India’s Gross Domestic Product (GDP) posted a growth of 6.3 per cent year-on-year for the July-September quarter of the current financial year. While this was lower than the 13.5 per cent growth seen in the June quarter when the low base had statistically pushed up the growth number, on a sequential (quarter-on-quarter) basis, there was an increase in growth.

Growth also improved significantly over the same quarter of the pre-Covid period.

Services sector was the major driver of growth, while manufacturing and mining saw a contraction. Agriculture growth was strong. Going forward, slowdown in external demand amid tightening financial conditions will pose downside risks to growth. The easing of commodity prices should provide support to the manufacturing sector in the coming quarters.

Also read: India’s public sector banks are laughing all the way to profits. But new stress can interrupt

Manufacturing sector slowdown

Manufacturing sector witnessed a slowdown owing to fall in profits — a key component of the Gross Value Added (GVA). Profits were adversely affected by higher costs of raw materials, energy prices and rise in interest rates. This is worrisome as manufacturing has a huge potential for employment generation.

According to the data by the Centre for Monitoring Indian Economy (CMIE), the combined net profit of 3,319 listed companies in the non-financial sector contracted by 24 per cent. Amidst a reversal of the accommodative monetary policy, the interest expenses of the same set of firms grew at more than 30 per cent. For the firms in the manufacturing sector, net profits were down more than 28 per cent.

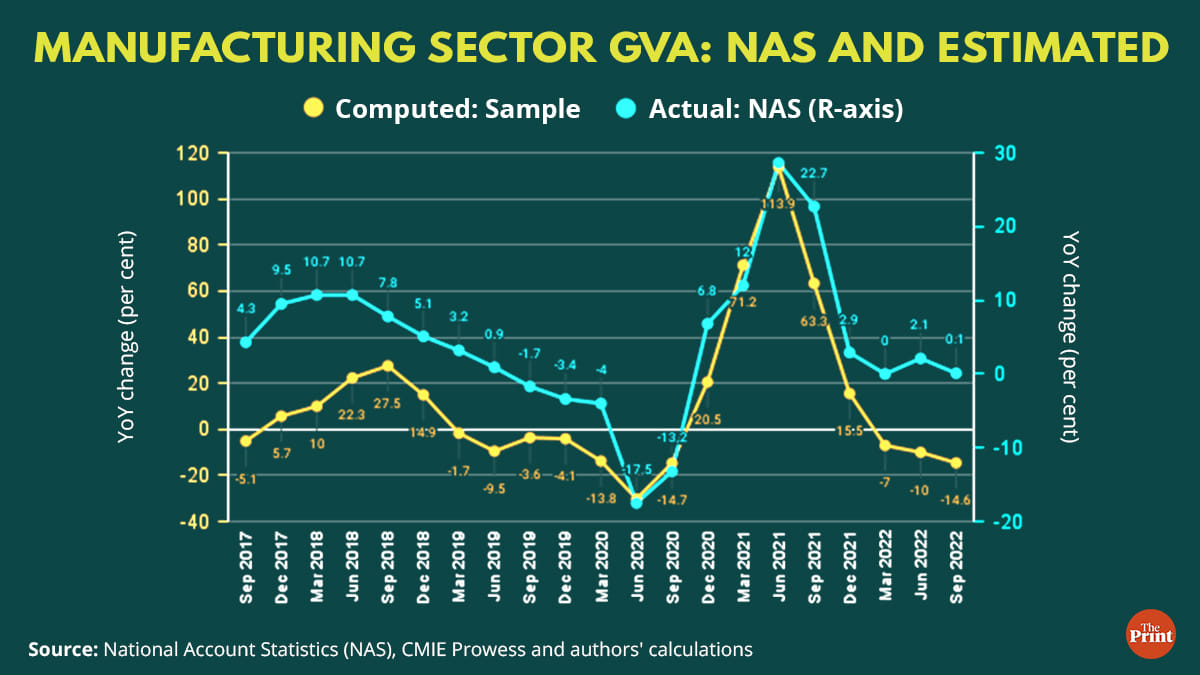

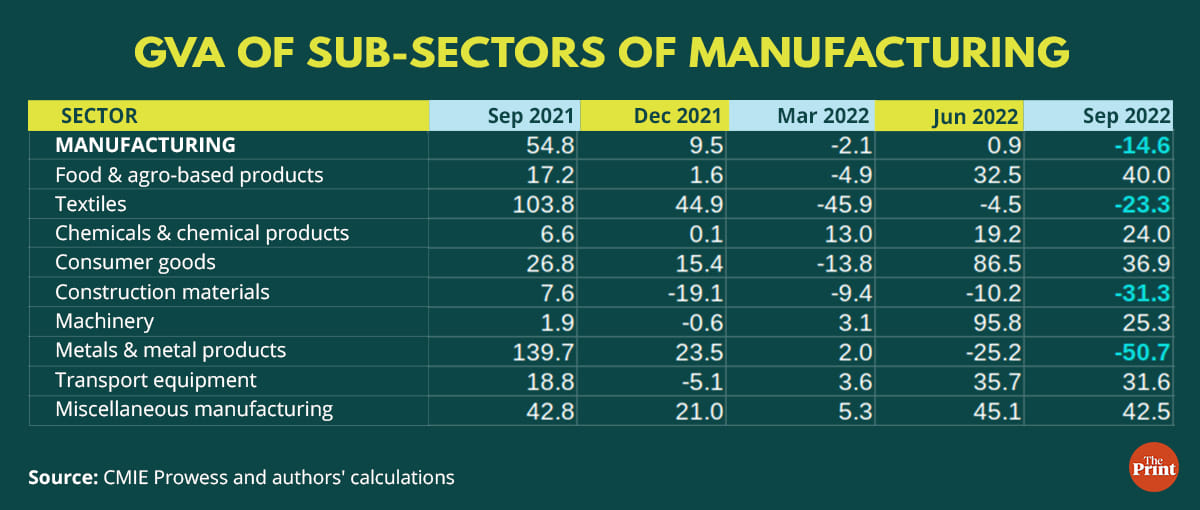

The GVA in the manufacturing sector contracted by 4.3 per cent. While the National Account Statistics (NAS) does not present details of the GVA at the sub-sectoral level, an estimation of the sub-sectoral manufacturing GVA based on the data from the CMIE Prowess database shows that textiles, metals and metal products, and construction materials witnessed a steep contraction in the July-September quarter. Consumer goods, chemicals and machinery recorded strong growth. The estimation of the GVA of the manufacturing sector firms in CMIE Prowess broadly matches the trends seen through the NAS.

The contraction seen in ‘Metals and metal products’ reflects the impact of correction in international metal prices, which had sky-rocketed in March on the back of supply concerns due to the geo-political tensions.

The contraction seen in the GVA of the textile sector for three consecutive quarters is a cause of concern as it is one of the major employment generating sectors.

For the first half of the year, manufacturing sector growth has been flat. The slowdown in the manufacturing sector that started from 2019 has still not seen a robust recovery.

On the positive front, the GVA of the agricultural and allied sectors posted a strong growth of 4.6 per cent. This is despite concerns that sowing was below par in the September quarter.

Mining GVA also contracted by 2.8 per cent. The GVA of the mining sector at current prices registered a strong growth of 35 per cent, possibly reflecting the impact of surge in prices.

Consumption and investment robust

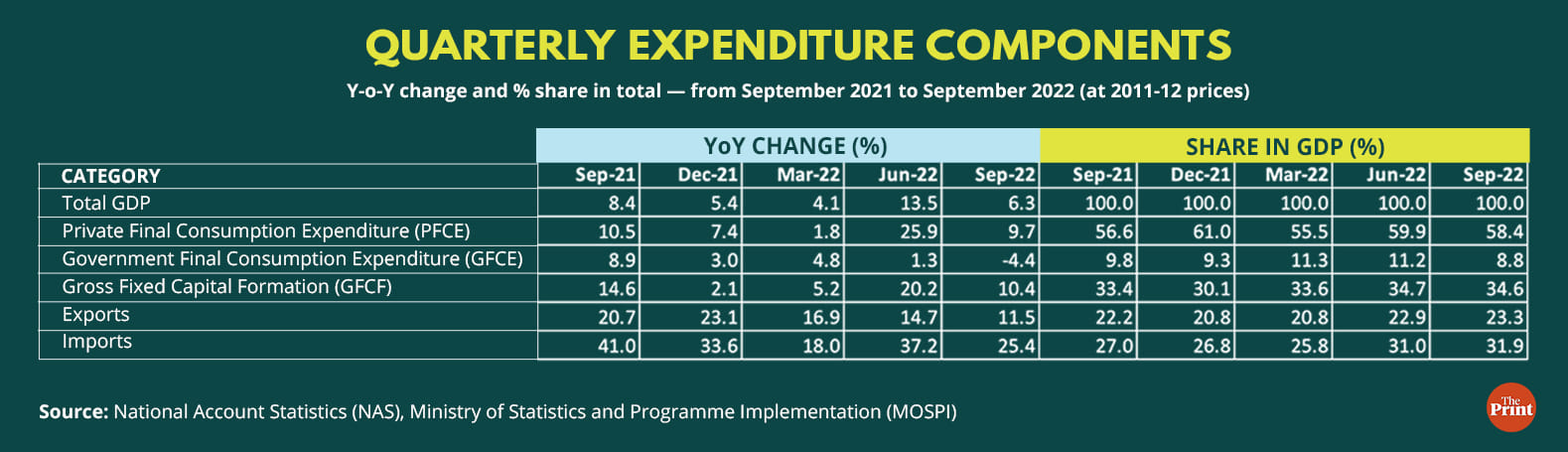

Private Final Consumption Expenditure (PFCE), a proxy for household consumption, was 58.5 per cent of GDP at constant prices as against 56.6 per cent in the same quarter, last year. The growth in consumption is likely driven by urban consumption. Rural consumption has been weak. The manufacturers of consumer goods have reported a decline in rural sales reflecting the impact of high inflation.

The improvement in domestic demand needs to sustain amidst a challenging global economy. The revival in consumption is also crucial to provide incentives for fresh private investments.

Gross fixed capital formation (GFCF), a proxy for investment demand in the economy, grew at 10.4 per cent. At 34.6 per cent of GDP at constant prices, GFCF is mildly lower than 34.7 per cent in the previous quarter. Growth in GFCF reflects the strong push to capital expenditure by the central government. Private investment also seems to be showing signs of recovery. Credit to the corporate sector has seen a pick-up in the recent months.

External sector: a drag on growth

Higher net imports exerted a drag on growth. While exports were 23.3 per cent of GDP, imports were 31.9 per cent of GDP. With most of the advanced economies, with the exception of the US, heading for a recession, exports are bound to be impacted. With the fall in global commodity prices, in the second half of the year, imports are also likely to soften.

Government consumption expenditure registered a contraction — the first contraction in five quarters. Government is keeping its revenue expenditure under check possibly to achieve fiscal consolidation.

In the first half, the economy clocked a growth of 9.7 per cent despite global headwinds and monetary policy tightening. If it is able to achieve a growth of above 4 per cent in the second half, it will be a decent achievement.

Radhika Pandey is a consultant at National Institute of Public Finance and Policy.

Views are personal.

Also read: Quit stalling & pay up — what’s climate finance and why rich countries must step up urgently