New Delhi: The number of illegal high-value cash transactions of more than Rs 2 lakh is steadily on the rise, despite the Narendra Modi government’s move to introduce stringent provisions in the Income Tax Act.

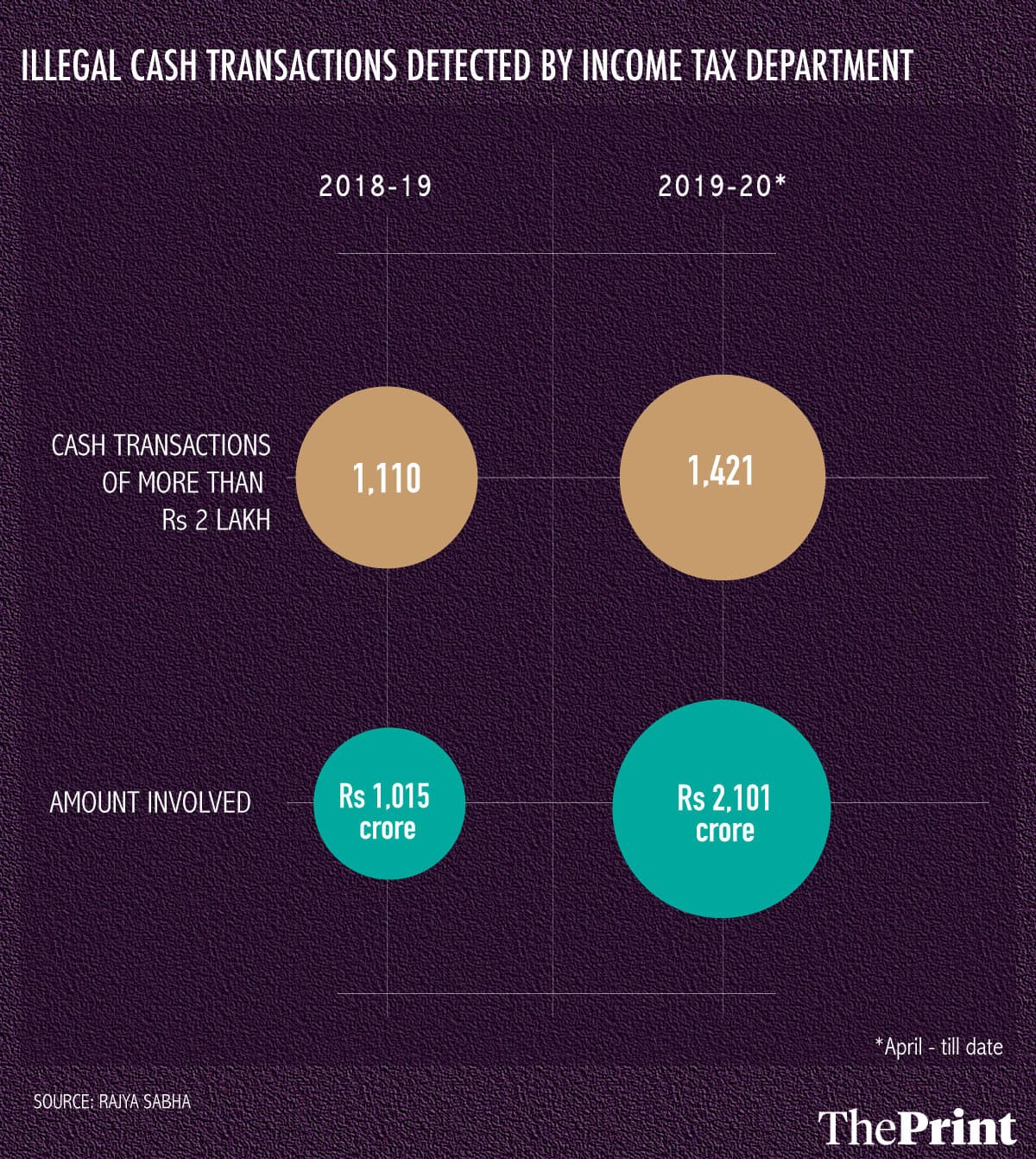

The Income tax department informed Parliament that it had unearthed 1,421 cases involving an amount of Rs 2,101 crore in the current financial year itself, up from 1,110 cases involving Rs 1,015 crore for the whole of 2018-19.

The tax department unearthed this through inspection and verification of the information obtained through Statements of Financial Transactions furnished by different institutions like banks.

In its reply on 10 December in the Rajya Sabha, the tax department also revealed that it found 35,620 cases involving an amount of Rs 6,692 crore so far this year where loans and deposits of more than Rs 20,000 were made through the cash route, in violation of Section 269SS of the Income Tax Act.

In 2018-19, around 40,039 cases, involving an amount of Rs 8,102 crore, were found in violation of the provision.

Also read: Modi govt looks to catch NRI tax evaders with retrospective change in Black Money Act

Stringent provisions introduced in 2017

Bringing back black money stashed overseas was one of the poll promises of the BJP in 2014. Once it came to power, the government enacted the Black Money (Undisclosed Foreign Income and Assets) and Imposition of Tax Act, aimed at unaccounted wealth stashed overseas. It also tightened the Benami property act to crack down on domestic black money transactions.

On the recommendation of a special investigation team on black money, the government had introduced the stringent Section 269ST in the Income Tax Act through the Finance Act, 2017, capping cash transactions at Rs 2 lakh per day, or for a single transaction, or for transactions related to one event from a person.

“In India, the quantum of domestic black money is huge, which adversely affects the revenue of the government creating a resource crunch for its various welfare programmes. Black money is generally transacted in cash and large amount of unaccounted wealth is stored and used in the form of cash,” the budget memorandum justifying the cap on cash transactions had stated.

The Income Tax Act provides that violation of this provision can lead to a penalty that will be equivalent to the amount received in cash.

‘Most transactions still undetected’

B.M. Singh, former chairperson of the Central Board of Direct Taxes pointed out that this data applies to only those transactions that can be traced through banking channels.

“Most of the cash transactions involving black money still remain undetected. But the increasing detections do indicate that the tax department is managing to mine data given by banks better to detect such transactions,” Singh said.

He added that after the implementation of the goods and services tax, the number of cash payments for services rendered is rising, to avoid a paper trail and payment of the indirect tax levy.

Also read: Why all funds deposited by Indians in Swiss banks are not black money

It is possible that political parties are also transacting large amounts in cash.