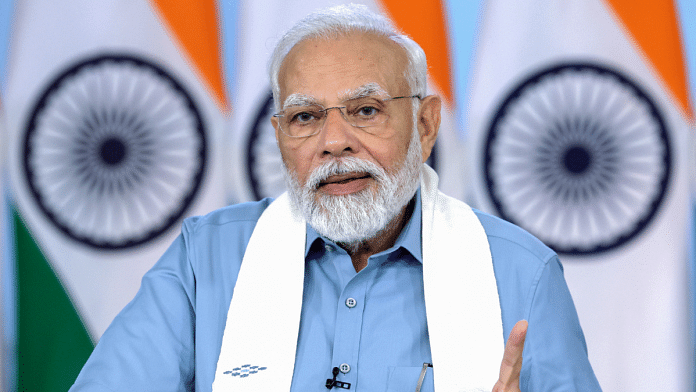

New Delhi: Even as India prepares to host the G20 Summit, Prime Minister Narendra Modi will make a quick visit to Indonesia for the 20th ASEAN-India Summit on 6 September where discussions about New Delhi’s asymmetrical trade with the 10-nation bloc are likely to be on the cards.

The ASEAN bloc includes Brunei, Myanmar, Cambodia, Indonesia, Laos, Malaysia, Philippines, Singapore, Thailand and Vietnam.

Last month, economic ministers from ASEAN countries and India agreed to review the ASEAN-India Trade in Goods Agreement (AITIGA) which was signed in 2009. A statement from the Indian government said this was to help make the pact “mutually beneficial”, especially since India’s trade deficit with the bloc stood at a whopping $43.57 billion in FY23.

According to Vinay Kumar, deputy secretary at the Union commerce ministry, India is keen to hold at least one meeting reviewing the trade pact by the end of this year, and quarterly negotiations may follow.

“The high-level meeting between Prime Minister Narendra Modi and ASEAN leaders this week will be important. So far, the two sides have agreed to hold talks and we want to hold at least one meeting by the end of this year,” he told ThePrint over phone.

Rules of origin, dispute settlement mechanism and chapters on safeguards will likely be the focus areas of discussions.

Rules of origin are the criteria used to define where a product was made. Some experts identified it as a key area due to the China factor.

“Rules of origin should be focussed on because there has been concern regarding Chinese goods being routed through some ASEAN countries,” Pankaj Vashisht, associate professor and coordinator of ASEAN-India Centre (AIC) at the Delhi-based think tank Research and Information System for Developing Countries (RIS), told ThePrint.

Ajay Sahai, director general & Chief Executive Officer of the Federation of Indian Export Organisations (FIEO), agreed, citing examples like gold items from South Korea.

“There have been concerns from the industry about imports of gold items from South Korea and goods from other ASEAN countries actually coming from China. Tightening of these rules is also the need of the hour,” he told ThePrint.

Digitisation of trade procedures and addressing non-tariff barriers like Sanitary and Phytosanitary (SPS) measures — which are applied to protect human, animal or plant life — are likely to be on the table as well.

Also Read: Manufacturing moving to India from China, but trade deficit a concern, says Mark Mobius

Imports from Indonesia, Singapore, Malaysia driving asymmetry

Since India’s trade pact with ASEAN came into effect in January 2010, New Delhi’s imports from the bloc have steadily increased while its exports have lagged behind. Data from the Indian commerce ministry shows that since FY17, India’s imports increased from $40.62 billion to $87.57 billion in FY23 — a 115 per cent jump. Meanwhile, India’s exports grew from $30.96 billion to $44 billion over the same period — a 42 per cent increase.

In ASEAN, there are three countries from which India has been importing the most — Indonesia, Singapore and Malaysia. Imports from Indonesia and Singapore crossed $20 billion each in the last fiscal, according to government data.

Goods that have been driving imports from these countries over the last five years include mineral fuels, oil and iron and steel from Indonesia, mineral fuels, machinery, electrical machinery and ships and boats from Singapore, and mostly vegetable fat and oil from Malaysia, Pankaj Vashisht, quoted earlier, told ThePrint.

“Over the last five years, imports of these specific products have increased by around $10 billion from Indonesia, $12 billion from Singapore and $3 billion from Malaysia,” he said.

Other factors contributing to the asymmetry in trade include multinational companies setting up their base in ASEAN countries due to the ‘China plus one policy’ and that India is importing a lot of intermediate products from these countries under the to Production Linked Incentive (PLI) scheme.

The ‘China Plus One’ — sometimes referred to simply as ‘Plus One’ — is a business strategy under which companies, especially multinational corporations, avoid investing only in China by adding an alternative manufacturing or sourcing location.

Under the Production Linked Incentive, or PLI, scheme, the Union government promises companies incentives on incremental sales of products manufactured in domestic units.

Under the 2009 trade pact between India and ASEAN countries, there are five distinct lists under tariff commitments: normal track, sensitive track, special products, highly sensitive list and exclusion list.

“Special products” include India’s crude and refined palm oil, coffee, black tea and pepper, which have seen preferential tariff rates reduced to 40 or 50 percent and it remains to be seen if these tariff lines are revised.

Preferential tariffs is the reduced rate countries agree to charge each other as compared to the non-discriminatory most-favoured nation (MFN) rate.

Annex 2 of the trade pact, which details rules of origin, may also see some tightening, especially with regard to “not wholly produced or obtained products”, “minimal operations and processes” and “indirect materials”, ministry officials said.

This is an updated version of the story.

(Edited by Uttara Ramaswamy)

Also Read: Who is India’s biggest trade partner? New Delhi hits back as China contests data which says US