Mumbai/New Delhi: India’s central bank will consider an early transfer of a part of its profit to the government, which is desperate for cash to fund populist pledges ahead of a national election.

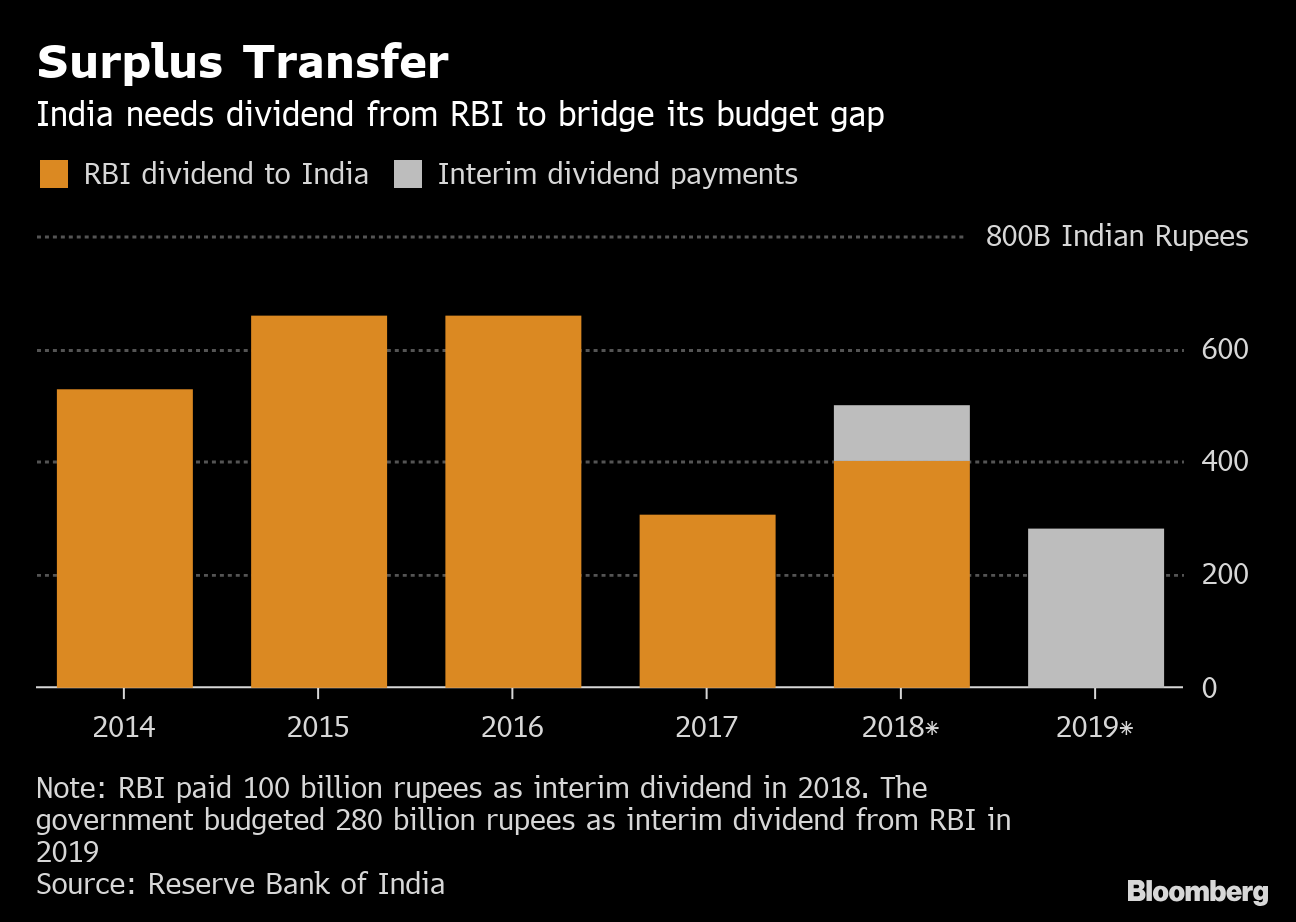

The Reserve Bank of India’s central board will decide on the interim dividend, Governor Shaktikanta Das said after a meeting where Finance Minister Arun Jaitley briefed members about the budget and the economic outlook in New Delhi Monday. The board may announce its decision later today. The government has budgeted for Rs 280 billion ($4 billion) in interim payment from the RBI.

Any payout from the central bank will help partly bridge the government’s budget gap in the year ending March after it missed tax collection and asset sale targets. It could also be key to funding the Modi government’s income support program for farmers ahead of a general election due by May.

Modi’s government needs cash after allocating Rs 200 billion toward the first installment of the $10.5 billion program by March 31. The cash support — handing about 120 million farmers with up to 2 hectares (4.9 acres) three payments of Rs 2,000 per year — was Modi’s last attempt at reversing fortunes after his Bharatiya Janata Party lost control of three key states in regional elections in December.

The budget has allocated resources for the farm income support program, Finance Minister Arun Jaitley told reporters at the same briefing, referring to the budget proposals announced on 1 February.

The government has, in all, budgeted Rs 741.4 billion in dividends from the RBI and the state-run lenders in the year ending 31 March and has penciled in Rs 829.1 billion for the next year.

Public standoff

The demand on the RBI for more dividends and to part with a greater share of its capital has been a contentious issue between the central bank and the government. It resulted in a public standoff last year and is seen as one of the reasons for the abrupt exit of then Governor Urjit Patel.

The finance ministry has asked the central bank to transfer about Rs 270 billion of surplus capital withheld by it in the previous two financial years. Separately, finance ministry officials estimate the RBI has at least Rs 3.6 trillion more capital than it needs, which they say can be used to help bolster weak Indian banks.

However, a recent study by the Centre for Advanced Financial Research and Learning, a Mumbai-based think tank, showed the central bank has insufficient capital, and much less a surplus to hand over to the government. –Bloomberg

Also read: RBI governor says he’ll meet CEOs of both public & private sector banks on 21 February