Last few months have witnessed considerable volatility in the bond market. Investors, both domestic and foreign, seem to have become more risk averse amid elevated uncertainty. Trading activity in the bond market saw a visible dip in October.

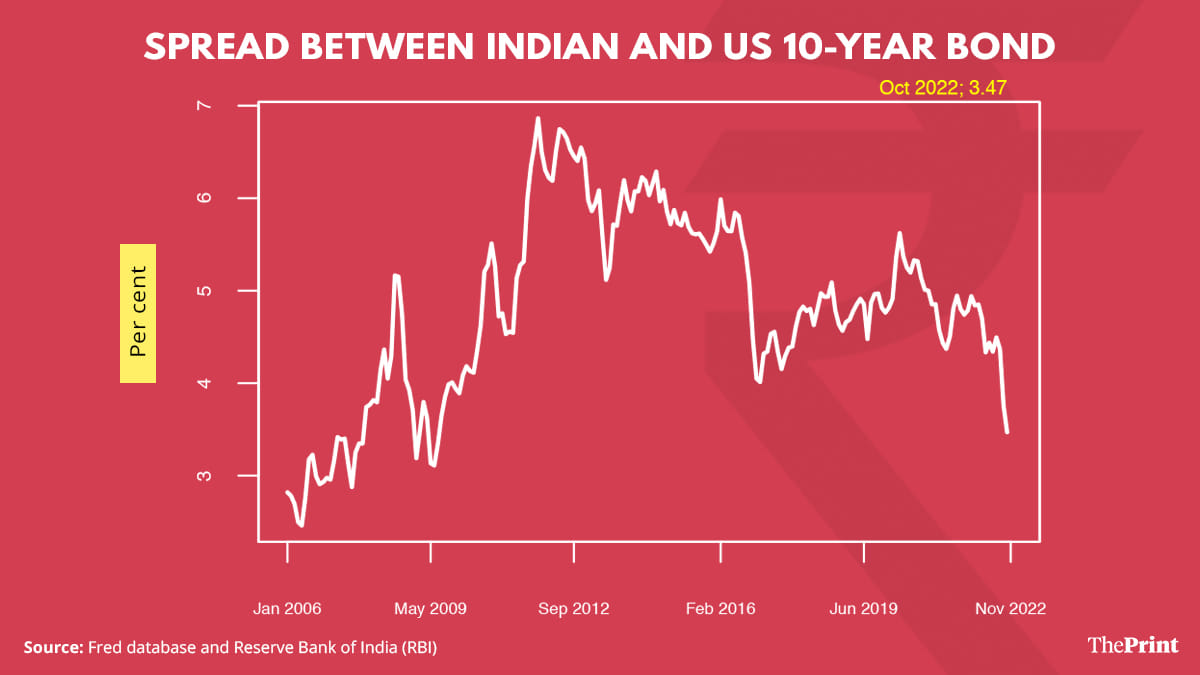

Sustained monetary policy tightening by the US Federal Reserve has led to narrowing of the yield differential between the Indian and the US bonds. As an outcome, overseas ownership of Indian government and sovereign bonds has fallen to record lows.

FPI ownership of bonds

Aggressive monetary policy tightening has led to surging yields in the US, UK and other advanced economies. While monetary policy has tightened domestically also, the pace of tightening in advanced economies has outpaced the tightening in India. This has led to narrowing of the yield spread (yield differential).

As an example, the difference between the 10-year Indian bond yield and the10-year US bond yield was 4.94 per cent in December 2021. This has narrowed to 3.47 per cent in October 2022. On 2 November, the US Fed announced the fourth consecutive 75 basis points rate hike and suggested that more rate hikes are in store. This will have a bearing on the yield differential in the coming months.

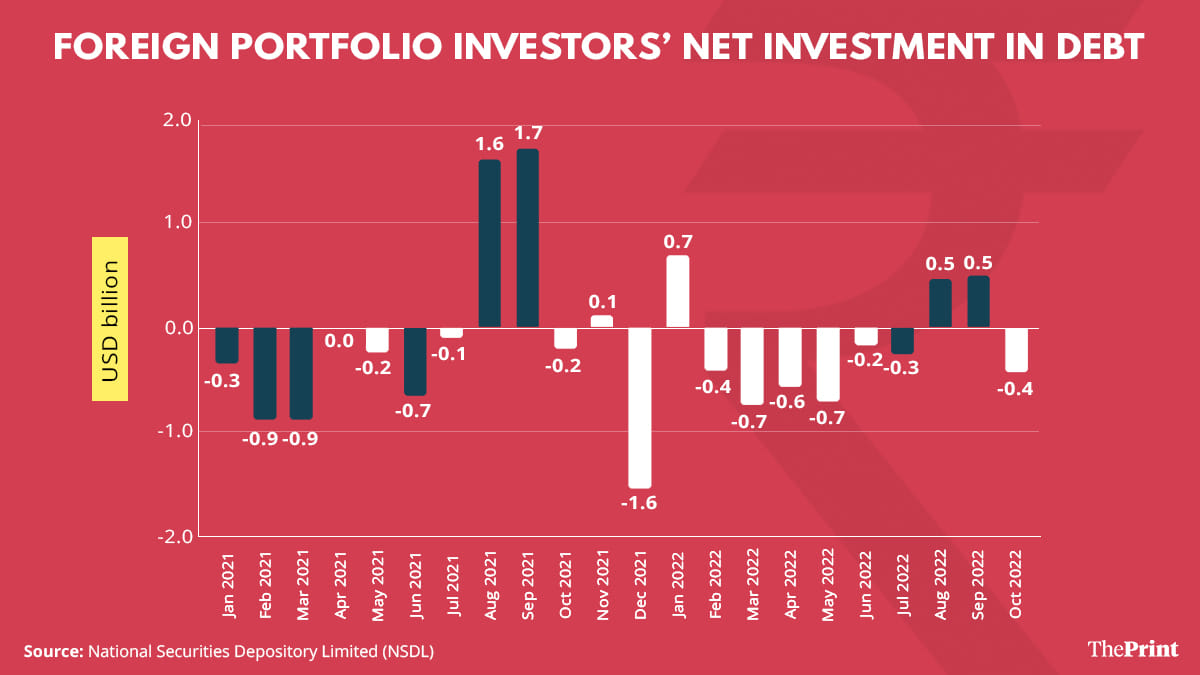

Reflecting the impact of narrowing yield differential, foreign portfolio investors’ (FPI) participation in Indian government and corporate bonds has slumped. Of the total limit available for investment in government bonds, FPIs have utilised less than 25 per cent in government bonds.

In case of corporate bonds, the limit utilised is even lesser at 17 per cent. Local currency depreciation has also triggered the exit of foreign investors from local debt securities. Emerging economies such as Brazil, whose currency has appreciated against the dollar, offer better returns on their bonds to foreign investors as compared to Indian bonds.

FPIs turned net sellers in debt as they sold debt worth USD 432 million in October. FPIs will likely turn to sustained buying only when there is some indication of slowing down of aggressive monetary policy tightening by the US Fed.

Trajectory of bond yields

During the pandemic, the RBI infused liquidity through its bond buying programme. Since October, 2021, it has stopped the programme. It has been withdrawing liquidity through Variable Rate Reverse Repo (VRRR) auctions.

Since May 2022, the RBI has been raising the policy rate to tackle the rising inflation. The actions of the central bank directly affect the short-term interest rates. For instance, the yield on the one-year government bond has risen from 5.1 per cent in early May to 7 per cent by October end. In contrast, the longer duration bond yield has seen a relatively moderate rise from 7.1 per cent in early May to 7.4.-7.5 per cent by October end.

Rate hikes have resulted in lower demand from traders — private and foreign banks, primary dealers and foreign portfolio investors prefer to adopt a wait and watch policy till more clarity emerges on rate hikes by the RBI.

Banking system liquidity

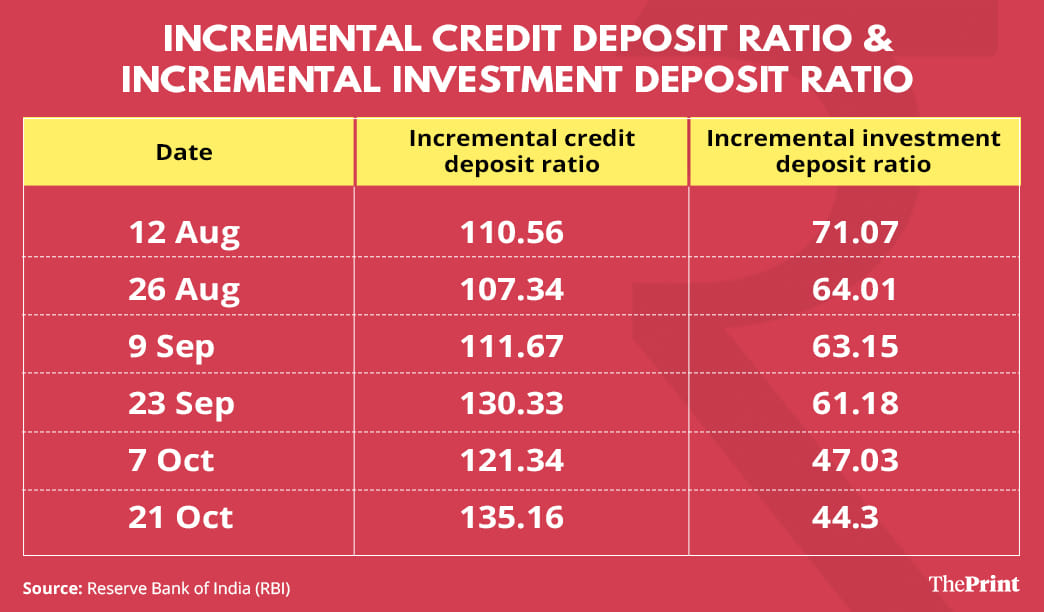

Another factor influencing the appetite for bonds in recent months has been the shrinking banking system liquidity. Sustained rise in bank credit, further bolstered by increased demand during the festive season, tax outflows, RBI’s spot market intervention to stem the rupee slide have led to drying up of banking system liquidity. Banks have been raising funds through the overnight interbank call money market. The surge in the demand for funds has led to a spike in the weighted average call rate. Banks are also tapping other sources such as Certificates of Deposits and fixed deposits to raise funds.

Banks’ incremental credit to deposit ratio or the proportion of new deposits that mobilise for fresh lending, has surged to 135 per cent as of 21 October. This indicates that banks are dipping into their bond portfolio to meet credit demand. Selling bond holdings by banks is likely pushing up the bond yields. Correspondingly, the incremental investment deposit ratio is seeing a decline, indicating that banks are going slow on bond investments.

A part of the volatility in bond yields can also be attributed to the delay in local bond inclusion in global bond indices. In September, in anticipation of Indian government bonds inclusion in global bond indices, there was an increased investor participation in Indian bonds. But reports of bond inclusion getting delayed to next year also likely led to muted investor interest in October.

Trading activity in the bond market

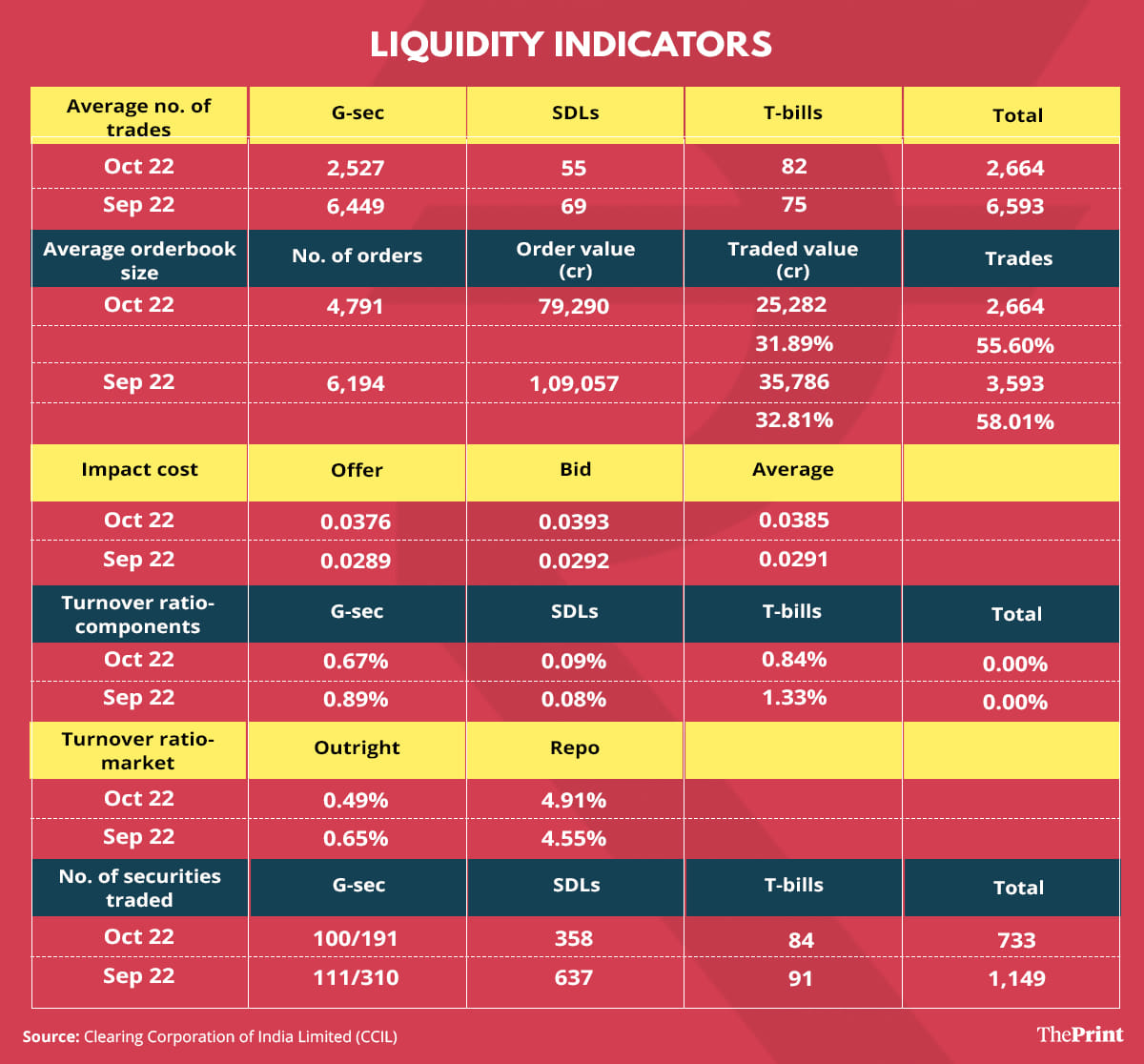

Trading activity in government bonds saw a visible decline in October. The data on market liquidity indicators by the Clearing Corporation of India Limited (CCIL) shows that the average number of trades in government bonds, including state government bonds, declined from 6,593 in September to 2,664 in October.

Other de-facto liquidity indicators such as the bid-ask spread (amount by which the ask price exceeds the bid price) for liquid securities and the impact cost also increased from September to October.

How are yields likely to move?

Markets have already priced in another 35-50 basis points rate hike this year. Much of the rate hikes have already happened. While yields at the shorter end could edge up with additional rate hikes by the RBI, the longer duration yield (10-year bond yield) is unlikely to go up beyond 7.5 per cent unless there is an unanticipated shock to the market. In short, yield movement is likely to be more range-bound going forward.

Radhika Pandey is a consultant at National Institute of Public Finance and Policy.

Views are personal.

Also read: Prudence over populism — why Modi govt must resist rolling out big-ticket schemes in Budget 2023