Recently, the Reserve Bank of India (RBI) issued a concept note on the Central Bank Digital Currency (CBDC). The note discusses the objectives, choices, benefits and risks of issuing a CBDC. The note also discusses the implications of issuing CBDCs on the banking system, monetary policy and financial stability, besides discussing the design choices, the underlying technology and possible uses.

Among the key motivations, the concept note positions CBDCs as a safe alternative to private virtual currencies. However, a one-on-one comparison between the two may not be appropriate. Private virtual currencies, such as Bitcoin, are seen more as assets than as a medium of exchange. They are largely seen as instruments to diversify risks.

A CBDC is a central-bank-issued digital money denominated in a sovereign currency. It is the same as cash but in digital form. It will be used as a medium of exchange rather than as an asset.

CBDCs could lead to greater financial inclusion and bring about innovations and efficiency in the payments system. It will, however, be important to address the offline functionality of CBDCs to enable mass adoption. Consultation with stakeholders and analysing international experience would help design CBDCs for universal access.

The note has rightly placed emphasis on consumer protection as an important pillar of financial stability. The adoption of a new digital form of money may give rise to different forms of consumer grievances such as technical disruption, frauds etc. Prompt and efficient framework for resolution of consumer grievances would build trust and facilitate adoption of CBDCs.

Also read: Real estate, IT, gig jobs, MNREGA: Making sense of India’s roller-coaster unemployment crisis

Objectives of issuing CBDCs

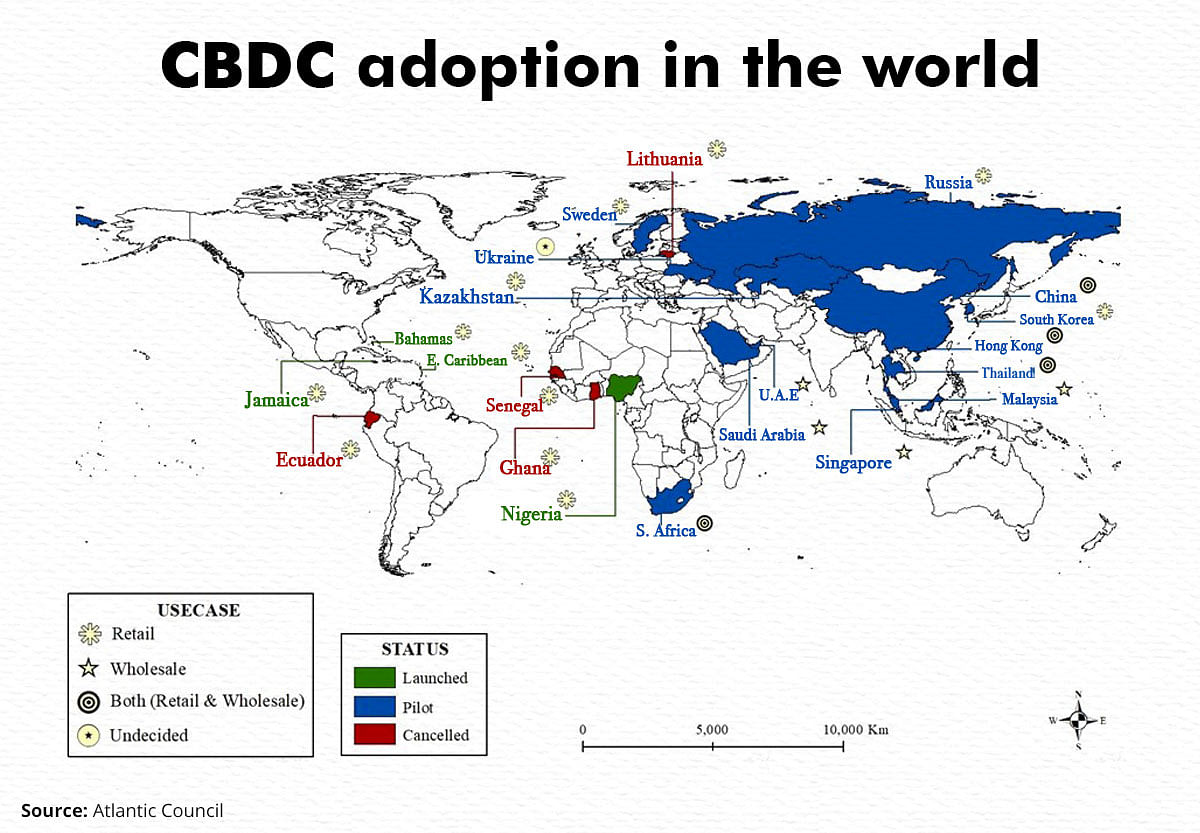

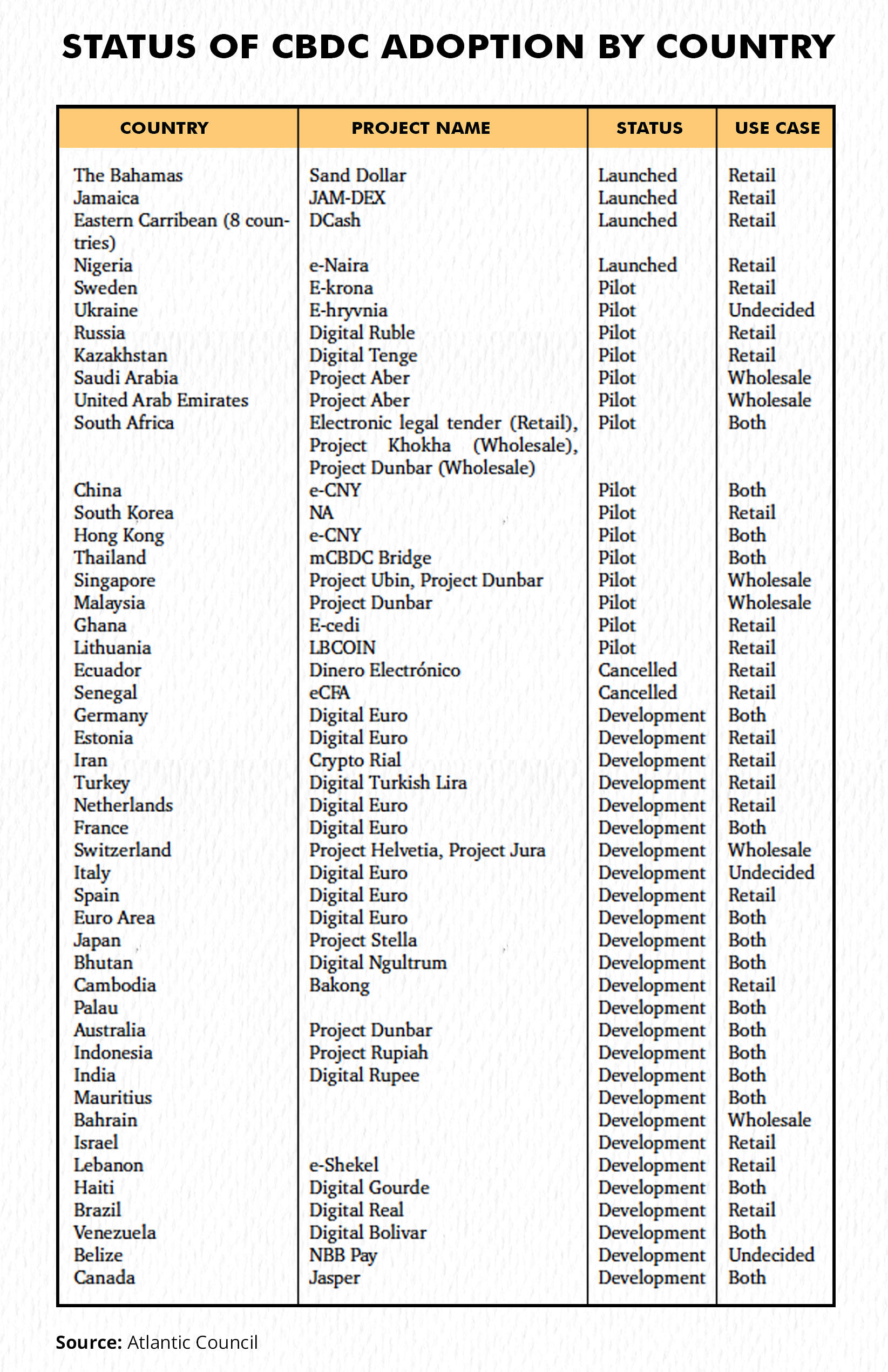

Currently, 105 countries are exploring CBDC, accounting for 95 per cent of the global GDP. These include 19 of the G20 countries, as per Atlantic Council’s data. Out of these, 50 countries are in an advanced phase of exploration: launch, pilot or development.

A review of international experience suggests that one of the key motivations for issuing CBDCs has been to foster financial inclusion. For instance, in the Bahamas, the Sand Dollar was introduced in order to facilitate financial inclusion because its population was spread across 30 islands, many of them remote.

In countries facing dwindling usage of cash, such as Sweden, central banks issue CBDCs as a digital complement to cash. Some countries, such as Japan are exploring CBDCs as a payment instrument alongside cash and also to ensure stability and efficiency of the payments system.

A key motivation behind issuing CBDCs in India is to reduce the cost of physical cash management. A CBDC would reduce costs related to printing, storage, transportation and replacement of banknotes. Despite significant push to digitisation, the usage of cash remains high, particularly for small value transactions. Cash is favoured for its anonymity. If reasonable anonymity is assured, the public may shift from cash to the CBDC for regular transactions and small value payments, thus furthering digitisation.

Introduction of CBDCs could support competition and innovation in payments and settlements by providing another avenue to the public. CBDCs could potentially promote financial inclusion by making financial services more accessible to the unbanked and underbanked population. This would require suitable design choices including offline functionality of CBDCs.

Types and design features of CBDCs

Based on the accessibility, the concept note distinguishes between wholesale and retail CBDCs. Retail CBDC would be available for use by all: private sector, non-financial consumers and businesses. Wholesale CBDCs are designed for restricted access by financial institutions.

The concept note also explores the possibility of using wholesale CBDCs for buying assets such as government securities, commercial papers and primary auctions for government securities bypassing the bank route.

Retail CBDC is an electronic version of cash. While India already has a sound payment infrastructure ranging from Real Time Gross Settlement (RTGS), National Electronic Fund Transfer (NEFT) to Unified Payments Interface (UPI) etc, the concept paper argues that CBDC can provide an alternative medium of making digital payments in case of operational or technical problems leading to disruption in other payment system infrastructures.

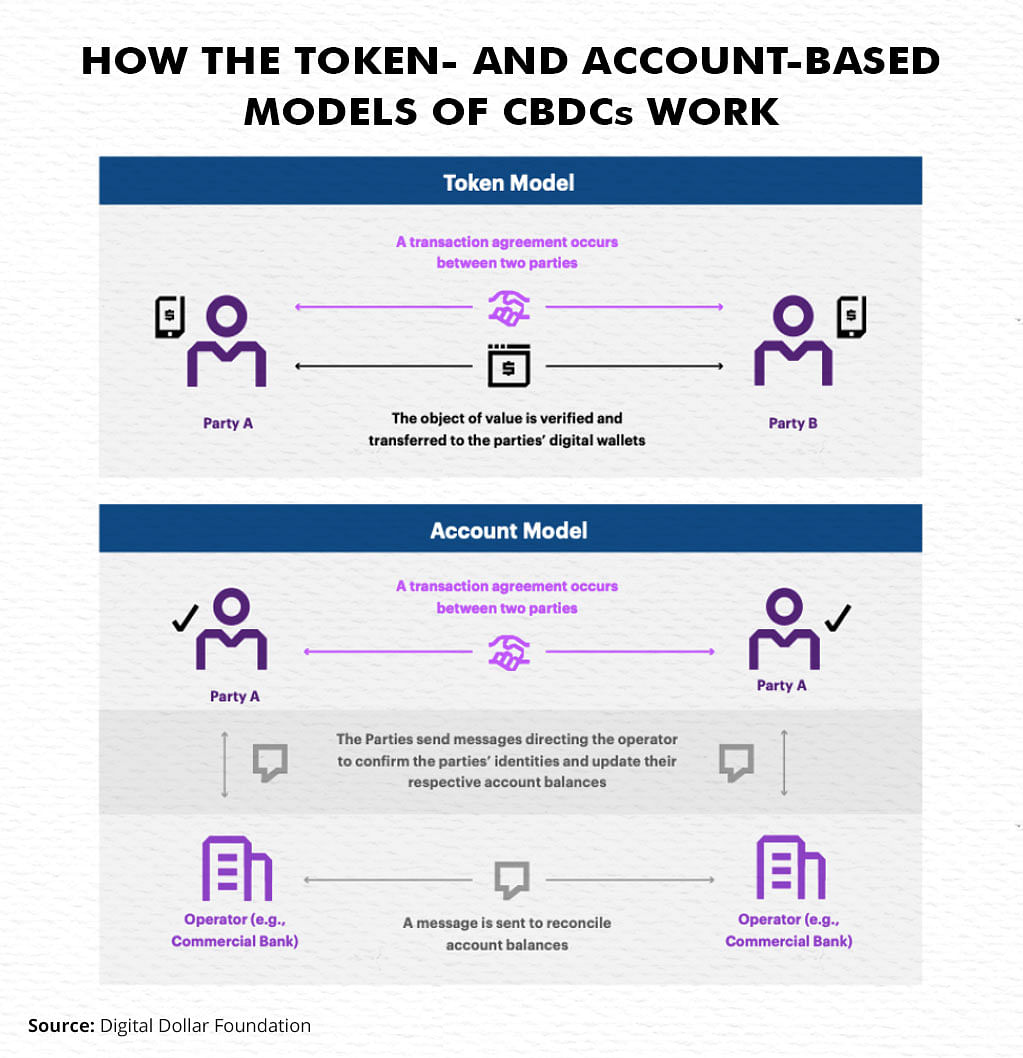

CBDC can be token-based or account-based. A token-based CBDC is a digital token representing a claim on the central bank. The transfer of tokens would entail transfer of ownership similar to handing over banknotes from one person to another. Tokens would be stored through “wallets” similar to the technology employed by cryptocurrency users.

In an account-based CBDC, the central bank would hold accounts for users of the CBDC. Money would be held as credit balances in accounts. Both designs will have separate legal considerations and will require suitable amendments to the legal framework.

Also read: India’s falling forex reserve isn’t a worry for now, but RBI has a tightrope walk ahead

Monetary and financial stability implications

While the roll out of CBDCs has many potential benefits, it may also pose risks to financial stability. The risks would vary depending upon whether the CBDC is interest-bearing (remunerated) or non-interest bearing (non-remunerated).

If accounts with central banks offer interest, then there will be an incentive for people to move their deposits in banks to CBDC accounts. This could have adverse implications for credit creation by commercial banks. Banks would have to offer higher interest rates on deposits, thus increasing their cost of funding.

Banks may be compelled to pass on the additional costs to borrowers. They may also turn to riskier sources for generating higher returns. The reliance on central bank’s liquidity could also increase.

If a CBDC is non-remunerated, the incentive to shift from bank deposits would be lesser. However, if there are concerns about the banking sector’s health or during economic instability, depositors may switch from bank deposits to CBDCs.

More discussion on the implications of CBDCs on bank runs, monetary policy transmission and central bank’s balance-sheets is needed to ensure that CBDC is issued with adequate safeguards to counter potential risks.

Radhika Pandey and Kriti Wattal are consultants at National Institute of Public Finance and Policy.

Views are personal.

Also read: Bank credit has bounced back, but rising interest rates & inflation can be new hurdles