Mumbai: The Reserve Bank of India (RBI) on Friday raised the benchmark lending rate by 50 basis points to 5.40 per cent to tame inflation.

With the latest hike, the repo rate or the short term lending rate at which banks borrow has crossed the pre-pandemic level of 5.15 per cent.

This is the third consecutive rate hike after a 40 basis points in May and 50 basis points increase in June. In all, the RBI has raised benchmark rate by 1.40 per cent since May this year.

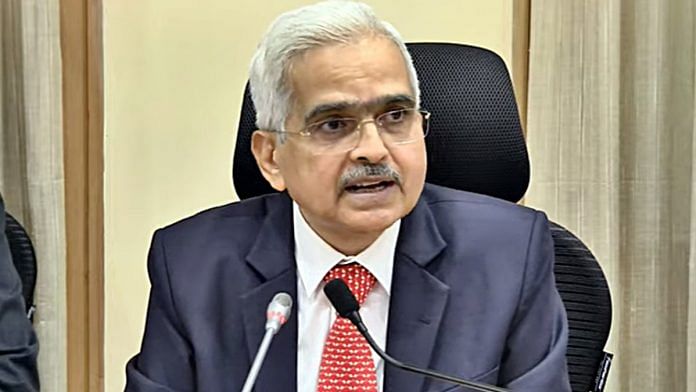

All the six members of the Monetary Policy Committee (MPC), headed by RBI Governor Shaktikanta Das, unanimously voted for the rate hike.

The Consumer Price Index (CPI) based inflation, which RBI factors in while fixing its benchmark rate, stood at 7.01 per cent in June. Retail inflation has been ruling above the RBI’s comfort level of 6 per cent since January this year.

Inflation based on the Wholesale Price Index (WPI) remained in double-digit for 15 months in a row. The WPI reading was at 15.18 per cent in June.

The latest RBI action follows the Bank of England raising rate by 50 basis points, the biggest hike in 27 years, to 1.75 per cent.

Last month, the US Federal Reserve effected its second consecutive 0.75 percentage point interest rate increase, taking its benchmark rate to a range of 2.25-2.5 per cent. -PTI

This report is auto-generated from PTI news service. ThePrint holds no responsibility for its content.

Also read: Why Modi govt is on strong ground on fiscal deficit but some states are struggling