Finance Minister Nirmala Sitharaman is set to present the first full budget of the Modi government 3.0 on 23 July. Between using the windfall dividend distribution to hasten the path of fiscal consolidation, boosting revenue spending to spur consumption and meeting the expectations of coalition partners, the Union Budget faces a tough balancing act.

Focus on stimulating private consumption and boost to labour-intensive sectors will ensure sustained high growth.

The macro-fiscal landscape

It is useful to analyse the macro-fiscal backdrop in which the budget is being presented. India is in a favourable macroeconomic position, with real GDP (gross domestic product) growth at 8.2 percent in FY 2023-2024.

For the current year as well, the economy is projected to grow at a decent 7.2 percent despite global headwinds. The International Monetary Fund, in its July update, has also revised its growth projection for India by 20 basis points to 7 percent.

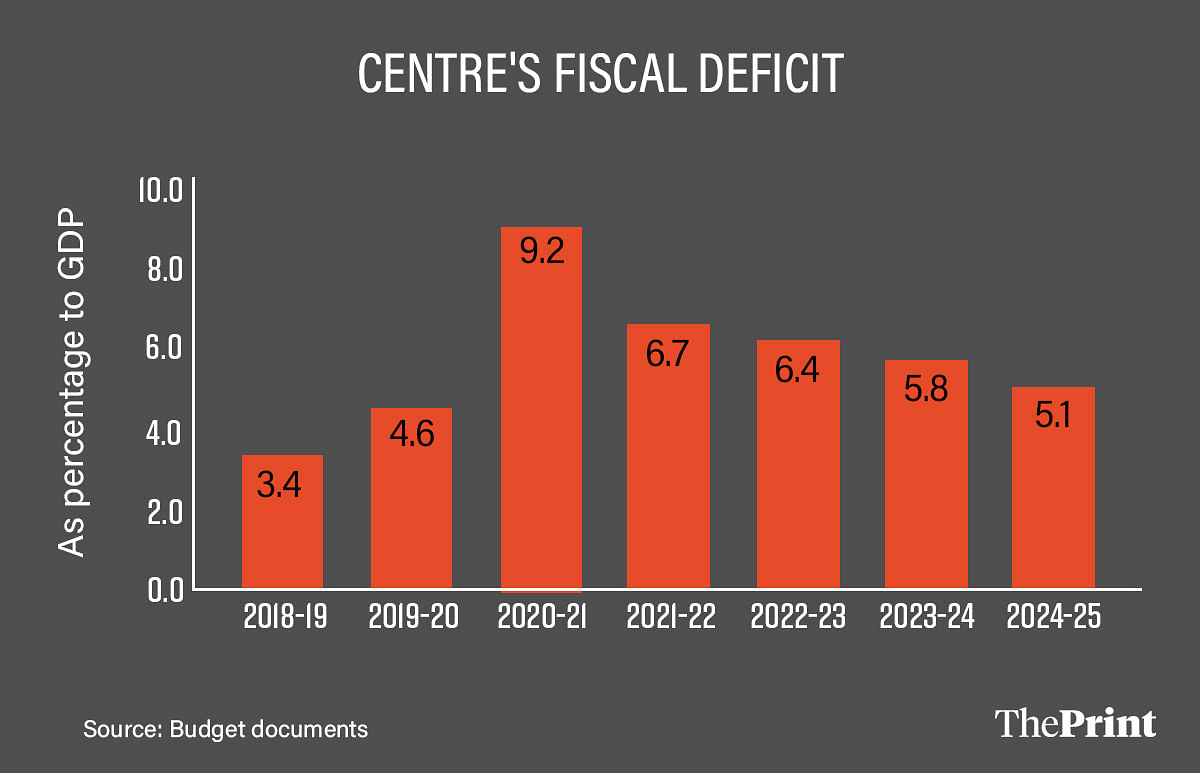

The twin deficits are in a comfortable position, with the current account balance posting a surplus in the March quarter of FY24. Fiscal deficit for FY24 came in at 5.6 percent, better than revised estimates.

Net direct tax collections grew 17.7 percent in FY24, surpassing the revised estimates. Indirect tax collections also exceeded the revised estimates. Alongside the healthy tax revenues, the boost from better than anticipated dividends from the Reserve Bank of India, suggest a favourable fiscal position.

While the aggregate growth numbers look robust, some sectors have shown relatively weaker growth. National accounts estimates show that private final consumption grew by 4 percent last fiscal.

The latest round of RBI’s Consumer Confidence Survey showed a moderation in the consumer confidence for the current period. The tepid consumption explains why private investment has not shown a sustained pick-up despite the deleveraged balance sheets of companies.

Policy options

With this macro-fiscal backdrop, the government has broadly two policy options.

First, to use the additional fiscal space to hasten the path to consolidation, and achieve the 4.6 percent fiscal deficit target closer to or by FY 2025-2026. The other option is to stick to the fiscal deficit target of 5.1 percent announced in the interim budget, and use the additional fiscal space to support the sectors that have witnessed subdued growth.

To be sure, the data for the first two months of the current financial year suggests that the government has the wiggle room to increase spending on some of the lagging sectors without losing focus on fiscal prudence.

Demand-boosting measures

As far as the tax policy is concerned, the focus so far has been on simplifying the tax regime with minimum exemptions and deductions. With retail inflation remaining elevated, providing relief to the common man through tax cuts would be a reasonable move. Raising the basic exemption limit or increasing the standard deduction should be considered given the increase in cost of living.

The budget will need to prioritise the rural and farm sector within the budgetary constraints. The interim budget had raised the allocation for the Mahatma Gandhi National Rural Employment Guarantee Programme to Rs 86,000 crore. The scheme may receive higher allocation than the interim budget.

With focus on affordable housing, the demand for work is likely to rise. As such, the MNREGA scheme is a key safety net in times of agrarian distress and should receive priority in the budget.

The Union Budget could also see increased allocations towards PM Kisan (cash transfers to farmers), rural housing under Pradhan Mantri Awas Yojana, and rural roads under Pradhan Mantri Gram Sadak Yojana. These schemes have the potential to generate employment opportunities, thereby supporting rural consumption.

In addition to cash transfers and enhanced allocation for some schemes, the budget should push for more structural reforms in agriculture, such as agri-logistics, R&D investments in climate-resilient crop technologies, and efforts towards providing real-time data to farmers, enabling them to make informed decisions to mitigate the risk of climate change.

Job creation

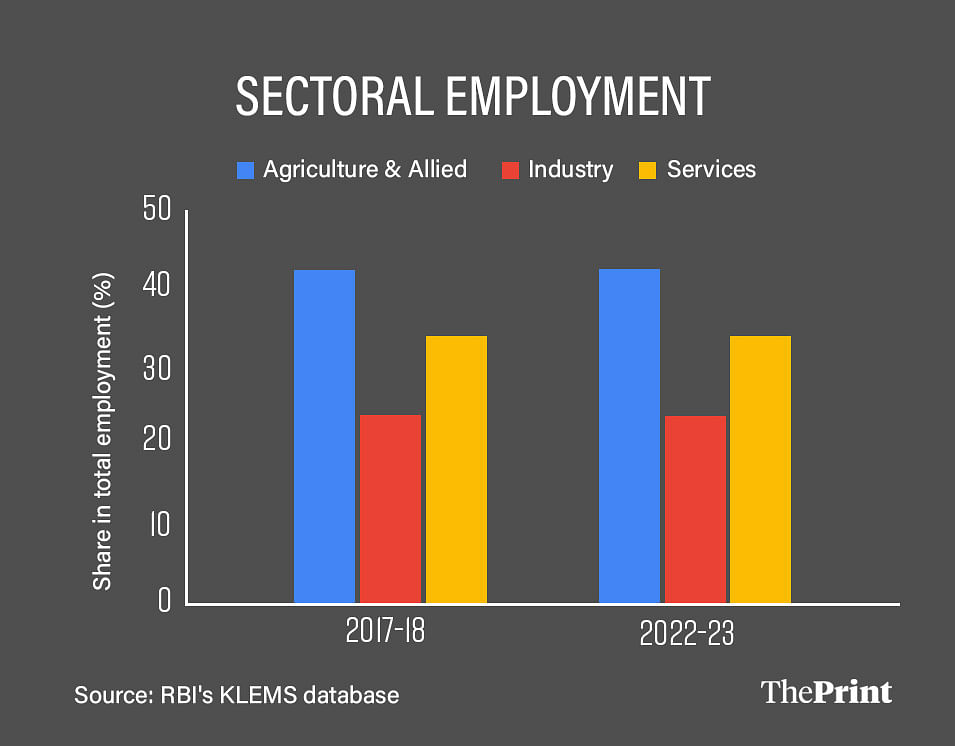

As India aims at becoming ‘Viksit Bharat’ by 2047, it will require creation of job opportunities in non-agricultural sectors. New estimates from RBI’s KLEMS database shows that employment rose by 4.67 crore in FY24. However, these are provisional numbers and do not provide sector-wise job creation figures.

In recent years, for which the disaggregated data is available, much of the job creation has occurred in agriculture, construction and trade. Data on labour productivity (value added per worker) shows that it is lowest in agriculture. Even in construction and trade, productivity is relatively lower than other sectors.

The budget needs to focus with renewed urgency on creation of jobs in labour-intensive sectors. This would require a multi-pronged approach.

For low-skilled employment, the budget could introduce an employment-linked incentive (ELI) scheme for firms in labour-intensive sectors, such as textiles and toy manufacturers. At the same time, appropriate safeguards must be put in place to prevent ELI from acting as a drain on the fisc.

For bridging the skill gap, the budget could initiate a National Skills Survey, which would take stock of employee and worker skills across a wide range of industries and occupations. This would aid policymakers and industry alike in identifying industry/skill-specific challenges. Further, incentivising collaboration between industry and academia would go a long way in closing the skill gap.

Outlining the fiscal glidepath

The more-than-expected dividend from the RBI gives the government the headroom to prune the fiscal deficit target below 5.1 percent and lower the market borrowings for the current year. This strategy would result in lowering of yields, something that would cheer the bond markets at a time when Indian bonds are part of the global bond indices.

This will, however, be challenging as the government’s coalition partners have demanded additional funds for their respective state governments in the form of grants and untied loans.

How the budget navigates these challenges will be crucial and will have implications for medium-term debt and deficit. Nevertheless, the government should use the Union Budget as an opportunity to articulate its debt and deficit glide path beyond FY26. Amendments to the Fiscal Responsibility and Budget Management Act (FRBM) should be made to reflect the roadmap.

Radhika Pandey is associate professor and Utsav Saksena is a research fellow at the National Institute of Public Finance and Policy (NIPFP).

Views are personal.

Also Read: Highly vulnerable to extreme climate, crucial sectors in India need well-crafted green strategies