New Delhi: Some of India’s largest corporate houses have directly, indirectly, or through their subsidiaries, bought large amounts of electoral bonds, an analysis of the data made public by the Election Commission of India shows.

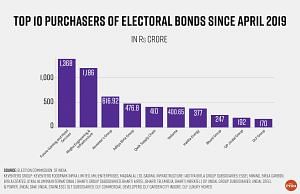

In fact, the top 10 corporate houses that have purchased electoral bonds account for 45 percent or Rs 5,400 crore of the bonds purchased since April 2019.

The analysis of the data of purchasers of electoral bonds shows that some of India’s largest corporate houses have, in fact, donated large amounts to political parties through electoral bonds, but have routed these bond purchases through as many as four different subsidiaries in some cases.

In other cases, the donations have been made by the flagship company. In yet other cases, companies have only indirect connections to large corporate houses, such as shared directors.

For instance, lottery firm Future Gaming and Hotel Services — on the face of the raw data — looks to be far and away the single-largest purchaser of electoral bonds (Rs 1,368 crore or 11.2 percent of the total).

The next largest purchaser of bonds is Megha Engineering and Infrastructure Limited (MEIL) — a Hyderabad-headquartered infrastructure company, which purchased Rs 966 crore worth of electoral bonds. This is more than Rs 400 crore lower than the amount purchased by Future Gaming.

However, once the donations made by the MEIL’s subsidiary — Western UP Power Transmission Company — of Rs 220 crore are added, this pushes MEIL’s total donations much closer to the top spot, to a total of Rs 1,186 crore.

Similarly, taken separately, the four companies of the Keventers Group feature relatively low on the list of purchasers of electoral bonds. However, added together, the three companies — Keventers Foodpark Infra Limited, MKJ Enterprises, Madanlal Ltd, and Sasmal Infrastructure — catapult the Keventers Group to the third spot, with total purchases of Rs 616.92 crore.

Yet another example of a group company distributing its bond purchases through various subsidiaries is the Aditya Birla Group. Essel Mining & Industries (Rs 224.5 crore), Utkal Alumina International (Rs 145.3 crore), Birla Carbon (Rs 107 crore), and Birla Estates (Rs 2 crore), together take the bond purchases of the Aditya Birla Group to a sizeable Rs 476.8 crore.

Essel Mining is a large iron ore mining company, while Utkal Alumina is an alumina refinery company and a 100 percent subsidiary of Hindalco Industries Limited, the metals flagship company of the Aditya Birla Group.

Birla Carbon Black is a large exporter of carbon black, which is the remainder from the incomplete combustion of coal tar, vegetable matter, or petroleum products. Carbon Black is a colouring agent and a filler for vehicle tyres.

Qwik Supply Chain, a supply chain management company, has purchased electoral bonds worth Rs 410 crore, making it the fifth-largest purchaser of electoral bonds.

One of Qwik Supply Chain’s whole-time directors, Tapas Mitra, is also a director on several companies owned and linked to Reliance such as Reliance Polyester, Reliance Oil and Petroleum, Reliance Photo Films, Jamnagar Ratlam Pipeline Company, and Jamnagar Kandla Pipeline Company.

Mining major Vedanta has purchased Rs 400.65 crore worth of electoral bonds, while power producer Haldia Energy — a part of the RP-Sanjiv Goenka Group — has purchased Rs 377 crore. This makes them the sixth and seventh largest purchasers, respectively.

The Bharti Group, largely focussed on telecommunications, has in total bought

Rs 247 crore worth of electoral bonds through three of its group companies — Bharti Airtel (Rs 198 crore), Bharti Telemedia (Rs 37 crore), and Bharti Infratel (Rs 12 crore).

The OP Jindal Group, across three of its steel industry subsidiaries (Jindal Steel and Power, Jindal Stainless, and Jindal Saw) has in total bought Rs 192 crore of electoral bonds, making it the ninth-largest purchaser so far.

Rounding out the top 10 purchasers of electoral bonds is the DLF Group, which has in total bought Rs 170 crore worth of bonds through its subsidiaries DLF Commercial Developers, DLF Garden City Indore, and DLF Luxury Homes

(Edited by Tikli Basu)