Gurugram: While Haryana fares relatively well when it comes to revenue mobilisation, a new government study has found that the state’s debt sustainability and quality of expenditure dragged down its overall fiscal performance in 2022-23.

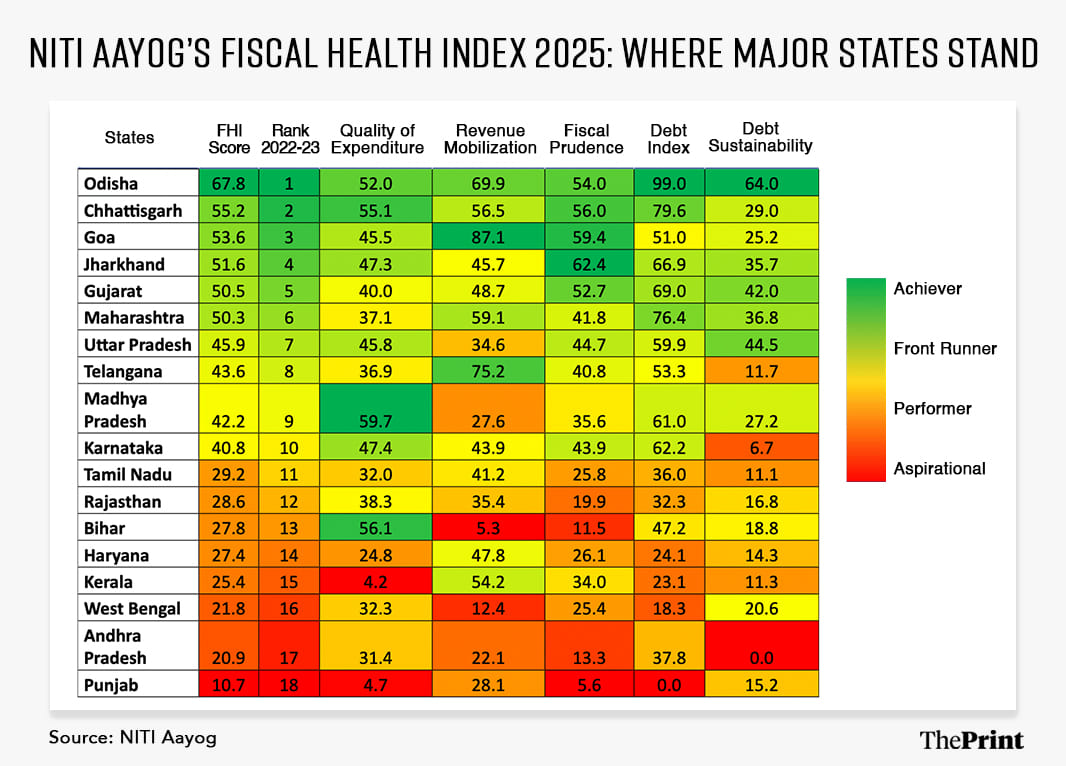

Haryana ranked 14 out of 18 major states in Niti Aayog’s Fiscal Health Index (FHI) 2025, which measures states’ finances for financial year 2022-23. The index was released Friday.

With Odisha at the top and Chhattisgarh and Gujarat among the top five, Haryana, with a composite score of 27.4, lags states like Bihar, Madhya Pradesh, Rajasthan and Uttar Pradesh, once tagged as the ‘BIMARU’ states of India.

Haryana’s immediate neighbour, Punjab, is at the bottom of the table with a composite score of 10.7.

The FHI analysis covers 18 major states that drive the Indian economy in terms of their contribution to India’s GDP, demography, total public expenditure, revenues and overall fiscal stability.

It evaluates these states based on five parameters: quality of expenditure, revenue mobilisation, fiscal prudence, debt index, and debt sustainability.

While Haryana has made strides in revenue mobilisation, its fiscal prudence and debt-related scores lag behind other states.

Haryana’s ranking puts it in the ‘performer’ category, alongside Tamil Nadu, Rajasthan and Bihar.

Speaking to ThePrint, Narendra Kumar Bishnoi, Professor, Department of Economics, Guru Jambheshwar University of Science and Technology, Hisar, said it was a matter of disappointment that out of 18 states under study, Haryana was placed at the 14th position.

The state’s score for revenue mobilisation is relatively better at 47.8, while other components i.e.; quality of expenditure (score 24.8), fiscal prudence (26.1), debt index (24.1) and debt sustainability (14.3) are unsatisfactory, states the report.

While the report does not include a nation-wide average, since it only looks at 18 states, comparing Haryana with the best and worst-performing states can give an indication of where it stands.

The top-ranked Odisha has a score of 69.9 in Revenue Mobilisation, 52 in quality of expenditure, 54 in fiscal prudence, 99 in debt index and 64 in debt sustainability.

Punjab, the worst-performing state, has a score of 28.1 in revenue mobilisation, 4.7 in quality of expenditure, 5.6 in fiscal prudence, 0.0 in debt index and 15.2 in debt sustainability.

Also Read: Haryana cow protection body’s budget rose to Rs 510 cr from Rs 2 cr in 10 years of BJP rule

Revenue mobilisation efforts

Ranked at number 8 and placed in the “front runner” category in revenue mobilisation in the FHI report, Haryana has shown improvement in this area of its finances, with the state’s own revenue contributing 80.3 percent of total revenue receipts in 2022-23, up from 76.7 percent in 2018-19.

Bishnoi said a closer look reveals that, currently, the state’s own tax revenue (SOTR) to GSDP ratio is 6.4 percent and own non-tax revenue to GSDP ratio is 0.9 percent and that is the cause of problems.

“In fact, during most of the 1990s and before 2008-09, the state’s own tax revenue to GSDP ratio was above 8 percent,” he explained. “Therefore, if the state government makes efforts to improve both the ratios to their historical elevated level, it can also take care of its revenue deficit and fiscal deficit indicators.”

However, while Haryana’s own tax and own non-tax revenue has shrunk as a size of its GSDP, both metrics have improved when compared to its overall revenue resources, indicating increasing fiscal independence rather than dependence on the Centre.

The report states that Haryana’s own tax revenue grew at a compound annual growth rate of 8 percent over the past five years, accounting for 86 percent of overall tax revenues in 2022-23.

The key contributors included sales tax, state goods and services tax, state excise and stamp duty.

Non-tax revenue, while smaller in share, recorded an 18.2 percent increase compared to the previous year, constituting 10 percent of total revenue receipts. The state’s revenue buoyancy ratios have also improved significantly over the past five years, signalling better fiscal capacity, according to the report.

Bishnoi said that with a reduced fiscal deficit, the state’s requirement for additional debt will also reduce and its debt sustainability ratio will improve.

He added that Niti Aayog’s index presumes development expenditure as a good thing and non-development expenditure as bad. However, development expenditure includes social security and welfare, which are basically transfer payments, while non-development expenditure includes expenses on general services that include police, administration, etc.

Therefore, Bishnoi said, this index could create perverse incentives for states to increase freebies in social services and limit useful expenditure on general administration.

“Similarly, categorisation between capital expenditure and revenue expenditure is also not very meaningful,” Bishnoi added. “For instance, if the state government gives a grant to a municipality, university, or public sector undertaking, it will be regarded as revenue expenditure.”

In general, a higher share of capital expenditure in total expenditure is considered higher quality expenditure, while a higher share of revenue expenditure is considered lower quality expenditure.

Haryana’s expenditure quality

Haryana’s quality of expenditure reveals notable imbalances, particularly in capital investments, placing the state at number 16 among the 18 states.

The report says that the state’s growth in capital expenditure has not kept pace with its economic expansion. In 2022-23, capital expenditure constituted only 1.4 percent of the state’s GSDP, significantly lower than budget estimates. The share of capital expenditure in total expenditure declined from 16.4 percent in 2018-19 to 9.7 percent in 2022-23, against the budget estimates of 34.4 percent.

A sharp contrast was observed in allocations, with a 31.3 percent reduction in spending on social services and a 46.7 percent increase in spending on economic services in 2022-23, compared to the previous year.

Additionally, around 55 percent of total revenue expenditure in 2022-23 was committed to fixed liabilities like salaries and pensions, leaving limited fiscal space for developmental priorities.

The combined expenditure on social and economic services also saw a decrease from 67.9 percent in 2018-19 to 62.6 percent in 2022-23, underscoring the need for balanced and strategic resource allocation.

While Haryana is in the process of shoring up its own revenues, the increase in its revenue expenditure—which includes subsidy spending—seems to be placing a strain on the state’s finances.

The Haryana government provides a number of benefits to people below the poverty line (BPL), and the list of BPL families recognised by Haryana is much higher than the number recognised by the Centre, as the state depends on its flagship Parivar Pehchan Patra data for this purpose.

In January 2023, then chief minister Manohar Lal Khattar had announced that 12 lakh more families had been added to the BPL list after Haryana revised the annual income criteria for BPL.

As of now, according to the Haryana food, civil supplies, and consumer affairs department, there are around 49 lakh families with over 2 crore people in the BPL category.

Additionally, 2.89 lakh families with over 10 lakh people are under the Antyodaya Anna Yojana (AAY), which targets the poorest of the poor.

Given Haryana’s population of 2.8 crore, as estimated by the state’s food, civil supplies, and consumer affairs department, nearly 75 percent of the population is living below the poverty line.

All these families are entitled to a plethora of schemes.

Overall finances under strain

Haryana ranks 12 out of 18 in the fiscal prudence metric and Niti Aayog’s index notes that the state’s persistent revenue and fiscal deficits were impacting its financial stability.

In the state-wise debt index, Haryana stands at number 15 among the 18 states, according to the FHI report. The state’s high debt-to-GSDP ratio indicates a heavy reliance on debt to finance expenditures. Furthermore, interest payments constituted 23 percent of revenue receipts in 2022-23, highlighting the financial strain of servicing this debt.

Despite efforts to contain borrowing, the inability to achieve targets set for outstanding liabilities from 2018 to 2023 underscores the need for a more robust debt management strategy, the report says.

It also states that Haryana’s debt sustainability remains a critical challenge, with structural issues in managing public debt. Although the debt-to-GSDP ratio stabilised at 31 percent in 2022-23, the rising interest payments—up 9.4 percent from the previous year—pose risks to fiscal health.

According to the report, the state’s fiscal sustainability is at risk in the short to medium term unless measures are taken to rationalise expenditures and enhance revenue collection.

Investing in revenue-generating assets and diversifying income sources could help mitigate the growing fiscal pressures, ensuring a more sustainable debt trajectory.

(Edited by Nida Fatima Siddiqui)

Also Read: Haryana ministers seek power to transfer govt employees, CM Saini puts his foot down