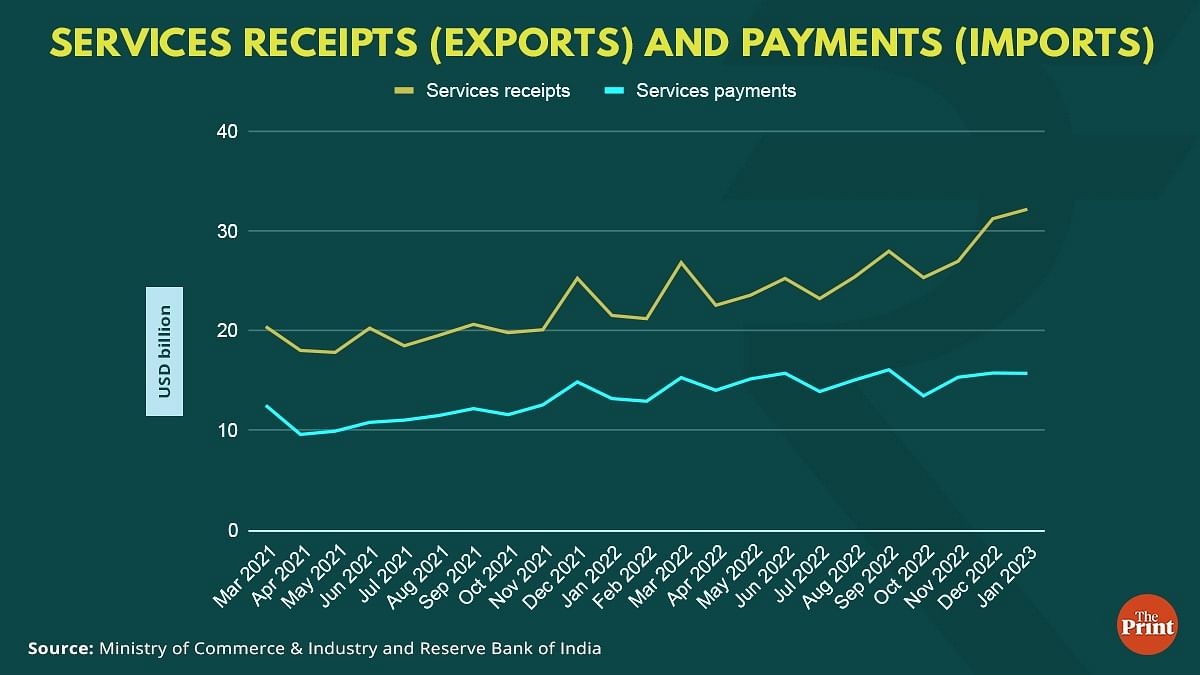

India’s merchandise trade deficit dropped to a 12-month low of $17.7 billion in January, while the services trade surplus surged to a record high of $16.5 billion. The combination of shrinking merchandise trade deficit and robust services trade surplus will help in moderating the current account deficit for the present financial year.

The surplus on the services trade is being led by robust services exports. In December, 2022 services exports jumped by more than $4 billion as compared to that in the previous month. The momentum of strong services exports was sustained in January as well. Despite global headwinds, India’s overall exports (merchandise plus services) registered a positive growth of 14.58 per cent in January 2023, over the same period last year.

Shrinking world trade & impact on India’s current account deficit

World trade growth has seen a sharp slowdown — from 10.4 per cent in 2021 to an estimated 5.4 per cent in 2022. According to the January update of the World Economic Outlook by the International Monetary Fund (IMF), global trade is expected to decline to 2.4 per cent in 2023 despite an easing of supply bottlenecks, before rising to 3.4 per cent in 2024.

The World Trade Organisation releases the Goods Trade Barometer that provides information on early trends in merchandise trade. The barometer index shows a downturn in trade activity in the closing months of 2022 and into 2023.

The World Trade Organisation’s (WTO) Services Trade Barometer, which illustrates the current state of services trade, also shows a likely slowdown in services trade activity in the coming months.

According to the latest data released on 22 December, while services trade was expected to remain strong in the September quarter, supported by spending on travel, information and communication technology (ICT) services, and financial services, there was a moderation in services trade, owing to declining growth prospects in major economies. Among the components of the barometer, financial and ICT services have been so far most resilient to the slowing global economy, whereas construction services and container shipping fell into contraction territory.

According to the Barometer, world services trade activity appears to have weakened in the December quarter of 2022 and is likely to remain weak in the opening months of 2023.

India’s trade in goods has seen a moderation

India’s merchandise exports had touched an all-time high of $422 billion in 2021-22. This year, exports have been impacted owing to the looming growth and trade slowdown amidst sustained tightening of financial conditions.

According to the latest data, India’s goods exports contracted by 6.6 per cent in January this year, on a year-on-year basis. Some of the items that saw a double-digit contraction (on year-on-year basis) include gems and jewellery, cotton yarn and fabrics, man-made yarn and fabrics, engineering goods and plastic products. On a cumulative basis, India’s goods exports were $368.5 billion from April-January 2022-23 as compared to $340.3 billion in the same period of last year.

Imports have been elevated this year owing to a sharp rise in commodity prices. For the April-January period, India’s goods imports surged to $601.7 billion as compared to $494.3 billion in the same period of last year.

Imports have witnessed growth in double-digits in most of the months of 2022. Only during the last two months, imports saw a contraction on a year-on-year basis. In January, goods imports contracted by 3.6 per cent. Contraction was seen on a sequential basis as well. This was on account of easing of global commodity prices, weak demand and the government’s curbs on non-essential imports. Particularly, imports of gold saw a contraction of more than 70 per cent as compared to the same period last year.

Services trade to offset some part of the rise in goods trade deficit

The monthly data on trade in services shows a sustained rise in exports of services. In January, India’s services exports touched $32.2 billion, almost equal to the goods exports for January. The overall surplus in trade in services touched $16.48 billion in January.

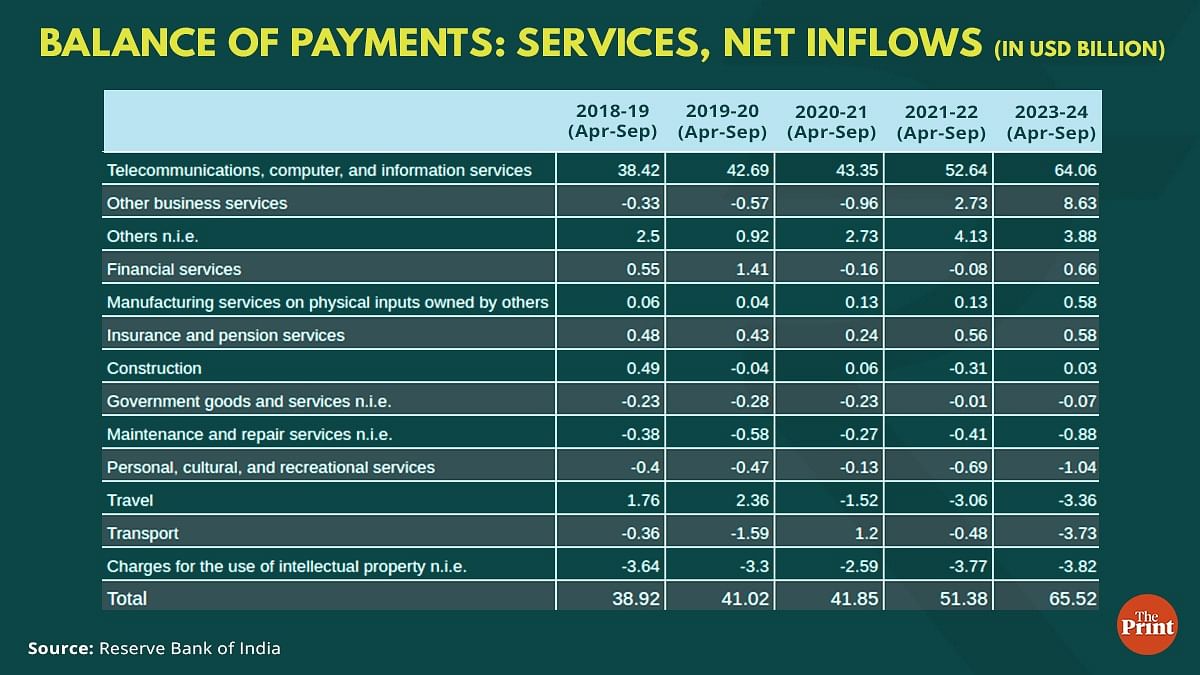

The monthly data presents an aggregate picture on trade in services. It does not delve into the drivers of the sharp rebound in services trade. The quarterly data on balance of payments shows that the rebound in services exports in the first half of the current financial year is driven by net inflows in telecommunications, computer and information services, financial services and business services.

While exports of telecommunications, computer and information services constitute the bulk of services exports, it is the exports of business services that have seen the sharpest rise in 2021-22 and 2022-23. Within the category of business services, exports of research and development-based services, and professional and management consulting services have seen a sharp growth in the April-September period as compared to the same period last year.

In contrast, inflows as part of trade in travel-related services have been hit since the onset of Covid and geo-political disruptions.

India attractive destination for outsourcing of services

In the US, while overall inflation has fallen and goods prices have declined, inflation in the broad array of services continues to remain elevated. The US Federal Reserve has conceded that disinflation is yet to take hold in the services sector. The bank would take a closer look at the service prices to decide on the future course of monetary policy tightening.

In a bid to save cost, countries affected by high inflation, particularly in services, have started outsourcing their work, in sectors such as auditing, accounting and legal services. India has emerged as a lucrative outsourcing destination owing to its skilled and qualified manpower with relatively lower payroll costs. Time-zone variations and lack of a language barrier have also enabled India as a favourable outsourcing partner. This explains the recent surge in exports of business services.

Radhika Pandey is Senior Fellow at National Institute of Public Finance and Policy.

Views are personal.

Also read: Different baskets, weights, items measured — Why 2 inflation indices are saying different things