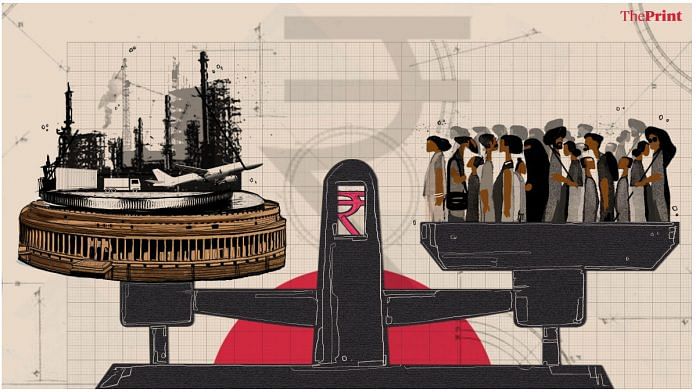

Budget making in the Ministry of Finance will be different this time. The Covid-19 pandemic has provided the government a unique opportunity to bring transparency to the calculation of the fiscal deficit.

Usually, at the time of budget making, most economists advise the government to stick to fiscal targets. This time, economists from all quarters are arguing for an expansionary Budget. This year, an increase in the fiscal deficit will not be treated as a slippage. In fact, the larger the fiscal deficit, the less critical the critics will be. This means that unlike previous years, the government does not have to try to hide the true deficit.

According to the Comptroller and Auditor General, the government’s fiscal deficit in recent years was 1.5-2 per cent higher than estimates reported mainly due to borrowing by public sector entities for government spending.

Even though growth is expected to be high and positive in 2021-22, it will primarily pull the economy back up to the levels in pre-Covid times. Tax revenue growth is likely to be sluggish as businesses try to get back on their feet, imports increase and production grows.

Also read: The 5 factors that will determine the shape of the Indian economy in 2021

Budget has to revive growth

What should Finance Minister Nirmala Sitharaman do under these circumstances? First, the economic weakness makes it imperative that the Budget is pro-growth. This should mean that the focus of the Budget should not be on how to collect more taxes, as it has sometimes been in the past, but on how to revive growth in the economy.

In years when finance ministers have hidden the actual size of the fiscal deficit, a part of it has been pushed off the balance sheet. Borrowing by public sector enterprises, oil companies and other mechanisms, through which the government raises money, are quietly hidden in the small print of the Budget.

This time, when most economists are arguing for a rise in fiscal deficit, the government, for the first time, will not be criticised for not being fiscally prudent. The revised fiscal deficit for the year 2020-21 may be as high as 6-7 per cent of GDP.

For the coming fiscal year 2021-22, the proposed fiscal deficit could be a percentage point lower at 5-6 per cent due to higher tax revenue, thanks to a revival in economic growth.

Also read: Why Indian economy seems set for revival in the new year after a tough 2020

Two ways to push demand

While the Budget may be expansionary, the next question is how this should come about. There are two ways to push demand. One is by an increase in expenditure, and the other is by a cut in taxes. One the one hand, the government can increase spending on sections of the population and on sectors that have suffered in the pandemic and are finding it hard to recover. Direct cash transfers put money into the hands of people and can help push demand quickly. While spending on infrastructure is desirable, the implementation capacity of the government is limited, and the effect on the economy is neither as big nor as immediate as desired.

The other way to push demand is by rationalising taxes. For example, a GST tax rate cut would immediately put money in the hands of people who can then spend it on other things and raise demand in the economy. This is not likely to happen in the Budget as the GST rate is decided by the GST Council, which includes both the Centre and the states.

In the Budget, the government can cut income taxes, simplify the corporate tax regime and tax administration system. Some of the elements of increased power to tax administration that have pulled down investor sentiment could be replaced by a less intrusive and more rational tax policy.

It is important that no further tax rate increases should be proposed, as these increase uncertainty, erode the tax base, and pull down growth. The strategy of improving tax collections by increasing tax rates and the power of tax officials for search and seizure has not paid off in terms of higher tax revenue; rather, it has pulled down investor confidence and the GDP.

Minimising negative impact of high deficit

The government can minimise the negative impact of a high fiscal deficit by using this opportunity to build fiscal institutions such as a Public Debt Management Agency (PDMA) and a Fiscal Council that have long been on the cards.

In summary, this year, in contrast to previous years, the government will look good if it says it has a higher fiscal deficit than estimated. Similarly, for Budget estimates 2021-22, it can propose a higher fiscal deficit. Instead of hiding the actual deficit as many past finance ministers have been accused of doing, Nirmala Sitharaman can flaunt the higher deficit that is actually hidden in the books of the government. Direct cash transfers on the one hand and cutting tax rates on the other can put money into the hands of households and businesses, and can give a boost to the economy. Institutional change that demonstrates a commitment towards a future path of fiscal prudence can help keep any ill-effects of a higher fiscal deficit at bay.

Ila Patnaik is an economist and a professor at National Institute of Public Finance and Policy. Views are personal.

Also read: Inflation is set to ease further, but it’s also time India analysed price data better

Any school student of economics would be able to give the same prognosis , increase govt expenditure or reduce taxes. But when eminent economists give their analysis and advice we really expect a lot more. The issue is to address much more that the production and consumption cycle, it is also to address the weaknesses which may cause it to recur again even after Covid is forgotten. The single most important action for the FM to take is to lift the actions to well above the needs of big businesses and poor unemployed citizens ( including the retired and the mentally and physically disabled ) It is about taking action to make India the best place to build, make, be , do , and that simply cannot happen just by reducing taxes or erecting waves of protection and tariffs.

Give us some recommendations which reflect the capability of your intellect and experiences. Ones which are daring , progressive and possibly game changers . Or should we keep waiting for Niti Aaayog to come up with these ?

Any farmer earning more than 10 lakhs per annum should be taxed.