The latest reports on the global economy by the International Monetary Fund (IMF) present some good news and some concerning assessments. First the good news. The latest World Economic Outlook (WEO) shows that the much feared global recession has been averted and inflation is down from the elevated levels of 2022 and inching towards the target.

Global economic growth is projected to remain stable yet lower than the pre-pandemic average.

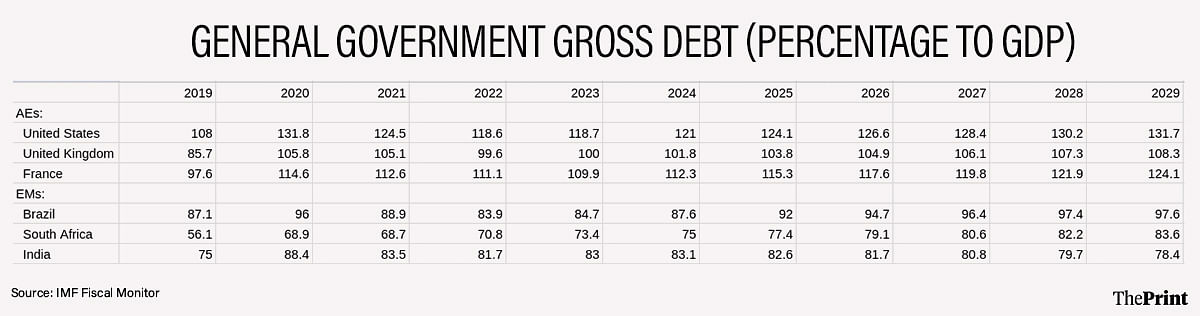

The bad news is that global debt is elevated and is likely to rise over the medium-term. The IMF’s Fiscal Monitor shows that global debt is expected to exceed USD 100 trillion in 2024.

Spending pressures to finance green transition, population aging, security concerns and development challenges will keep the debt outlook elevated. Notably, global factors have turned more prominent in shaping the debt outlook of countries.

Stable growth amid contrasting country dynamics

While global growth is projected to remain stable at 3.2 per cent (same as the forecast in the July update), it masks the differing country dynamics.

Amongst advanced economies, growth for the United States has been revised upward to 2.8 per cent, (0.2 percentage higher than the July forecast). The improvement in growth outlook is driven by robust consumption and non-residential investment. A solid job market, low unemployment and wage increases have helped support consumption in 2024. But this may change next year. Growth in the US is expected to slow to 2.2 per cent due to gradual tightening of fiscal policy and a cooling labour market.

In contrast, in the Euro Area, growth is expected to remain subdued at 0.8 percent this year and is expected to pick up to 1.2 per cent next year, helped by improvement in domestic demand.

Amongst emerging markets, while growth is expected to be strong in Asia, Saudi Arabia and countries in sub-Saharan Africa have seen a downward revision in growth projections for the current year. Next year, growth is expected to pick up in these economies as drivers of growth slowdown are expected to fade away.

For India, the IMF has maintained its growth estimate at 7 per cent for 2024-25, followed by 6.5 per cent next year. The slowdown from the 8.2 per cent growth in 2023 is attributed to the exhaustion of the pent-up demand accumulated during the pandemic. The emerging picture from the high-frequency indicators suggest that the growth projection may be optimistics. After a 6.7 growth in the first quarter, growth is seen to be weakening in the second quarter as well. Indicators such as passenger vehicle sales, personal loan growth, airline traffic, suggest moderation in urban consumption. The HSBC Purchasing Managers’ Index for industry and services have eased in recent months. The FMCG companies have also flagged a slump in urban demand in their latest quarterly assessments.

Downside risks to global growth projections

While global growth is expected to remain stable in the short-term, there are various downside risks to growth. If inflation proves more persistent, monetary policy easing may be delayed, leading to tighter financial conditions and slow economic recovery.

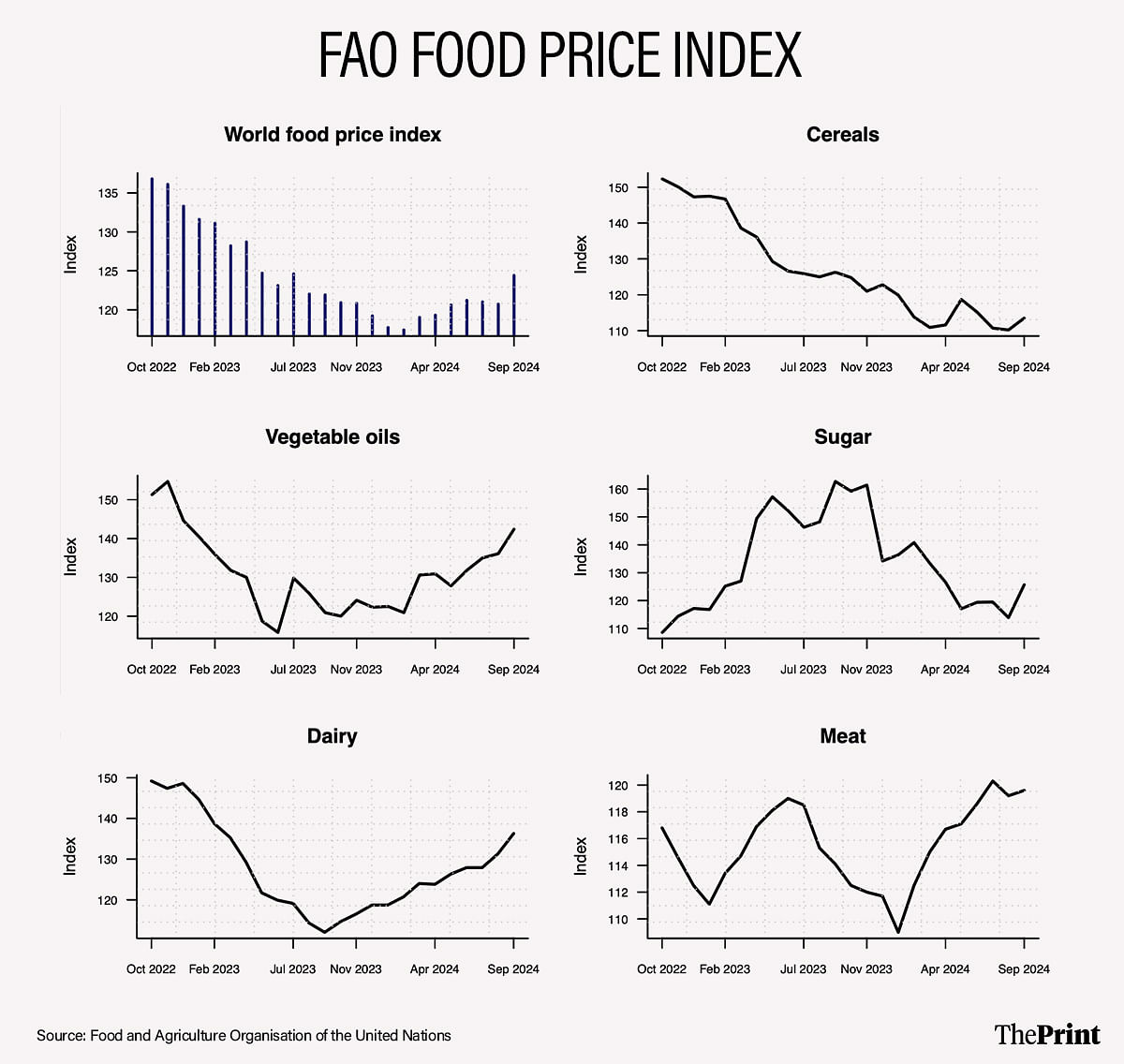

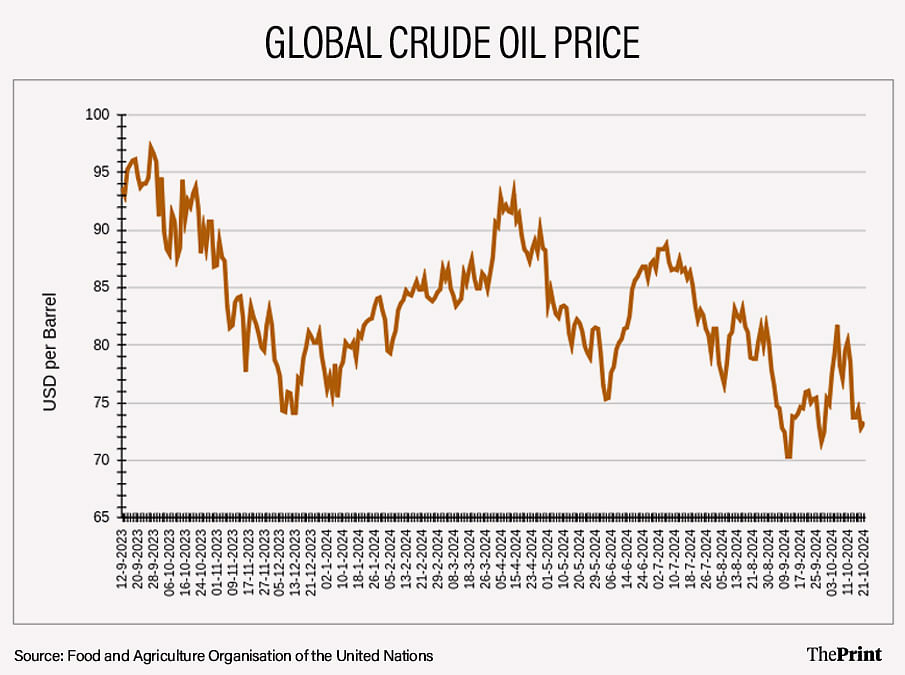

Spikes in commodity prices due to intensification of regional conflicts could further complicate the path towards monetary policy normalisation. The benchmark for world food commodity prices saw its fastest increase in September. Global crude oil prices have also witnessed volatility.

Further, the intensification of protectionist policies could disrupt global supply chains and weigh on medium-term growth prospects by restricting access to innovation and technology.

Of deeper concern is the IMF projection of a mediocre 3.1 per cent growth in five years. Structural challenges such as population aging, weak investment and low productivity are likely to pose a drag on medium-term growth prospects.

Global headline inflation is expected to moderate from 6.7 percent in 2023 to 5.8 percent in 2024 and further to 4.3 percent in 2025. While goods inflation has eased, services inflation continues to remain elevated, particularly in advanced economies.

Elevated global debt and greater risks to baseline projections

The IMF’s Fiscal Monitor presents an alarming picture on the global debt position. The report projects global debt to exceed USD 100 trillion, about 93 per cent of GDP this year. By 2030, global debt is expected to rise to 100 per cent of GDP, 10 percentage points of GDP above 2019.

Given the rising uncertainty, the debt burden under adverse risk scenarios is likely to be much higher than the baseline projections.

A critical feature of the emerging debt dynamics is that in addition to the domestic factors, global factors are increasingly playing an important role in shaping the debt trajectory of countries. In particular, countries whose sovereign yields have high correlation with the US bond yields and in general the uncertainty surrounding the US fiscal and monetary policy pose an upside risk to the debt outlook for countries. These trends underscore the role of spillovers from systemically important countries such as the United States in shaping the global debt landscape.

The Fiscal Monitor notes that in the existing environment of high debt and deficits, economies globally face a ‘fiscal trilemma’ characterised by three elements. First, significant expenditure requirements in sectors such as defence, climate change, and health due to domestic and international priorities. Second, resistance towards tax increases due to political economy constraints. Third, maintaining macroeconomic stability, which includes sustainable public debt, financial, and monetary stability. In essence, the fiscal trilemma implies that countries that choose to spend more without corresponding increases in taxation, will face financial instability due to mounting deficits and debt.

This is similar to the traditional monetary policy trilemma that posits that central banks can choose two of three elements: independent monetary policy, free foreign capital flows, and a fixed exchange rate. Nonetheless, the IMF notes that the fiscal trilemma is merely a challenge, and not a trap; one which can be navigated with the correct set of policy choices.

The policy prescriptions to manage elevated debt levels, however, vary across countries. Advanced economies that have been flagged in the report (the US, the UK, France, & Italy) should focus more towards reprioritising expenditures, including pension and entitlement reforms. Emerging economies, on the other hand, should increase their tax base by enhancing revenue administration and reducing informality, whilst simultaneously safeguarding public investment and social safety nets.

Radhika Pandey is associate professor and Utsav Saksena is a research fellow at the National Institute of Public Finance and Policy (NIPFP). Views are personal.

Also Read: The global sovereign ratings space needs revamp. Indian agency’s entry a welcome change