New Delhi: The acquisition of Odisha’s Gopalpur port, announced Monday by Adani Ports and Special Economic Zone Limited (APSEZ) at an enterprise value of Rs 3,080 crore, is the latest addition to the expanding footprint of India’s largest private ports operator.

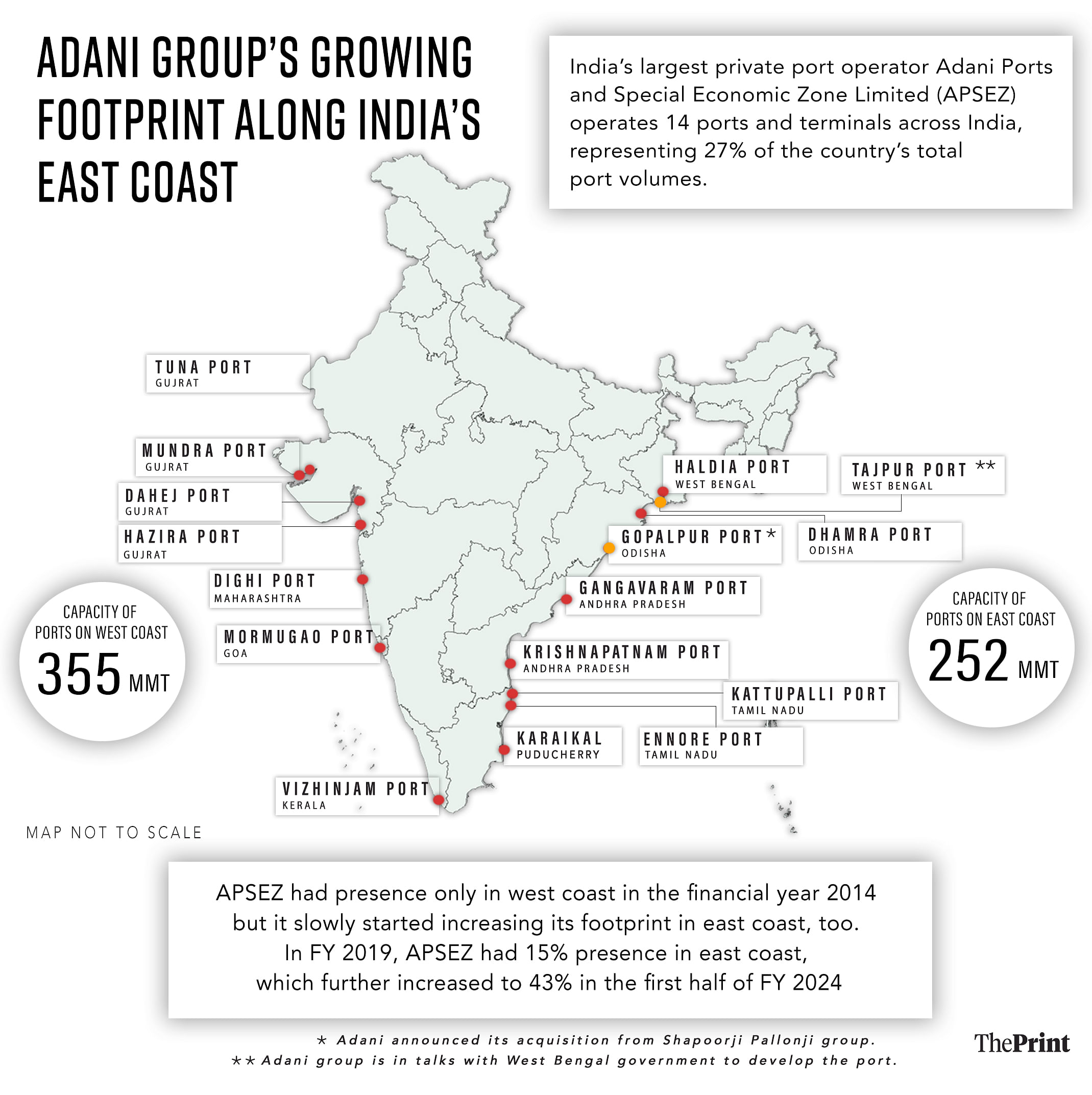

Currently, APSEZ operates 14 ports and terminals across India representing 27 percent of the country’s total port volumes. Seven each are on the east and west coast.

APSEZ had presence only in the west coast in the financial year 2014 but it slowly started increasing its footprint in the east coast too, according to an APSEZ January 2024 investor presentation. In FY 2019, APSEZ had 15 percent presence in the east coast, which further increased to 43 percent in the first half of FY 2024. While the capacity of ports on the west coast is 355 million metric tonnes (MMT), on the east coast it is 252 MMT.

While Haldia in West Bengal, Dhamra in Odisha, Gangavaram and Krishnapatnam in Andhra Pradesh, Kattupalli and Ennore in Tamil Nadu and Karaikal in Puducherry are on the east coast, Mundra, Tuna, Dahej, and Hazira in Gujarat, Mormugao in Goa, Dighi in Maharashtra and Vizhinjam in Kerala fall on the west coast. Of the 14, Mundra is the biggest private commercial port by volume handled. It is also the largest container port with 33 percent of India’s container traffic passing through it.

India has a total of 12 major ports, which are run by the central government, and 64 non-major ports, which are administered by state maritime boards but are privately owned.

Gopalpur port, a multi-cargo port with capacity to handle 20 million metric tonnes per annum (MMTPA) of dry bulk cargo, including iron ore, coal, limestone, ilmenite, and alumina, is the latest addition to APSEZ’s port portfolio on India’s eastern coastline.

The Adani group is also in talks with the West Bengal government to develop Tajpur port.

In a statement Tuesday, APSEZ said that it has entered into a definitive agreement to purchase the 56 percent stake of the Shapoorji Pallonji Group and 39 percent of Orissa Stevedores Limited (OSL) in Gopalpur Port Limited (GPL). “The acquisition is subject to statutory approvals and fulfillment of other conditions precedents,” the statement said.

The Odisha government had awarded a 30-year concession to GPL in 2006, with the provision of two extensions of 10 years each.

A Shapoorji Pallonji Group spokesperson said that the planned divestment of Gopalpur Port and earlier the Dharamtar Port, Maharashtra are key milestones in the group’s roadmap to reduce its debt and set the stage for growth, taking advantage of the macro trends for demand in their core businesses, both in India and overseas.

Maritime sector experts say that the Gopalpur acquisition is a natural progression for the APSEZ that has made it very clear that they want to increase capacity and footprint in the port sector, not just in India alone.

This fits very well with APSEZ’s strategy, says Shailesh Garg, director at Drewry Shipping Consultants Limited. “Adani group as a complete private port operator, whether it is Mundra or Gopalpur or Dhamra or Gangavaram, have complete control over the entire chain which includes vessel, cargo and landside operations. So you can control and optimise the entire operation. I think that is the advantage when you are there as the private owner and operator of the port.”

Garg said that APSEZ representing 27 percent of India’s total port volumes, though not a huge number, is significant. “They do not have a monopoly as there is still more than 70 percent capacity, which is handled by different other ports. But starting from Dhamra, now Gopalpur, they have a chain of ports on the east coast. They have got a lot of capacity actually built for handling bulk cargo in particular,” he says.

APSEZ’s revenue, according to the January 2024 investor presentation, from its 14 ports increased from Rs 8,967 crore in the first half of FY 2023 to Rs 9,963 crore in the first half of FY 2024. Its profit in the same period from the ports sector increased from Rs 6,236 crore in H1 FY 2023 to Rs 7,148 crore in H1 FY 2024.

Gopalpur port, Garg adds, has been there for so many years. “The current concession will end in 2036. That means that a large part of it is already gone, and Gopalpur has not achieved what it was supposed to. So it is good that somebody like the Adani group has taken it… they will build the port, use this infrastructure for more productive and optimum use of resources. They will make more investment to increase its capacity because they have the land. So there’s this whole expansion of possibilities that somebody like the Adani group can actually do.”

The Gopalpur port has received more than 500 acre of land on lease for development, with an option to receive additional land on lease to meet future capacity expansions, the APSEZ said in its statement.

Garg said that there is always a fear in the market that if one operator comes in whether it is Adani or anybody else, this could create a monopoly. “But there is competition within that market also because you have Paradip, you have Vizag… So, why not? Market will go where there is the best product or services, not always the cheapest but if the overall cost is optimised,” he said, adding that though it increases competition, it also brings economies of scale.

But he admits that there has to be checks and balances to see that this is within the legal framework and that competition is not leading to monopoly in the market. “I am sure there are structures in the market that should look at that,” he said.

Besides India, APSEZ also has a presence outside the country. It operates Israel’s largest port, Haifa, which handles 50 percent of the country’s total cargo. It also has Operation and Maintenance contracts at ports in Australia and Tanzania, and a container terminal at Colombo, Sri Lanka.

(Edited by Tony Rai)

Also Read: Shahpurkandi dam complete after 3 decades, will help check unutilised Ravi water flowing to Pakistan