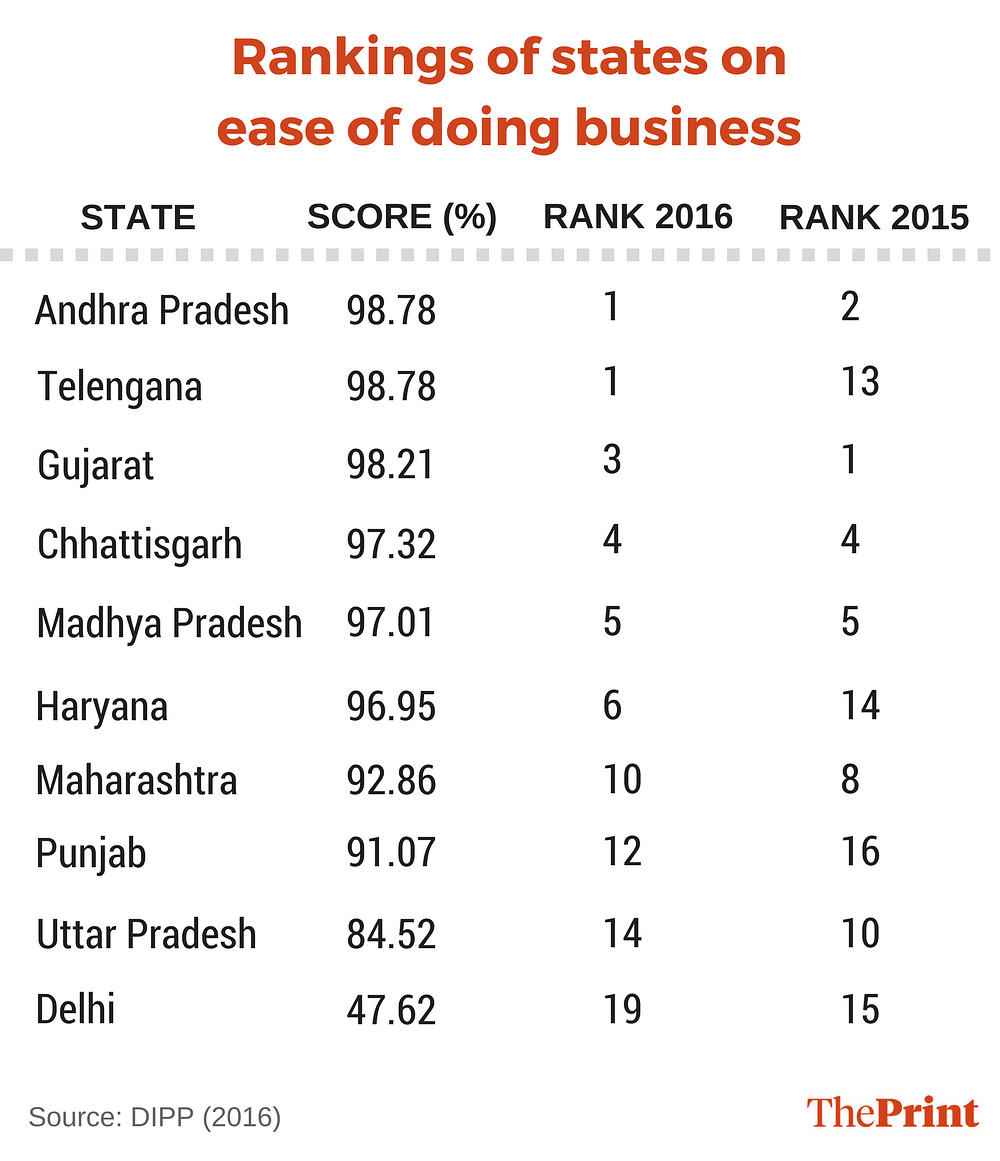

The Department of Industrial Policy and Promotion (DIPP), in partnership with the World Bank, also releases state-wise rankings on the status of implementation of business reforms. These rankings are on a similar set of performance indicators, and capture a country-wide picture of ease of doing business. The following table summarises the ranks of all states for the past two years.

Full table: http://eodb.dipp.gov.in/Press%20Release.pdf

Full table: http://eodb.dipp.gov.in/Press%20Release.pdf

A state-wise comparison highlights two aspects of the World Bank rankings. First, across India, Delhi and Maharashtra are among the average performers on ease of doing business conditions. States like Andhra Pradesh, Telangana and Gujarat have done exceeding well on these rankings, and have shown a promising business environment.

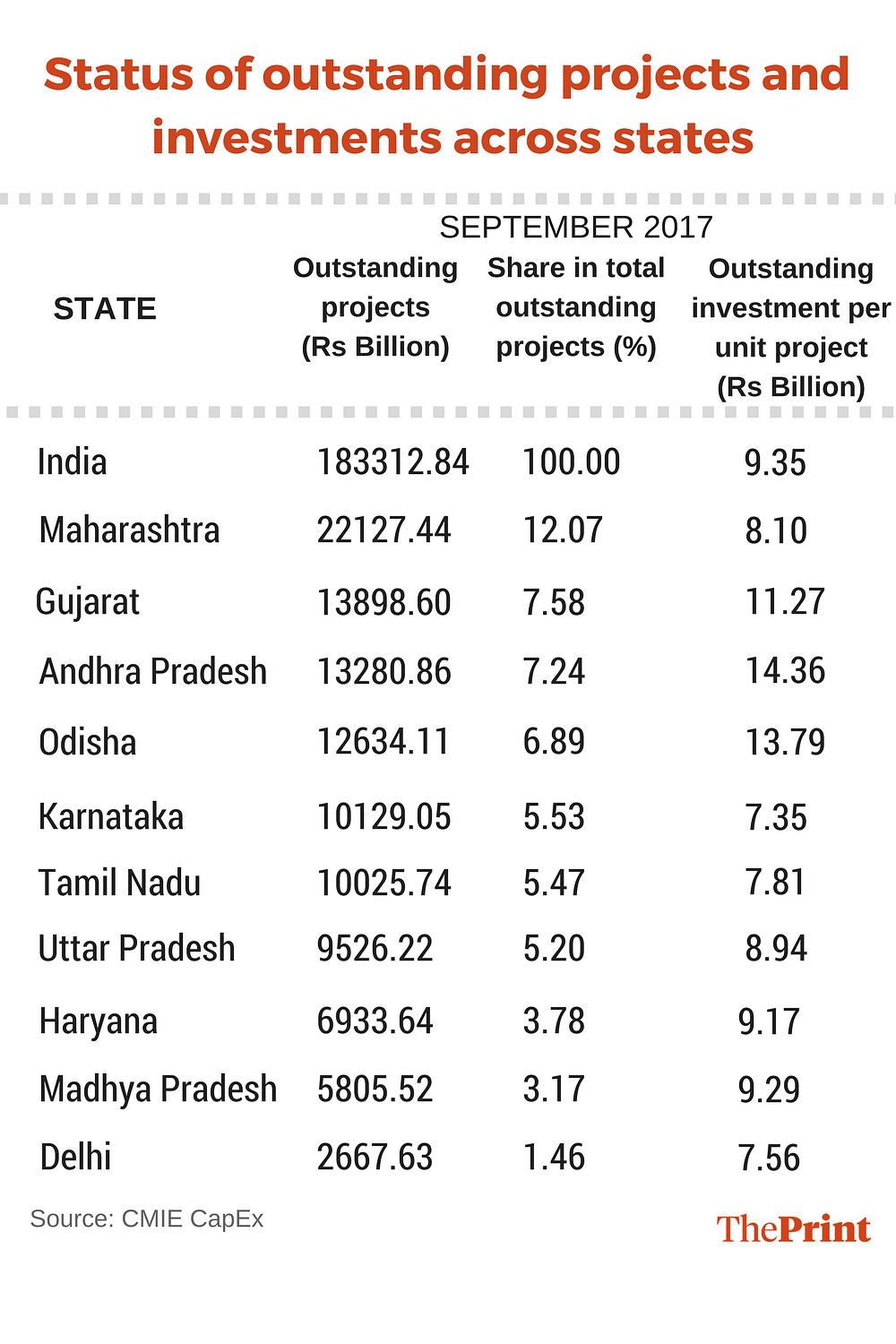

Second, if the World Bank survey were to be more representative of business conditions across India, the country’s overall rankings would probably have improved by a much higher margin. To get a sense of the business environment, we can take a look at the status of outstanding projects and investments across India. The following table shows the total outstanding projects under implementation and the per-project investment in all states.

Delhi and Maharashtra account for about 14% of the total investments in projects across India. There are states with much higher per-project investments, which are equally investment-friendly destinations.

Overall, the World Bank rankings present only a limited picture, whereas conditions of doing business in India would have improved significantly across different states.

What is the roadmap for the future?

Ease of doing business is an important indicator of improvement in regulatory environment. However, achievement on this count is not sufficient in itself. The 2018 rankings do not take into account major policy initiatives like the introduction of the Goods and Services Tax (GST). These policies are likely to further boost the regulatory environment, and be business-friendly.

What can be done to further our rankings? The Financial Resolution and Deposit Insurance Bill (FRDI) supplements the insolvency framework, as it provides a framework for resolving financial firms. Together with the Insolvency and Bankruptcy Code, the FRDI Bill, when implemented, can complete the loop on insolvency framework.

In the field of credit, regulatory impetus should be given to non-bank sources of financing. Bond markets are better placed than banks to catalyse long-term investment. Addressing frictions, including the restrictions on foreign investor participation in bond markets, can potentially ease constraints in supply of credit. Schemes to augment the flow of credit to small and medium enterprises need to be revisited to improve their effectiveness for intended beneficiaries.

Major takeaways

First, India as a business destination is not limited to few major metro centres. Several other states have also shown an equal promise of being investor-friendly destinations, which the 2018 World Bank rankings miss.

Second, ongoing policy reforms are yet to show their full impact on ground.

Third, there are a series of ‘low hanging fruit’ measures which, if implemented, can further boost India’s rankings.

Radhika Pandey, Amey Sapre, and Pramod Sinha are Consultants at the National Institute of Public Finance and Policy (NIPFP).