High growth in savings and investments are key to India’s sustained long-term growth. India’s aggregate saving rate has seen a moderation in recent years. Savings by households have also remained stable as a share of GDP, after peaking in 2011-12. Household savings comprise financial and physical savings. In 2021-22, gross financial savings of households saw a dip as compared to the previous year and savings in physical assets saw a rise.

Over the past few years, financial savings have been witnessing a compositional shift with more households diversifying their portfolio and shifting away from traditional instruments such as bank deposits. However, last year saw profound changes in the savings and investment pattern of households. Mutual funds and equity emerged as an important instrument for financial savings. Investments by households in real estate saw a boost last year. Investment in gold also increased but real estate was far ahead.

Also read: How services trade surplus, led by robust exports, is helping balance India’s trade deficit

Savings and its composition

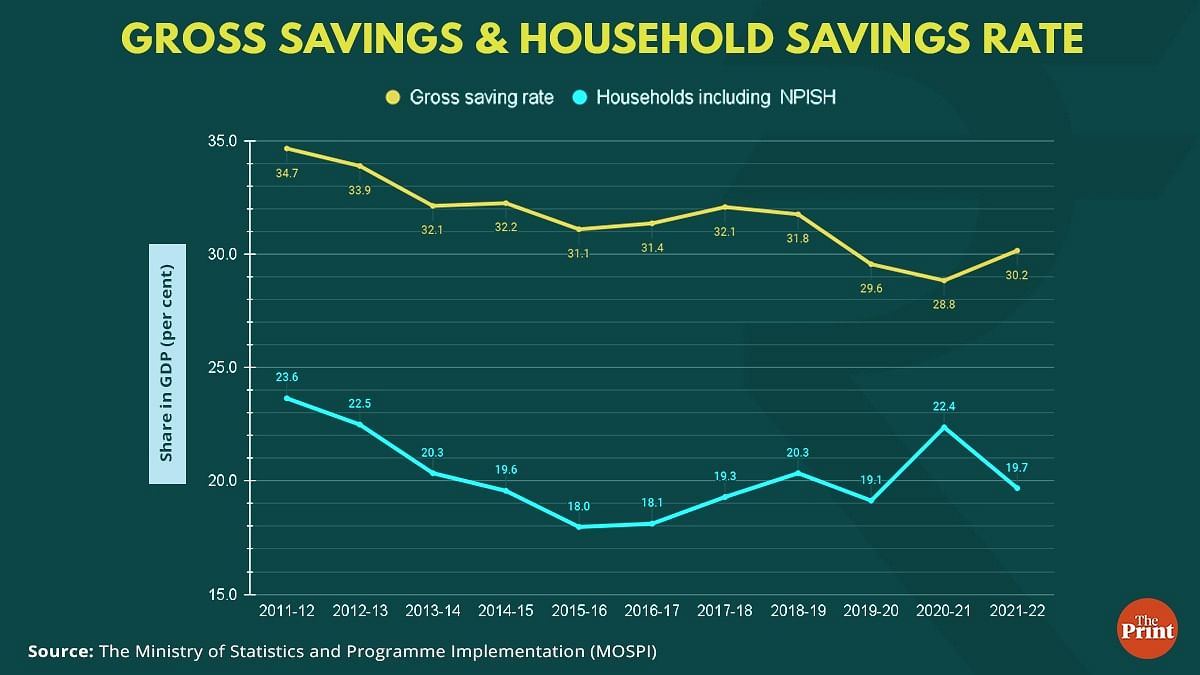

A high domestic savings rate (savings expressed as a share of GDP) has been a critical part of India’s growth story. The economy’s high growth phase starting 2004 till 2011 was supported by a strong savings rate. The savings rate peaked at 36.91 per cent in 2010-11. Since then, the rate has been moderating. It dropped to a low of 28.8 per cent in 2020-21. Encouragingly, the latest figure for 2021-22 shows the aggregate savings rate at 30.2 per cent.

Savings by the household sector is the most prominent component, accounting for more than 65 per cent of the overall savings. The other components are savings by financial and non-financial corporations in the private and public sector, and the general government sector.

Household savings as a percentage of GDP has been hovering around 19-20 per cent over the past five years. Only in the Covid impacted year, savings by the household sector rose to 22.4 per cent of GDP. People saved money as a protection for health and to cushion against falling incomes. The re-opening of the economy along with the pent-up demand resulted in decline in savings by households in 2021-22.

Elevated inflation also resulted in a dip in savings. Household savings as a share of GDP declined to 19.7 per cent in 2021-22 from 22.3 per cent in the previous year.

Households saved more in physical assets in 2021-22

Households save in financial instruments and physical assets. The financial savings of households are held in cash, bank deposits, mutual funds (MFs), insurance and pension funds. Households also save in physical assets such as gold and real estate. During the past five years, the savings in physical assets ranged between 58-60 per cent of the household savings. Last year, the share of savings in physical assets jumped to 65 per cent.

To ensure a sustained flow of funds for investments, household financial savings need to increase. Financial savings of households saw a decline from Rs 30.54 lakh crore in 2020-21 to 25.98 lakh crore in 2021-22. While some part of the decline could be explained on account of pent-up demand, the decline, nevertheless, was substantial.

As a percentage of Gross National Domestic Income (GNDI), households’ financial savings declined from 15.2 per cent in 2020-21 to 11 per cent in 2021-22. Even in the pre-Covid year, the gross financial savings as a per cent of GNDI was higher. The ratio of 11 per cent in 2021-22 is the lowest since 2016-17. Concomitantly, savings in physical assets by households has seen a jump in 2021-22. Savings in physical assets rose from 10.5 per cent of GNDI in 2020-21 to 11.7 per cent in 2021-22.

During the past three years, savings in physical assets as a share of GNDI was seeing a decline. The year 2021-22 reversed the trend of decline in the physical savings as a share of GNDI.

Shift in composition of households’ financial savings

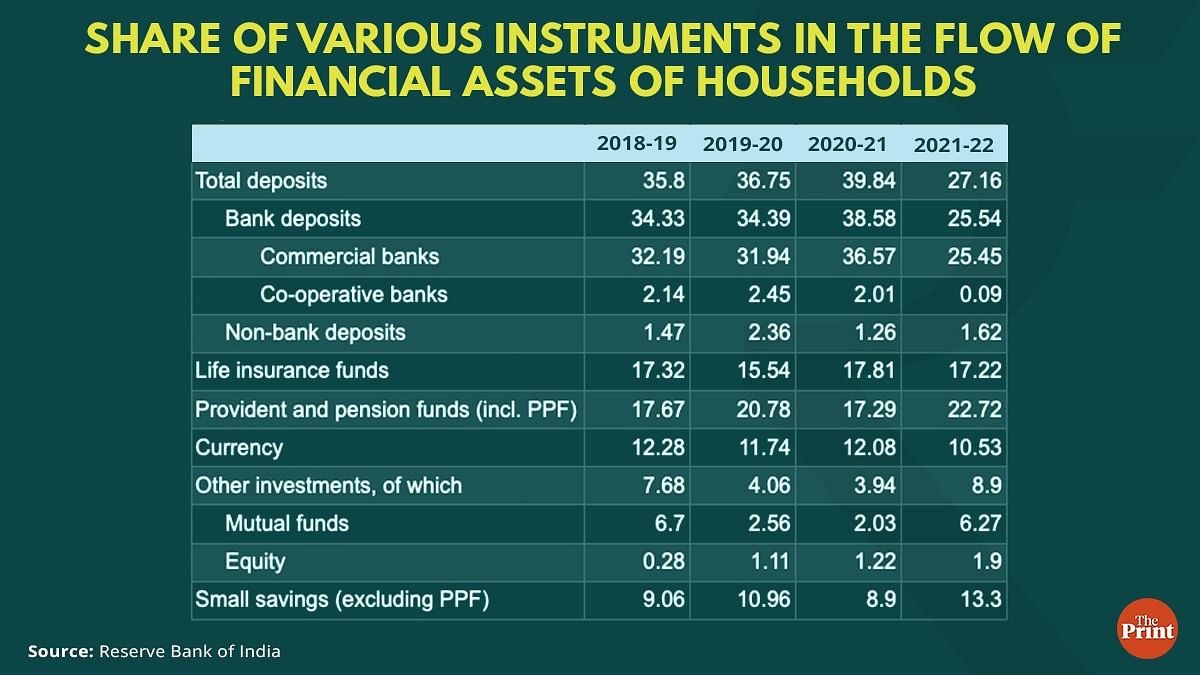

There has been a shift in the composition of gross financial savings over the past decade. In 2011-12, bank deposits dominated household financial savings, contributing more than half of it. For the year ending March 2022, bank deposits constituted roughly one-fourth of the households’ financial savings. The contribution of provident and pension funds has seen a gradual rise over the last decade, though the rise is not consistent. In 2011-12, provident and pension funds accounted for 10 per cent of the financial savings.

Last year, the share had risen to more than 22 per cent, indicating greater move towards a formalised economy. They had the second highest share in 2021-22. These were followed by life insurance funds and small savings.

A noteworthy change is the increase in the share of mutual funds and equity in households’ financial savings, particularly in 2021-22. The share of mutual funds (MF) in households’ financial savings stood at 6.3 per cent, a more than 4 per cent rise from 2020-21. The record rise in MF investments came amid a boom in the stock market in 2021.

Substantial liquidity pumped in by global central banks, stimulus package announced by the government, rotation of foreign investments from China to India and a record number of Initial Public Offerings contributed to the stock market rally and encouraged greater retail investor participation.

Poor inflation adjusted returns from traditional instruments, such as bank deposits, also lured investors towards the stock markets. Direct exposure to equity instruments has also seen a sustained rise. From a meagre 0.28 per cent share in FY 2018-19, the share of equity instruments has risen to 1.9 per cent in 2021-22.

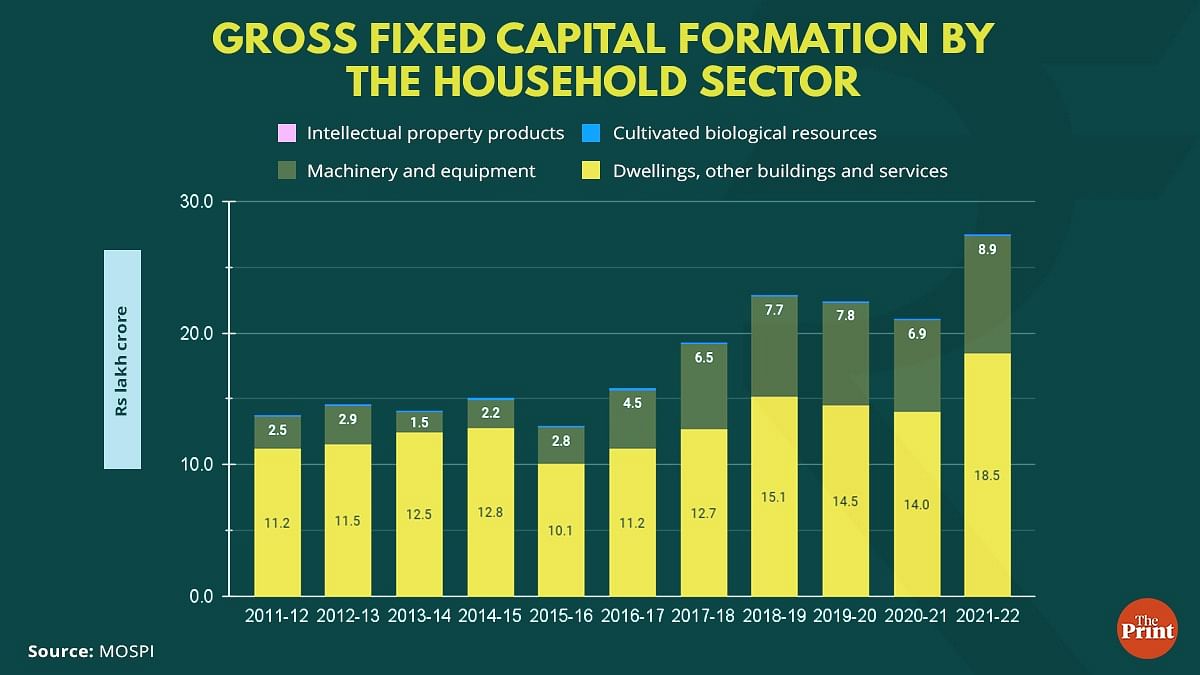

Physical savings are moving towards real estate

An assessment of household savings in physical assets can be made through looking at the pattern of their gross fixed capital formation (GFCF), a proxy for investment. The key assets in which households invest are dwellings and machinery and equipment. Last year saw a spurt of more than Rs 4 lakh crore of investments in dwellings. New launches and sales of housing have picked up pace post Covid. The strong uptick in housing sales has led to a significant decline in inventory overhang. Bank credit for housing has also seen a consistent rise in 2021-22. The outstanding loans to the housing sector was Rs 15 lakh crore in April 2021 and by March 2022, it touched almost Rs 17 lakh crore.

Recent months have seen a further uptick in bank credit for housing. Investment in housing is being considered as an appropriate hedge against inflation. Government’s infrastructure push and higher budget allocation for PM Awaas Yojana is expected to further support the demand for housing.

Radhika Pandey is a Senior Fellow and Pramod Sinha is a Fellow at the National Institute of Public Finance and Policy (NIPFP)

Views are personal.

Also read: How did Indian economy perform during pandemic & after? Turns out, not as badly as was estimated