The December edition of the Reserve Bank of India’s (RBI’s) Financial Stability Report and the Report on Trend and Progress of Banking in India have unanimously highlighted the resilience of the Indian financial system. Banks have recorded better asset quality and improved capital position. The high-interest rate regime has bolstered their profitability.

The two reports, however, flag incipient risks building in the financial sector, which underscore the need for continuous vigil in 2024. Unsecured loans by both banks and non-bank financial companies (NBFCs) have risen at a brisk pace. There has also been a sharp rise in bank lending to non-bank financial companies. Their growing inter-connectedness could pose systemic risk concerns.

Bank credit and asset quality

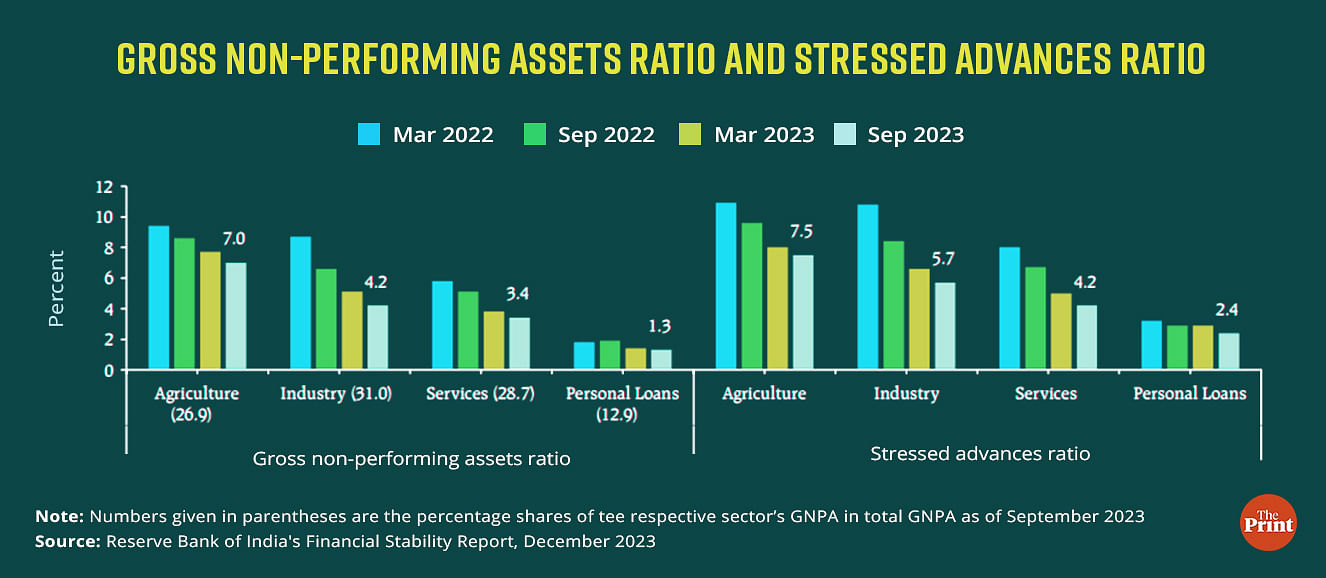

Bank credit continued to grow at a strong pace in the current year. Private-sector banks witnessed a higher growth than their public-sector counterparts. There has been a compositional shift towards personal loans and services. Between September 2021 and September 2023, retail loans in particular, have grown at a faster pace (at 25.5 percent) as compared to the overall bank credit (at 18.6 percent). Consequently, the share of retail lending in gross advances increased from 37.7 percent in September 2021 to 42.2 percent in September 2023.

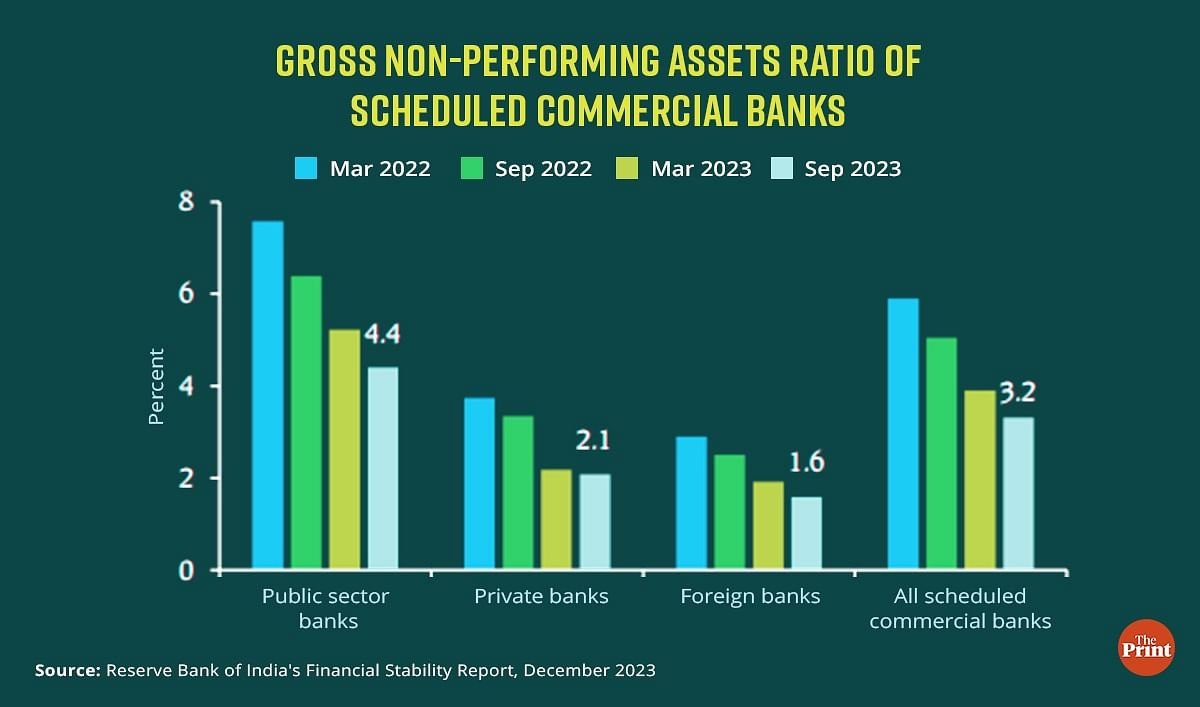

The improvement in banks’ asset quality that began in 2018-19 continued in 2022-23 and the first half of the current financial year. While the Gross non-performing assets (GNPA) ratio declined to an eleven-year low of 3.2 percent in September 2023, the net non-performing assets ratio declined to 0.8 percent.

However, the GNPA ratio of agriculture remained high at seven percent in September 2023. The elevated GNPA ratio in agriculture is seen to be associated with weak growth in the sector.

Despite the rapid growth, personal loans had the lowest GNPA ratio. While most of the categories of personal loans saw an improvement in asset quality, the credit card receivables saw a marginal pick up in non-performing assets.

The capital-to-risk-weighted assets ratio (CRAR) at 16.8 percent at the end of September 2023, as against a regulatory threshold of 11.5 percent shows that banks are strong enough to withstand macroeconomic shocks even in the absence of further capital infusion.

Rise in unsecured loans

Over the last two years, both banks and NBFCs have seen a rapid growth in unsecured lending. Between September 2021 and September 2023, unsecured retail lending by banks grew by 27 percent. Unsecured loans characterised by the absence or inadequate collateral present credit risk for banks.

In November last year, the RBI increased risk weights on unsecured retail loans to prevent the build-up of risk. Banks will have to allocate higher capital for unsecured loans to enhance their loss-absorbing capacity. This will likely stem the fast-pace rise in unsecured loans.

Growing NBFC-bank interconnectedness

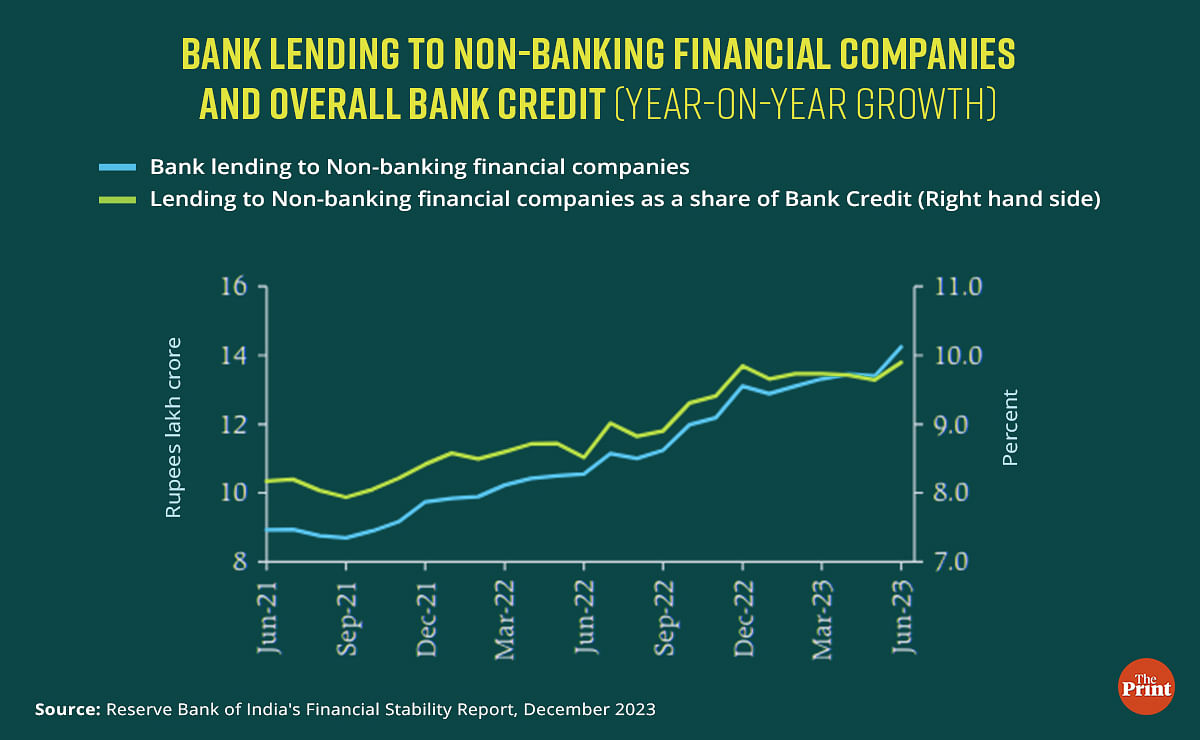

The Infrastructure Leasing & Financial Service (IL&FS) default made Mutual Funds more cautious in their exposure to NBFCs and prompted a shift towards bank financing by NBFCs.

As the financial landscape evolves, the interconnectedness between banks and NBFCs continues to be a focal point of concern, particularly in light of recent lending trends.

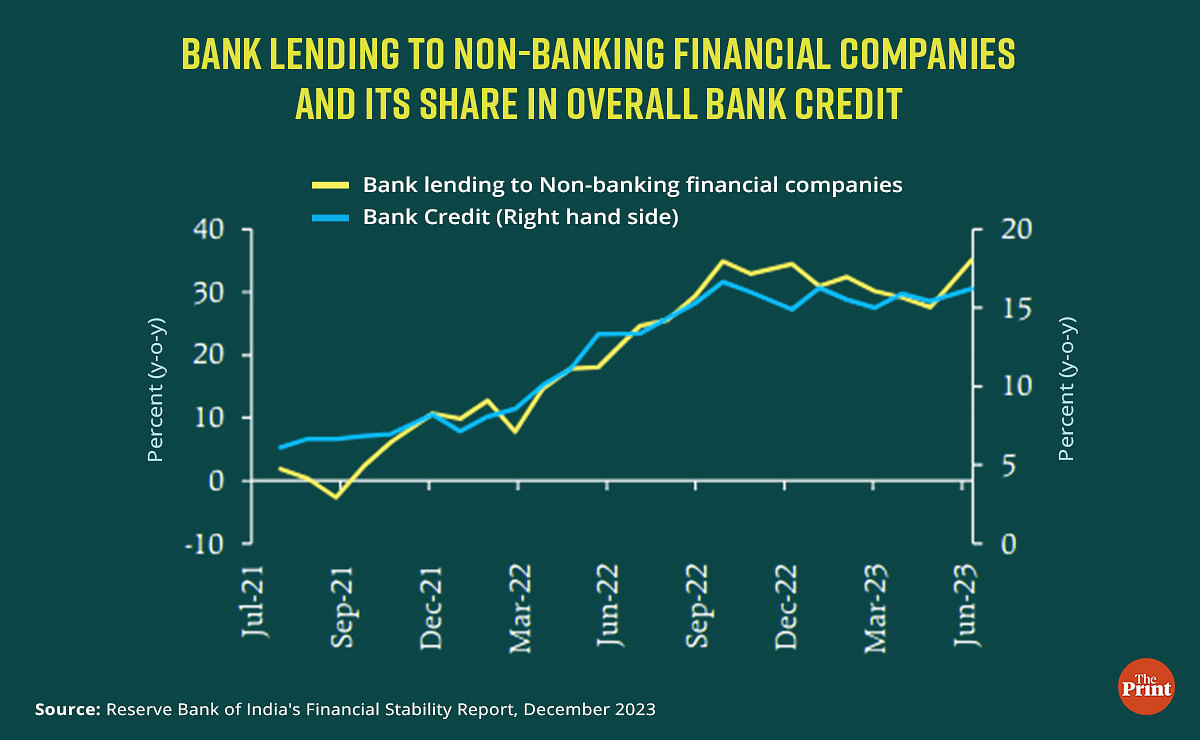

In the last two years, bank lending to NBFCs has outstripped the growth in the overall bank credit. According to the Financial Stability Report, between June 2021 to June 2023, bank lending to NBFCs grew at 26.3 percent well above the growth of 14.8 percent in the overall bank credit. Lending to NBFCs as a share of bank credit has also inched up to almost 10 percent from 8 percent in the same period.

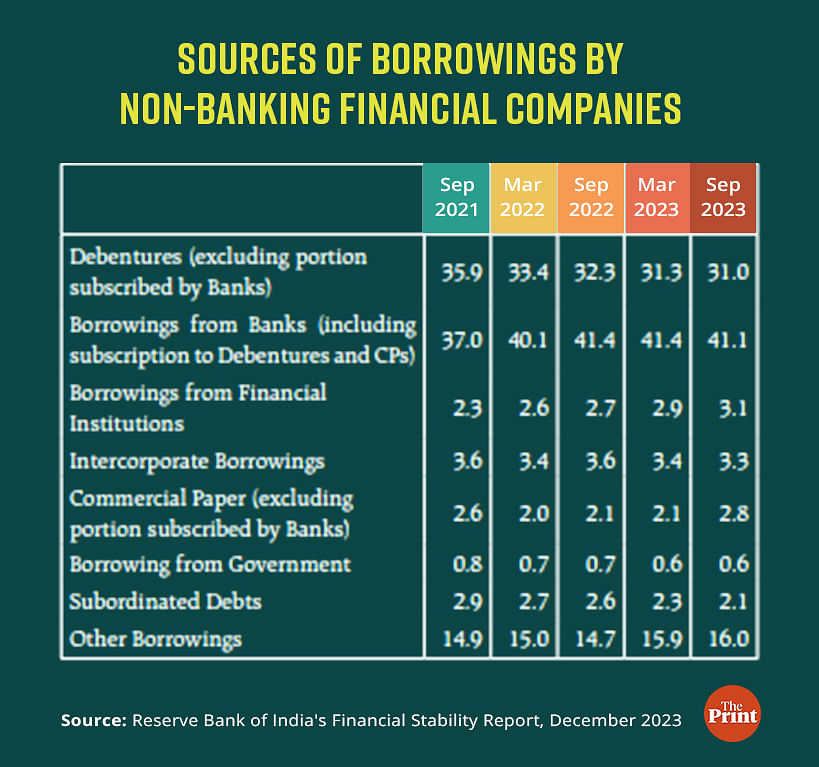

Looking from the NBFCs’ perspective, bank borrowings displaced debentures as the largest source of funds for NBFCs. As of September 2023, banks account for 41 percent of the total borrowings of NBFCs. This share was 37 percent two years back.

Borrowings from banks grew at a robust 23 percent in the last financial year. While banks’ exposure to NBFCs is through direct lending, they also subscribe to bonds and commercial papers issued by NBFCs. The rising inter-connectedness could amplify systemic risk concerns.

Further, the increased risk-taking by NBFCs in the form of higher unsecured lending could have a spill-over impact on banks. To address the concern emerging from the growing bank-NBFC interconnectedness, RBI has increased risk weights on bank lending to NBFCs. The RBI would like to see NBFCs diversifying their sources of funds away from banks.

The rising reliance of NBFCs to bank borrowing stands in contrast to global trends. Globally banks remain net borrowers from non-bank financial institutions (NBFIs). And, the inter-connectedness has been declining over the years. The opposite holds true for India where banks are net lenders to NBFIs and the inter-connectedness has increased.

Banks’ profitability could moderate this year

In the first half of the current year, banks experienced heightened profitability due to a substantial net interest margin and reduced requirements for additional provisioning.

Looking ahead, as deposit rates align with lending rates, there is a potential for a moderation in bank profitability. Additionally, factors such as tight liquidity, subdued agricultural credit, and enhanced risk weights on unsecured consumer lending and NBFCs may contribute to a slowdown in credit growth.

Radhika Pandey is associate professor at National Institute of Public Finance and Policy (NIPFP).

Views are personal.

Also read: Food inflation getting more persistent & widespread and, unfortunately, showing no signs of easing