Mumbai: Dewan Housing Finance Corp., an Indian mortgage lender that has delayed payment on some of its obligations, plans to ask banks to lend 15 billion rupees ($217 million) every month to help revive the company, a person with knowledge of the proposal said.

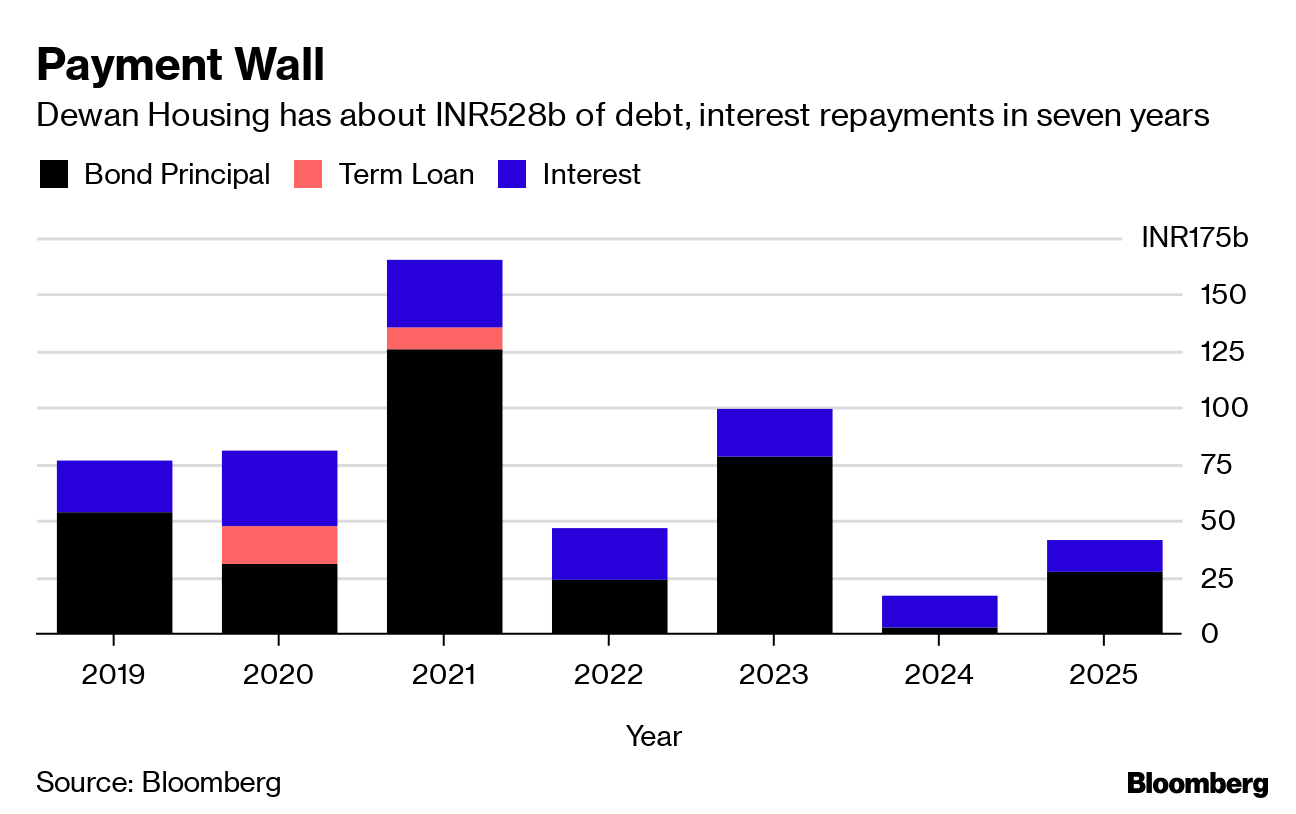

The financier, which has about 800 billion rupees of obligations, will submit the resolution plan on July 10 to a consortium of seven lenders led by state-run Union Bank of India, the person said, asking not to be identified as the discussions are private. The other proposals include increasing the tenor of some loans and converting part of its debt into equity, according to the person.

Investor confidence was shaken after financier Infrastructure Leasing & Financial Services Ltd. defaulted for the first time in June 2018, shutting the door for bank loans for many shadow lenders. Dewan Housing was among the worst hit in the wake of the IL&FS shock, which also pushed up financing costs and made it harder for non-bank financing companies to access the bond market. Dewan Housing’s credit rating was slashed to D from AAA this year as it delayed repayments.

Under the proposal, Dewan Housing will offer banks new loan pools as security for the funds, the person said. That in turn will help lenders meet their mandatory targets to lend to farmers and small businesses. Dewan Housing is proposing banks fund the company for the next six months, the person said.

Also read: Satin Creditcare, one of India’s top microlender, seeks $900 million to fund loan growth

Dewan Housing has so far securitized about 250 billion rupees from its 1.2 trillion rupees of loan book, the person said. The details of the proposal are subject to change and it’s unclear if the lenders will approve the plan, the person said. A spokeswoman for Dewan Housing declined to comment.

While lenders mull the resolution plan, Dewan Housing will continue looking for an investor for a stake in the company. Founders hold about 39.6% in the company, and plan to sell half of their shares, the person said. The company has been selling assets including a mutual fund, low-cost housing-finance unit, and an education-loan company. Dewan Housing shares have lost about 87% of their value over the past year.

If the resolution plan is accepted by the lenders, Dewan Housing will seek approval from institutional investors to either extend the maturity of its bonds or change the coupon rate, the person said. The company expects to repay individual investors without changing bond terms.

The financier expects to earn enough interest on its assets to meet debt repayments due this quarter, which total about 70 billion rupees, the person said. It was behind schedule in servicing its financial obligation last month. It delayed payments on debt of 11.85 billion rupees.- Bloomberg

Also read: India to inject Rs 482 billion into state lenders to boost loans