New Delhi: Chief Economic Advisor to the Government of India, V. Anantha Nageswaran, has called for urgent reform of the World Bank’s indices which are used by credit agencies to rate the investment safety of countries. He said that these indices are opaque and subjective, and do not reflect the ground realities of a country.

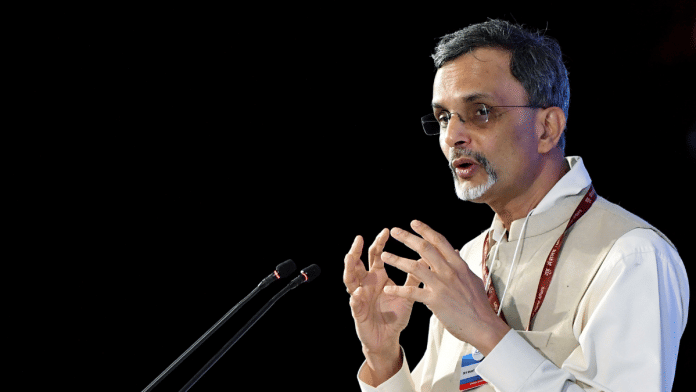

Nageswaran made these remarks at a seminar on “Multilateral Institutions for the 21st Century” organised by the Department of Economic Affairs, Government of India, Centre for Social and Economic Progress (CSEP) and the Indian Council for Research on International Economic Relations (ICRIER) at the Sushma Swaraj Bhawan New Delhi Wednesday.

“The Worldwide Governance Indicators of the World Bank created by ‘experts’ who have no presence on the ground or understand the realities of a country in a subjective manner, decide how governance in a country ranks,” said Nageswaran.

The Worldwide Governance Indicators, published annually since 1996, is a compilation of data from over 30 data sources, including think tanks, international organisations, non-governmental organisations and private firms.

The indicators measure six aspects of governance: voice and accountability, political stability and absence of violence/terrorism, government effectiveness, regulatory quality, rule of law and control of corruption.

Nageswaran said that “these indicators are important as they are used by the big three credit rating agencies [Standard & Poor, Moody’s and Fitch Ratings] to decide credit ratings of sovereign nations.”

He added that this affects the interest rates that countries have to pay to borrow from international markets for development projects.

According to him, credit agencies are not transparent in sharing how much of an impact the worldwide governance indicators of the World Bank have in their calculations of credit ratings of governments.

Suggesting some possible changes, Nageswaran said, “One immediate change that can be done by the Managing Committee of the World Bank, that does not require the approval of the board, is making the worldwide governance indicators more transparent and less arbitrary.”

His proposal was supported by Vera Songwe, a member of the G20 Independent Expert Group on Strengthening Multilateral Development Banks (MDBs).

Speaking at the seminar, Songwe explained why credit ratings are important for countries to access funds from global markets.

Highlighting how economies that are in need of credit are at a disadvantage in comparison to the developed economies, Songwe said that no emerging market economy has a AAA or AA credit rating, which are the highest ratings.

“The advanced economies are able to borrow at concessional interest rates of 200 basis points [2 percent], while 24 countries, especially low and middle-income economies, are borrowing with interest rates at 700 basis points [7 percent] or higher,” Songwe highlighted.

Also Read: ‘Don’t bet against India’ — CEA Nageswaran vs ex-CEA Subramanian in economy debate

Need for reform in IMF

The seminar also discussed the need to reform the International Monetary Fund (IMF), which was described as the “centre [of] global monetary order” by Suman Berry, the vice-chairman of NITI Aayog.

He said that global finance is not supportive of the long-term goals that the world subscribes to, and questioned how to get the incumbents to give up power.

“Since 1997, India’s current account deficit has been around 2 percent of the GDP. In earlier years, the current account deficit of South Korea was 5, 6 and even 7 percent. I am not recommending for India to increase its current account deficit, but to show there is a global discouragement for risk,” Berry said.

Meanwhile, Mark Flanagan, deputy director of the IMF’s strategy, policy and review department, said the problem the world is facing today is a funding crisis, not a systemic risk to global finance.

Flanagan, who was speaking as a panelist on the subject “Managing Global Debt Vulnerabilities”, added that following the math, three to seven countries in the next five years may have an incident leading to a liquidity or solvency crisis.

“This is not a systemic risk, it is manageable,” he said.

(Edited by Richa Mishra)