New Delhi: The central government’s consistent infrastructure push over the past few years coupled with a capacity utilisation level that is reaching the point where new capacity is starting to be needed, and a steady increase in fresh orders, are all setting the stage for a revival in private investments, according to economists.

Moreover, ThePrint’s analysis of various data — including bank credit to large industries and the amount of money the private sector has been raising from the markets — suggests the private sector is getting ready to make use of this gradually improving investment opportunity.

In short, companies are using their existing capacity extensively, are receiving an increasing amount of fresh orders and are borrowing more from both banks and the bond market. All of this, experts say, suggests that the current financial year will likely see a revival in private-sector investment sentiment.

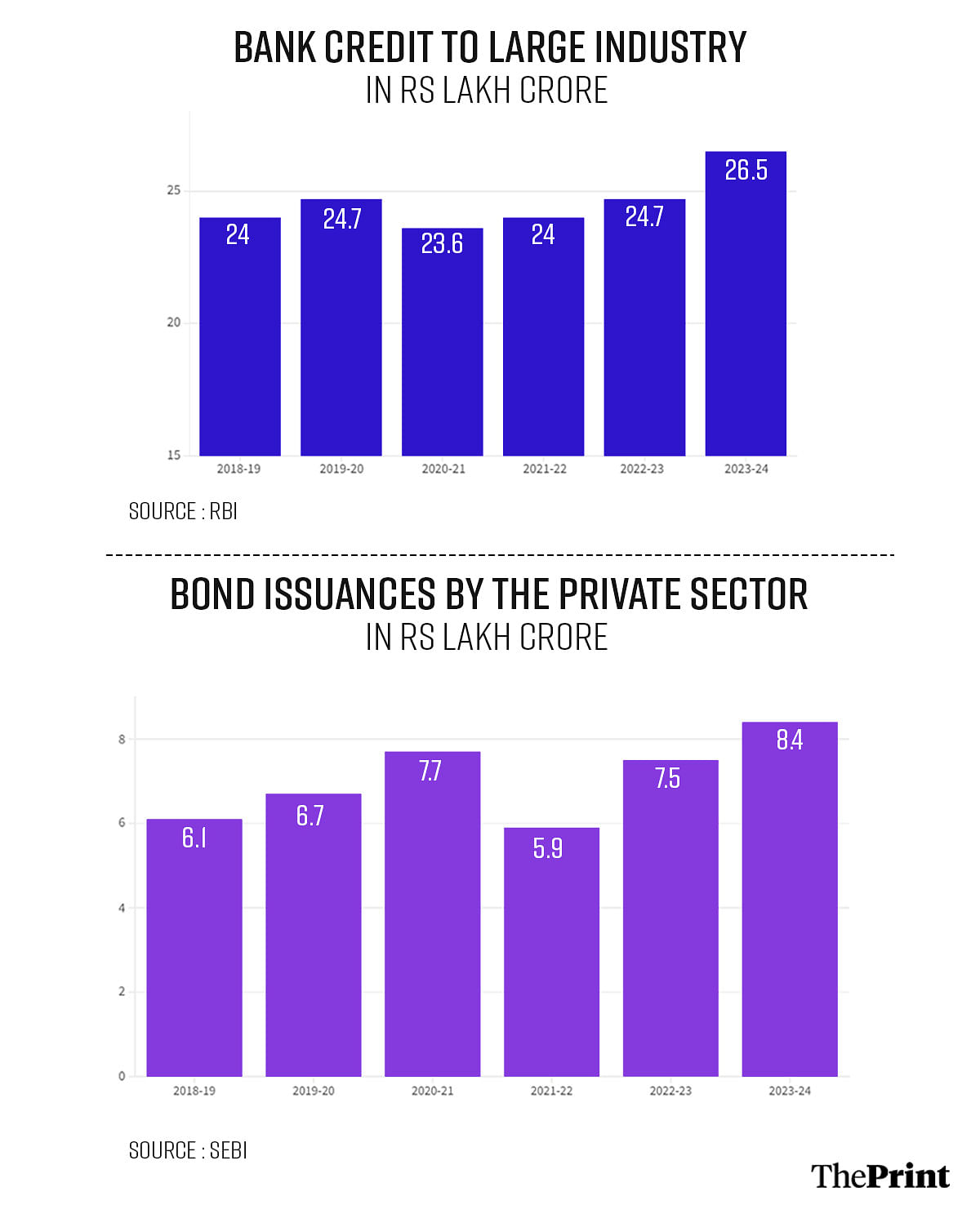

Bank credit data from the Reserve Bank of India (RBI) released Tuesday shows that credit to large industries increased by 7 percent in 2023-24 to Rs 26.5 lakh crore. This is not only the highest it has been in at least seven years, but it also marks the highest growth since 2018-19.

Additionally, the Indian private sector raised Rs 8.4 lakh crore from the bond market — the highest since the Securities and Exchange Board of India (SEBI) started providing data in 2008.

Also Read: Climate change doesn’t just affect poor people, farmers. Cities and banks aren’t safe either

Government boost to private companies

According to economists tracking the economy at a sectoral level, taken together, this increased borrowing by the private sector, especially larger companies, shows that not only are they benefiting from the government’s infrastructure push but also are preparing to increase capacity as soon as demand in the economy revives.

“The government’s focus on infrastructure spending (capital expenditure) generally has a crowding-in effect, encouraging private investment alongside, as businesses anticipate rising demand and better infrastructure,” economist Rishi Shah told ThePrint. “While there is a lag, some impact should materialise in the coming year.”

Further, the government push is inducing companies in key sectors of the economy — such as steel, cement, and mining — to increase their borrowing so that they can execute the large orders placed by the government.

“Credit to the large industry is also influenced by the heavy capital expenditure the government is doing since this is being delivered by the private companies like steel, cement, mining and engineering, procurement and construction (EPC) companies,” said Ranen Banerjee, leader of the government sector division at PwC India.

“So, if capex is growing 30 percent, then these companies will also grow strongly and will need to take on credit to execute the projects,” he added.

Another factor affecting the investment decisions of private companies is that enough time has now passed since the implementation of the Production-Linked Incentive schemes for companies to have started moving on with their plans.

“The rollout of Production-Linked Incentive schemes almost two years ago is another positive,” Shah said. “As plans around capex reach fruition, we can expect increased investment activity across these targeted sectors.”

High capacity usage & new orders flowing

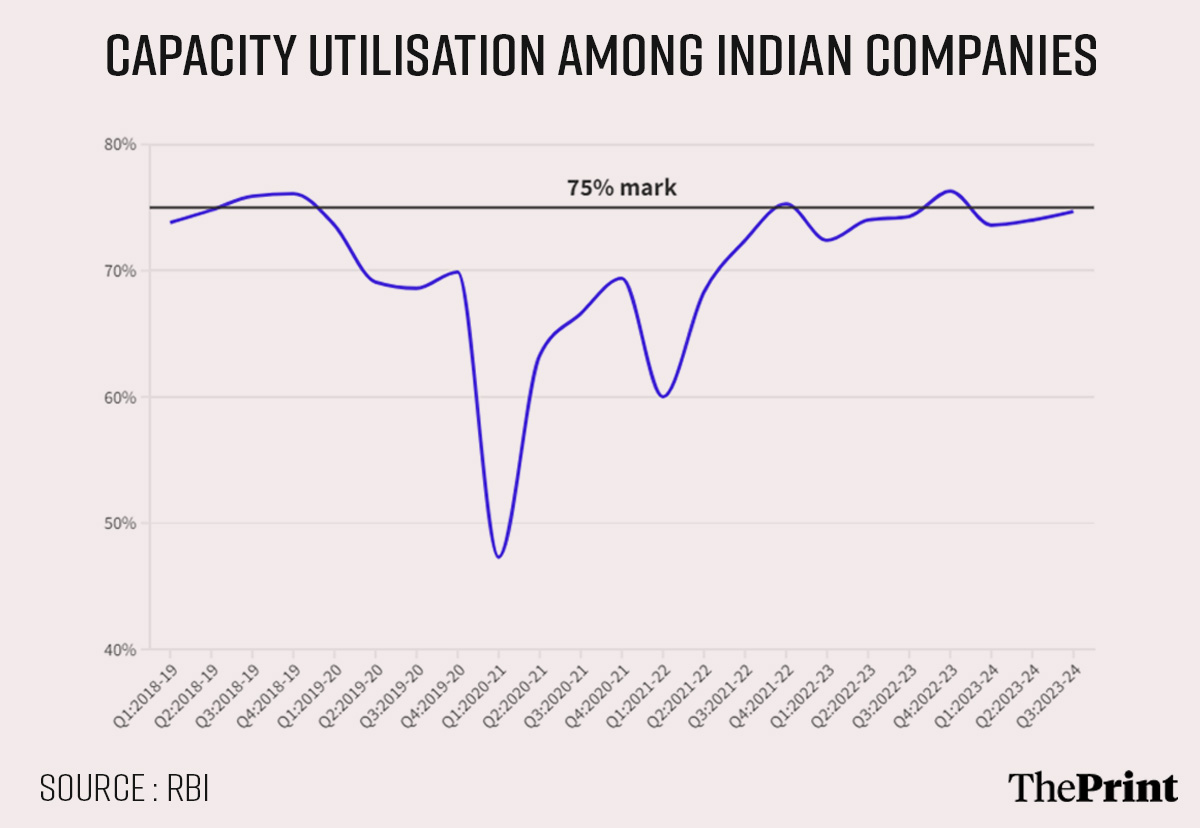

The RBI data also points to a confluence of two other factors that suggest new private investments could be around the corner.

On the one hand, capacity utilisation levels — a measure of how intensively factory capacity is being used, and an indicator of whether new capacity is needed — have been hovering around the 75 percent mark, which is conventionally when companies start to expand their capacities by making new investments.

On the other hand, the trend in new orders being placed with Indian companies shows a growth of 10 percent in the October-December 2023 quarter for the RBI’s sample of companies. This is the highest growth in new order levels since the July-September 2022 quarter.

In other words, not only is the existing capacity being used reasonably extensively, but new orders are flowing in at a rate that would soon require capacity expansion.

“Rising capacity utilisation nearing 80 percent indicates businesses are nearing production limits,” Shah said. “This typically triggers fresh investments in expanding capacity, further boosting the investment climate.”

With the India Meteorological Department (IMD) predicting a normal monsoon for the year, chances are that companies will look to expand capacity since indicators point to demand remaining strong, Banerjee said.

“The private sector will add capacity if it is confident that demand will grow,” he explained. “Once you are at 74-75 percent capacity utilisation and the IMD is saying that the monsoon will be normal this year, and the capex trend will be sustained, there is an expectation that demand will be sustained.”

However, Banerjee highlighted that the most recent data from the FMCG sector for the January-March 2024 quarter points to a slump in demand. “If FMCG growth starts picking up in this first quarter, then that would be a lead indicator that demand is starting to pick up. Then people will have confidence and start increasing capacity,” he said.

That said, he added that the lower debt levels of corporate India, which means they can take on more debt now to finance investments, does bode well for the investment scenario in the rest of this financial year.

Also Read: PSE policy is dying a slow death. More than half are non-operational or loss-making

Tax calculations could be at play

Anil Gupta, senior vice-president and co-group head of financial sector ratings at ICRA, has pointed out that some of the increase in bank credit to large industries could be because of a change in tax laws implemented last year.

In particular, he was referring to Section 43B of the Income Tax Act, which was inserted in 2023. According to this clause, any payments owed to MSMEs by large companies that are not paid within 45 days will not qualify for tax deductions until the payment is made.

“The amendments to the income tax rules, whereby any payments overdue beyond 45 days will not be allowed as a deductible expense for taxable income, prompted many large industries to promptly pay off the MSME customers, which is reflected as a sharp increase in sequential borrowing by large industries in March 2024 vis a vis February 2024,” Gupta explained.

In other words, some of the increase in borrowing by large companies was to pay their MSME vendors because they would otherwise not get a tax benefit.

“Effectively, this is a shift in working capital borrowings from MSMEs to large industries segments,” Gupta said.

(Edited by Richa Mishra)

Also Read: Indians spending beyond their means. Don’t just fix it with freebies, bring policy changes