Tata Group’s interest in purchasing Jet Airways may be a ‘step in the right direction’, although it won’t transform overnight an industry fighting to cover costs.

New Delhi: A rescue of beleaguered Jet Airways brokered by the Indian government is unlikely to end the pain of local airlines that are struggling to make money in one of the toughest markets, according to analysts.

Tata Group’s interest in purchasing Jet Airways India Ltd. may be a “step in the right direction,” although it won’t transform overnight an industry fighting to cover costs, said Binit Somaia, a Sydney-based analyst at CAPA Centre for Aviation. Even a deep-pocketed conglomerate like Tata will face an uphill challenge, said Shukor Yusof, founder of aviation consultancy Endau Analytics.

Airlines are struggling to find profits in India as they face punitive local taxes, a weakening local currency, the most expensive jet fuel in Asia, and intense competition that prevents them from raising fares. While Jet Airways India Ltd. is teetering, even some rivals are showing signs of stress. IndiGo, the budget carrier and market leader, reported its first quarterly loss since going public in 2015, while SpiceJet said it was seeking delayed payments for leased planes.

Prime Minister Narendra Modi’s administration, seeking to avoid the embarrassment of seeing a business collapse on its watch, approached Tata Group to save the country’s biggest full-service carrier through a possible purchase, people familiar with the matter said last week. The nation’s largest conglomerate has confirmed it’s in preliminary talks, although no proposal has been made.

Modi is poised to face elections by May, and potential job losses from failing airline could be bad optics before his second bid for the top office. Jet is only the latest in a long line of struggling Indian carriers. SpiceJet Ltd. almost collapsed in 2014 before a co-founder bailed it out. Kingfisher Airlines, founded by beer tycoon Vijay Mallya, ended operations two years earlier after failing to clear its dues to banks, staff, lessors and airports.

“India is a very complex place, probably one of the most difficult places if you are an airline,” said Kuala Lumpur-based Shukor. “The challenges that one faces in going into India’s aviation industry is that consumers expect to get cheap fares to fly and there’s not much government support for the industry.”

India’s central government last month decided to cut the excise duty on Jet fuel to 11 percent, from 14 percent, but the reduction hardly made a dent. Some states still impose a sales tax of as high as 30 percent on aviation turbine fuel, resulting in Indian carriers coughing up exorbitant rates. Making matters worse, the Indian rupee has depreciated 11 percent this year against the dollar, driving up finance costs.

Flying Rights

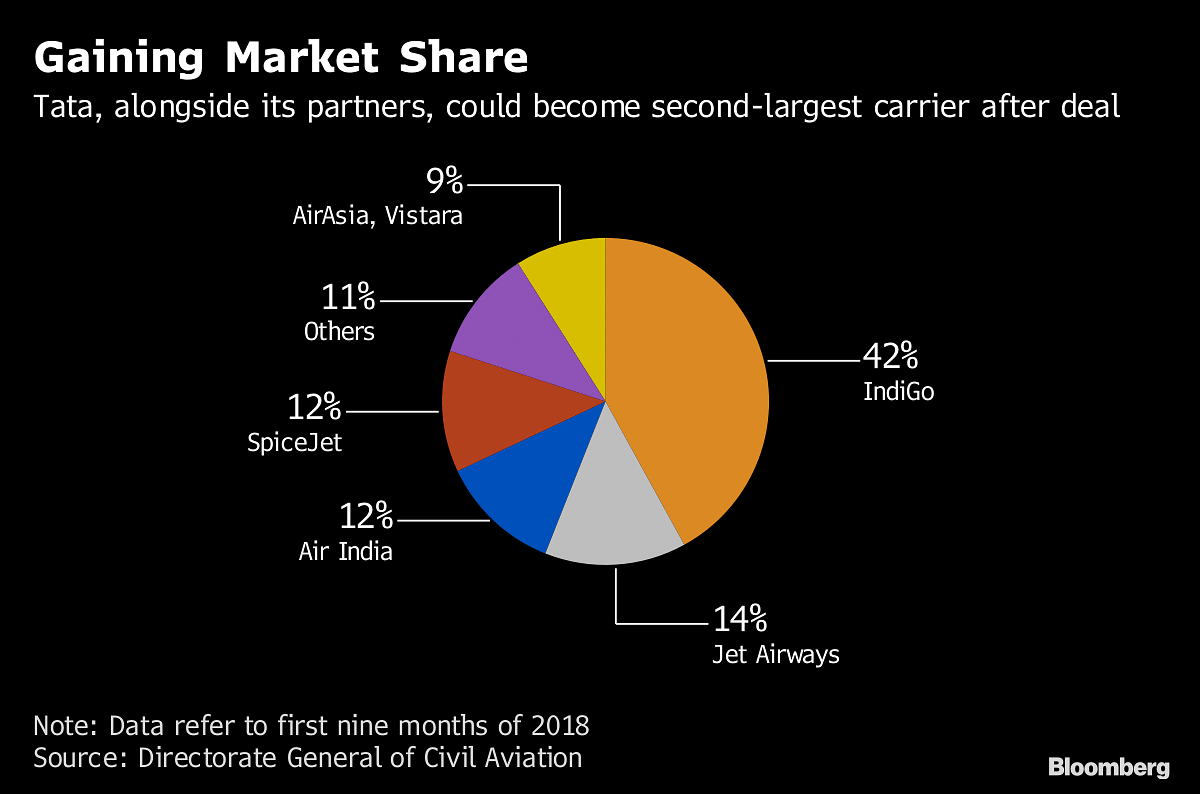

Tata already has two aviation joint ventures: one with Singapore Airlines Ltd. called Vistara, and another with AirAsia Group Bhd. A successful deal would catapult the Tata Group’s fledgling aviation business to India’s biggest after IndiGo. One option is to combine Jet Airways with Vistara, said one of the people.

With Jet’s acquisition, Tata will gain a fleet of about 135 planes, a hub in India’s second-biggest airport that has virtually no free slots for aspiring carriers, and flying rights to everywhere from Bangkok to London. For Jet, getting Tata as an investor would help ease the cash crunch. Controlled by founder Naresh Goyal, the carrier — of which Abu Dhabi’s Etihad Airways PJSC owns 24 percent — hasn’t seen a profit in nine of the past 11 fiscal years and has fallen behind on payments to staff and lessors.

“With Tata coming on board, capital isn’t going to be an issue for Jet Airways,” said Santosh Hiredesai, a Mumbai-based analyst with SBICap Securities Ltd. That means competitors like IndiGo are likely to slow down their aggressive capacity-building and “the industry should be able to take some increase in fares,” breaking the downward spiral in ticket prices, he said.

Airlines are likely hoping that to be the case.

“We’ll continue to make sure the aviation sector will grow, but for private airlines, it’s for the board, the management to make sure they function properly,” Civil Aviation Minister Suresh Prabhu told reporters Monday.– Bloomberg