Demand-killing trade war threatens Indian exports that have already been hurt by policy disruptions over the past 2 years.

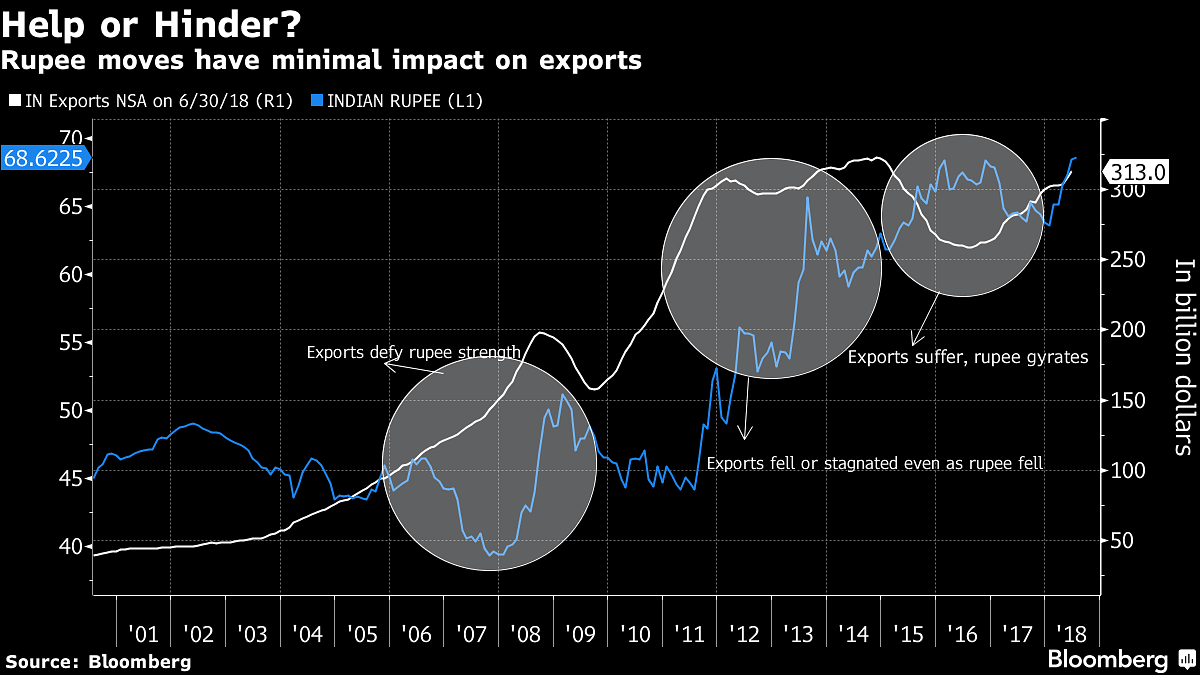

A weak currency is good for exports. In India’s case, the script is not so straightforward.

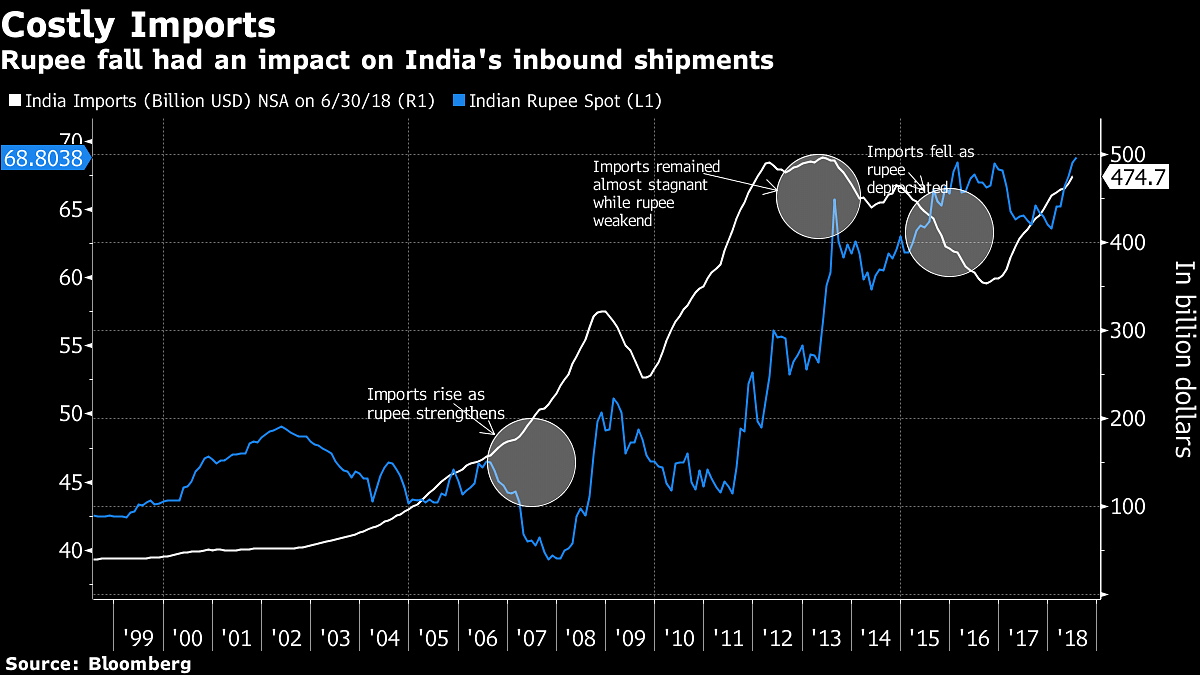

While the rupee is Asia’s worst-performing major currency this year, a demand-killing trade war threatens Indian exports that have already been hurt by policy disruptions over the past two years. History shows the currency’s moves have hardly impacted shipments. If anything, a slide in the rupee has ended up inflating the nation’s import bill.

“The situation for export prospects is weak given the kind of trade war happening in the world,” said N.R. Bhanumurthy, an economist at Delhi-based National Institute for Public Finance and Policy and a co-author of a 2013 paper on whether rupee’s weakness matters to Indian manufacturing exports.

Unlike China, Taiwan and South Korea, India isn’t part of big supply chains globally. Trade tensions between the US and China have prompted export-reliant countries like Vietnam to guard against Chinese products flooding their local markets. India’s goods exports contribute only about 12 per cent of gross domestic product (GDP) and government officials have blamed its poor showing on the rupee’s strength.

The currency slumped to an all-time low of 69.0925 per dollar last month as prices of crude oil – the nation’s top import – climbed and foreign funds exited stocks and bonds amid an aversion to riskier assets. The rupee touched 69 Thursday and is down over 7 per cent this year.

The rupee continues to be overvalued on a real effective exchange rate despite the slide, and there was no question about being nervous about the depreciation, said Rajiv Kumar, vice chairman of think-tank NITI Aayog. Modi’s chief economic adviser, Arvind Subramanian, also welcomed the rupee’s decline, adding that it was a natural adjustment that was taking place.

Along with rising oil prices and Indians’ love for electronic goods made abroad, an adverse terms of trade position could widen the country’s current-account deficit.

“The rupee’s weakness against the dollar along with rising oil prices has increased India’s import bill,” said Rohan Chinchwadkar, an assistant professor of finance at the Indian Institute of Management at Tiruchirappalli in southern India. “Despite the depreciation, export growth continues to be weak because of rising protectionism, sluggishly recovering global growth and disruption of domestic supply chains.” – Bloomberg

The way we need to look at it is should be Objective. In terms of Governance, yes Government needs to be accountable for Governance. Obviously protest are the only means for making your demand known. At the other side of the fulcrum, Law & order will go for a toss, if bad elements go on a rampage and fuel it further with fake news that incites the Mob