Mumbai: The rupee’s resilience in the face economic headwinds has come to an end, with India’s currency losing its year-to-date gains in the space of just one month.

The country’s massive domestic market is now dragging on the rupee as growth at home slows, foreigners pull cash from local equities and the currency increasingly tracks moves in the yuan as the trade war heats up.

“Even though India is directly less vulnerable to U.S.-China tensions, it can’t remain completely insulated to the wider risk aversion,” said Dushyant Padmanabhan, a forex strategist at Nomura Holdings Inc. in Singapore. The economic slowdown and capital outflows don’t bode well for the rupee, he said.

The rupee is set for its worst monthly loss in six years and some analysts warn of more pain to come. JPMorgan Chase & Co. expects it to approach the record low hit last October by year-end, while Nomura forecasts the currency to finish 2019 at 72.5 per dollar. That’s weaker than the median estimate of 71 in a Bloomberg survey.

Here are some of the reasons behind the currency’s rapid reversal:

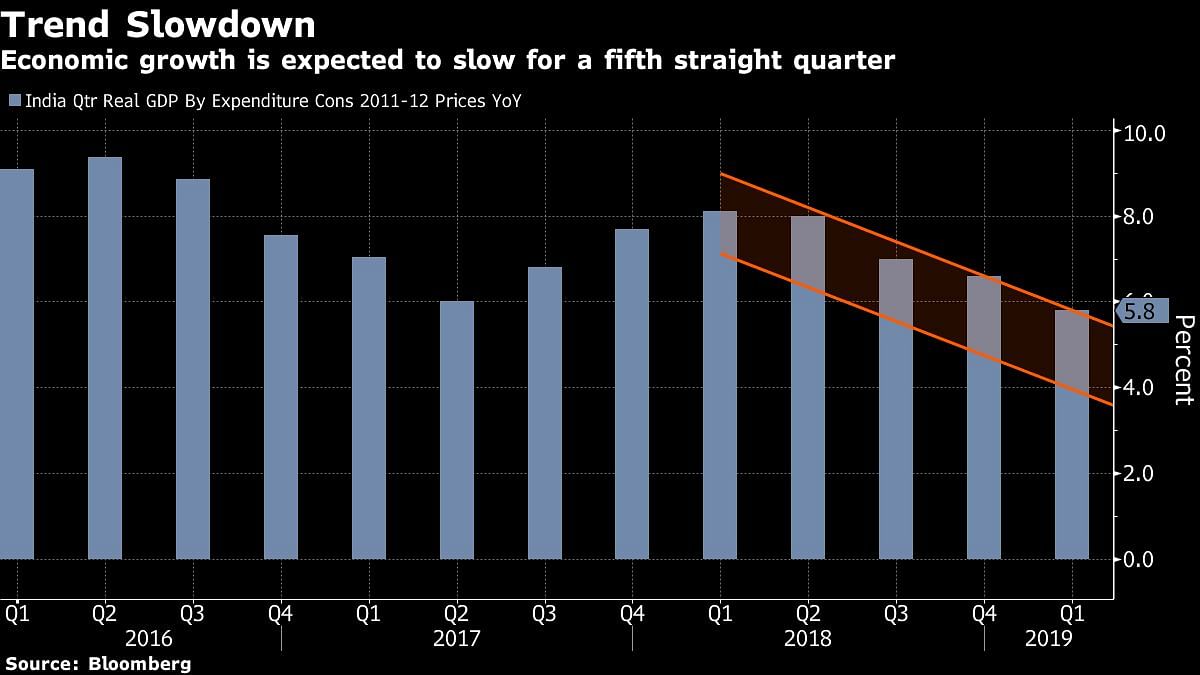

Growth Slowdown

Demand for everything from cars to cookies has waned as India’s lingering shadow-banking crisis weighs on private consumption, which accounts for almost 60% of the gross domestic product. And the increasingly bitter trade war has complicated the government’s task of re-igniting Asia’s third-largest economy.

Not surprisingly, data due Friday will likely to show that gross domestic product slowed in the June quarter, to 5.7%.

“Fundamentals remain challenging for the rupee, and it will keep depreciating given the global and local headwinds,” said Ashish Vaidya, head of trading at DBS Bank Ltd. in Mumbai. India no longer enjoys “a premium” over other emerging markets, he said.

Equity Outflows

Foreigners have pulled $3.8 billion from local shares since July, as a tax on the super rich announced in the budget last month combined with the risk-off mood triggered by the trade conflict.

While the government scrapped the levy Friday to prevent a vicious cycle of capital outflows and a weakening currency, the withdrawals have persisted this week.

Large outflows have fueled the rupee’s weakness and the size of the drop “has caught a lot of people by surprise,” said Mitul Kotecha, senior emerging-markets strategist at TD Securities in Singapore.

China Angle

Rupee’s fortunes are also getting linked to the moves in the yuan, according to JPMorgan, which has moved away from its call of rupee outperformance against the more-trade oriented currencies like the Korean won.

“If the CNY continues to depreciate against the USD, as we expect, we believe the rupee will depreciate virtually lockstep with the CNY,” analysts including Sajid Chinoy and Jonathan Cavenagh wrote in a recent note.

August Wall

Weak fundamentals aside, the currency is also in a seasonally weak month. The rupee has slid an average 2.3% in August over the past nine years, data compiled by Bloomberg show. Yet this time, the losses are much larger than usual and have erased gains accumulated in June and July.

Also read: Bimal Jalan recommends these steps for RBI’s future and Indian economy