Mumbai: India’s central bank is on course for its most aggressive monetary policy easing in more than three years, as it seeks to support the world’s fastest-growing major economy in the face of risks both at home and abroad.

The Reserve Bank of India delivered its second successive interest rate cut Thursday and said it stands ready to use all tools available to it to ensure liquidity in the banking system, after lenders failed to fully pass on the previous cut to borrowers.

Economists predict the RBI will cut at least once more, possibly as early as June, as businesses rein in investments amid political uncertainty fueled by elections starting next week. With consumption taking a hit due to a crisis in the shadow banking sector and exports stagnating because of a global slowdown, India’s growth prospects have considerably dimmed.

Traders were disappointed the RBI didn’t shift its policy stance from neutral to signify more aggressive action, prompting the rupee and bonds to drop.

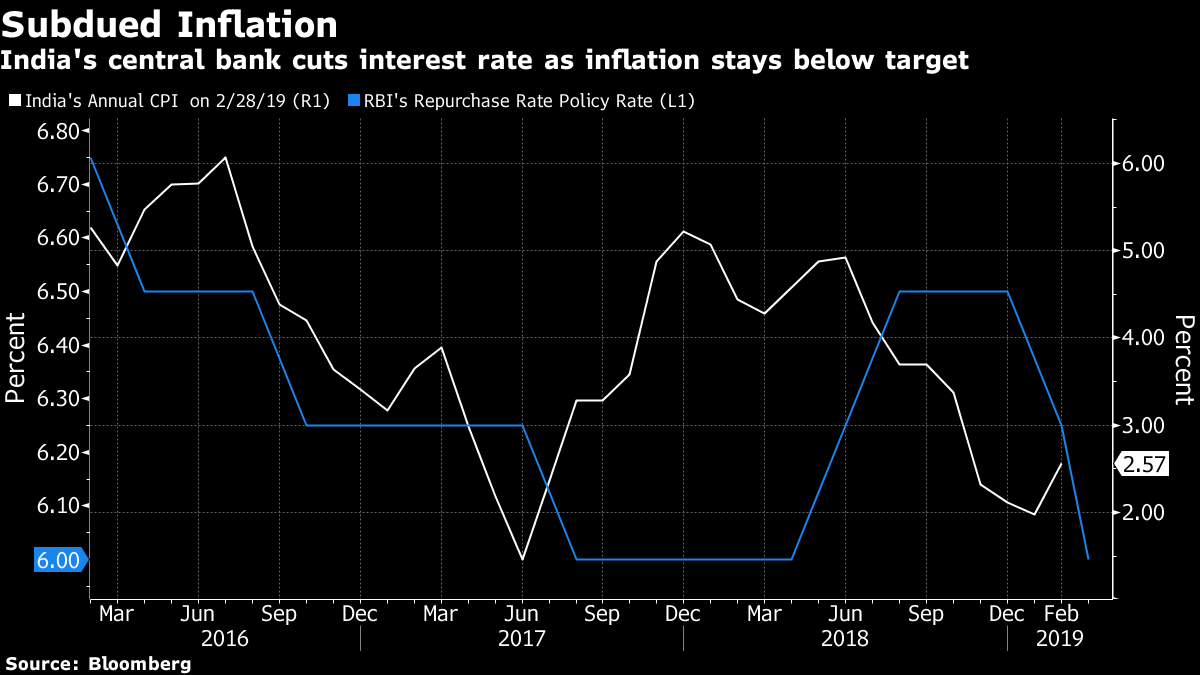

The central bank, which targets inflation at 4 per cent in the medium term, lowered forecast for consumer price growth and said underlying pressures could ease given the recent slowdown. The RBI downgraded gross domestic product growth forecast for the financial year that began 1 April to 7.2 per cent from 7.4 per cent seen in February.

“With the inflation outlook remaining benign, the RBI will address the challenges to sustained growth of the Indian economy, while ensuring price stability on an enduring basis,” Governor Shaktikanta Das told reporters in Mumbai Thursday. He added that there was a need “to strengthen domestic growth impulses by spurring private investment, which has remained sluggish.”

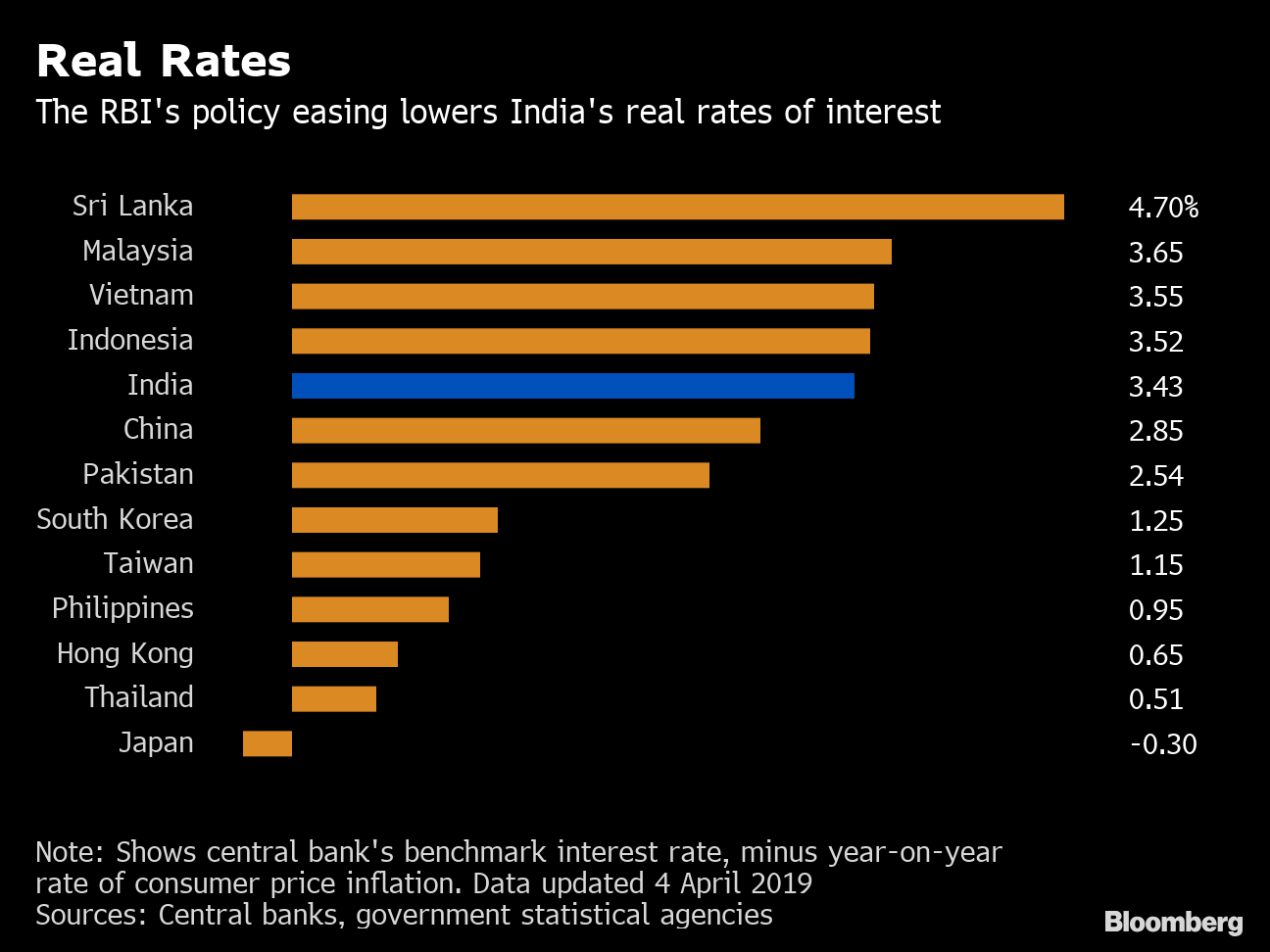

Companies have shied away from borrowing in a market that was home to one of the highest real rates of interest. The total value of new projects fell to 1.99 trillion rupees ($29 billion) in the quarter to March from 3.12 trillion rupees in the three months through June, according to data from the Center for Monitoring Indian Economy. The latest purchasing managers’ survey also point to a slowdown in the manufacturing and services sectors.

Rate Reversal

Thursday’s cut reverses the 50 basis points of increases delivered by the RBI in 2018 and dragged the real interest rate below Malaysia and Indonesia. It also marks the most aggressive easing by any major emerging market central bank this year amid a slowdown in inflation and the US Federal Reserve’s shift to a more dovish policy stance.

“Rate cuts are important but sustained focus to ensure its transmission to the economy are crucial to provide support to growth,” said Anubhuti Sahay, head of south Asia economic research at Standard Chartered Bank, who expects one more rate cut this fiscal year.

Banks have so far been averse to passing on the cut, citing higher interest rate on deposits and competition from the government for small savings.

The RBI said it will continue to add liquidity to ease constraints in the banking system. Das said he will use all instruments including open-market bond purchases and foreign currency swap auctions to inject cash and ease financial conditions after economic growth in the quarter to December hit a six-quarter low.

Policy Risk

The growth slowdown is a setback for Prime Minister Narendra Modi, who came to power in 2014 on the back of pledges to reform the economy and create 10 million jobs each year. Modi is seeking a second term in office in elections starting April 11.

Uncertainty about the poll outcome has fueled worries about policy continuity and has clouded the economic outlook.

Aurodeep Nandi, an economist at Nomura Plc in Mumbai, said he has a more bearish outlook on economic growth of 6.8 per cent in the current fiscal year. “Contained inflation amid growth disappointment will open up space for further policy easing,” with another 25 basis-point cut expected, most likely in June, he said.

Also read: Funds to get cheaper as RBI cuts rates by 25 bps days before Lok Sabha elections

This comes partly from the heart, partly from the gut, not that my brain has shut down. I would be pleasantly surprised if the economy is growing above 4%.