A confluence of factors helped India draw more inbound investments than China for only the second time in a decade.

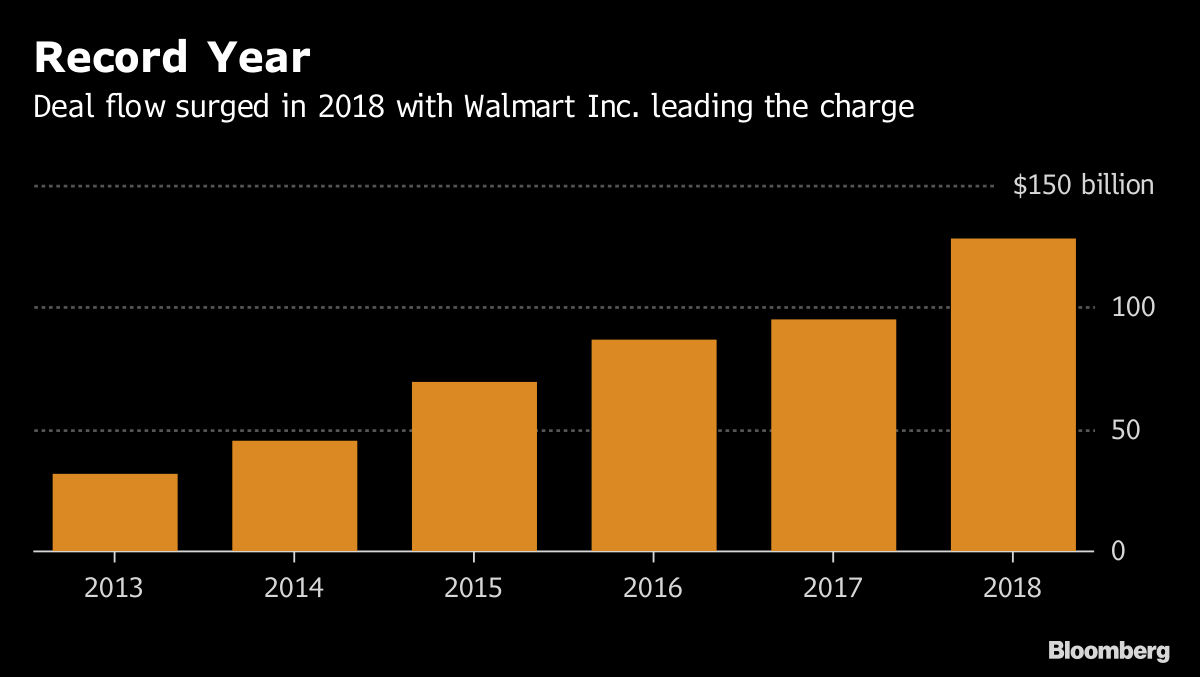

In a record year for India deals, the rock n’ roll loving leader of Goldman Sachs Group Inc.’s local unit helped broker some of the biggest transactions as Walmart Inc., ArcelorMittal and Berkshire Hathaway Inc. joined a buying spree in the country. Next year will be at least as busy, he says.

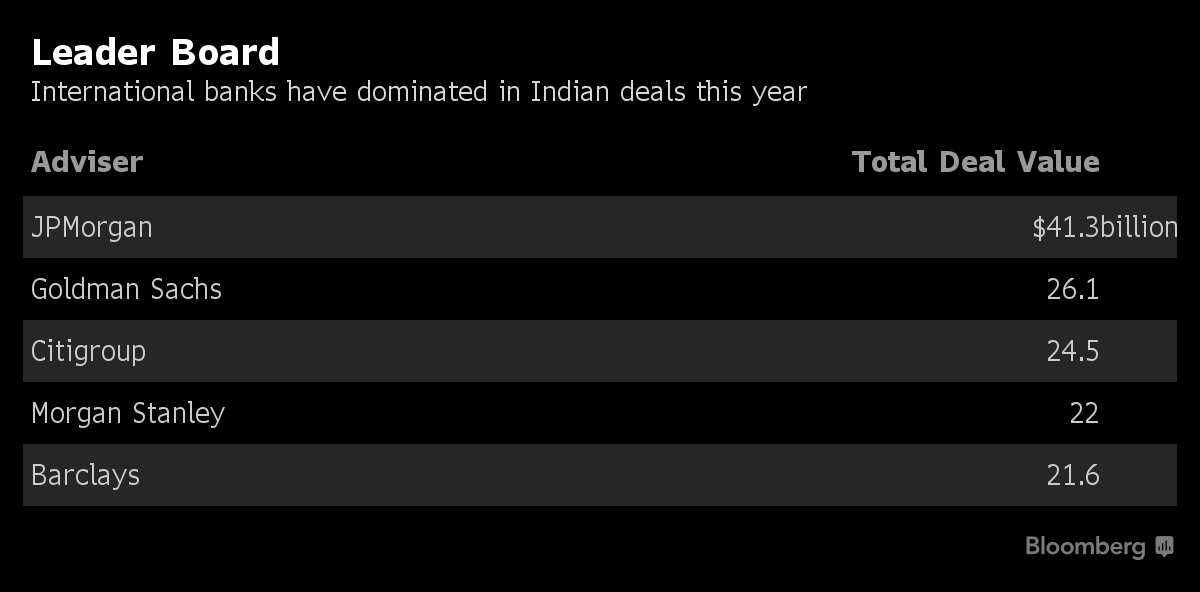

Goldman advised on two of the three biggest acquisitions involving Indian companies in 2018, when $128 billion transactions were announced. That put the U.S. investment bank at No. 2 among advisers, according to data compiled by Bloomberg. Chairman and Co-chief Executive Sonjoy Chatterjee predicts that deals in technology-driven consumer and financial services will keep the momentum going in the year ahead.

“All pools of global capital — from strategics to financial sponsors — are focused on India,” Chatterjee said in an interview in Mumbai. “Some of these large global companies are sitting on enormous amounts of cash. They need to get into markets which are important for them, and India is a top priority.”

A confluence of factors helped India draw more inbound investments than China for only the second time in a decade. Foreign acquirers struck a record $39 billion of acquisitions in India this year, Bloomberg-compiled data show. A crackdown on soured loans put assets worth billions on the block just as Asia-focused private equity funds looked to deploy a record war chest and the race for e-commerce dominance started in earnest.

Despite this pace, the 25-year banking veteran makes time to pursue a lifelong passion. For five years now, Chatterjee has moonlighted as the drummer for Victor and the Crowns, a rock-and-roll band that performs on the local circuit of clubs and bars, belting out 1980s classics like “Summer of ’69” and “Mony Mony.”

The two jobs demand the same focus. “Sometimes you feel a bit drained as all these crunch situations involve very high stakes. You have to stay engaged,” Chatterjee said. “In the band, it is no different. If I don’t show up for practice at night and if I don’t do the bit that’s needed to qualify to go on stage, I won’t be given or deserve that position.”

In his day job, that means stretching beyond snagging the biggest deals and trying to unseat JPMorgan Chase & Co. as India’s most active M&A adviser this year. The Asian nation has been awash with corporate scandals of late, with some of its largest companies from Sun Pharmaceutical Industries Ltd. to ICICI Bank Ltd. and Infrastructure Leasing & Financial Services Group facing allegations about the actions of top executives.

Elsewhere in Asia, Goldman is embroiled in probes over how executives dodged the bank’s internal controls while helping Malaysian authorities raise billions of dollars that later went missing.

Chatterjee says he turns down business if it doesn’t pass his filters, chief among which are being comfortable with the source of money and knowing whether the bank can work with a company’s founders in a crunch.

“If we don’t have the confidence that we can deal with an adverse situation when it arises, the business is not for us,” he said.

Fortunately there’s been no dearth of deals, and Chatterjee expects interest among foreign investors to remain strong in 2019.

Already, media tycoon Subhash Chandra has announced plans to offload up to a $1.2 billion stake in India’s biggest publicly-traded TV broadcaster. Top wireless carrier Vodafone Idea Ltd. is exploring a potential sale of its fiber network, while beleaguered Jet Airways Ltd. is also in talks to bring in fresh investments.

In investment banking as in music, you need to be “comfortable amidst changing scenarios,” Chatterjee said. “As the settings change you have to evolve in both banking and music. Without passion, without enjoying it, you can’t do it.”

Here are some excerpts from the rest of the interview:

How is corporate India changing?

“A painful but interesting churn is happening in India — driven by governance and capital — where you will see a new corporate order emerging by 2020. The third factor driving change in corporate India are families that want to rethink the future, either because of the next generation, an uncertain horizon or simply to optimize their portfolio and capital allocation.”

Disruptions caused by the IL&FS defaults

“There is a liquidity issue, which everybody from the central bank to the government is trying to deal with. Investors who are serious, mature and deep will look at the data following disruptions in 2008 and 2013 and determine when to come back in. Going by empirical evidence, the sector takes about 18 months to reverse.”

Opportunities amid the current liquidity crunch

“Special situations funds lend themselves very nicely to wherever capital is scarce. Today, as some of the banks are not able to play, there is a big opportunity. This is the sweet spot. There are opportunities in structured credit, in buying out distressed loans and in real estate financing.” “If you were trying to do this three years back, when all the banks were very active here, they would never let you come on top of the collateral structure. You would be junior to everyone else. That is no longer the case. It’s an opportunity to step in on one’s terms, which protects and provides the returns being sought. For those who want to play in this space, looking back over the years, I cannot think of a better time.”

How long will the opportunity for special situation funds last?

“This opportunity will last for the next three years,” as the bankruptcy processes continue and banks recoup capital. “The financial system also has to get used to the new prudential norms of classification of assets, which have constrained credit activity.” –Bloomberg