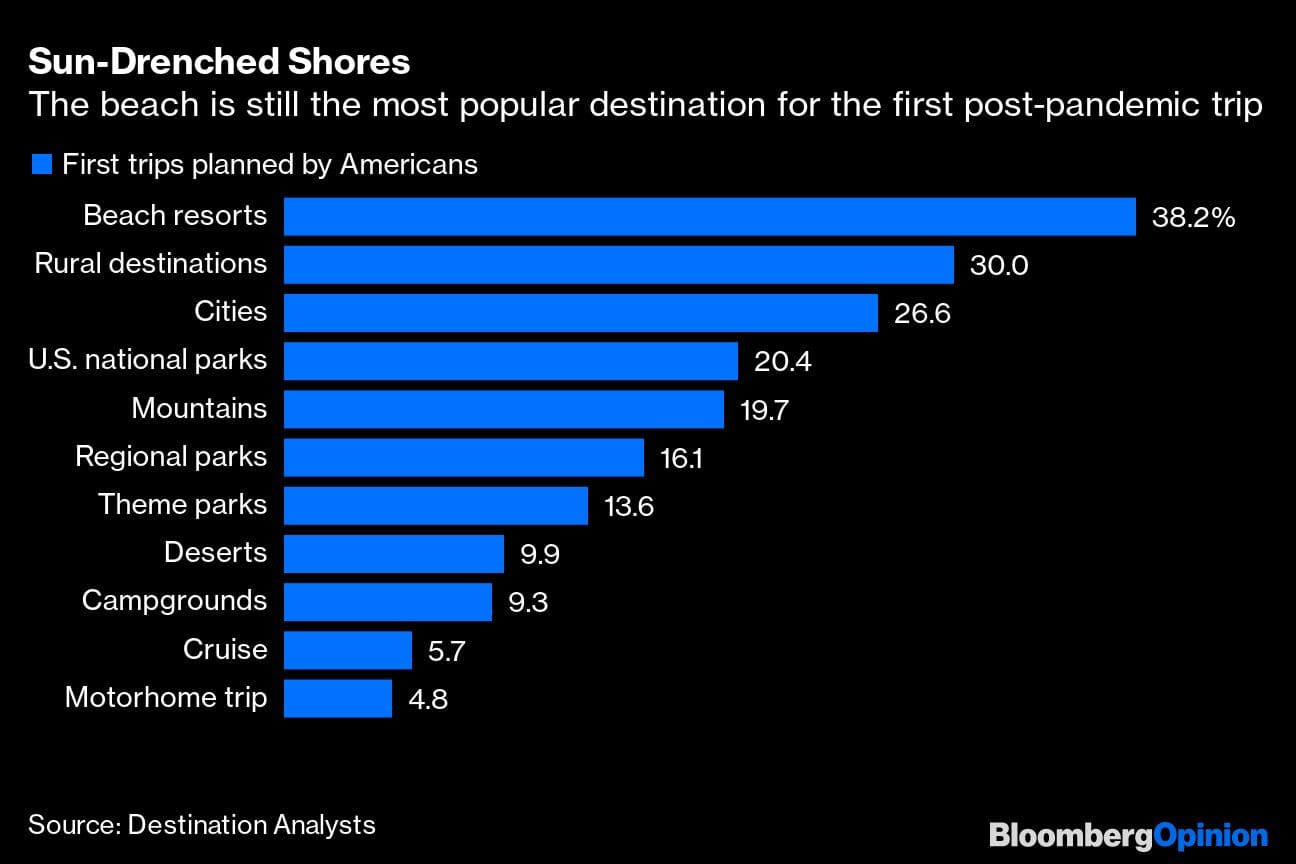

Anyone up for a beach holiday right now? The answer is probably a resounding yes, anything to escape lockdown and incessant worrying about the coronavirus outbreak and imminent global recession.

But would you actually book one for this summer or even the fall? There the answer is more complicated, as it becomes painfully clear that our next vacations will be close to home and overshadowed by concerns about health precautions.

There are the optimists: Almost three-quarters of the people who were due to sail in May, but had their dream cruise canceled by British operator Saga Plc, chose to rebook at a later date. The pessimists: More than half of Americans surveyed by Destination Analysts agreed their next vacation would be a “staycation.” Those organized souls who planned their July Fourth escapes before Covid-19 was upon us are playing wait-and-see. French hotel giant Accor SA has seen less than 10% of reservations for July and August scrapped. But it’s still bracing for occupancy rates of 25-30%, as opposed to 75%, when travel begins again

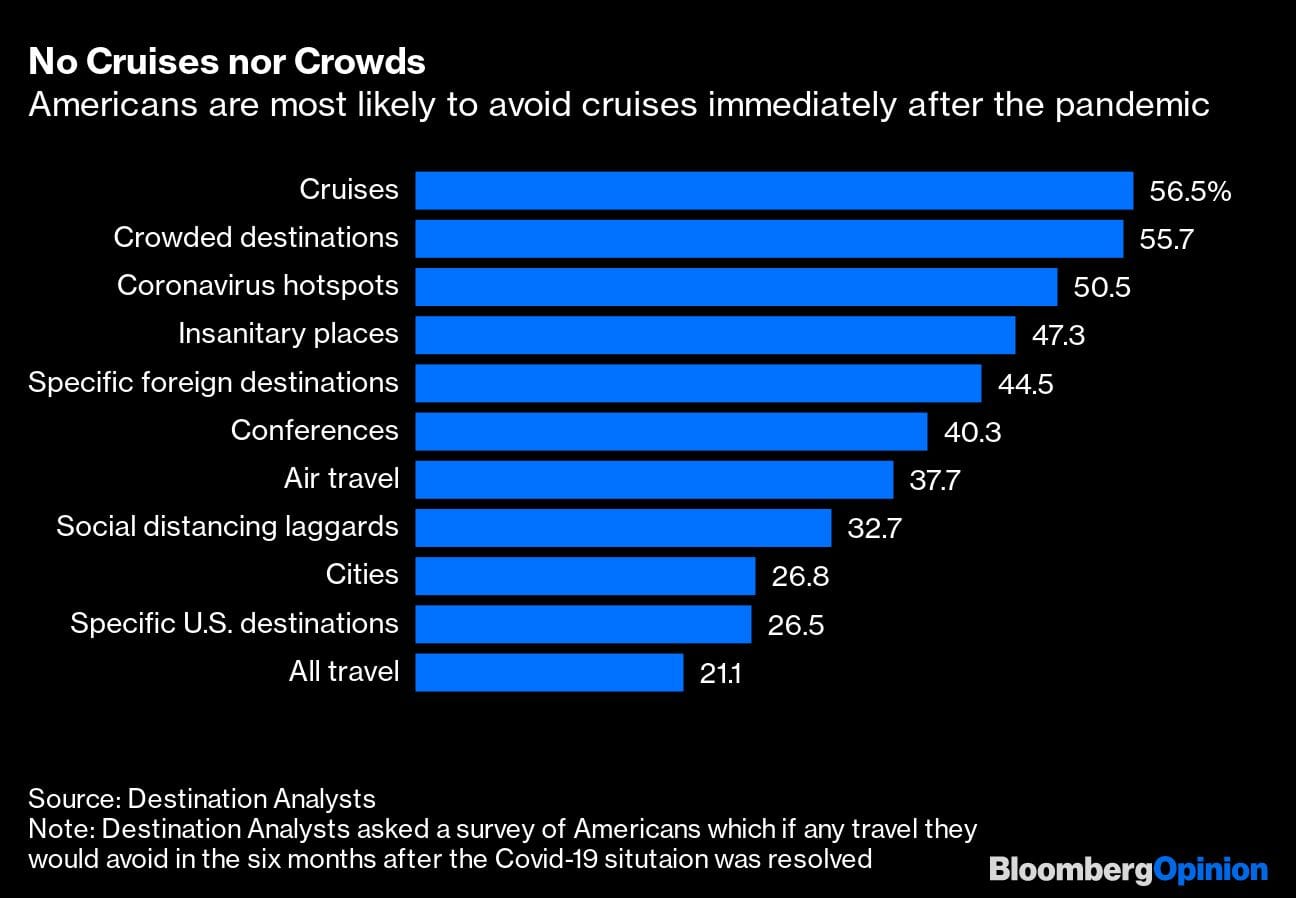

What’s clear is that we’re all going to be expecting something different for our next getaway: hotels with detailed Covid-19 symptom checks, abundant hand sanitizer, rigorous disinfecting and bars and restaurants configured for social distancing.

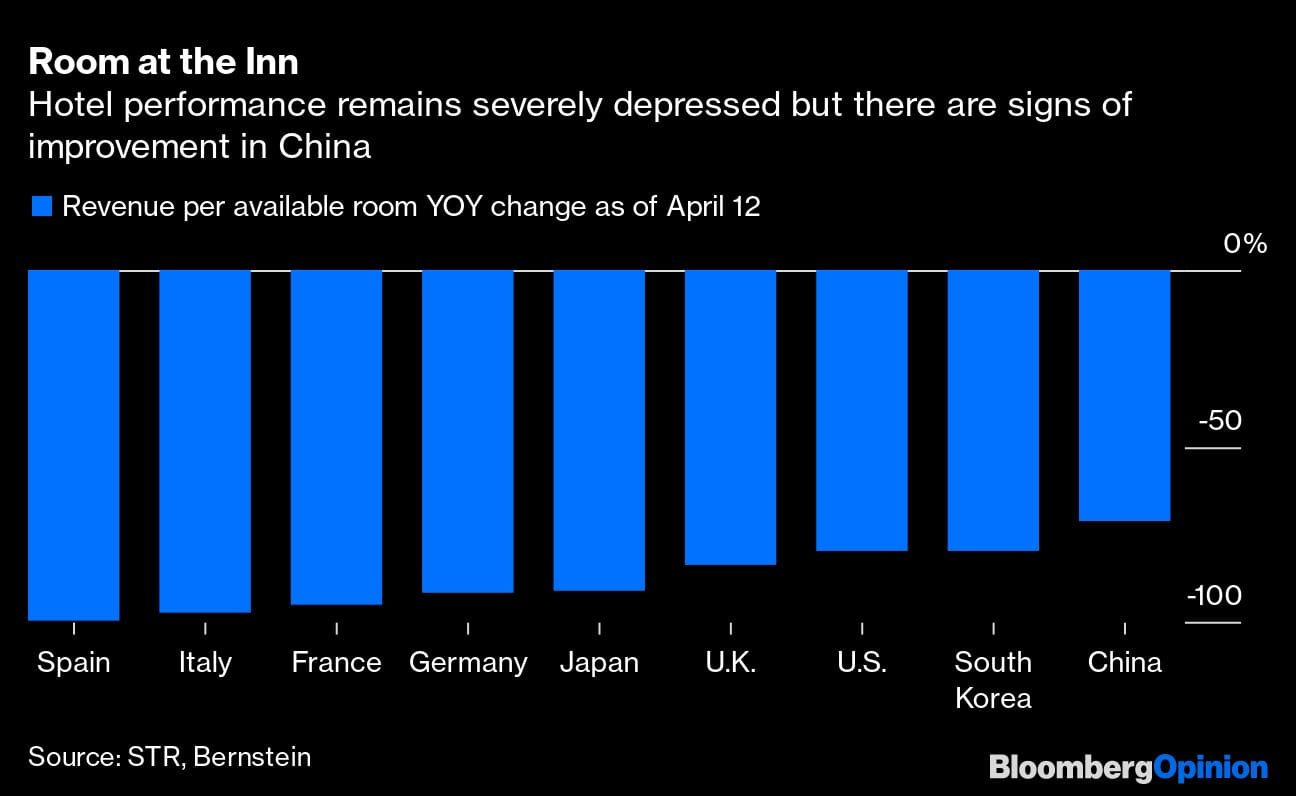

The $5 trillion global tourism industry has already taken a huge hit from the pandemic, and it’s not over. Figuring out how to cater to tourists and business travelers in this new era will throw up huge challenges for even the most flexible and deep-pocketed companies. The about 35% gain in the Stoxx 600 Travel & Leisure Index since March 18 looks overly optimistic.

In the near term, consumers may be reluctant to crowd into airplanes or return to busy tourist hot spots. In response, European discount carrier EasyJet Plc said it’s likely to leave middle seats empty on aircraft with a three-seat configuration, at least when it first resumes flights. The cruise industry, a haunting symbol of the Covid-19 outbreak, is likely to promote smaller vessels, which are more easily adapted to social distancing, a robust on-board medical staff and promises to fly holidaymakers home at the first whiff of a problem. Flexible booking policies without any deposit may become the norm. If all this fails to tempt, then deep discounts will be necessary.

This season may be a washout but there are some signs things will pick back up. Dart Group Plc said on Friday that bookings were still coming in to its Jet2 leisure travel business for late summer. EasyJet said winter bookings were significantly ahead of this time last year. Even if some of this may be rescheduling of trips that were canceled, it illustrates people’s eagerness to travel once again. To capture pent-up demand, tour operators including European giant TUI AG and Jet2 have launched their 2021 summer holiday programs early.

It may still be a hard sell depending on the destination. For Italy, Spain and France, as well as New York City, the repercussions of having been the epicenter of the pandemic at some point may linger even longer. It took about 18 months for travel to Paris to recover completely after the harrowing 2015 terrorist attacks.

With international flights grounded and foreign tourists unwelcome in most places, it’s impossible to say how soon we can start trotting the globe again. The big luxury and event-oriented hotels, such as those operated by Marriott International Inc. and Hyatt Hotels Corp., are more dependent on international travelers than their more downmarket peers. Companies will likely shore up offerings for domestic tourists. For example, Saga, which caters to the 50s-and-over crowd, already offers cruises around the British isles. This business could be expanded if customers are nervous about venturing further afield.

In more thrifty times, people tend to seek out no-frills lodging. In the U.S., Wyndham Hotels & Resorts Inc., has the most exposure to the economy and mid-scale sectors, with brands such as Super 8, Ramada and Days Inn, according to Brian Egger, an analyst at Bloomberg Intelligence. In Europe, Whitbread Plc has the Premier Inn chain in Germany and the U.K., where 80% of its properties are outside of London.

Airbnb Inc. may be a big beneficiary if tourists seek out private residences to avoid mingling with too many people in hotel lobbies, elevators or restaurants. The trailblazer for the sharing economy may provide more options in smaller towns or isolated regions. But as with hotels, people must have confidence in hosts’ hygiene standards.

And as I have noted, some sectors, such as cruising, may struggle to attract customers other than their most ardent devotees. Carnival Corp., operator of the now infamous Grand Princess, said that as of March 15 bookings were down even for the first half of 2021.

It’s hard to say just how bad and enduring the impact from this new coronavirus will be. For those companies that manage to adjust, they can expect to be rewarded with some positive long-term prospects, as more people enter the middle class around the world and an aging population has more leisure time. But it will take much more than pictures of idyllic getaways to woo them.

Also read: Corona vacation, why some millennials only see cheap flights and resorts in the pandemic