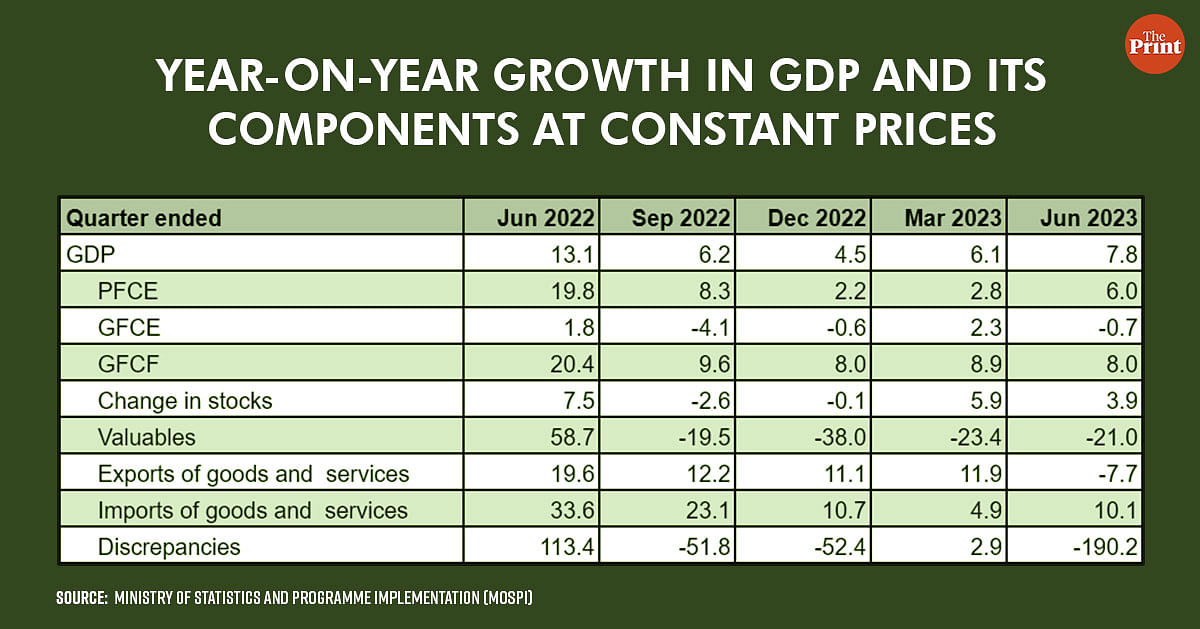

India’s Gross Domestic Product (GDP) grew by 7.8 percent in the April-June quarter of 2023-24, up from 6.1 percent in the January-March quarter. The growth is attributed to double-digit growth in the services sector, revival in consumption demand and strong capital expenditure.

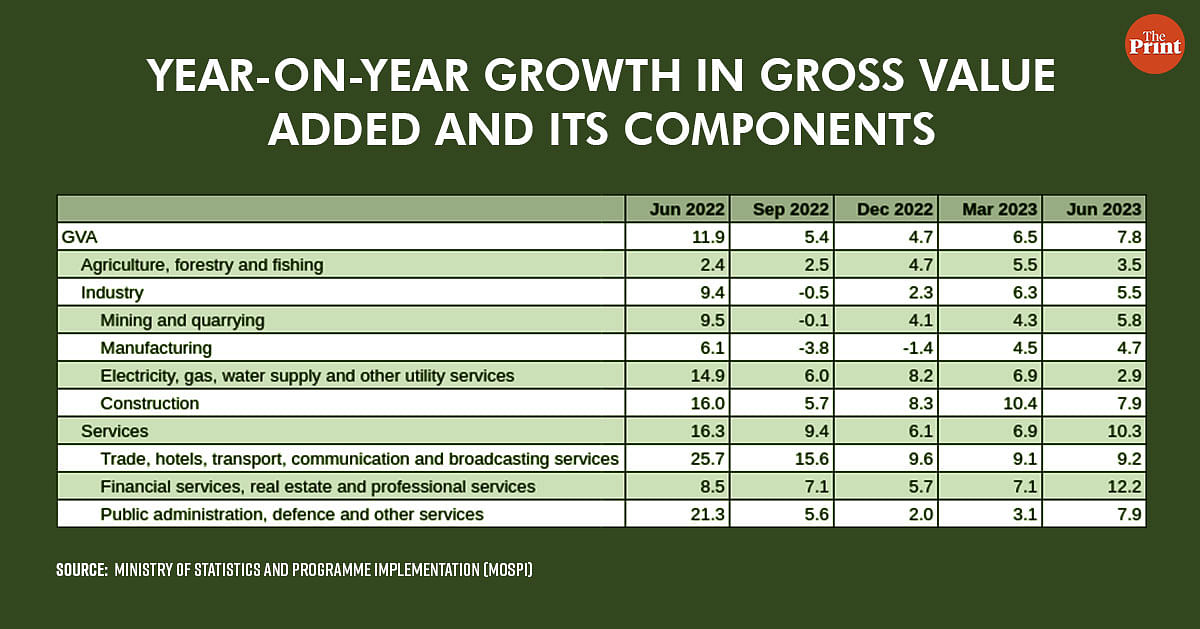

While services growth was robust, the manufacturing sector posted only a marginal improvement from the previous quarter, with growth of 4.7 percent, compared to 4.5 percent in the quarter ended March.

Resilient services sector but manufacturing growth weak

Services posted growth of 10.3 percent, compared to 6.8 percent in the previous quarter. Growth in services was broad-based with the three segments — trade, hotels, hospitality; financial and real estate; and public administration — reporting a higher growth, compared to the previous quarter.

High-frequency indicators such as air passenger traffic and Purchasing Managers’ Index (PMI) for services indicate resilience in the services sector. Passengers handled at airports have been growing at a robust pace of more than 20 percent in the last few months. PMI Services has been above the 50-mark for more than two years and rose to 62.3 in July — the highest since June 2010.

Bank credit has shown strong growth of above 15 percent in the April-June quarter.

Agriculture grew by 3.5 percent in the quarter ended June — higher than the 2.4 percent in the same quarter last year but lower than 5.5 percent recorded in the previous quarter. Going forward, if agriculture is to be a key growth enabler, monsoon rains need to pick up in rain deficient areas. With the threat of El Niño looming large, the performance of agriculture could be under pressure.

Manufacturing sector continues to be the weak point in India’s growth story. Growth came marginally higher at 4.7 percent in the first quarter of 2023-24, compared to 4.5 percent in the quarter ended March. While the easing of commodity prices was expected to lift manufacturing growth, the impact appears to be uneven.

Capital formation remains on the uptick

Capital formation, proxied by Gross Fixed Capital Formation (GFCF), sustained its growth momentum as it clocked 8 percent growth in the quarter ended June. GFCF has been growing at a rate of 8-9 percent in the last four quarters. Government’s sustained capex push has led to a decent growth in capital formation.

As the government continues to push for infrastructure development, the impact on capital formation becomes increasingly significant. This trend is expected to stimulate further growth in private investments.

The central government’s capex grew by 59.1 percent in the April-June quarter. This accounted for 27.8 percent of the budgeted amount. Latest data for July shows that the government has spent 31.7 percent of the budget estimate. States are also showing an increase in capital formation. While there would be variations amongst states, overall states capex (For 19 major states) also grew by 75.2 percent in the first quarter of 2023-24.

While the heavy lifting on capital formation is being done by central and now state governments as well, early signs of private corporate sector capex are visible, though not on a durable basis. The RBI’s survey on Order Books, Inventories and Capacity Utilisation (OBICUS) showed that capacity utilisation is at a multi-year high.

Capacity utilisation (CU) in the manufacturing sector increased to 76.3 percent in January-March from 74.3 percent in the previous quarter. However, data from the Centre for Monitoring Indian Economy’s capex database shows that new projects announced halved in the quarter ended June to Rs 6.4 trillion from more than Rs 13 trillion in the previous quarter.

Decent growth in consumption but broad-based growth still distant

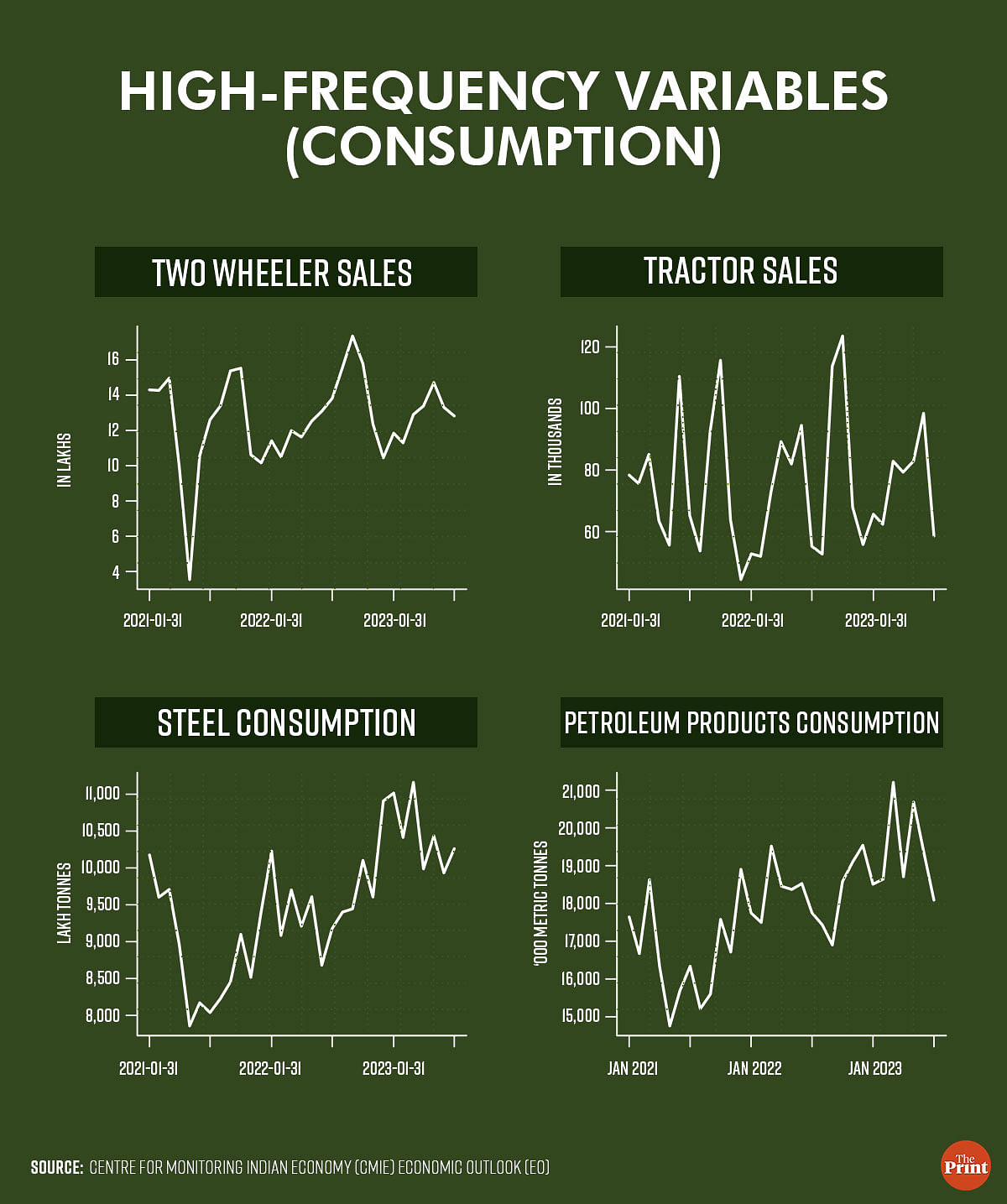

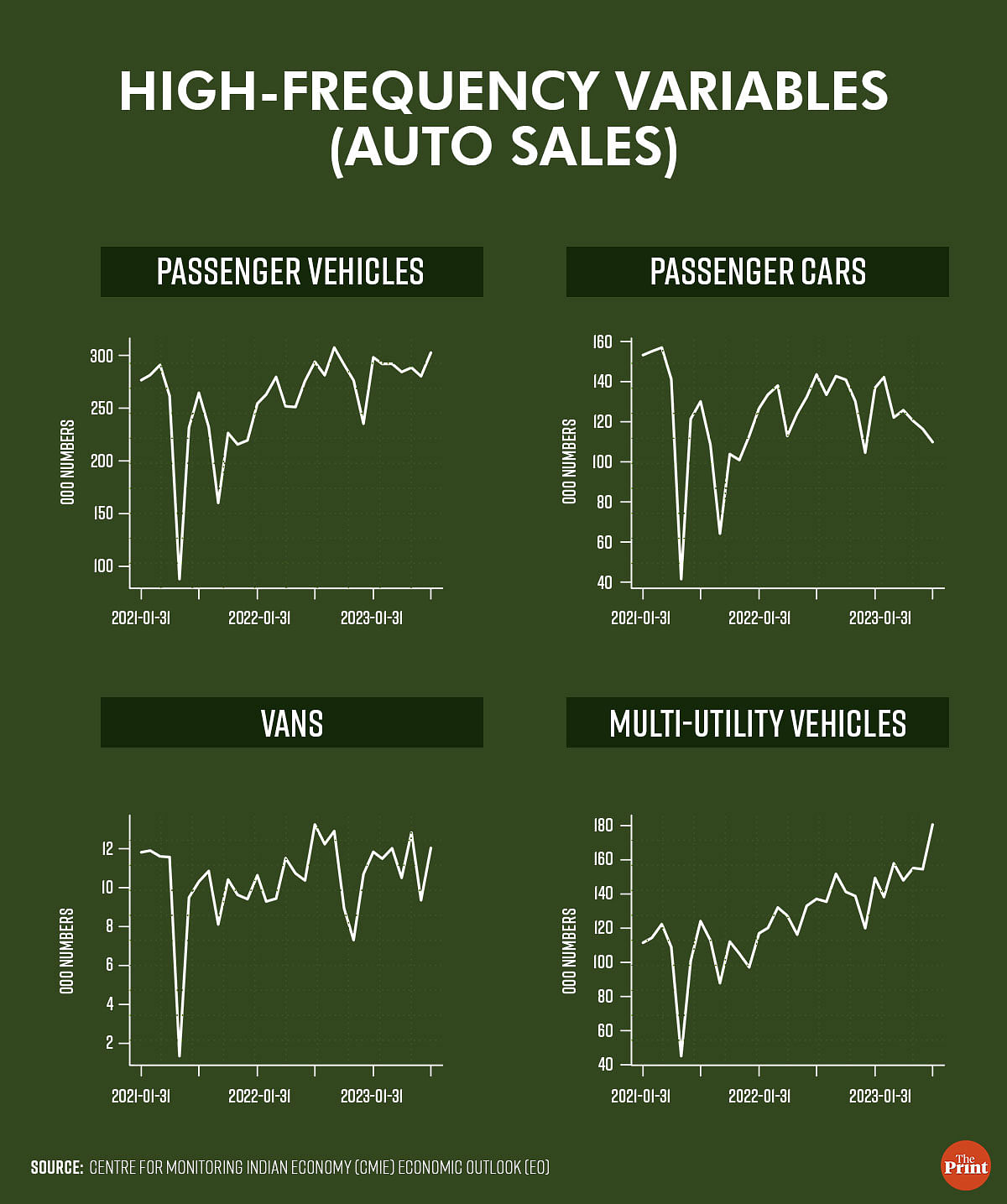

Private consumption grew by 6 percent on an annual basis. This is higher than the 2.8 percent growth seen in the previous quarter. However, high-frequency indicators on consumption present a mixed picture. While variables such as steel consumption, three-wheeler sales have posted robust growth, others such as two-wheeler and tractor sales have remained muted. Similarly, while the overall passenger vehicle sales have seen growth, this has been mainly on account of higher sales of vans and multi-utility vehicles. Passenger car sales have not picked up in a sustained manner. Consumption seems to be skewed towards goods and services consumed by higher income brackets.

Government consumption, proxied by Government Final Consumption Expenditure (GFCE), contracted as the government’s revenue expenditure was tepid in the quarter ended June. Exports recorded contraction due to global economic slowdown. With advanced economies growth and consumption showing signs of protracted slowdown due to aggressive monetary policy tightening, export is likely to remain a drag on growth.

Despite global headwinds, the growth momentum continued in the first quarter of the current financial year. The contact-intensive services sector whose growth was dented during the Covid pandemic posted a sharp rebound. However, the road ahead is going to be challenging. Erratic rainfall, impact of El Niño, possible easing in government’s capital expenditure due to the general elections, along with global economic slowdown and rebound in crude oil prices could limit the growth trajectory in the coming quarters. Revival of private investment and consumption would be the key to ensure a sustained growth.

Radhika Pandey is associate professor and Rachna Sharma is a Fellow at National Institute of Public Finance and Policy (NIPFP).

Views are personal.

Also Read: Muted tax collection in Q1 of FY24 widened fiscal deficit, govt focus still on capex