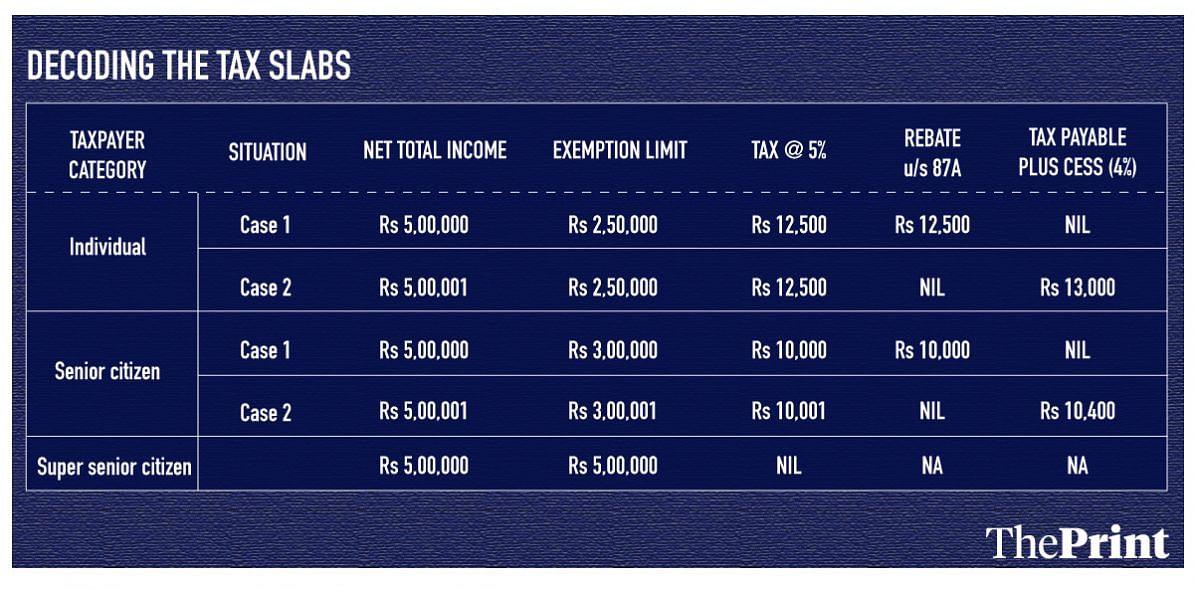

If your taxable income is over Rs 5 lakh, the rebate will not apply.

An increase in the income tax slab rates was one of the big expectations from the interim budget. Towards the end of his speech, acting finance minister Piyush Goyal instead announced a rebate for people with taxable income below Rs 5 lakh.

In other words, if your taxable income is over Rs 5 lakh, the rebate will not apply.

The rebate, in summary, shall be restricted to Rs 12,500 per year (previously Rs 2,500), adding roughly Rs 1,000 a month as extra disposable income.

To illustrate, the impact of this is reflected on the net total income after claiming the deductions under Chapter VI-A, which governs tax savings scheme investment and housing loan deduction up to Rs 1.5 lakh per annum.

Also read: My name is Piyush Goyal & I’m not a poet

On a macro level, even if this is a populist step eyeing the upcoming Lok Sabha elections, it’s a smart move as the government’s treasury wouldn’t be drastically affected.

Acting finance minister Piyush Goyal announced that the government will forego Rs 18,500 crore by offering such rebate. When compared with the overall individual tax collection target of Rs 6.2 lakh crore and incremental tax collection of Rs 91,000 crore, the rebate will not create a big hole in the exchequer’s pocket. It will, however, have material impact on the psyche of marginal taxpayers. In other words, the step will not go down well with taxpayers in the middle-income bracket who already feel burdened by the large tax slabs.

The government’s underlying philosophy, it seems, is to retain the group that has a taxable income between Rs 2.5 lakh and Rs 5 lakh per year.

Also read: Modi danced the fine line – his budget wasn’t anti-rich & his govt didn’t defend past sins

The tax base has increased from 3.79 crore to 6.85 crore individuals over the last 10 years. This is partly due to the formalisation of the economy and higher compliance. If the slab rates are rejigged now, several taxpayers will go out of the net. And, this will go against the larger target of increasing the tax base.

The author is managing partner, BMR Legal. This article has been authored with assistance from advocate Surabhi Suri.

I wholeheartedly support the increase in amount of relief under Sec. 87A. However, I see one problem for senior citizens like me. If my taxable income is under Rs 5.00 lakhs, I have to neither to invest in Sec. 80C schemes nor have to pay any tax. But I am not free from hassles of filing Income Tax Return (ITR) every year. Further there is a penalty of Rs 1,000/- for not filing ITR. Hence, my request to the Union Finance Minister will be to reconsider levy of penalty for delayed filing ITR when the tax liability is Zero, at least in case of senior citizens.