Could Apple’s belated focus on India, as a market and as a manufacturing base, become in the fullness of time as significant an event as the entry of Suzuki (Maruti) into the Indian car market exactly 40 years ago? The answer has to be “yes” and “no”, though the differences in the two cases outweigh the similarities.

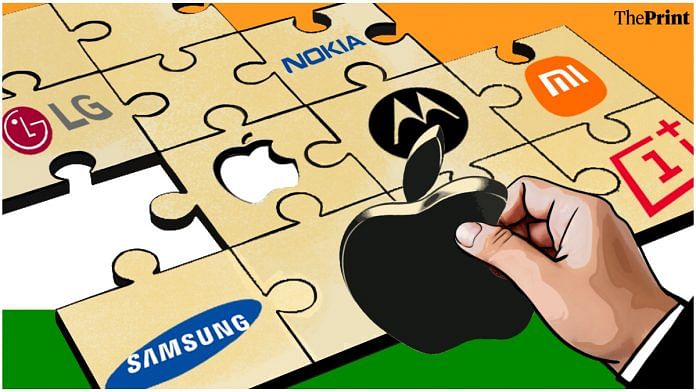

Suzuki entered a tiny car market whose outdated models had poor product standards, and hoped to expand the market dramatically with its low-priced entry. Apple is entering a market that is already one of the largest for mobile phones, and, unlike Suzuki, is focused on the market’s top end — which is why its market share in units, at about 5 per cent, converts into 18 per cent by share of value (next only to Samsung’s 22 per cent).

Suzuki entered in partnership with the government, and enjoyed special benefits and protection from competition for an extended period, whereas benefits offered to Apple and its suppliers are also available to competitors. Suzuki introduced contemporary cars to Indians (alongside Japanese companies that entered the motorcycle and commercial vehicle markets at about the same time), and has enjoyed dominance in the small-car market ever since. Apple is entering a bitterly competitive market that is already used to the best as well as the cheapest products on offer.

Importantly, Suzuki brought with it a slew of Japanese vendors to set up shop in India and become suppliers for its Maruti cars. The result is India’s internationally competitive auto component industry. Since a car factory is largely an assembly unit, it is the vendor ecosystem created by Suzuki that has proved to be crucial. Part of that ecosystem is the steel industry itself, which had to start making special grades like deep-drawing steel.

Apple could end up playing the same role of catalyst if India can show that it is indeed a good base for the mass manufacture of phone components and sub-assemblies. But two policy crutches (production-linked incentives and the tariff protection, which has just been frowned on by the World Trade Organization) will have to go at some point. Will today’s booming mobile phone exports from India remain viable then?

The second important thing is that other car manufacturers around the world were watching. As India’s car market expanded, they eventually followed in Suzuki’s footsteps — with varying results. For good measure, a couple of homegrown ventures also became significant players in the passenger vehicle market, as did three others in the motorcycle segment. Will the same happen in mobile phones?

Also read: The cost of tackling climate change & how countries’ GDP metrics may fail to accurately reflect it

Samsung initially found India not friendly enough and focused on Vietnam, but it has a production centre near Delhi. The question is whether it can be persuaded to expand that production base, especially since it also has a large presence in the markets for TV sets and consumer durables.

The full measure of Apple’s success in India will depend on its becoming more than a phone company, and on its achieving a Samsung-style broadening of consumer appeal to its full product profile, so that it can also sell many millions of laptops, tablets, and watches — which too could then be assembled/produced in India. Could Tata (for instance) then become an Indian Foxconn, or, better still, a Wistron? Or India acquire a new reputation for flexible labour policies and efficient manufacturing? The short answer is that it is early days yet.

Two qualifications are in order. First, when a car and its parts are made in India, the country captures the bulk of the value chain. It is very different with mobile phones, for which the production cost is a small part of the retail price; the bulk of the Apple value chain remains in the US.

And second, although the Apple chief executive officer has talked of doubling and trebling his Indian workforce from the current 100,000, it is hard at this stage to see electronics manufacturing/assembly becoming quite as employment- and value-generating as the automobile industry with its extensive forward and backward linkages. Still, it is sufficient for the moment that the promising start of electronics assembly and exports could be the beginning of something much bigger.

By special arrangement with Business Standard