New Delhi: Free or highly subsidised power supply and the mess in India’s power sector is a topic that makes headlines frequently, with states such as Punjab, Haryana and Delhi high on the recall list for using electricity as a “freebie”.

But as it turns out, it isn’t the power sector in any of these states that accounts for the biggest financial mess in the country but the one in Tamil Nadu, a state known to be among India’s more industrialised, developed and progressive.

According to a Reserve Bank of India (RBI) bulletin published in June titled ‘State Finances: A Risk Analysis’, power distribution companies (DISCOMs) in 19 states owed around Rs 4.5 lakh crore by the end of 2019-20, and almost a third of this (Rs 1.24 lakh crore) was owed by Tamil Nadu’s TANGEDCO (Tamil Nadu Generation and Distribution Corporation Limited) alone.

Separately, a government dashboard that shows how much DISCOMs owe power generation companies (Gencos) lists Tamil Nadu as the state with the highest dues.

Power comes under the concurrent list, hence it is both a state and central subject. DISCOMs in almost all states are run their respective governments. Only in some urban areas including Delhi, Mumbai and Kolkata among others has the private sector entered the power distribution business.

Also Read: Why Uttarakhand wants to revive 20 hydro-electric projects and dump 24 others

UDAY scheme & DISCOM debt

The promise of free power — an already electric political issue — has gained even more traction after Prime Minister Narendra Modi, in a speech last month, urged states to clear power sector dues and steer away from “subsidy culture”.

In 2015, the Modi government launched the UDAY (Ujwal DISCOM Assurance Yojana) scheme, essentially aimed at managing the debt of power distribution companies and prompting operational reforms.

However, the dues of DISCOMs across the country have risen since its inception. In 2014-15, power DISCOMS owed about Rs 4 lakh crore, which rose to Rs 5.14 lakh crore by 2019-20, and is estimated to have reached Rs 6 lakh crore by 2021-22.

India has, over the past decade, improved its access to electricity, resulting in increased demand.

But low realisation of dues from consumers leads to a cycle of DISCOMs — which also take up loans to set up power distribution plants — becoming indebted to Gencos.

According to estimates by credit ratings agency ICRA Limited, the consolidated debt of Indian power DISCOMs was a whopping Rs 6 lakh crore by the end of the financial year (FY) 2021-22.

This is where the UDAY scheme comes into the picture — it allows state governments that own DISCOMs to issue bonds against the money they owe to Gencos, and these bonds can be redeemed after 10-15 years according to the arrangement. The idea behind the scheme is to buy DISCOMs enough time to streamline operations to the extent that they are able to honour the bonds as and when they mature.

Under this scheme, state governments can sell bonds carrying the value of up to 75 per cent of the debt owed by a particular DISCOM (or DISCOM run by them), while the DISCOMs will keep the balance 25 per cent of their debt in the form of some financial instrument.

However, research by the RBI shows that the issue is more complicated than it seems at first glance.

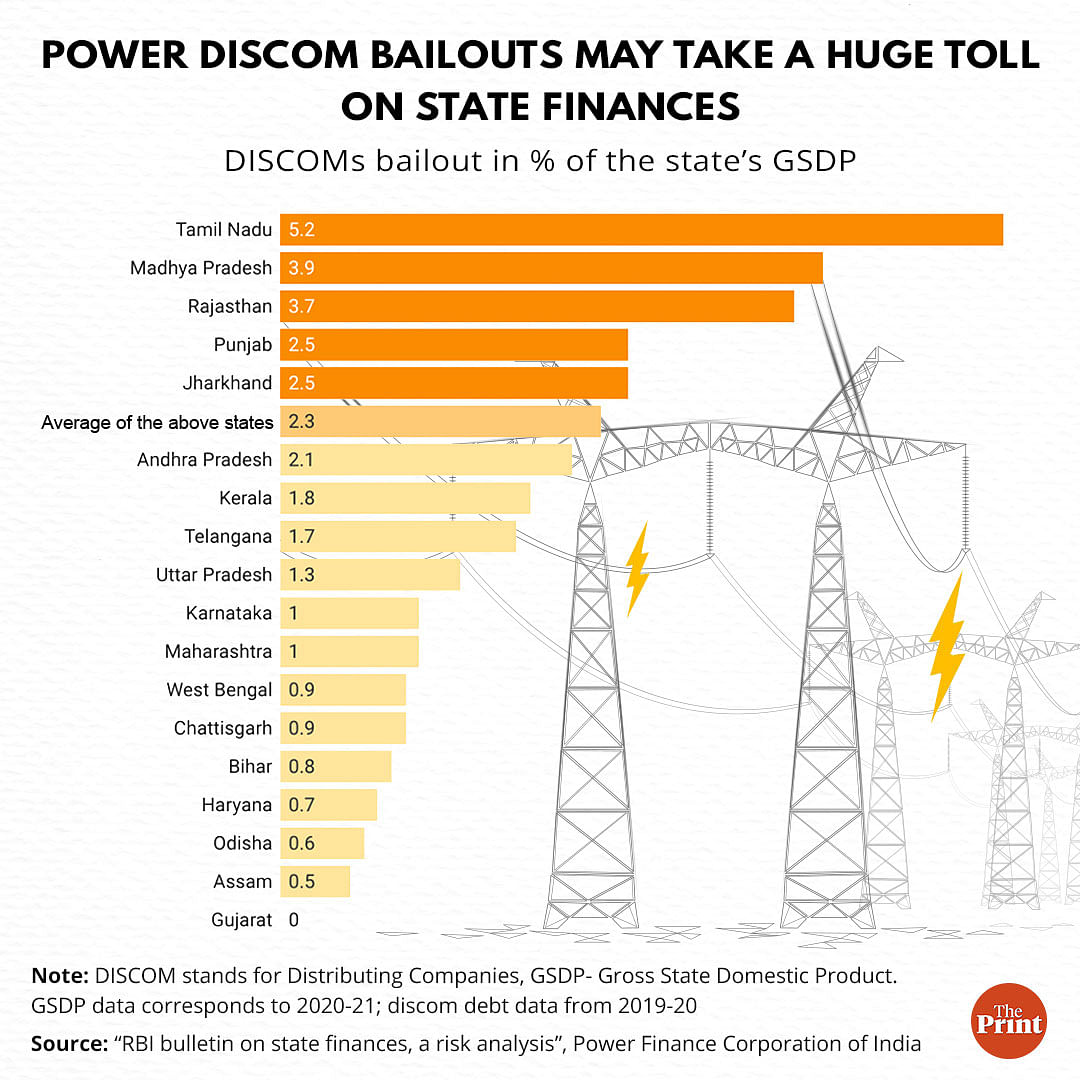

Data shows that to be able to clear 75 per cent of the debt of its DISCOMs, the Tamil Nadu government will have to shell out 5.2 per cent of the state’s GSDP (Gross State Domestic Product). This means that for every Rs 100 that people in the state earned in 2020-21, at least Rs 5 would have had to be spent on clearing the debts owed by its DISCOMs in 2019-20.

In this context, the national average for select states is 2.3 per cent.

The RBI report says that after Tamil Nadu, which will have to shell out 5.2 per cent of its GSDP to clear 75 per cent of its DISCOM dues, the number is high for Madhya Pradesh (4 per cent or Rs 42,000 crore), Rajasthan (3.7 per cent or Rs 48,000 crore), Punjab (2.5 per cent or Rs 13,600 crore) and Jharkhand (2.5 per cent or Rs 11,500 crore).

Gujarat fares the best, with not even one per cent of its GSDP spent on clearing DISCOM debt, simply because it doesn’t owe much (Rs 563 crore) in the first place.

How much do states owe

Apart from state governments, the mismanagement of DISCOMs also spells trouble for Gencos, which are unable to realise the debt owed to them by state-owned distributors.

‘PRAAPTI’ — the central power ministry’s dashboard of how much DISCOMs owe Gencos — shows that among Indian states, Tamil Nadu owes the most to Gencos in the form of DISCOM debt.

The portal, which keeps track of the number of months each state has fallen behind in making payment of dues to Gencos, also shows that DISCOMs of Telangana, Meghalaya and Jammu & Kashmir haven’t paid their dues for more than a year.

DISCOMs of Jharkhand, Tamil Nadu and Karnataka, are running 6-12 months behind, while Madhya Pradesh and Maharashtra are running 3-6 months behind on their payments.

Similarly, DISCOMs of Rajasthan, Uttar Pradesh, Sikkim, West Bengal, Karnataka, Kerala, Tripura, Manipur, and Mizoram are running 1-3 months behind and the remaining states are running 0-1 month behind on their payments.

In absolute terms, Tamil Nadu owes its Gencos the most in DISCOM debt — over 25,000 crore, followed by Maharashtra with at least Rs 20,000 crore and Uttar Pradesh with at least Rs 11,000 crore, according to the PRAAPTI portal.

Also Read: The LIC way or the Air India way — that is the multi-crore disinvestment question

Why Tamil Nadu’s power sector is in a mess

Much of the mess that TANGEDCO finds itself in was accrued over the past decade, arising from all sides of the business, ranging from production to distribution and consumption.

According to a study by Climate Risk Horizons, a Bengaluru-based think tank that works on providing financial analyses with respect to climate change, Tamil Nadu is a power surplus state which can generate much more power than required, but still keeps its old, coal-based power plants functional, which adds to operational costs despite these plants being underutilised.

This, the research suggests, adds to inefficiency, which in financial terms translates to an increase in the cost of producing electricity in the state. If Tamil Nadu uses an optimal number of plants, it stands to save up to Rs 26,000 crore, the study argues.

Tamil Nadu also offers subsidies to almost all power consumers.

According to clean energy advocacy agency Auroville Consulting’s estimates, even households that consume about 1,000 units pay only 63 per cent of the cost of supply. Consequently, power subsidy in Tamil Nadu has metastasized to an extent that it now costs more than the food subsidy offered by the state government.

Despite all of this, the state government hiked its power tariffs for general consumers for the first time in eight years this July.

The Tamil Nadu government’s white paper on its finances shows that nearly 15 years ago, in 2006-07, power subsidies cost the state exchequer Rs 1,424 crore — only 0.43 per cent of GSDP.

Cut to 2021, and power subsidy alone costs the state exchequer more than Rs 21,300 crore or 1.1 per cent of GSDP, which is more than twice the amount allocated for food subsidy (Rs 9,604 crore).

It is owing to these subsidies that power distributors in Tamil Nadu incur huge losses since they charge customers a subsidised price but have to pay the producers the full cost of supply and often, the government falls short of clearing their bills on time.

Hence, DISCOMs like TANGEDCO are left with few options other than taking loans from banks to pay their dues. What adds to their debt is the issue of DISCOMs having to invest in distribution infrastructure and ensuring proper collection of dues.

Since there is no competition in Tamil Nadu’s power distribution sector, DISCOMs often lack the incentive to proactively streamline operations, believes Vibhuti Garg, an energy expert and economist at the Detroit-based Institute for Energy Economics and Financial Analysis (IEEFA).

“Power sector bailouts have happened multiples times now; it is becoming a norm. The discoms have become complacent in their operations and then would expect the state and central government to rescue them.

“Apart from the fact that most Gencos and DISCOMs are run by governments which do not work with a profit maximisation objective, they take loans from government banks and then ask for discounts and write-offs when they are unable to pay them back,” Garg told ThePrint.

She added that increasing competition in the power distribution sector is one of the ways in which TANGEDCO can resolve the crisis they now find themselves in.

“What we need is fair competition when it comes to distribution. The agency that maximises the realisations and minimises the costs, should get a chance to carry out the power sector functions, which otherwise, are run by a monopoly.

“Rationalising subsidies, modernisation and digitalisation of the grid, tariff reforms, reducing the distribution costs and improving revenue collection techniques can help debt-stressed DISCOMs come out of their bad phase to some extent,” she said.

Need for political will

The bottom line is — can DISCOMs settle their dues without making a significant dent in the state’s coffers and where does the UDAY scheme figure into all of this?

While the scheme allows DISCOMs and state governments to issue UDAY bonds to Gencos, it essentially means that DISCOMs are taking on fresh debt to pay an older debt and will have to ultimately pay back the value of the bonds plus interest.

Issuance of UDAY bonds was based on an agreement between state governments, DISCOMs and the Union power ministry.

At the time, it was assumed that states would achieve operational and financial efficiency within a stipulated time, which has not happened in most states, said Lekha Chakraborty, a professor at the state-run National Institute of Public Finance and Policy (NIPFP). “According to the tripartite Memorandum of Understanding (MoU) between state governments, DISCOMs and the ministry of power, the power sector debt restructuring was based on time-bound financial and operational efficiency plans.”

“However, many states including Tamil Nadu, Rajasthan and Madhya Pradesh have not achieved these financial efficiency norms; operational efficiency parameters either,” she told ThePrint.

As a result, DISCOMs are now under pressure to increase their revenues, which can happen either by charging consumers more for the cost incurred on the power supply or by reducing the costs of supplying power — both of which haven’t been done yet.

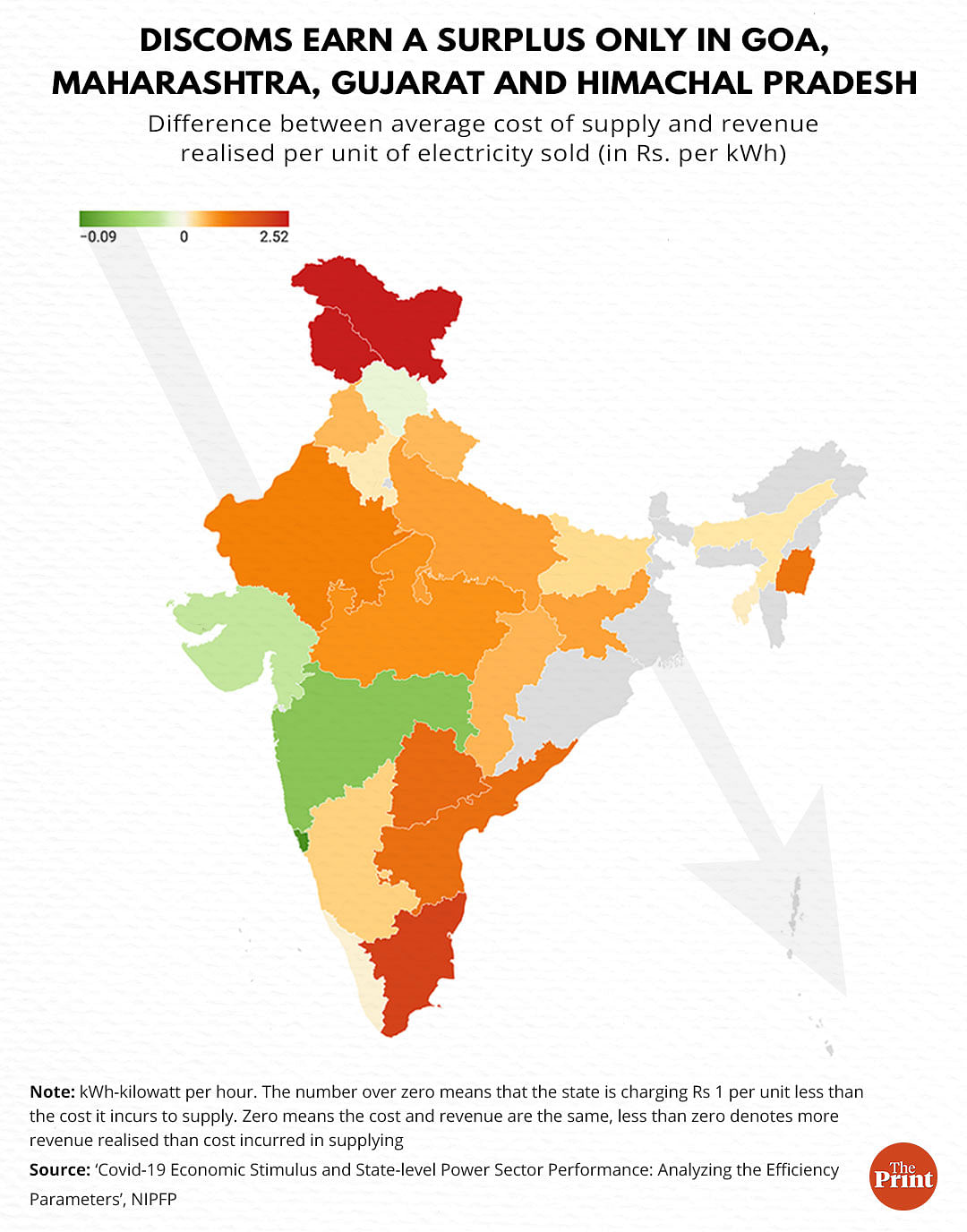

A study by scholars from NIPFP shows that for most Indian states, the gap between what the states earn from consumers and what they have to pay Gencos, has only increased in the four years between 2017 and 2021.

According to the paper authored by Amandeep Kaur, Lekha Chakraborty and Divy Rangan, in about 19 states, the Average Revenue Realised (ARR) per kilowatt hour of power sold was lower than what the Average Cost of Supply (ACS) — expenditure incurred to supply every 1 kWh unit of electricity.

The study also showed that this gap was the widest in Jammu & Kashmir, where, on average, the state realises an average revenue which is Rs 2.52 less than the cost incurred to supply a single unit (kWh) of electricity.

J&K is followed by Tamil Nadu with a deficit of Rs 2 per unit sold, Telangana with Rs 1.24 and Andhra Pradesh with Rs 1.13.

There are, however, exceptions in the form of states where DISCOMs are running in surplus — earning more in revenue per unit than what it takes to supply electricity to consumers. These states are Gujarat, Goa, Maharashtra and Himachal Pradesh.

Chakraborty adds that states were supposed to reduce costs and bridge revenue gaps, both of which are yet to happen.

“The NIPFP study led by our former director Pinaki Chakraborty looked into the financial and operational efficiency parameters to be achieved as part of the bailout package.

“However, there are no systematic tariff revisions undertaken by the state governments to optimise the ACS and ARR. The gap between Average Cost of Supply to Average Revenue Realised is still very high in many states,” she said.

The Tamil Nadu government had responded to the audit report released by the Comptroller and Auditor General of India (CAG) in May this year saying that an increase in tariff would unsettle customers, adding that it had plans to reduce supply costs instead.

But the CAG found that despite these measures, the gap between the average revenue realised versus the cost of supply in Tamil Nadu had risen by 78 per cent since the implementation of the UDAY scheme.

Chakraborty recommends “segregation of the grid and a differential rate treatment of customers into various slabs” as one of the potential ways to rationalise these subsidies.

Sabyasachi Majumdar, the ICRA group head, while releasing the ratings for Indian DISCOMs in May last year, had said that strong political will is needed to implement reforms intended for the power sector.

“The implementation of reforms in the distribution segment is essential which could either be through privatisation or through delicensing as proposed by the Government of India.

“However, strong political will and support from the state governments are required for the implementation of such proposals given that power is a concurrent subject,” Majumdar had said.

(Edited by Amrtansh Arora)

Also Read: If there’s one Gujarat model we must replicate, it’s the power sector reforms one