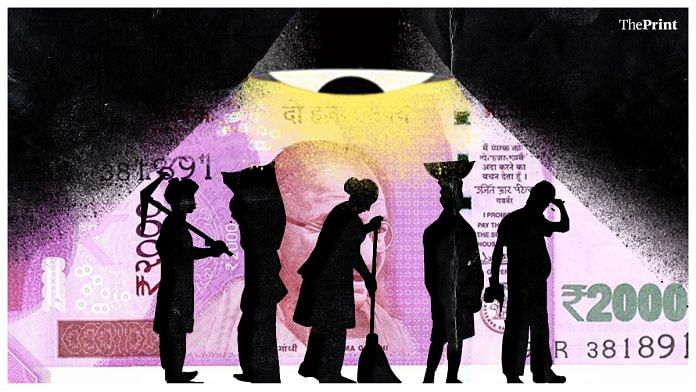

The financial lives of low-income households are fundamentally different from those of middle- and upper-income households. And yet, a reflection of this difference is largely absent in the discourse of financial inclusion.

The resultant disregard of the distinctive nature of the financial lives of low-income households, by financial service providers and regulators alike, means there are not enough products and sometimes no markets that can fulfill the specific needs and goals.

The limited options of suitable or adequate financial products and services, in turn, means that low-income households cannot sufficiently tap into the potentially transformative power of finance to meet their goals and needs, build resilience, or generally improve their financial well-being. The deterioration in the well-being of vulnerable households, considering the disproportionate impact of the COVID-19 pandemic, raises the question of whether we design policies and products that truly suit and serve low-income households.

Also read: What is the ‘Jan Dhan Account-Aadhaar-Mobile’ trinity & has it aided India’s war on poverty?

Financial lives of low-income households

Unlike other households along the economic well-being spectrum, low-income households earn their living through informal employment that is mostly intermittent, part-time or casual and, as a result, not guaranteed. Multiple research studies conducted to date have shown that low-income households work with small income inflows that are irregular and unpredictable, introducing volatility in their financial lives.

Consider the example of a household that is dependent on daily wage labour for a living. The primary earning members work as agricultural labourer for a few months of the year and the rest of the year, migrate to a nearby town or city to work at construction sites.

Income inflows, in this case, depend on the availability of work and, unlike in the case of salaried employees, income is not stable in terms of both timing and amount. Therefore, the financial status of the household will likely not remain the same from one day to the other, affecting the household’s ability to meet daily expenses, save, borrow, plan for future needs and meet unexpected expenses caused by events such as ill health or death of an earning member.

Thus, in the absence of a reliable source of income, day-to-day money management becomes the primary concern of low-income households. This involves manipulating small and unreliable income inflows to ensure money is available when needed. The financial planning and management horizon, therefore, shrinks for low-income households necessitating frequent financial decisions in response to frequent changes in circumstances.

Two financial needs directly flow from this scenario:

- a) A persistent need for liquidity.

- b) The need for money to meet more than one requirement.

If a low-income household were to look to the formal market for products that can meet these precise financial needs, they would find mostly the standardised products designed for non-low-income households whose financial needs manifest quite differently.

Low-income households may instead find that the informal market and their own social network, which they have historically relied on, are better suited to meet their peculiar financial needs.

Therefore, providers building for low-income households must dispense with the siloed approach to designing financial products but instead aim to situate their products in the existing network of social and financial inter-dependencies and relationships.

Challenges and opportunities for policy makers

The way forward to meaningful financial inclusion, therefore, lies in financial service providers building products and services that meet the needs and behaviours of low-income households.

Beyond just product development, the key to progressing on the goals of increasing adoption and sustaining use of financial services and products lies in the regulator fostering an ecosystem that adequately and suitably serves the needs of low-income households. Products, delivery channels and institutions, market infrastructure, and regulatory and supervisory frameworks will have to evolve with the innovations of the private sector and the changing needs of customers.

Furthermore, financial sector policy must create an environment that rewards innovation in the design and delivery of financial services and products. Measures such as having a regulatory sandbox would allow for the testing and development of such innovative solutions in a controlled environment.

In conclusion, the difference in the financial lives of low-income households from those of middle- and upper-income households comes not only from an insufficiency in income but also due to the nature of their income, in that it is also unpredictable and irregular. This gives rise to a whole set of financial behaviours and coping strategies and mechanisms by low-income households that would be largely unfamiliar to the rest of the population.

It is, therefore, essential that financial service providers rise to this challenge, and policymakers allow for the rise, so that low-income households finally get their due.

Amulya Neelam and Sowmini Prasad are Research Associates, Dvara Research.

The article is part of our series of financial explainers in partnership with Dvara Research.

Views are personal.

Also read: Protecting the users — what the primary aim of a personal data protection legislation should be