The main sources of protein for an average Indian are pulses and poultry products such as meat and eggs. For nearly two years prices of both have been rising sharply. Since October 2019, CPI pulses has shown an average annual inflation rate of 15 per cent, CPI meat and fish about 13 per cent and CPI eggs about 12 per cent. With doctors advising higher intake of protein to recover from Covid-19, the demand for eggs and poultry meat that was recovering, albeit slowly, with reopening of trade and restaurants is now seen to be growing faster. We analyse the price trends and highlight possible causes for inflation.

Also read: India’s imports from China rise despite boycott calls, pandemic. But this may not last

Price trends

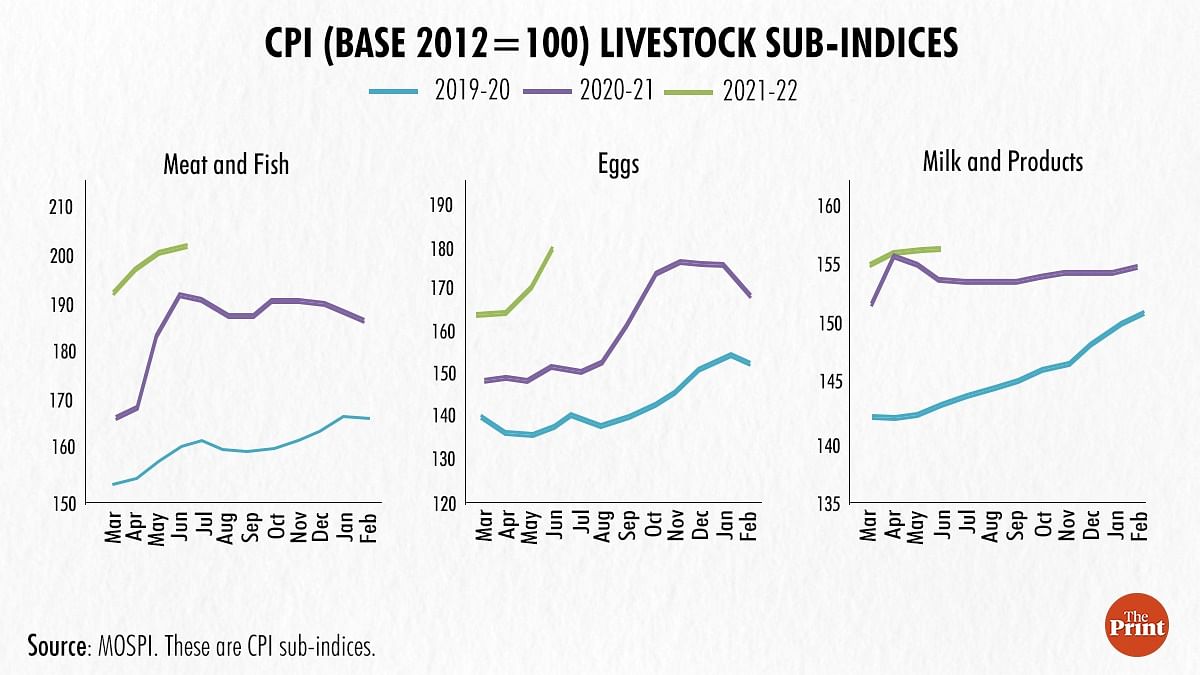

In June 2021, CPI eggs grew by about 19.35 per cent (Figure 1). As per the National Egg Co-ordination Committee (NECC) data for Delhi, prices went up by about 50 paisa per egg between 2020 and 2021. Milk got expensive too. Recently, AMUL, Mother Dairy and other suppliers hiked milk retail prices by Rs 2 per litre. Meat, especially poultry prices have been rising too. In Delhi, poultry meat that sold at about Rs 180/kg last year is now selling at Rs 230/kg.

Headline CPI inflation plateaued in May and June 2021 at high levels of 6.3 per cent. About 18 per cent contribution to this number was made by the three livestock categories: ‘milk and products’, ‘eggs’ and ‘meat and fish’ in June 2021. This contribution was about 22 per cent in May 2021.

Also read: Consumer confidence returning, RBI in ‘whatever it takes’ mode to ensure recovery, says Das

What’s driving prices up

Livestock, mainly poultry, is seeing pressures from both demand and supply sides. Demand, as mentioned before, is rising both at retail and institutional levels.

On the supply side, there are two key factors: (i) the higher price of feed, mainly maize and soybean and (ii) rising crude oil prices. The higher prices of feed pushes up the cost of production. Expensive crude makes logistics and movement expensive.

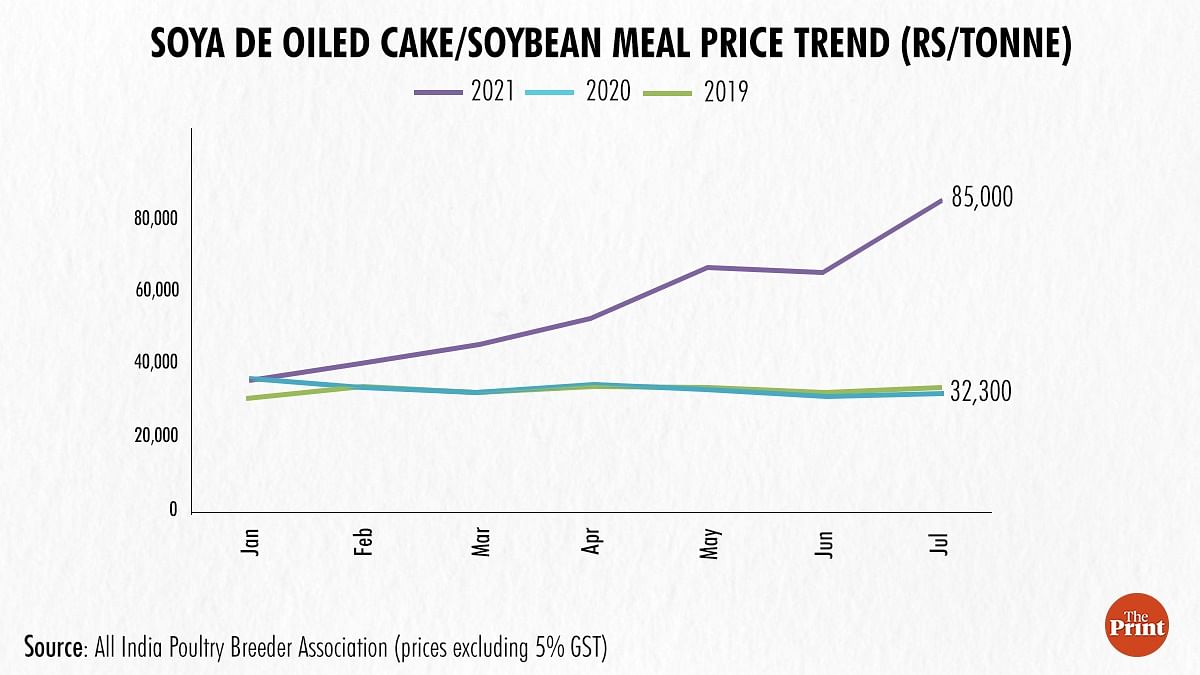

As per our research, in case of both broiler bird (meat) and layer bird (for egg production) the cost of feed constitutes around 60-70 per cent of the cost of production. The de-oiled soya cake or soybean meal is a by-product of soybean oil extraction and is used for feeding animals as it is a rich source of protein. Remaining components of the feed constitute maize, broken rice etc that are energy sources. Prices of maize and soybean meal have been rising sharply in recent months. MP is one of the largest producers of both soybean and maize and the state’s wholesale prices for soybean grew 119 per cent in a year: from Rs 35 per kg in July 2020 to Rs 77 per kg in July 2021; the maize prices too grew by about 42 per cent from about Rs 11.57 per kg in July 2020 to about Rs 16.45 per kg in July 2021 (Agmarknet). Expensive soybean made its by-products like soymeal expensive. According to the data from All-India Poultry Breeder Association, prices of soybean meal in the country in July 2021 were Rs 85,000/MT, about 163 per cent higher than last year’s price of Rs 32,300/MT. On 7 August 2021, the price of soybean meal was around Rs 94,000/MT. The combined effect of these higher prices has pushed up total feed cost for poultry by about Rs 16,000/MT (i.e., from Rs 32,000/MT in July 2020 to Rs 48,000/MT in July 2021).

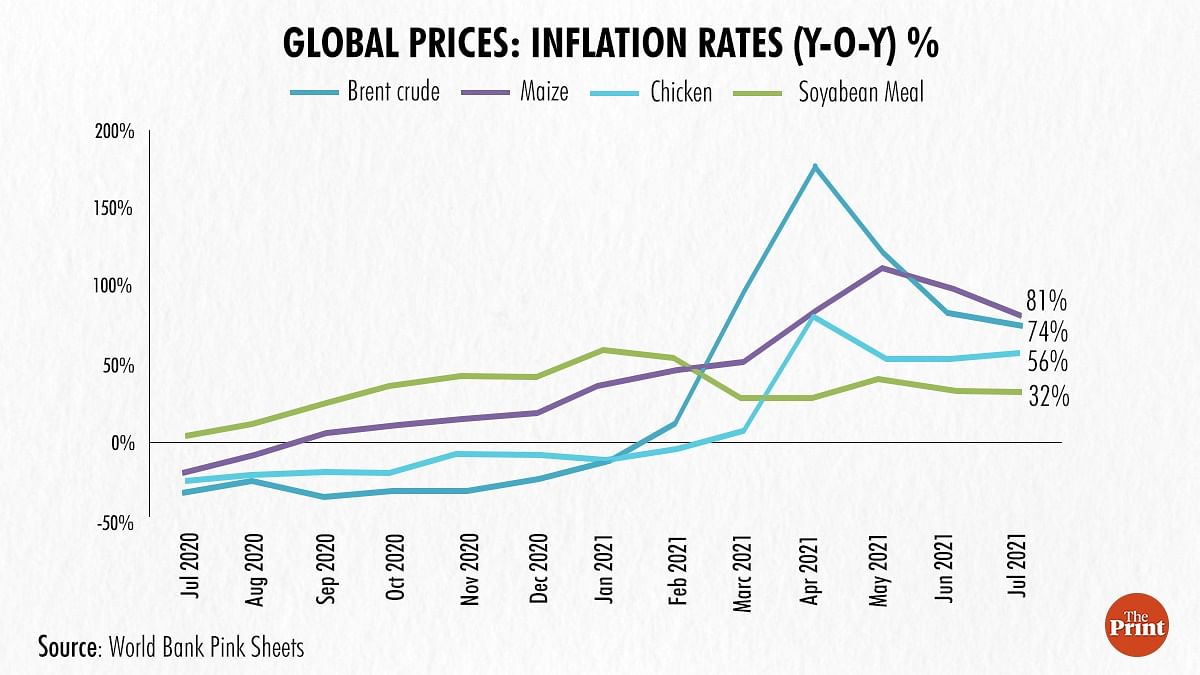

There appears to be a transmission of higher global prices into domestic markets. In July 2021, globally, maize sold at about $277/MT, which was about 81 per cent above July 2020 levels. And soybean meal sold at about $471/MT, about 32 per cent higher than last year.

Crude, of course, has been getting expensive. In July 2021, Brent sold at $74.39/barrel, which was 74 per cent higher than last year.

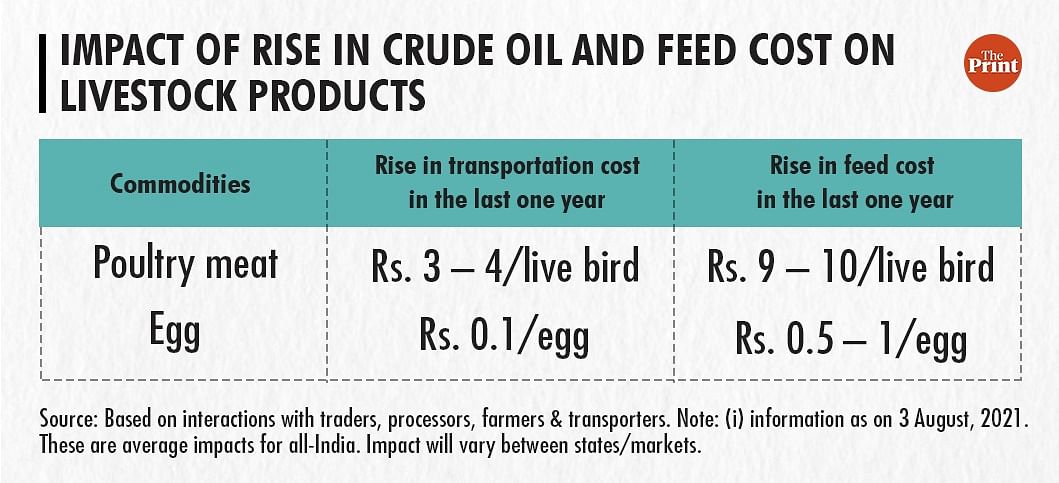

As part of an ongoing research at Indian Council for Research on International Economic Relations (ICRIER), where we track and research selected agricultural commodities, we also study livestock commodities. Based on market assessment, we estimated the likely base impact of higher crude prices and higher feed cost on per unit price of egg, and meat. Results are presented in the table below.

Higher feed cost has pushed up a live hen’s price by about Rs 9 to 10 and an egg’s by about 50 paisa to Re 1. Expensive transportation pushed up prices for the former by Rs 3-4 and 10 paisa for the latter.

But why are the prices rising? Higher global prices of maize and soybean meal incentivised Indian exports. While maize exports grew by about 711 per cent (from 0.35 MT in 2019-20 to 2.8 MT in 2020-21), soybean meal exports grew by 136 per cent (from 0.9 MT to 2.05 MT). Higher exports impacted domestic availability. In case of maize, the domestic rabi crop production in 2020-21 was marginally lower than last year and increased exports reduced domestic availability further. In the case of soybeans, however, production in 2020-21 was higher by about 2.2 MT compared to the production in 2019-20.

Also read: If we raise duties to make Indian industry competitive, we’ll end up close to 1991: Montek

Gaps in data

If production of soybean is higher this year as per the government data, then why are prices rising?

As per the Agriculture Ministry’s fourth advance estimate (released on 11 August 2021) of oilseed production, soybean production in 2020-21 (July-June crop year) was 12.9 MT. But according to the Ministry of Fisheries, Animal Husbandry and Dairying (MFAD) estimate, the production of soybean in 2020-21 is marginally lower at around 12.25 MT. According to the estimates of Soybean Processor Association of India (SOPA), the production in 2020-21 is lower at around 10.45 MT. There appears to be inconsistency in data not just between the government and industry but also between two ministries of the government.

Soymeal cake has a shelf life of about 1 to 1.5 years. Is the private sector holding higher stocks of soymeal? Can those be utilised to dampen current price pressures? The government has to decide and decide soon.

Also read: Why Modi govt’s prized food scheme went from ‘dal of choice’ to no dal at all

Way forward

Compared to last year, the next soya and maize crop is likely to be better as higher current prices have driven up their acreages. As on August 7, 2021, acreage under both soybean and maize is higher than last year. But until this new crop enters the market in October-November 2021, the market will reel under price pressures triggered by tight supplies. Pre-empting the extreme pressures of August-September 2021, should the government not import soybean meal to meet the demand pressures for these two months? The government, however may have to be cautious about timelines as farmers would start to bring their new crops from October 2021 onwards.

As there appears gap in production assessment of soybean between trade and government (and even between ministries of government), getting access to credible and real-time production data becomes critical. Soybean is an important input for both marine (shrimp) and poultry industries that are growing at a CAGR of about 10-12 per cent. Ensuring sustained high growth of soybean should be a policy priority. India cannot import soybean (or even soymeal) in large quantities because we do not allow GM soy imports. Therefore, domestic production of the crop needs a sustained boost.

With expensive crude, movement of food across board gets expensive, pushing up food inflation. While higher global crude prices are beyond the control of policy makers, the high central excise duty and VAT levied by state governments are surely within their domain. Should they not be reduced to give respite to the consumers? There are certainly fiscal implications of such a reduction on government finances which are already constrained, but unaffordable fuel will have a multiplier effect on the economy, slowing its reviving growth momentum.

Shweta Saini @shwetasaini22 is Senior Visiting Fellow and Sandip Das @sandipdas02 is Senior Consultant, ICRIER. Views are personal.

(Edited by Anurag Chaubey)