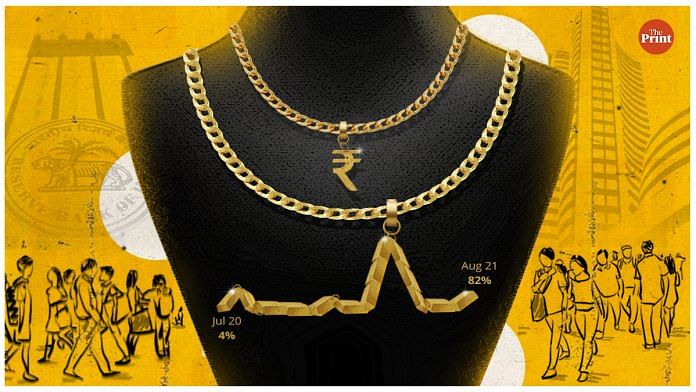

India’s gold imports in August nearly doubled from a year earlier. While imports have been rising over the last few months on account of marriage and festive demand, and high inflation, decline in interest rates on savings instruments and signs of overheating in equity markets could make gold an attractive investment option for households in the coming months.

The value of gold

Gold is essentially a dollar asset in a country where there are capital controls. The price of gold is fundamentally determined in dollars in world markets. Over and above that, currency depreciations move in line with domestic inflation in the long run.

Since few households can actually set up the financial infrastructure to buy dollar assets, gold is the best substitute they have.

In addition, of course, is the love for gold as customs like weddings and festivals encourage its purchase. The postponement of weddings during the second Covid-19 wave appears to have resulted in delaying of gold purchases and a sharp increase in sales in August.

However, the increase in buying may have more to it than just the jewellery component. Gold is also an important financial asset to invest in, especially when returns on other assets have declined with loose monetary policy.

Traditionally, small saving instruments such as Public Provident Fund (PPF), National Savings Certificates (NSC), Senior Citizens Savings Scheme (SCSS) and KVP etc. are some of the popular investment options among households looking for a fixed and assured return. Over the last two years, the small saving rates across various instruments have seen a decline.

The domestic term deposit rates have also been declining since January 2019. The rate of interest on outstanding rupee term deposits has fallen from 6.89 per cent in May 2019 to 5.32 per cent in May 2021. The decline in deposit rates has prompted households to shift from bank deposits to other avenues such as the capital markets.

The estimates of household financial savings by the Reserve Bank of India (RBI) show that the ratio of household (bank) deposits to GDP declined to 3.0 per cent in the third quarter of 2020-21 from 7.7 per cent in the previous quarter.

Also read: India’s GDP & fiscal situation seem back on track. Reforms must continue to build confidence

State of the market

At the same time, as equity markets reach new peaks, expectations of further increases might be getting lower. This would encourage households not to put additional savings into the stock market.

So, while retail participation in the stock market has significantly grown over the last few months of the current year, recent IPOs have seen reduced retail interest.

According to a report by the State Bank of India, the market added around 44.7 lakh retail investors during the first two months of the current fiscal. The rush of the retail investors resulted in initial public offerings (IPOs) being oversubscribed over 100 times.

As an outcome, the holdings of retail investors in listed companies hit a record high of more than 7 per cent. However after a period of record subscriptions, retail investors have slowed down the pace of buying in the equity market over the last few weeks. With concerns around stock market overvaluation, households would prefer a diversified portfolio.

Inflation factor

Typically among the various asset classes, gold is considered as a hedge against inflation. Studies find that periods of high and volatile inflation are associated with greater propensity among households to purchase gold. The commodity is seen to have delivered returns higher than inflation.

Current levels of inflation are higher than the expected long run rate of 4 per cent, which is the RBI’s target. This along with low nominal returns on bank deposits make gold returns more attractive.

The government has typically responded to the rise in imports of gold through hikes in import duties, and capital controls. In August 2013, when inflation was in double-digits and demand for gold was rising, the then United Progressive Alliance (UPA) government raised import duty on gold from 6 per cent to 10 per cent. Restrictions were also imposed through capital controls.

The government introduced the 80:20 scheme to curb gold imports. Under the scheme, while 80 per cent of gold imports could be sold in the country, at least 20 per cent of imports had to be exported.

These measures did bring down the imports but higher domestic demand led to smuggling of gold and circular trading.

A Comptroller and Auditor General (CAG) report published in 2016 found that the scheme had resulted in a loss of Rs 1 lakh crore to the exchequer. The scheme was scrapped in November 2014, after the Narendra Modi government came to power.

Also read: RBI optimistic about 9.5% GDP growth projection for FY22 being met, Shaktikanta Das says

What the government has done, and should do

The Modi government introduced the Sovereign Gold Bond (SGB) scheme in 2015 to curb gold imports in the Indian market and shift part of the household savings used for the purchase of physical gold into financial savings.

SGBs have given an alternative to investors who want to invest in gold but don’t want to hold gold in physical form. SGBs are government securities denominated in grams of gold. They are benchmarked to the price of gold. The tenor of the bond is eight years with an annual interest of 2.5 per cent.

While SGBs are an optimal investment vehicle, liquidity is a constraint. Liquidity in the stock markets is limited as there are not too many buyers.

The government has mobilised Rs 31,290 crore from the scheme since its inception.

While SGBs can fulfil the same purpose as gold when purchased as a financial asset, higher liquidity is required to make it a more attractive asset. Instead of import duties or bans and capital controls, the government should encourage the availability of liquid gold-backed assets to wean Indian households away from gold.

Ila Patnaik is an economist and a professor at National Institute of Public Finance and Policy.

Radhika Pandey is a consultant at NIPFP.

Views are personal.

Also read: Retrospective tax is good riddance. But Modi govt can do more to attract foreign investors