Indore: Banking on Indore’s credibility as the cleanest city of India, its civic body is planning to issue municipal bonds to help fund its solar power project, ThePrint has learnt.

The Indore Municipal Corporation (IMC) plans to raise approximately Rs 250 crore through the sale of these ‘green bonds’ in January next year. These funds will be used for the installation and operation of a solar power plant at Jalud village in Khargone district once the Securities and Exchange Board of India (SEBI) approves it, officials said.

The project — a solar power plant of 60 megawatts for pumping and supplying water — will be the largest to be implemented by IMC, Municipal Commissioner Pratibha Pal told ThePrint.

“All the paperwork and documentation are finished, everything is ready. We have got a rating of AA plus and will be in a position to issue them in January’s first week,” Pal told ThePrint. “The Pravasi Bharatiya Divas and the Global Investors summit will also be held around that time. It will create a buzz since a lot of investors will be coming in.”

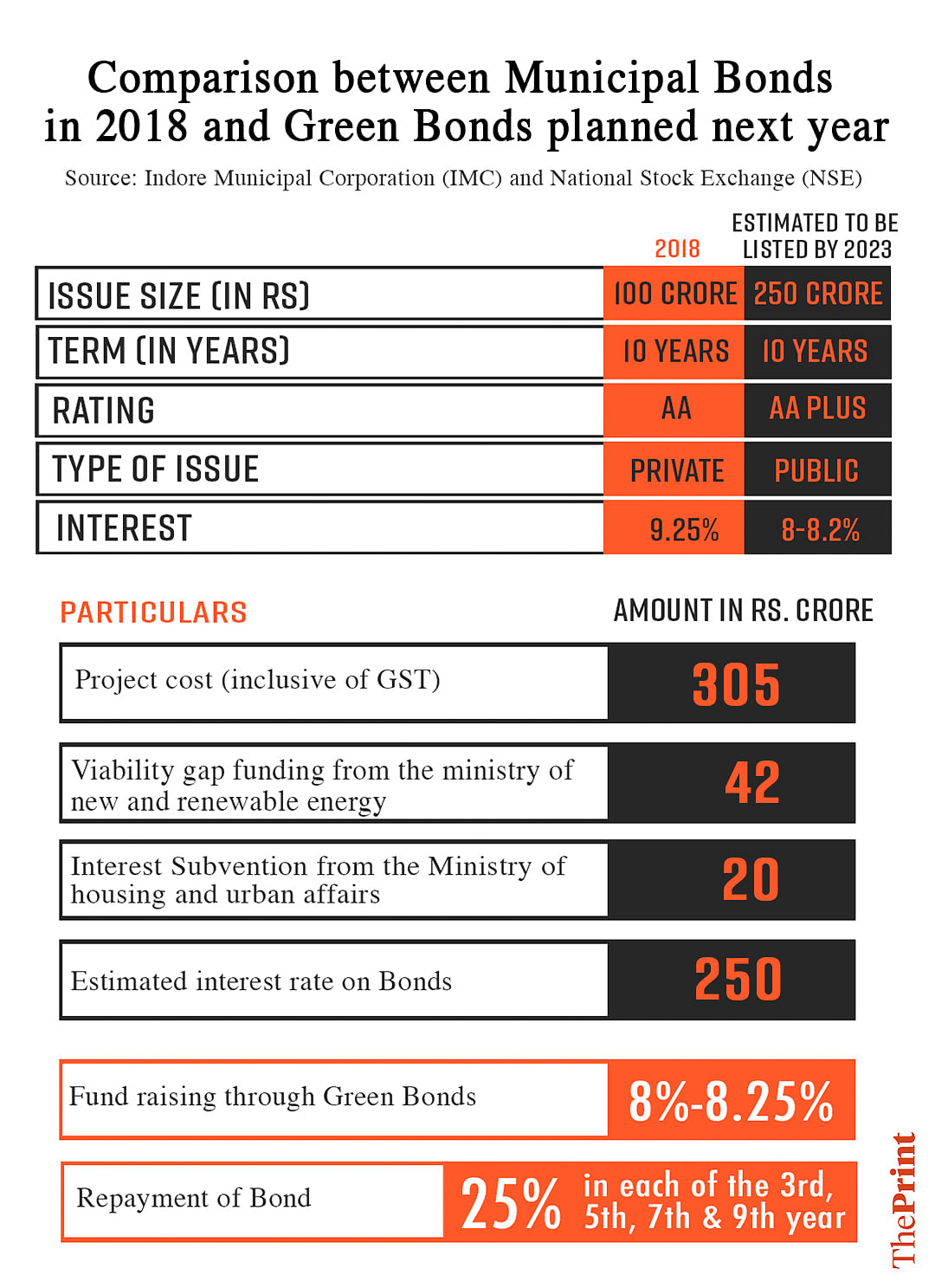

This is one of the many firsts with Indore. In 2018, it became the first city in India to list municipal bonds, or muni bonds, on the National Stock Exchange’s (NSE) debt securities platform to raise Rs 100 crore on a private placement basis.

Private placement basis is the sale of stocks and bonds to pre-selected investors and institutions rather than the open market. Municipal bonds are debt securities issued by a local government institution to investors to raise money that can be used to fund either their day-to-day obligations or for a specific project.

This is the first time that IMC’s municipal bonds will be open to the public. In 2018, its bonds were issued to private players such as corporates, insurance companies, and foreign institutional investors in exchange for interest payments for a period of 10 years.

It will also be IMC’s first green bonds, which are issued for environment-friendly projects.

Also Read: These are the secrets to Indore’s 5-year ‘cleanest city’ streak. And it’s not rocket science

The plan

Indore’s reputation as India’s cleanest city has been firmly cemented over the last few years. In October, the city was adjudged India’s cleanest city for the sixth time in a row.

Divyank Singh, Chief Executive Officer (CEO) of Indore Smart City who’s overseeing the green bonds project, told ThePrint that the solar power plant is estimated to cost Rs 305 crore. While Rs 250 crore will be raised in bonds, the rest will be covered through government subsidies.

“There are two types of government subsidies that can be availed. First is the viability gap funding from the Ministry of Renewable Energy to the tune of Rs 42 crore and Rs 20 crore in interest subvention.”

While viability gap funding is a scheme designed to provide capital support to PPP projects which will not otherwise be financially viable, interest subvention is a waiver of some percentage of interest.

For its green bonds scheme, the IMC plans to offer an interest rate of 8 to 8.25 per cent interest on its bond — less than the 9.25 per cent on offer in 2018, the IMC’s project proposal says.

The civic body also hopes its bonds are oversubscribed by 10-15 times as against the 1.26 times witnessed the last time. Oversubscription is a term used when demand for new stock is greater than the number of shares actually available.

“Our credibility has been established since the success of Swachhata campaign and through other projects that we have undertaken in the last five years, such as waste processing facilities,” IMC commissioner Pal, quoted above, told ThePrint. “Under the Atal Mission for Rejuvenation and Urban Transformation, we issued private security bonds first. An expert team advised us that a shift towards green bonds will be good. Additionally, our recurring expenditure on electricity for water supply was quite high, it needed to be reduced.”

Indore has an annual budget of Rs 7,500 crore and spends Rs 25 crore on electricity to pump water into the city. The project will help to bring down its energy costs by Rs 4.3 crore a month, Singh said.

“The main aim is not to generate money but to incorporate a kind of new financial instrument into city budgeting,” Singh said. “In (the) near future, the market is going to play a big role in city budgeting. Revenue sources are limited. Cities are becoming smarter, and smarter in every sense. There will be a need for a lot more budgeting.”

Indore’s previous experience with municipal bonds and “the faith of Indorians” — about 70 per cent of whom pay advance taxes — in the local body have been huge factors in deciding to issue municipal bonds again, say authorities.

“This step was demand-based as it was the people who asked us to bring in public issue. It’s because they trust us with their investment and have confidence in our ability to pay back,” Pal told ThePrint.

Another factor that played a huge role was the municipal body’s credit rating. Credit rating agency India Ratings and Research has given IMC AA-plus tag, an improvement from AA.

“It is the second-best rating now. (This) is mainly because of the good financial strength of the Indore Municipal Corporation,” Singh said.

Earning revenue through carbon credits

CEO Singh told ThePrint that not only will the solar power project help Indore bring down its electricity costs for supplying water, but it will also the civic body earn revenue by selling carbon credits in the international trading market.

For context, carbon trading is the buying and selling of carbon credits — a permit that allows its owner to emit a certain amount of carbon dioxide or other greenhouse gases. The aim of such a mechanism is to gradually reduce carbon emissions to help mitigate climate change.

The money saved through energy bills as well as the revenue earned through selling carbon credits “will be incorporated into designing the return of dividends and payment to the bond-holders”, Singh said.

“For the first 10 years, we will be saving Rs 17 lakh per month after returning bond holders’ money. So it will be profitable for the city, people, and the environment.”

Apart from being the first Indian city to debut municipal bonds, Indore is also the first city to have begun earning through carbon trading. The city has been making considerable efforts to cut down carbon emissions and to work on carbon credit monetisation.

Under this form of revenue generation, projects that are expected to reduce carbon emissions are identified and listed. After third-party agencies — in Indore’s case, it was the Washington-based non-profit Verified Carbon Standard — verify these claims, credits are sold in the markets, giving project owners monetary incentives.

In 2020, the civic body made Rs 50 lakh by selling credits against 1.70 tonnes of carbon dioxide. This was done by setting up a biomethanation plant in the private-public partnership mode.

‘Fewer budgetary constraints’

Financial experts say that raising funds through municipal bonds is a “good idea” because this means there are fewer budgetary constraints.

Ranen Banerjee, a partner of economic advisory services and a government sector leader PricewaterhouseCoopers (PwC), said IMC’s move raising money through bonds meant “better delivery” of the project “because it doesn’t require finance from the budget”.

“You are leveraging your balance sheet to borrow from the market and finance the project, which has its own revenue stream and can pay for it. So, there will be no budgetary constraints,” Banerjee said.

It was prudent of Indore to have opted for a long-term bond of 10 years, he said, adding that with a strong balance sheet, Rs 250 crore was not a large sum.

“If you have to give about 8 per cent (in interests), that is essentially Rs 20 crore. So even if the project doesn’t generate revenue, this amount can be covered up,” he said. “In the balance sheet (of over Rs 7,000 crore), it is very small because even the corporation doesn’t want to default as it will jeopardise similar future ventures”.

(Edited by Uttara Ramaswamy)

Also Read: From dumping grounds to golf courses — how Indore became India’s cleanest city